Crypto is moving at breakneck speed in 2025, and Gemini’s bold IPO move, backed by Ripple’s $75 million credit line, shows just how high the stakes are for exchanges, investors, and anyone looking to buy crypto with confidence. If you’re watching the markets, you know this isn’t just another headline. It’s a seismic shift in how security, trust, and liquidity are shaping the future of crypto buying.

Gemini’s IPO Power Play: Betting on Trust Amid Big Losses

Let’s get right to the numbers. Gemini filed for its Nasdaq IPO under the ticker “GEMI” after reporting a massive $282.5 million net loss in the first half of 2025, up from $41.4 million a year ago. Revenue dipped to $68.6 million from $74.3 million. For most companies, these stats would be reason to slam on the brakes. Instead, Gemini is pushing forward, signaling supreme confidence in its model and its ability to win back market share.

The real kicker? The Ripple credit deal. In July 2025, Gemini locked in a $75 million credit facility with Ripple Labs (expandable up to $150 million). This isn’t just about plugging financial gaps, it’s about leveraging Ripple’s RLUSD stablecoin for liquidity and showing Wall Street that crypto-native solutions can power mainstream finance.

Security and Trust: What Crypto Buyers Need to Know About RLUSD

If you’re serious about how to buy crypto safely, this partnership demands your attention. By integrating RLUSD into its operations, Gemini is betting that buyers want more than hype, they want stability and transparency in every transaction. Stablecoins like RLUSD are designed for exactly that: pegged 1: 1 to the US dollar (in theory), they promise fast settlement without wild price swings.

But don’t take anything at face value! Every new stablecoin, especially one tied so closely to a major exchange, needs scrutiny:

- Is RLUSD fully backed by reserves?

- How transparent are those reserves?

- What regulatory oversight exists?

Your due diligence is your shield against risk! As Gemini and Ripple ramp up RLUSD adoption, expect more eyes on audits and compliance reports than ever before.

The Market Impact: Institutional Money Meets Crypto Volatility

This isn’t just an inside-baseball story for finance geeks, it matters for everyone who holds or wants to hold digital assets. With powerhouse banks like Goldman Sachs and Citigroup backing Gemini’s IPO push (source), traditional finance is officially rolling out the red carpet for crypto exchanges.

The potential result? A rush of institutional capital could turbocharge liquidity across top tokens, including Bitcoin at $113,500, Ethereum at $4,142.56, and XRP at $2.89. But let’s not ignore reality: Gemini’s losses highlight how volatile this industry remains, even as it goes mainstream.

XRP, Bitcoin, and Ethereum Price Predictions Post-Gemini IPO (2026-2031)

Forecasts reflect Gemini’s IPO, Ripple’s RLUSD integration, and evolving crypto market conditions.

| Year | Asset | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Market Scenario Insight |

|---|---|---|---|---|---|---|

| 2026 | XRP | $2.40 | $3.05 | $4.20 | +5% | Consolidation after IPO; RLUSD adoption grows, but regulatory clarity pending |

| 2026 | BTC | $97,000 | $122,500 | $145,000 | +8% | Post-halving volatility, institutional inflows steady |

| 2026 | ETH | $3,500 | $4,380 | $5,500 | +6% | ETH 2.0 upgrades drive moderate growth |

| 2027 | XRP | $2.20 | $3.40 | $5.10 | +11% | Global stablecoin regulation; RLUSD sees increased cross-border use |

| 2027 | BTC | $92,000 | $135,000 | $170,000 | +10% | ETF expansion, macro headwinds dampen upside |

| 2027 | ETH | $3,250 | $5,000 | $6,700 | +14% | DeFi and L2 scaling adoption accelerate |

| 2028 | XRP | $2.35 | $4.10 | $6.50 | +21% | Regulatory breakthroughs; XRP/Stablecoin pairs expand |

| 2028 | BTC | $105,000 | $151,000 | $195,000 | +12% | Next cycle peak; increased institutional allocation |

| 2028 | ETH | $3,900 | $5,900 | $8,100 | +18% | ETH becomes backbone for tokenized assets |

| 2029 | XRP | $3.10 | $5.25 | $8.00 | +28% | Mainstream RLUSD adoption; Ripple tech powers new payment rails |

| 2029 | BTC | $110,000 | $167,000 | $225,000 | +11% | Sustained growth, but cycle top signals caution |

| 2029 | ETH | $4,600 | $7,100 | $9,800 | +20% | ETH dominates DeFi and Web3 |

| 2030 | XRP | $3.50 | $6.40 | $10.00 | +22% | XRP rivals top stablecoins in usage; new institutional products |

| 2030 | BTC | $120,000 | $185,000 | $260,000 | +11% | Next halving anticipation, global adoption themes |

| 2030 | ETH | $5,100 | $8,400 | $11,200 | +18% | ETH as core settlement layer |

| 2031 | XRP | $3.90 | $7.80 | $12.50 | +22% | Full regulatory integration, XRP ecosystem matures |

| 2031 | BTC | $132,000 | $210,000 | $300,000 | +14% | Store of value narrative dominates |

| 2031 | ETH | $5,800 | $10,000 | $13,800 | +19% | ETH secures leading smart contract role |

Price Prediction Summary

XRP, BTC, and ETH are poised for steady, progressive growth from 2026 to 2031, buoyed by Gemini’s IPO and the integration of Ripple’s RLUSD stablecoin. While XRP’s collaboration with Gemini signals enhanced liquidity and institutional confidence, broader market cycles and regulatory developments will drive volatility. Bitcoin and Ethereum remain foundational, with BTC benefiting from institutional adoption and ETH from ongoing network upgrades and DeFi innovation. Investors should expect both bullish and bearish swings, with the greatest upside tied to regulatory clarity and mainstream adoption.

Key Factors Affecting Ripple Price

- Gemini IPO’s success and market reception

- Ripple RLUSD stablecoin adoption and liquidity impact

- Global regulatory developments around crypto and stablecoins

- Macro-economic conditions and institutional participation

- Technological upgrades (ETH 2.0, Bitcoin halving cycles)

- Competition from other blockchains and stablecoins

- Market sentiment and cycles, including potential crypto winters

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For everyday crypto buyers, this is a double-edged sword. On one hand, more institutional involvement and new stablecoin rails like RLUSD can mean faster trades, tighter spreads, and more reliable exits. On the other, the risks of rapid expansion and unproven models are real. Gemini’s willingness to borrow at 6.5%-8.5% interest rates shows just how aggressively exchanges are willing to compete for market share in 2025.

What does this mean for your portfolio? The integration of RLUSD could make Gemini a preferred venue for large-volume traders seeking stability, especially if audits confirm robust backing and compliance. But as always with crypto, speed shouldn’t come at the expense of discipline. Watch for regulatory updates around RLUSD and Gemini’s lending activity, these will be key signals for broader trustworthiness.

Best Practices: How to Buy Crypto Safely in 2025

Top 5 Safety Tips for Buying Crypto on Exchanges in 2025

-

1. Choose Regulated Exchanges Like Gemini or CoinbaseOpt for platforms with strong regulatory oversight and transparent financial disclosures. Gemini, for example, is pursuing a Nasdaq IPO and is subject to U.S. SEC scrutiny, increasing accountability.

-

2. Use Stablecoins With Proven Backing, Such as RLUSD or USDCWhen trading or holding crypto, prefer stablecoins like RLUSD (now integrated on Gemini) or USDC, both of which offer transparent reserves and regular audits to maintain their dollar peg.

-

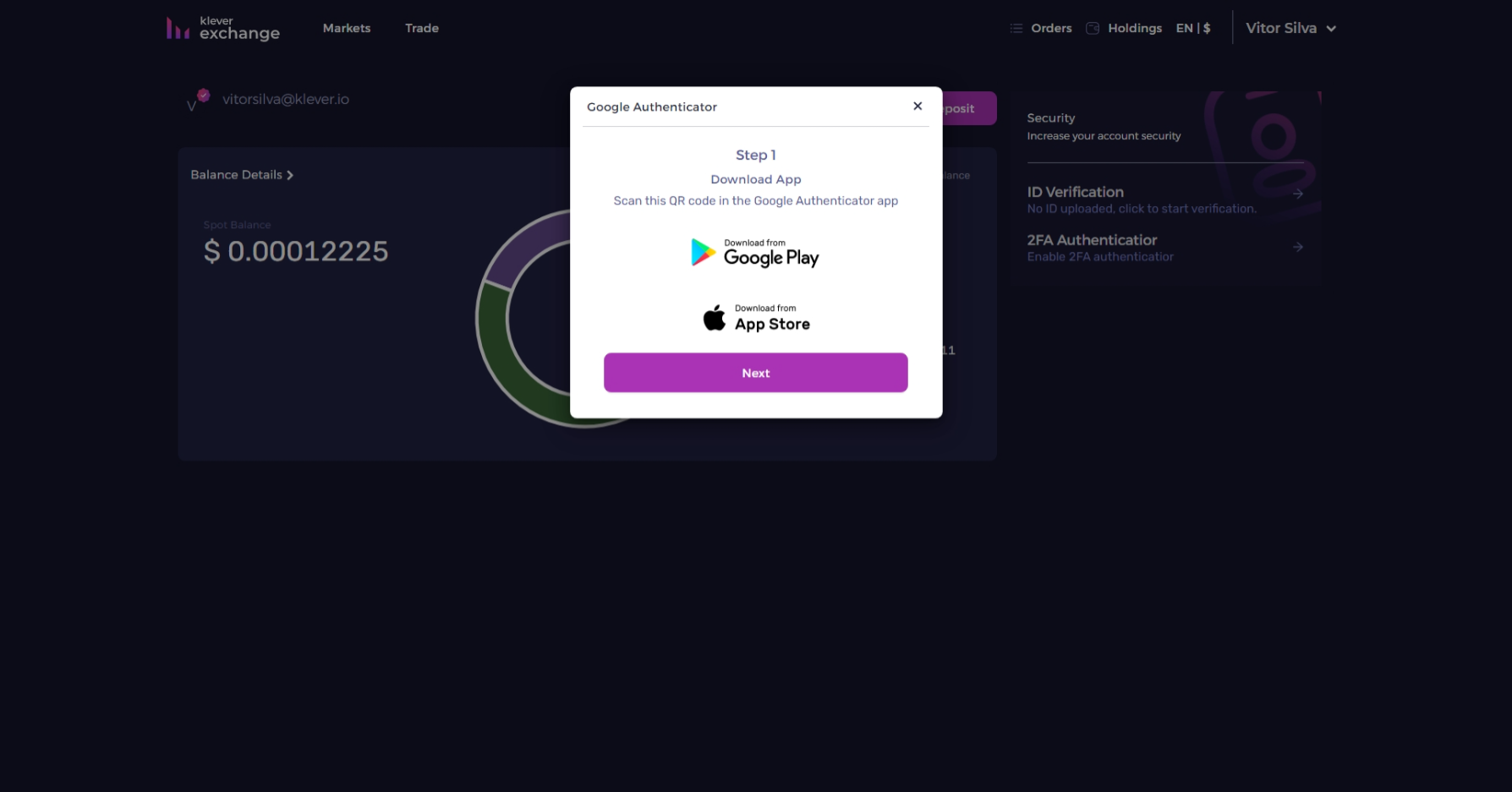

3. Enable Multi-Factor Authentication (MFA) on Your AccountAlways activate MFA on your exchange accounts. Both Gemini and Coinbase offer robust MFA options, significantly reducing the risk of unauthorized access.

-

4. Monitor Real-Time Market Data Before BuyingCheck up-to-date prices and recent changes for major tokens like Bitcoin ($113,500), Ethereum ($4,142.56), and XRP ($2.89) to make informed purchase decisions and avoid volatile swings.

-

5. Verify Asset Insurance and Cold Storage PoliciesEnsure your chosen exchange insures digital assets and stores the majority in cold (offline) wallets. Gemini, for instance, provides digital asset insurance and industry-leading cold storage solutions.

With so much action around the Gemini IPO Ripple credit deal, it’s easy to get swept up in the hype. Here’s what disciplined buyers should do right now:

- Stay updated on RLUSD audits and reserve disclosures – Transparency is non-negotiable.

- Diversify across multiple exchanges and assets – Don’t put all your eggs in one basket.

- Use two-factor authentication (2FA) and hardware wallets – Security is your edge.

- Track regulatory news – New rules can change market dynamics overnight.

- Set clear stop-losses – Volatility cuts both ways, especially after major IPOs.

Looking Ahead: The Ripple Gemini Partnership Impact

The next six months will be telling. Will RLUSD become a dominant stablecoin on Gemini? Will other exchanges follow suit with similar partnerships? And most importantly, will increased trust translate into sustainable profits for buyers?

If you’re navigating this space, keep your eyes peeled for quarterly reports from both Gemini and Ripple Labs. Their transparency (or lack thereof) will set the tone for crypto exchange security in 2025 and beyond.

The bottom line: This isn’t just a financial story, it’s about trust, adaptability, and seizing opportunities as they emerge. The winners in this new era of crypto buying will be those who move fast but never lose sight of risk management fundamentals. Stay sharp!