Ethereum bulls are charging back into the spotlight, and the numbers don’t lie. After spiking to $4,765.83 on August 21,2025, Ethereum (ETH) has slightly cooled off to $4,309.88, but the big question on every trader’s mind is: Does this dip scream opportunity? With institutional whales like SharpLink Gaming throwing down billions and ETF inflows smashing records, the stage is set for some serious action.

SharpLink’s $3 Billion Bet: What Does It Signal?

If you’re looking for conviction in the crypto market, look no further than SharpLink Gaming. This sports betting titan just snapped up 143,593 ETH at an average price of $4,648 each, a jaw-dropping $667.4 million buy-in that brings their total Ethereum stack to a staggering 740,760 ETH, valued at about $3.2 billion (source). And they’re not just holding; nearly all of it is being allocated to staking strategies. That’s serious institutional commitment.

This isn’t just one company making a splash. It’s a signal flare for the entire market: institutions are hungry for Ethereum exposure. When entities with deep pockets double down at near-record prices, even after a pullback, it’s time for retail traders to pay attention.

ETF Inflows Break Records as Demand Surges

The inflow story is even more electrifying. U. S. spot Ether ETFs have attracted over $3 billion in net inflows in just the first two weeks of August, marking their second-best monthly performance ever (source). On July 23 alone, ETFs saw a historic $332.18 million net inflow, fourteen straight days of positive flows! Even more telling? For five consecutive days, Ethereum ETF inflows outpaced Bitcoin ETFs, as corporate treasuries and institutional desks loaded up while exchange supply keeps dropping.

This isn’t retail FOMO, it’s structural demand from big players who aren’t flinching at volatility. The result? As supply tightens and demand climbs, any dip becomes magnified as a potential entry point.

Ethereum (ETH) Price Prediction Table: 2026-2031

Forecasts based on current institutional inflows, ETF trends, and market adoption as of August 2025.

| Year | Minimum Price | Average Price | Maximum Price | Potential Annual Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $5,050 | $6,200 | +17% (avg) | Strong institutional accumulation continues, but market volatility remains. Regulatory clarity in major markets supports upward trend. |

| 2027 | $4,300 | $6,200 | $7,900 | +23% (avg) | Ethereum 2.0 enhancements drive network usage; ETF inflows remain high; possible new all-time highs if macro conditions are favorable. |

| 2028 | $4,700 | $7,200 | $9,800 | +16% (avg) | Global adoption of ETH as a settlement layer increases; staking rewards attract more institutional funds; potential for regulatory headwinds. |

| 2029 | $5,100 | $8,100 | $11,500 | +13% (avg) | Layer 2 scaling and mainstream DeFi use cases expand; competition from other smart contract platforms intensifies. |

| 2030 | $5,500 | $9,200 | $13,800 | +14% (avg) | ETH supply on exchanges hits historic lows; tokenization of assets and RWAs boosts demand; some profit-taking creates volatility. |

| 2031 | $6,100 | $10,400 | $16,000 | +13% (avg) | Ethereum cements itself as a global financial infrastructure; mass adoption in gaming, DeFi, and tokenized assets; market cycles could cause sharp swings. |

Price Prediction Summary

Ethereum is forecasted to maintain an upward trajectory through 2031, underpinned by robust institutional demand, ETF inflows, and ongoing technological upgrades. While short-term volatility is likely, the long-term outlook remains bullish with the potential for new all-time highs, especially if regulatory and macroeconomic conditions remain supportive. Investors should remain aware of cyclical corrections and emerging competition.

Key Factors Affecting Ethereum Price

- Sustained institutional accumulation, particularly via ETFs and corporate treasuries.

- Ethereum network upgrades (e.g., scaling solutions, protocol improvements).

- Global regulatory developments, especially around ETF approvals and staking.

- Competition from other Layer 1 and Layer 2 blockchains.

- Market adoption in DeFi, NFTs, gaming, and tokenization of real-world assets.

- Macroeconomic factors, such as interest rates and global risk appetite.

- Supply dynamics (staking, exchange reserves, and ETH burn mechanisms).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ethereum Price Dip: Opportunity or Trap?

Let’s get tactical: With ETH currently trading at $4,309.88, down from last week’s high of $4,765.83 but still well above recent lows, traders are asking if this is a classic buy-the-dip moment or if caution is warranted.

- Institutional Accumulation: Companies like SharpLink aren’t dollar-cost averaging, they’re deploying capital aggressively near all-time highs.

- ETF Flows: Billions pouring into spot ETFs suggest sustained appetite from asset managers and family offices.

- Tightening Supply: With most new ETH entering staking protocols or cold storage, liquid supply on exchanges keeps shrinking, a recipe for high-volatility moves upward if demand persists.

The momentum is real, but so is volatility. Whether you’re stacking spot ETH or playing derivatives, risk management remains your best friend in this fast-paced environment.

With so much capital flooding in from institutions and ETFs, the Ethereum narrative is shifting. The days of retail-driven hype cycles are giving way to a new era where deep-pocketed players set the tone. This dynamic can amplify both rallies and corrections, so traders need to stay nimble and disciplined.

How to Navigate the Current Market: Actionable Strategies

If you’re eyeing this dip as a potential entry, here are some high-impact strategies to consider:

Actionable Tips for Securely Buying Ethereum Now

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange and wallet accounts. This extra layer of security helps protect your funds from unauthorized access amid increased trading activity.

-

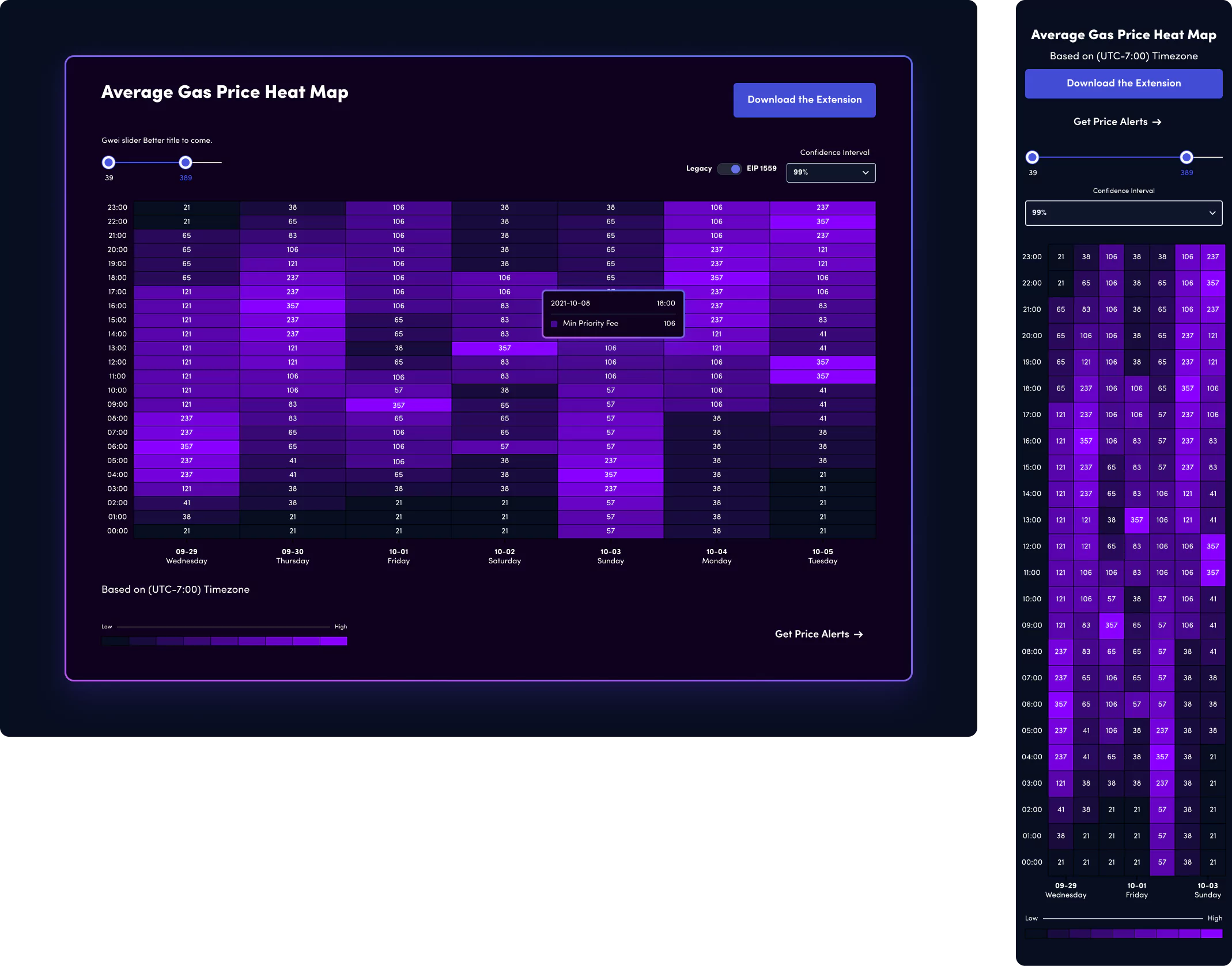

Verify Transaction Fees and Network Status: With institutional inflows, Ethereum network fees can spike. Use tools like Etherscan Gas Tracker to monitor current gas fees and choose optimal times to transact.

-

Double-Check Recipient Addresses: Always copy and paste wallet addresses, and verify them before sending ETH. Consider using Ethereum Name Service (ENS) for human-readable addresses to reduce errors.

-

Stay Informed on Institutional Activity: Follow official sources like Cointelegraph and CoinDesk for real-time updates on ETF inflows and major purchases (e.g., SharpLink’s $667M ETH buy), which can impact short-term price movements.

Don’t underestimate the power of smart execution. Consider laddering your entries instead of going all-in at once. Use limit orders near key support levels, such as $4,100 or below, where institutional buyers have shown interest recently. And always keep an eye on ETF inflow data; it’s become one of the best real-time indicators for demand shifts.

Pro tip: Watch staking metrics closely. With SharpLink allocating most of its $3.2 billion ETH haul to staking, reduced liquid supply could trigger sharp price rebounds if new demand spikes again.

What Could Change the Game?

The biggest wildcards now are regulatory updates and macroeconomic shifts. Any positive news on further ETF approvals or broader crypto adoption could ignite another leg up for ETH, while sudden risk-off events might test support zones in a hurry.

Ultimately, whether this dip is a golden opportunity or a value trap will be revealed by your own risk appetite and time horizon. One thing is clear: Ethereum’s fundamentals have never looked stronger, with unprecedented institutional conviction fueling every move.

If you’re ready to act, do it with speed and discipline, that’s how winning traders thrive in markets like this!