The landscape of cryptocurrency investing is undergoing a seismic shift in 2025, as spot Bitcoin and Ethereum ETFs in the United States shattered records with a combined weekly trading volume of approximately $40 billion in August. This surge, driven by both institutional and retail demand, is not only a headline milestone but also a catalyst for profound changes in how investors approach crypto buying. With Bitcoin (BTC) currently priced at $117,767.00 and Ethereum ETFs contributing around $17 billion to this week’s volume, the ETF market is setting new precedents for accessibility, liquidity, and mainstream adoption.

Bitcoin Maintains Position Above $100,000 as ETF Volumes Hit Record Highs

August 2025 marked an inflection point: spot Bitcoin and Ether ETFs posted their highest-ever weekly trading volumes, reflecting a paradigm shift in market participation. Notably, Bitcoin’s price remains firmly above the psychological $100,000 threshold at $117,767.00, while Ether ETFs have seen inflows push the asset near its previous peaks. According to analysts, much of this volume spike can be attributed to Ethereum ETFs “stepping up big, ” capturing heightened investor interest and even outpacing some Bitcoin ETF flows for the week.

How Spot ETFs Are Reshaping Crypto Accessibility for All Investors

The introduction of spot ETFs has dramatically lowered barriers to entry for both institutional giants and everyday investors. Previously, direct crypto ownership required navigating unregulated exchanges or managing private keys, a process fraught with security risks and technical complexity. Now, regulated products like BlackRock’s ETHA or leading Bitcoin ETFs allow exposure via familiar brokerage accounts.

This accessibility is fueling fresh capital inflows from major players such as Goldman Sachs and BlackRock, entities that were once cautious about digital assets but are now increasing their holdings significantly. The impact is clear: mainstream financial institutions are helping drive these record volumes, signaling broader acceptance of crypto as an investable asset class.

Bitcoin (BTC) Price Prediction 2026-2031

Forecast based on the impact of spot ETF adoption, institutional flows, regulatory trends, and historical market cycles (Baseline: August 2025 BTC Price: $117,767)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $92,000 | $128,000 | $168,000 | +8.7% | Post-ETF consolidation; potential mid-cycle correction as crypto digests 2025’s rapid inflows |

| 2027 | $110,000 | $147,000 | $200,000 | +14.8% | Renewed institutional accumulation amid broader ETF adoption and possible new regulatory clarity |

| 2028 | $134,000 | $173,000 | $235,000 | +17.7% | Bullish expansion phase as next halving approaches; increased global ETF offerings |

| 2029 | $155,000 | $208,000 | $280,000 | +20.2% | Post-halving rally, mainstream adoption accelerates; possible entry of major pension funds |

| 2030 | $180,000 | $242,000 | $326,000 | +16.3% | Mature market, high but more stable growth; Bitcoin seen as digital gold in portfolios |

| 2031 | $165,000 | $265,000 | $350,000 | +9.5% | Market maturation and increased competition from other assets; regulatory harmonization globally |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 remains broadly bullish, with ETF-driven institutional inflows, regulatory progress, and continued mainstream adoption as primary catalysts. Average prices are projected to rise from $128,000 in 2026 to $265,000 in 2031, with maximum prices potentially reaching $350,000. However, market cycles, corrections, and global economic shifts could introduce volatility, especially after major ETF-driven rallies.

Key Factors Affecting Bitcoin Price

- ETF-driven institutional demand and inflows

- Regulatory clarity and global harmonization

- Bitcoin halving cycles and supply constraints

- Macro-economic conditions (inflation, interest rates, global liquidity)

- Competition from Ethereum and other digital assets

- Technological improvements (scalability, security, integration with TradFi)

- Potential for broader retail adoption and new use cases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Liquidity Surge: What Record ETF Volumes Mean for Crypto Buyers

A key effect of the $40 billion weekly trading volume has been a significant boost in liquidity across both Bitcoin and Ethereum markets. Higher liquidity means tighter spreads, smoother transactions, and potentially reduced volatility, making it easier for large investors to enter or exit positions without dramatic price swings. This influx of capital coincided with Bitcoin reaching an all-time high of $124,000 earlier in the month before settling back to its current level.

For retail investors wondering how to buy crypto during the ETF boom, these developments mean that purchasing through regulated spot ETFs offers not just simplicity but also deeper market stability compared to previous cycles dominated by speculative mania on unregulated platforms.

With the ETF-driven surge, the dynamics of crypto buying in 2025 are fundamentally shifting. Not only are ETFs making it easier for investors to gain exposure, but they are also providing a new level of transparency and price discovery that was previously lacking in fragmented crypto markets. The ability to track real-time inflows and outflows gives buyers clearer signals about institutional sentiment and market direction.

Secure Cryptocurrency Buying Tips in the Era of Record ETF Volumes

While ETFs have simplified access, prudent investors should not overlook security fundamentals. Even when purchasing through regulated products, consider these essential tips for secure cryptocurrency buying:

Top Security Practices for Buying Crypto via ETFs and Exchanges

-

Use Reputable, Regulated Platforms: Choose established exchanges and ETF providers such as Coinbase, Kraken, BlackRock, or Fidelity. These entities adhere to strict regulatory standards, reducing the risk of fraud and ensuring investor protections.

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange accounts and ETF brokerage platforms. This adds an extra layer of protection beyond just a password, making unauthorized access significantly more difficult.

-

Monitor ETF Custodian Security: Verify that your chosen ETF provider uses reputable custodians like Coinbase Custody or BitGo, which employ advanced cold storage and insurance measures to safeguard digital assets.

-

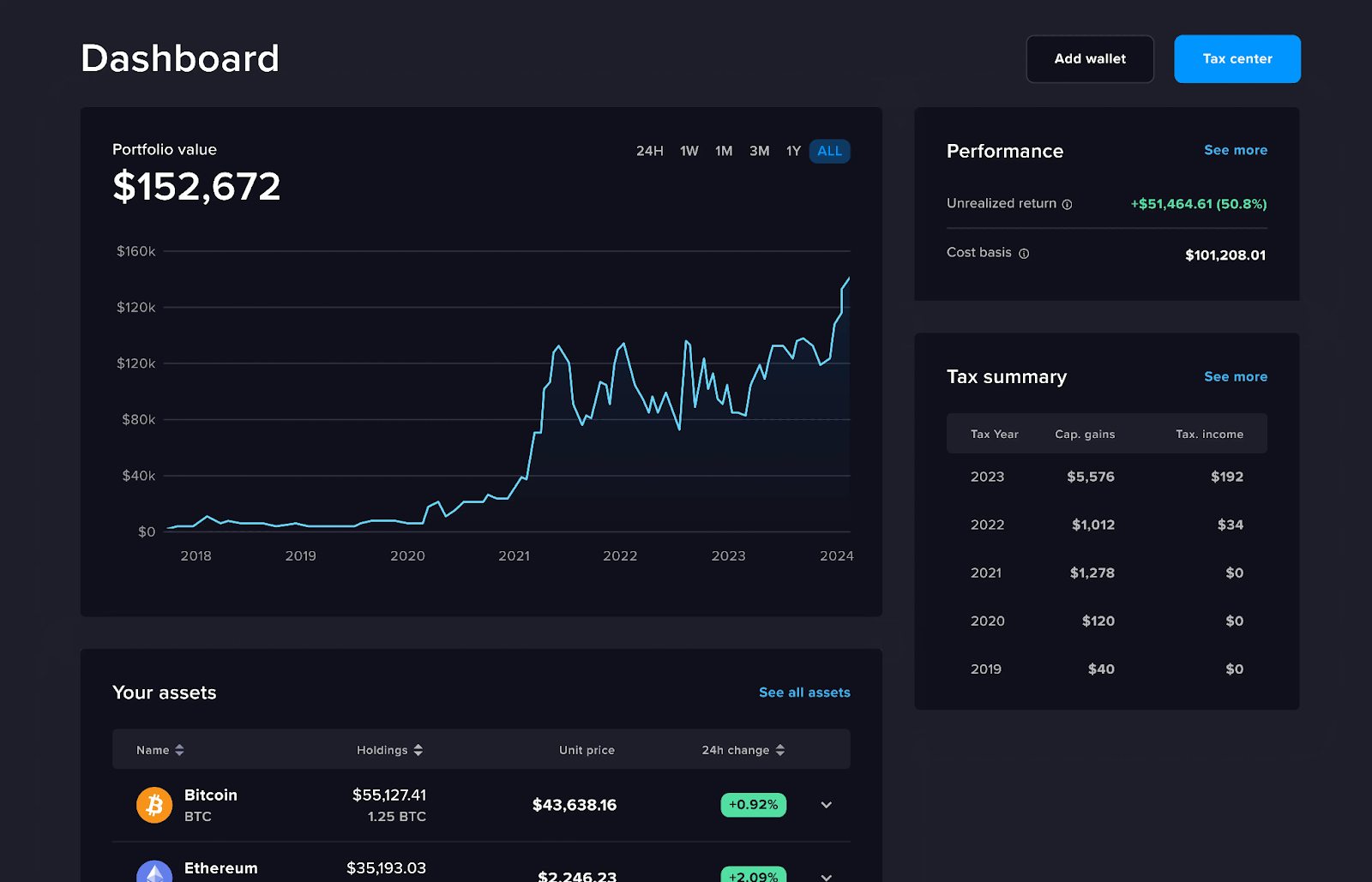

Regularly Review Account Activity: Frequently check your ETF and exchange accounts for any unauthorized or suspicious transactions. Promptly report any anomalies to your provider to prevent potential losses.

-

Stay Informed on Regulatory Updates: Follow updates from the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). Regulatory changes can impact ETF structure, investor protections, and overall market security.

-

Beware of Phishing and Social Engineering: Be cautious of unsolicited emails, messages, or links claiming to be from your ETF provider or exchange. Always verify URLs and never share sensitive information outside official, secure channels.

-

Utilize Secure Internet Connections: Access your ETF and exchange accounts only over trusted, private networks. Avoid public Wi-Fi when making transactions to minimize the risk of data interception.

For those still interested in direct ownership, combining ETF exposure with self-custody strategies can diversify risk. Always verify the regulatory status of your chosen brokerage or platform, and ensure multi-factor authentication is enabled on all accounts.

What Bitcoin ETF Record Volume 2025 Means for Market Predictions

The unprecedented $40 billion weekly ETF volume is a strong indicator that institutional adoption is accelerating. Historically, such surges have preceded periods of heightened price discovery and innovation within the sector. As Bitcoin holds at $117,767.00, analysts project continued upward momentum if inflows remain robust and regulatory clarity persists.

Ethereum’s strong showing, contributing $17 billion to weekly ETF volume, signals that alternative layer-1 assets are no longer sidelined by Bitcoin’s dominance. This broadening investor interest could lead to new product launches beyond BTC and ETH, further diversifying the crypto investment landscape in 2025.

How to Buy Crypto During the ETF Boom: Practical Steps

Navigating this new environment requires adapting your approach. Here’s how buyers can capitalize on current trends:

- Monitor ETF flows: Use data from providers like Farside Investors to gauge sentiment shifts.

- Diversify holdings: Consider both spot ETFs and direct crypto ownership for balanced exposure.

- Stay updated on regulations: Regulatory changes can quickly impact product availability and tax implications.

Community Sentiment: Are Spot ETFs Changing Your Crypto Strategy?

Have spot Bitcoin and Ethereum ETFs changed how you buy crypto?

With U.S. spot Bitcoin and Ethereum ETFs hitting a record $40 billion in weekly trading volume and making crypto investing more accessible, we’re curious: Have these ETFs influenced your approach to buying crypto assets like Bitcoin ($117,767) or Ethereum?

The consensus among market watchers is clear: spot Bitcoin and Ethereum ETFs are not just a passing trend but a structural evolution in digital asset investing. As we move deeper into 2025, expect continued innovation, potentially including multi-asset crypto funds or tokenized versions of traditional assets, built atop this foundation of record-breaking ETF volumes.