For years, the idea of buying cryptocurrency in a retirement account felt out of reach for most Americans. That changed dramatically on August 7,2025, when President Donald Trump signed an executive order instructing the Department of Labor to allow 401(k) plans to invest in alternative assets, including digital currencies and private equity. This pivotal move is already reshaping how everyday savers approach long-term investing and opening the door to new opportunities, and risks, for retirement portfolios.

Fidelity Leads the Way: Making Bitcoin Accessible in Retirement

Fidelity Investments, the nation’s largest 401(k) provider, has been quietly building bridges between traditional retirement savings and digital assets since at least April 2022. Their Digital Assets Account lets employers offer employees direct exposure to Bitcoin within their 401(k) portfolios, albeit with allocation limits and employer approval. Now, with regulatory barriers easing thanks to the executive order, Fidelity is poised to accelerate this integration even further.

This isn’t just a theoretical shift. As of August 9,2025, Bitcoin is trading at $116,652, while Ethereum sits at $4,242.89. These aren’t fringe assets anymore, they’re major financial instruments that more Americans can now access directly through workplace retirement plans.

Trump’s Executive Order: Democratizing Crypto Access for Every American Worker

The new executive order signals a strategic pivot by policymakers toward financial inclusion and innovation. By instructing federal agencies to update regulations around alternative investments in retirement accounts, President Trump aims to give workers more tools for diversification, and potentially higher returns, while also increasing personal responsibility for risk management.

According to a CBS News report, this regulatory overhaul could eventually allow trillions in retirement savings to flow into cryptocurrencies like Bitcoin and Ethereum. However, implementation will take time as plan sponsors assess volatility concerns and fiduciary duties. For now, self-directed IRAs remain the most flexible route for those eager to add crypto immediately.

Current Market Snapshot: Bitcoin Holds Above $100K as Rules Shift

The timing of these reforms is significant. With Bitcoin maintaining its position above $100,000 at $116,652, sentiment among investors is shifting from skepticism toward cautious optimism about crypto’s role in diversified portfolios. Ethereum’s steady performance, currently priced at $4,242.89: adds further credibility to digital assets as viable long-term holdings.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on post-401(k) reform adoption, market cycles, and evolving regulatory landscape. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $125,000 | $155,000 | +7.2% | Potential consolidation after 2025 rally; cautious institutional adoption despite new 401(k) access. High volatility as regulatory frameworks are implemented. |

| 2027 | $110,000 | $143,000 | $188,000 | +14.4% | Increased 401(k) and IRA participation; broader institutional acceptance. Potential for bullish breakout if adoption accelerates. |

| 2028 | $128,000 | $165,000 | $220,000 | +15.4% | Maturing regulatory clarity, improving on-chain scalability. Bitcoin’s role as a long-term store of value strengthens. |

| 2029 | $140,000 | $184,000 | $255,000 | +11.5% | Bullish cycle peak possible; macroeconomic uncertainty may drive demand. Increased competition from alternative digital assets. |

| 2030 | $120,000 | $168,000 | $240,000 | -8.7% | Potential market correction or consolidation post-peak; regulatory tightening or macro headwinds could pressure prices. |

| 2031 | $135,000 | $190,000 | $285,000 | +13.1% | Renewed growth as adoption resumes; technological improvements and further integration into retirement accounts. |

Price Prediction Summary

Bitcoin’s outlook from 2026 to 2031 is shaped by the acceleration of crypto adoption in retirement portfolios post-Trump’s executive order and Fidelity’s 401(k) integration. While increased access and regulatory clarity can fuel steady growth, volatility remains high due to market cycles, regulatory shifts, and global macroeconomic factors. Expect a generally upward trend with periods of consolidation and correction typical of crypto market cycles.

Key Factors Affecting Bitcoin Price

- Regulatory clarity and pace of 401(k) crypto integration

- Institutional and retail adoption rates, especially via retirement products

- Market cycles: halving events, bull/bear trends, macroeconomic shifts

- Competition from other digital assets and evolving blockchain technologies

- Ongoing technological improvements in Bitcoin security and scalability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This evolving landscape is generating buzz across social media and financial news outlets alike:

Still, experts urge caution before jumping in headfirst. As noted by Yahoo Finance and other analysts, adding private assets like crypto introduces new complexities around valuation swings and regulatory oversight, a reality both investors and employers must weigh carefully.

For everyday Americans, these changes mean that the once-complex process of buying cryptocurrency for retirement is becoming more straightforward. Fidelity’s streamlined interface, combined with employer-sponsored access, removes many of the friction points that have historically made crypto investing intimidating or inaccessible for the average worker. The ability to allocate a portion of your 401(k) directly into Bitcoin at $116,652 or Ethereum at $4,242.89 is no longer just a talking point, it’s a reality for thousands and soon millions of savers.

Balancing Opportunity and Risk: What Savers Need to Know Before Buying Crypto in Their 401(k)

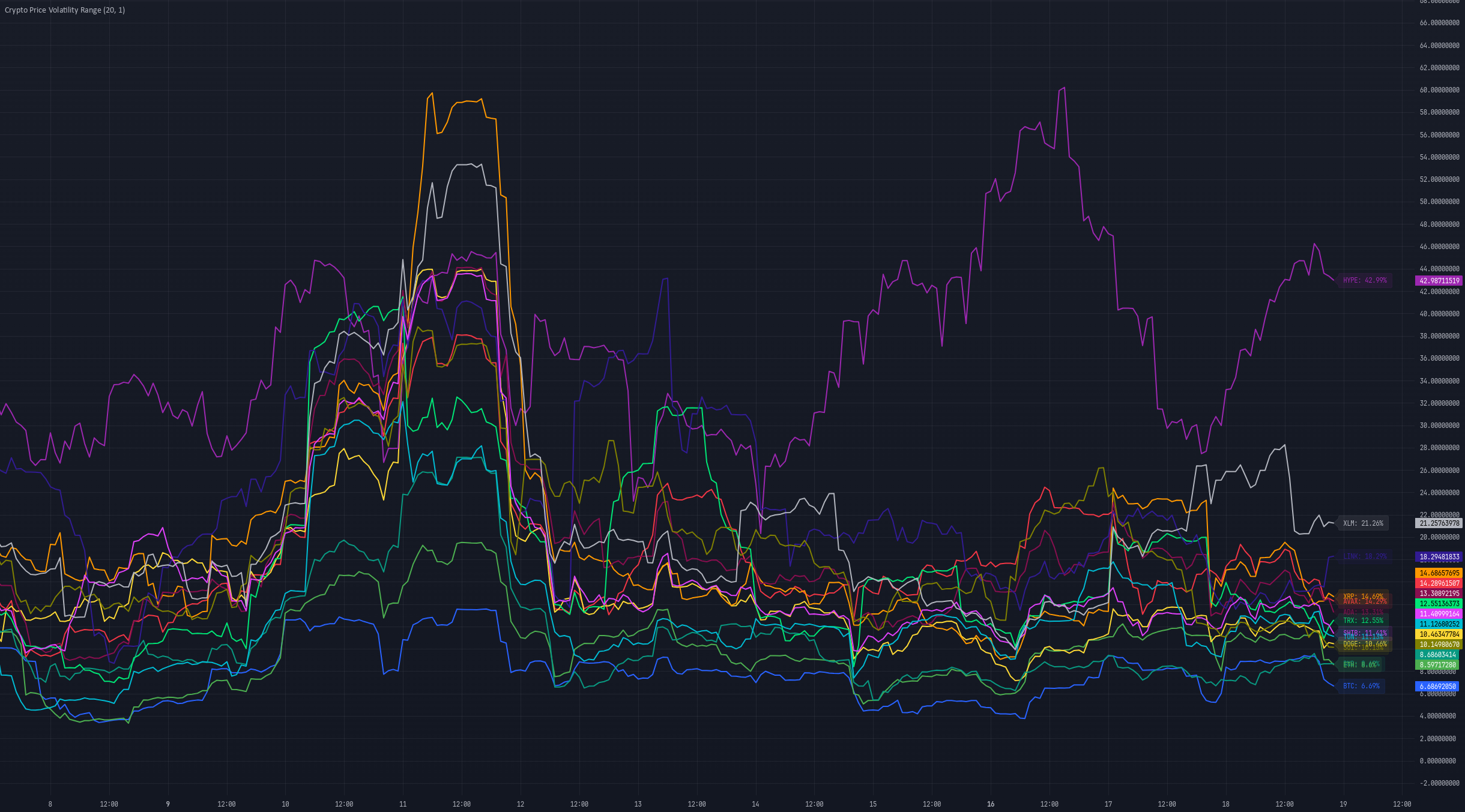

While access is expanding rapidly, responsible investing remains paramount. Cryptocurrencies are still highly volatile compared to traditional assets, price swings like Bitcoin’s recent range between $116,367 and $117,796 in a single day illustrate this reality. It’s essential for plan participants to understand key risks before allocating significant portions of retirement savings to digital assets.

Key Considerations Before Adding Crypto to Your 401(k)

-

High Volatility: Cryptocurrencies like Bitcoin (currently $116,652) and Ethereum ($4,242.89) can experience rapid price swings. This volatility can impact retirement savings, so assess your risk tolerance before allocating funds.

-

Allocation Limits: Providers such as Fidelity Investments typically cap crypto allocations within 401(k) plans (often around 20% or less of your portfolio). Check your plan’s specific limits to avoid overexposure.

-

Employer Approval Required: Not all employers allow crypto investments in their 401(k) plans. Confirm with your HR or plan administrator if your company has opted in for crypto options like Fidelity’s Digital Assets Account.

-

Fees and Costs: Crypto investment options often come with higher fees compared to traditional funds. Review expense ratios and transaction fees from your plan provider, such as Fidelity, before investing.

-

Long-Term Outlook and Regulation: The regulatory landscape for crypto in retirement accounts is evolving, especially after President Trump’s August 2025 executive order. Stay informed about regulatory changes and consider how crypto fits into your long-term retirement strategy.

Fidelity and other providers are introducing educational resources and built-in guardrails, like allocation caps, to help investors avoid common pitfalls. Employers must also weigh their fiduciary responsibilities carefully; not every plan will immediately offer crypto options, especially as regulatory guidance continues to evolve.

What Comes Next? The Road Ahead for Crypto in Retirement Plans

The executive order has set the stage for rapid innovation in retirement investing, but implementation will be gradual. Federal agencies are now tasked with refining rules and working alongside major custodians like Fidelity to ensure that new products meet both security standards and investor protection requirements.

If you’re eager to get started right away, self-directed IRAs remain an option that allows direct crypto purchases outside of employer plans. For those preferring the convenience and oversight of a workplace 401(k), it may take several quarters before widespread access becomes standard.

“This is a watershed moment for financial inclusion, ” says one industry analyst. “But it’s also a call for education, Americans need clear guidance as they navigate this new frontier. “

The bottom line: As regulatory barriers fall and platforms like Fidelity lead the charge on secure crypto integration, everyday Americans are gaining unprecedented access to digital assets within their retirement accounts. The opportunity is real, but so are the risks. Strategic allocation, ongoing education, and careful monitoring will be critical as this new era unfolds.