Ethereum is on fire, and the numbers don’t lie. After smashing through its previous 2021 record, Ethereum hit a new all-time high of $4,945.60 on August 24,2025. The real kicker? This surge is fueled not by retail FOMO but by a tidal wave of institutional money shifting away from Bitcoin and into ETH. If you’re looking for where the smart money is moving in crypto right now, it’s all about Ethereum.

Institutions Bet Big: Why Ethereum Is Stealing Bitcoin’s Thunder

The market landscape has changed dramatically in just a few weeks. BlackRock, the world’s largest asset manager, made headlines by scooping up 100,000 ETH in less than 24 hours while trimming its Bitcoin exposure by 4,000 BTC. Galaxy Digital followed suit with a jaw-dropping over-the-counter purchase of 108,278 ETH, worth roughly $283 million. These aren’t speculative plays, they’re strategic moves that signal growing confidence in Ethereum as an institutional-grade asset.

The numbers back it up: U. S. spot Ethereum ETFs saw net inflows of $533.9 million in a single day, one of the largest since their launch, while spot Bitcoin ETFs bled out with net outflows of $67.9 million. The message is clear: institutions are recalibrating their portfolios to favor ETH over BTC.

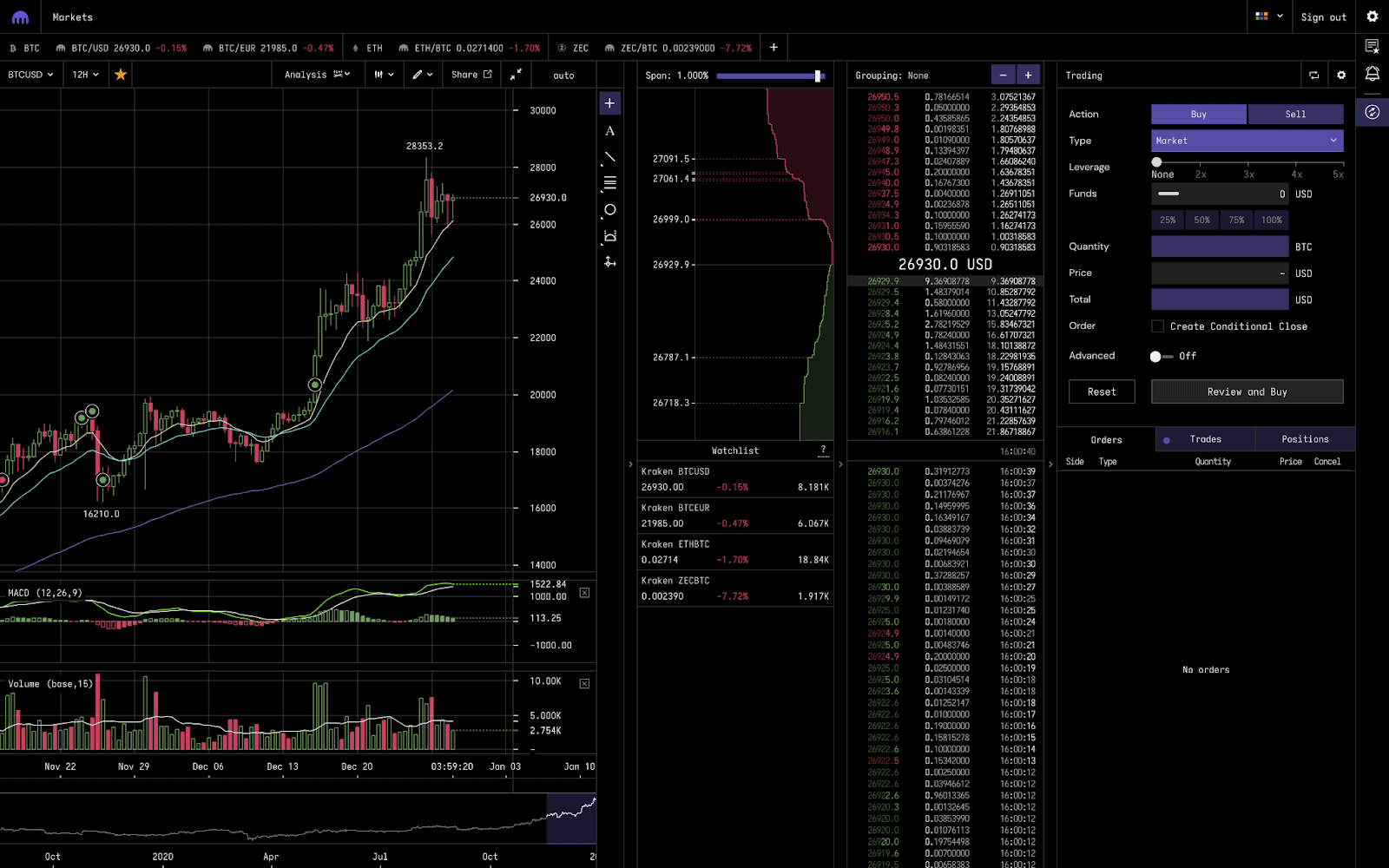

Ethereum Price Action: Near All-Time Highs with Room to Run?

As of August 25,2025, Ethereum is trading at $4,576.09, with an intraday high of $4,951.20. Even after a minor pullback (-0.0723% over 24 hours), the momentum remains undeniably bullish.

This rally isn’t just about price speculation, it’s being driven by concrete fundamentals:

- ETH Staking Yields: Staking rewards hover around 3, 4%, giving investors a steady income stream on top of capital gains (source).

- ETF Approval: Regulatory green lights for spot Ethereum ETFs have made it easier for institutions and individuals alike to gain exposure without direct custody risks (source).

- Catalyst Events: Pro-crypto regulatory moves from major governments (including Trump’s administration) are fueling even more bullish sentiment (source).

Bullish Predictions: Can ETH Hit $20K or Even $30K?

The big names aren’t shy about their targets. Arthur Hayes is calling for $20,000 ETH this cycle, citing massive buybacks and relentless institutional accumulation as key drivers (source). Tom Lee’s BitMine just pumped another $873 million into its ETH treasury, even as prices briefly dipped, showing unwavering conviction from some of Wall Street’s sharpest minds.

Ethereum (ETH) Price Prediction Table: Arthur Hayes vs. Tom Lee Outlook (2026-2031)

Comparing leading analysts’ ETH forecasts in light of institutional inflows, regulatory shifts, and market cycles. Based on current price of $4,576.09 (August 2025).

| Year | Minimum Price (Bearish Scenario) | Average Price | Maximum Price (Bullish Scenario) | % Change from 2025 Avg | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $6,200 | $12,000 | +35% | Potential post-ETF correction, but strong institutional support and staking yields drive recovery. Regulatory clarity boosts confidence. |

| 2027 | $5,000 | $8,500 | $18,000 | +72% | Scaling upgrades and Layer-2 adoption increase usage. Macro conditions stabilize, more corporate treasuries hold ETH. |

| 2028 | $6,200 | $11,500 | $22,000 | +111% | Bullish cycle peak possible. Hayes’ $20K target plausible if institutional inflows and DeFi growth accelerate. |

| 2029 | $7,500 | $13,800 | $25,000 | +150% | Post-peak volatility. Some correction, but ETH maintains dominance in Web3 and tokenization. ETFs expand globally. |

| 2030 | $6,800 | $15,000 | $30,000 | +190% | Tom Lee’s $30K scenario achievable if Ethereum leads enterprise blockchain and regulatory frameworks are globally adopted. |

| 2031 | $8,000 | $18,000 | $32,000 | +250% | Matured crypto market. ETH solidifies as primary digital asset for DeFi, NFTs, and tokenized RWAs. Competition from new chains, but network effects persist. |

Price Prediction Summary

Ethereum is positioned for significant long-term growth, driven by institutional adoption, ETF inflows, and continuous network upgrades. Both Arthur Hayes and Tom Lee provide bullish outlooks, with price targets ranging from $20,000 to $30,000 by 2030 if current trends persist. However, investors should expect volatility and potential corrections along the way, especially around cycle peaks and regulatory uncertainties.

Key Factors Affecting Ethereum Price

- Institutional adoption and ETF inflows shifting from Bitcoin to Ethereum

- Regulatory approval of Ethereum ETFs and global crypto frameworks

- Technological advancements (e.g., Layer-2 scaling, staking upgrades)

- Macroeconomic factors and risk sentiment in global markets

- Corporate treasury and enterprise blockchain adoption

- Competition from other smart contract platforms (e.g., Solana, Avalanche)

- Potential impact of U.S. political/regulatory changes (e.g., pro-crypto legislation)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re wondering how to position yourself for this next wave, whether you’re considering direct ownership or ETF exposure, the time to get educated and act is now. Momentum like this doesn’t come around often in crypto markets.

Ethereum’s narrative is shifting from “tech play” to “blue-chip asset, ” and that’s exactly why the world’s biggest investors are all-in. The combination of staking yields, ETF inflows, and high-profile endorsements has created a perfect storm for ETH. What does this mean for buyers? The opportunity isn’t just in price appreciation, but in the ecosystem’s expanding utility and income potential.

How Crypto Buyers Can Ride the Wave: A Fast-Action Checklist

Step-by-Step Checklist to Buy Ethereum Securely in 2025

-

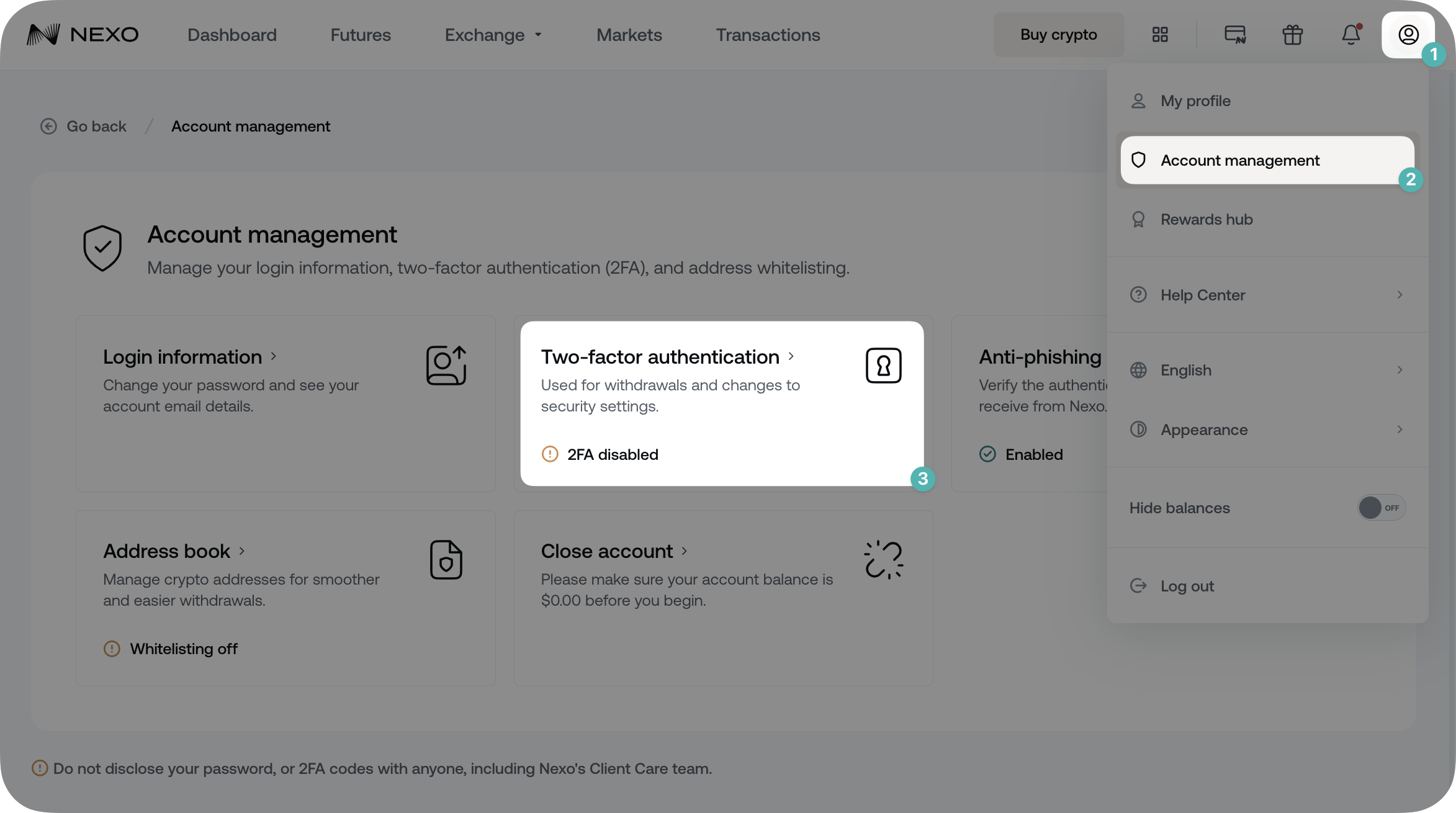

Set Up Account Security: Enable two-factor authentication (2FA) and use a strong, unique password. Consider activating additional security measures like anti-phishing codes and withdrawal whitelists.

-

Complete Identity Verification: Fulfill KYC (Know Your Customer) requirements by uploading valid identification. This step is mandatory for most major exchanges and enhances account security.

-

Deposit Funds Securely: Add funds using bank transfer, wire, or a reputable payment method. Avoid using credit cards if possible due to higher fees and potential fraud risks.

-

Buy Ethereum (ETH): Purchase Ethereum at the current market price of $4,576.09 (as of August 25, 2025). Use limit orders for more control over your entry price.

-

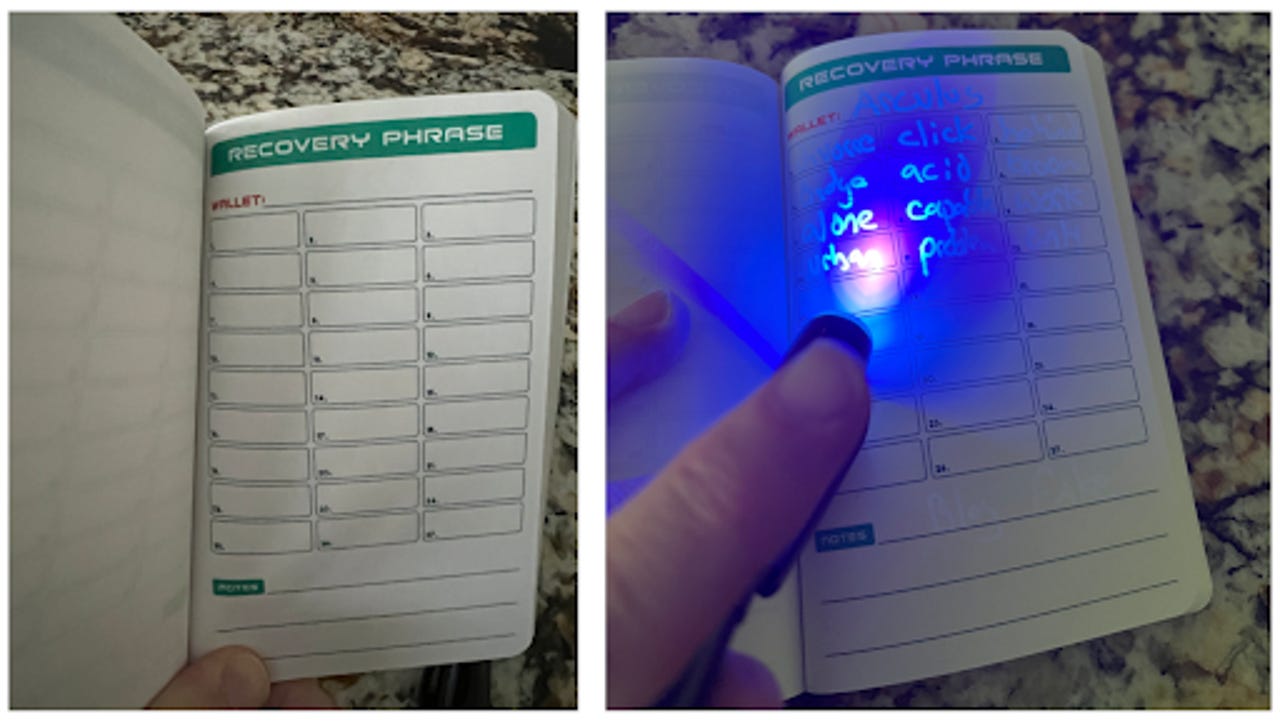

Back Up Your Wallet: Safeguard your wallet’s seed phrase and private keys in multiple offline locations. Never share them online or store them in cloud services.

-

Review Security Regularly: Periodically audit your wallet and account security settings. Stay alert for phishing attempts and always use official websites or apps.

With Ethereum trading at $4,576.09, just shy of its all-time high, the window to enter before another explosive move could be closing fast. Here are some power moves to consider:

- Diversify your portfolio: Don’t be stuck in Bitcoin maximalism. ETH is now a core institutional asset, treat it like one.

- Explore staking: Locking up ETH can generate passive income while you ride price appreciation (source).

- Use regulated platforms: Take advantage of spot ETFs or trusted exchanges for secure purchases (source).

- Stay nimble: The market can turn on a dime, set alerts at key price levels like $4,950 and $5,000.

If you’re new to crypto or want a refresher on best practices, don’t skip security. Hardware wallets, two-factor authentication, and withdrawal whitelists are non-negotiables in today’s high-stakes environment.

ETH vs BTC for Investors: What Makes Ethereum Stand Out Now?

The numbers tell the story: while Bitcoin sits at $112,394.00, institutions are reducing their BTC exposure and doubling down on ETH. Why? Flexibility. Ethereum isn’t just a store of value, it powers DeFi, NFTs, stablecoins, and real-world tokenization projects. That means multiple revenue streams and use cases that Bitcoin simply can’t match right now.

If you’re weighing ETH vs BTC for your next move, consider this: Ethereum’s surge is being driven by both speculative momentum and fundamental adoption. That dual engine is what gives it real staying power through market cycles.

Pro Tips: Secure Your Edge as Momentum Builds

- Monitor ETF flows daily: Rising inflows signal continued institutional demand.

- Diversify entry points: Use dollar-cost averaging or set limit orders around current support ($4,533) and resistance ($4,951).

- Stay plugged into news catalysts: Regulatory moves or big treasury buys (like BitMine’s) can trigger sharp moves, don’t get caught flat-footed!

If there was ever a time to act with speed and discipline, it’s now. Ethereum’s breakout could redefine the crypto leaderboard for years to come.