Bitcoin has once again rewritten the rules of the digital asset landscape, surging to a record high of $124,480 on August 14,2025. This milestone was propelled by a potent mix of regulatory tailwinds, institutional buying, and shifting macroeconomic expectations. But for new crypto buyers, these dizzying heights prompt a pressing question: Is it safe to buy Bitcoin at its all-time high?

Bitcoin’s $124,480 All-Time High: What’s Driving the Surge?

The current Bitcoin price sits at $118,739, just shy of its recent peak. The rally was ignited by several key developments:

- Regulatory Support: The Trump administration’s pro-crypto executive orders have allowed Bitcoin to be included in 401(k) retirement accounts, fueling mainstream adoption and investor confidence. (newsbytesapp.com)

- Institutional Investment: Heavyweights such as Tesla and Trump’s media group have made sizeable Bitcoin purchases, further legitimizing crypto as an investable asset class. (english.mathrubhumi.com)

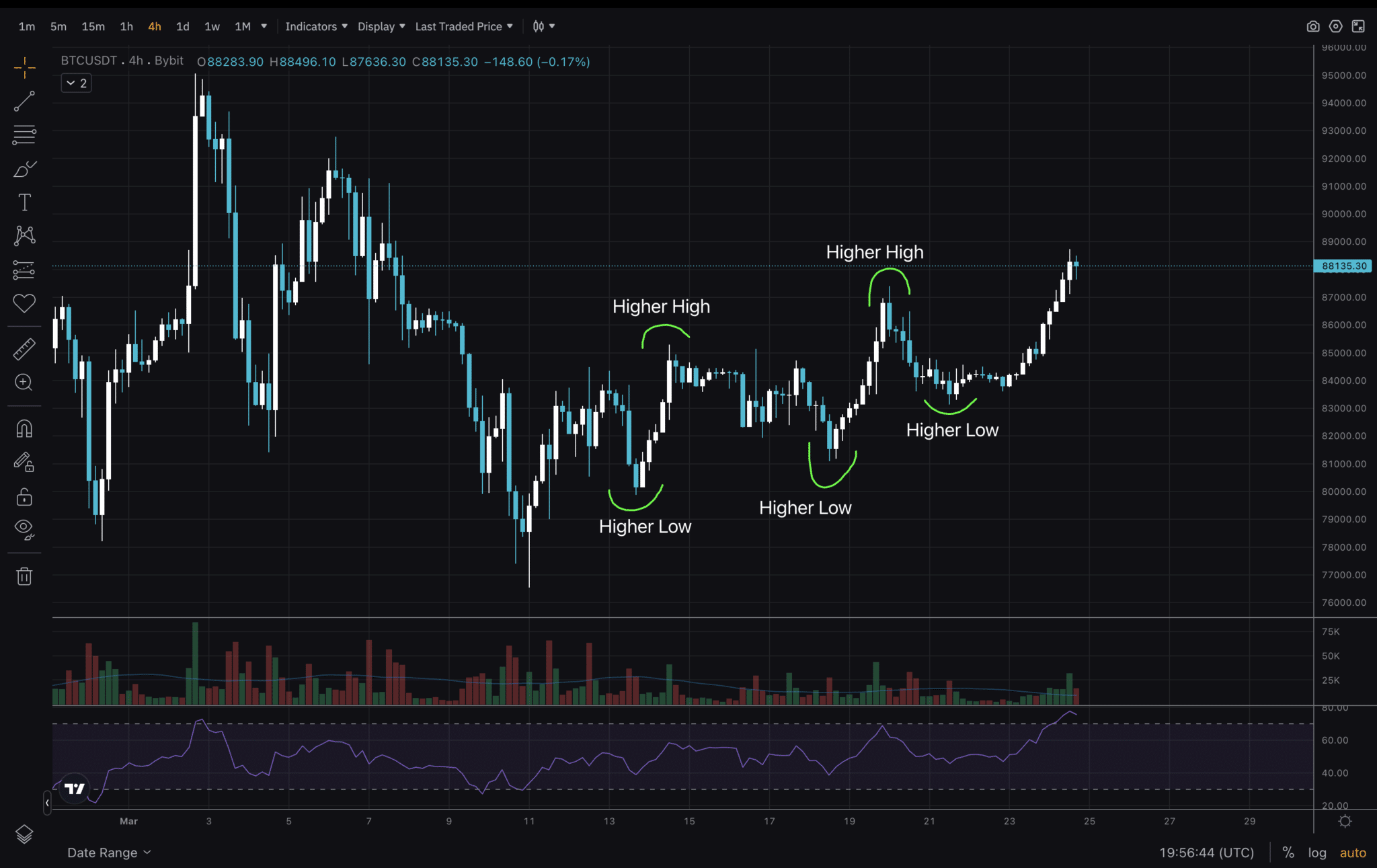

- Macro Trends: Anticipation of Federal Reserve rate cuts is pushing investors toward alternative assets like Bitcoin in search of higher returns. (coinmerce.io)

This environment has created a potent mix of FOMO (fear of missing out) and strategic opportunity for both seasoned and first-time buyers.

Risks and Rewards: Timing Your Crypto Entry in 2025

The temptation to jump into Bitcoin during a historic run is understandable. Historically, those who held through volatility have often been rewarded. However, buying bitcoin at all-time high levels comes with heightened risk:

- High Volatility: Within hours of reaching $124,480, Bitcoin fell nearly 4% to $118,000 after U. S. inflation data rattled markets. Such swings can erode capital quickly if you’re not prepared.

- Regulatory Uncertainty: While U. S. policy is currently favorable, future administrations or global regulators could shift stance unexpectedly.

- Security Concerns: Even as accessibility improves with ETFs and retirement plans (coinmerce.io), fraud and hacking risks persist for crypto holders.

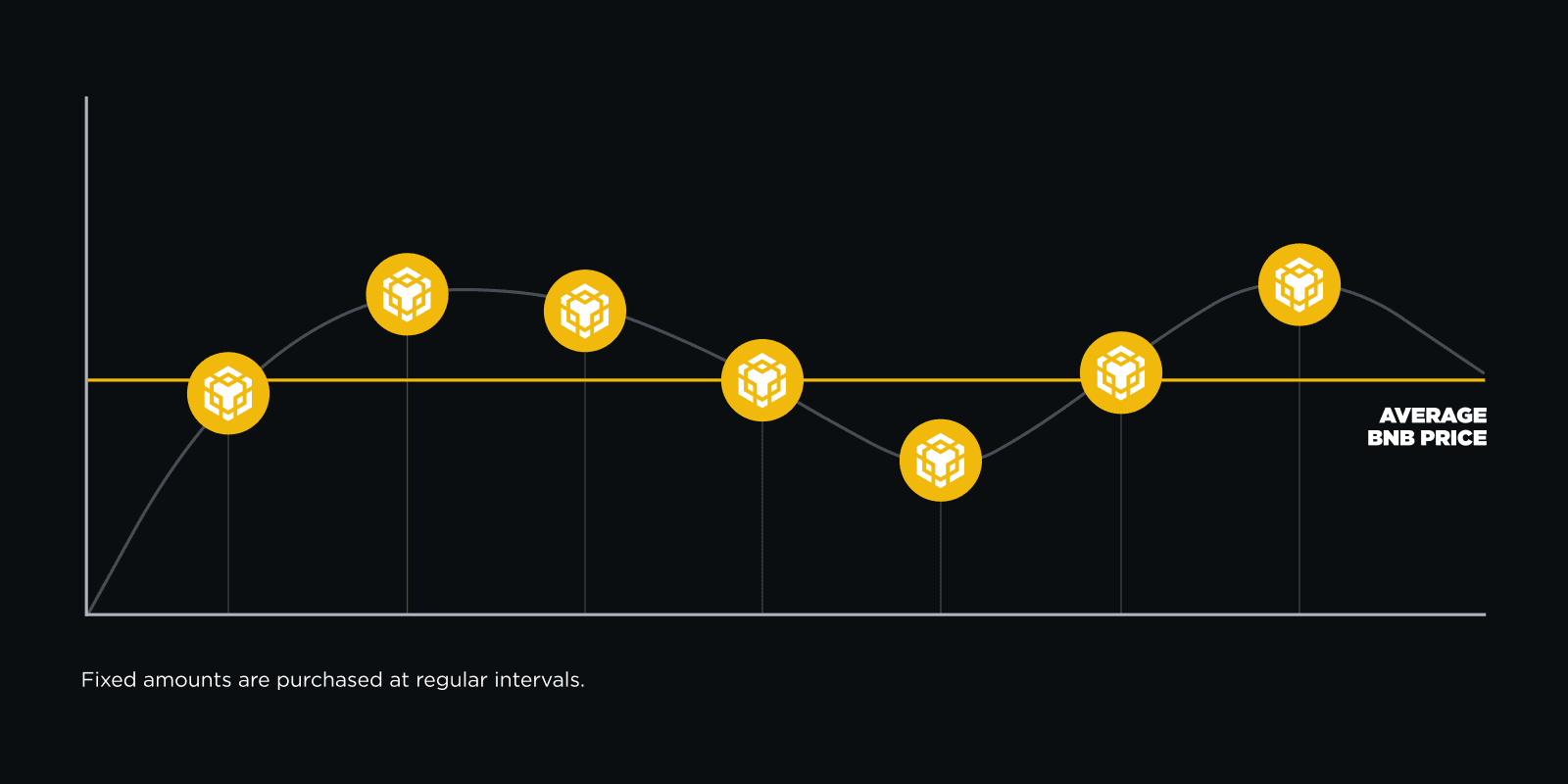

If you’re asking “is it safe to buy crypto now?” the answer depends on your risk tolerance and strategy. Many experts suggest dollar-cost averaging (DCA) as a way to mitigate timing risks, spreading out purchases over weeks or months rather than making a single lump-sum investment at record highs.

Bitcoin (BTC) Price Prediction 2026–2031

Professional outlook based on current 2025 all-time high, market cycles, and evolving regulatory and adoption trends.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $127,000 | $168,000 | +7% | Post-ATH consolidation, possible volatility as market digests 2025 highs; regulatory clarity and ETF flows support floor. |

| 2027 | $110,000 | $142,000 | $190,000 | +12% | Renewed bullish momentum as institutions increase allocation, tech upgrades (e.g., Layer 2), and global adoption accelerate. |

| 2028 | $125,000 | $159,000 | $220,000 | +12% | Next halving year; supply shock and increasing scarcity drive strong price appreciation; macro environment supportive. |

| 2029 | $130,000 | $172,000 | $245,000 | +8% | Potential cycle top formation; heightened volatility; regulatory changes in major economies could cause price swings. |

| 2030 | $115,000 | $156,000 | $230,000 | -9% | Possible post-cycle correction; profit-taking and market saturation; new competitors and tech shifts introduce uncertainty. |

| 2031 | $120,000 | $165,000 | $250,000 | +6% | Market stabilization, mature adoption in financial systems, and renewed bullishness if regulatory and technological conditions remain positive. |

Price Prediction Summary

Bitcoin is projected to remain on a long-term upward trajectory, with periods of volatility tied to market cycles, regulatory developments, and macroeconomic conditions. Prices may consolidate or correct after major surges, but growing institutional adoption, technological improvements, and global integration support upward pressure into 2031. Investors should expect both significant opportunities and risks, particularly around halving events and major regulatory shifts.

Key Factors Affecting Bitcoin Price

- US and global regulatory stance (e.g., crypto-friendly policies, ETF approvals)

- Institutional investment levels and corporate treasury adoption

- Bitcoin halving cycles and resulting supply shocks (notably in 2028)

- Macro environment (interest rates, inflation, risk appetite)

- Technological advancements (scalability, security, integration with traditional finance)

- Potential competition from other digital assets or technology platforms

- Market sentiment, FOMO, and behavioral cycles following all-time highs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating FOMO: Smart Strategies for New Crypto Buyers

The surge in bitcoin price has also increased interest in altcoins and diversified crypto strategies for 2025. While some Reddit users argue there’s “no wrong time to buy bitcoin if you don’t sell, ” this mindset isn’t suitable for every investor, especially those new to the space or with short-term goals.

- Diversify Your Portfolio: Avoid putting all your capital into one asset class, even one as dominant as Bitcoin.

- Use Secure Platforms: Only purchase via regulated exchanges or wallets with robust security protocols.

- Educate Yourself: Stay informed about market trends and potential risks before committing significant funds.

- Avoid Emotional Decisions: Don’t let headlines or social media hype dictate your entry points; stick to your pre-defined investment plan.

This disciplined approach can help reduce regret if prices pull back after your purchase, a common occurrence in highly volatile markets like crypto.

For those considering buying bitcoin at all-time high levels like $124,480, understanding the psychological dynamics is just as critical as analyzing charts. The current price of $118,739 reflects not just technical and macroeconomic factors but also a surge of new entrants and speculative capital. This influx can amplify both upside momentum and downside risk, especially if sentiment shifts quickly.

Key Questions New Crypto Buyers Should Ask

Before making a purchase, ask yourself:

Essential Questions for First-Time Crypto Buyers

-

What is my risk tolerance for extreme volatility? Bitcoin’s price recently dropped from its all-time high of $124,480 to $118,739 in a single day—a 4% decrease. Can you handle such rapid fluctuations without panic selling?

-

What is my investment horizon? Are you prepared to hold your crypto assets for several years, or do you expect quick returns? Historical data shows long-term holding (HODLing) often outperforms short-term trading for most investors.

-

How much of my portfolio should I allocate to Bitcoin? Experts recommend limiting high-risk assets like Bitcoin to a small percentage of your overall investments. Consider your broader financial goals and diversify accordingly.

-

Should I diversify into other cryptocurrencies or stick with Bitcoin? While Bitcoin remains the most established, assets like Ethereum (ETH) are gaining traction, especially after the launch of spot ETH ETFs with nearly $1B in net inflows. Evaluate the risks and potential of each asset before investing.

-

How will I securely store my crypto assets? Security is critical—consider using reputable hardware wallets like Ledger or Trezor, and enable two-factor authentication on exchange accounts to protect against hacks and fraud.

-

Am I using regulated and reputable platforms? Choose well-known exchanges such as Coinbase, Gemini, or Kraken that comply with regulatory standards and offer robust security measures.

-

Do I understand the tax and regulatory implications? Crypto gains are subject to taxation in many countries, and regulations can change. Stay informed about the latest laws and reporting requirements in your jurisdiction.

-

What is my plan if the market drops after I buy? Do you have a strategy like dollar-cost averaging or setting stop-loss orders to manage potential losses, especially when buying near all-time highs?

Timing the market is notoriously difficult, even for professionals. Many investors who bought during previous peaks experienced sharp drawdowns but were ultimately rewarded if they held through cycles. Still, not everyone has the appetite or discipline to weather double-digit swings. Tools like dollar-cost averaging (DCA) can help smooth entry points and reduce exposure to short-term volatility. For a step-by-step guide on DCA and other strategies, see expert analysis at MoneyWeek.

Long-Term Outlook: What Do the Experts Say?

Market analysts remain divided on whether the current rally will sustain or face a correction. Some forecasts suggest Bitcoin could revisit its recent highs or even surpass them by year-end if institutional flows persist and macro conditions remain favorable. Others caution that a pullback toward the $103,718.96–$114,903.94 range predicted for late 2025 (Changelly) is possible if global economic headwinds intensify.

Bitcoin Price Prediction 2026-2031

Professional BTC price forecasts based on August 2025 all-time highs, market trends, and macroeconomic factors.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $87,000 | $110,000 | $145,000 | -7.3% | Possible post-ATH correction & consolidation; volatility expected as market digests 2025 highs. |

| 2027 | $95,000 | $121,000 | $167,000 | +10.0% | Renewed institutional accumulation, potential new ETF inflows, and next halving anticipation. |

| 2028 | $105,000 | $137,000 | $192,000 | +13.2% | Halving year: supply shock could drive price higher; increased mainstream adoption. |

| 2029 | $118,000 | $157,000 | $217,000 | +14.6% | Bullish cycle continuation; global regulatory clarity and technological improvements boost sentiment. |

| 2030 | $130,000 | $177,000 | $245,000 | +12.7% | Wider global adoption, integration in financial products, but maturing market may slow explosive growth. |

| 2031 | $140,000 | $195,000 | $268,000 | +10.2% | Market matures further, Bitcoin seen as digital gold; competition from other assets increases. |

Price Prediction Summary

Bitcoin is expected to experience volatility in the years following its 2025 all-time high, with a likely correction and consolidation phase in 2026. By 2027-2028, new adoption cycles and the next halving event could drive renewed growth. Continued institutional interest, regulatory clarity, and technological progress may propel BTC to new highs by 2030-2031, though the pace of growth is expected to moderate as the market matures.

Key Factors Affecting Bitcoin Price

- Post-all-time-high corrections and market cycles

- Impact of US and global regulatory developments

- Institutional adoption and ETF inflows

- Bitcoin halving events reducing new supply

- Macro factors: inflation, interest rates, and monetary policy

- Technological improvements (scaling, security)

- Competition from other cryptocurrencies and digital assets

- Mainstream adoption and integration into traditional finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Security remains paramount. As more platforms offer bitcoin access, from ETFs to direct custody, so too do threats from hackers and scammers evolve. Always use two-factor authentication and consider cold storage for significant holdings. For additional tips on secure cryptocurrency purchase methods in 2025, reference guidance from The Week.

The Ripple Effect: Altcoin Interest in 2025

The spotlight on Bitcoin’s latest surge has also reignited interest in altcoins like Ethereum (ETH), which recently saw spot ETFs record nearly $1B in net inflows and pushed ETH above $4,500 (Gemini). While some investors are diversifying into altcoins seeking higher returns or different utility cases, remember that these assets typically exhibit even greater volatility than Bitcoin itself.

Your Next Steps: Building a Resilient Crypto Portfolio

If you’re ready to enter the market after this historic rally:

The bottom line? Buying at an all-time high like $124,480, with prices now at $118,739, carries both promise and peril. Historical data shows that disciplined strategies, like diversification and DCA, outperform hasty bets driven by FOMO for most investors (CryptoDnes.bg). Protect your capital first by staying informed and making decisions aligned with your financial goals.