Ethereum has entered August 2025 with a surge that’s impossible to ignore. Not only has Ethereum (ETH) crossed the $4,400 mark, but it is also outpacing Bitcoin in whale accumulation and institutional inflows. On-chain data confirms that Ethereum whales, addresses holding massive quantities of ETH, have grown to 1,275 in August, with 48 new large holders emerging. This uptick signals a profound shift in market sentiment among the industry’s biggest players.

Ethereum Whale Activity Surges: Capital Rotation Accelerates

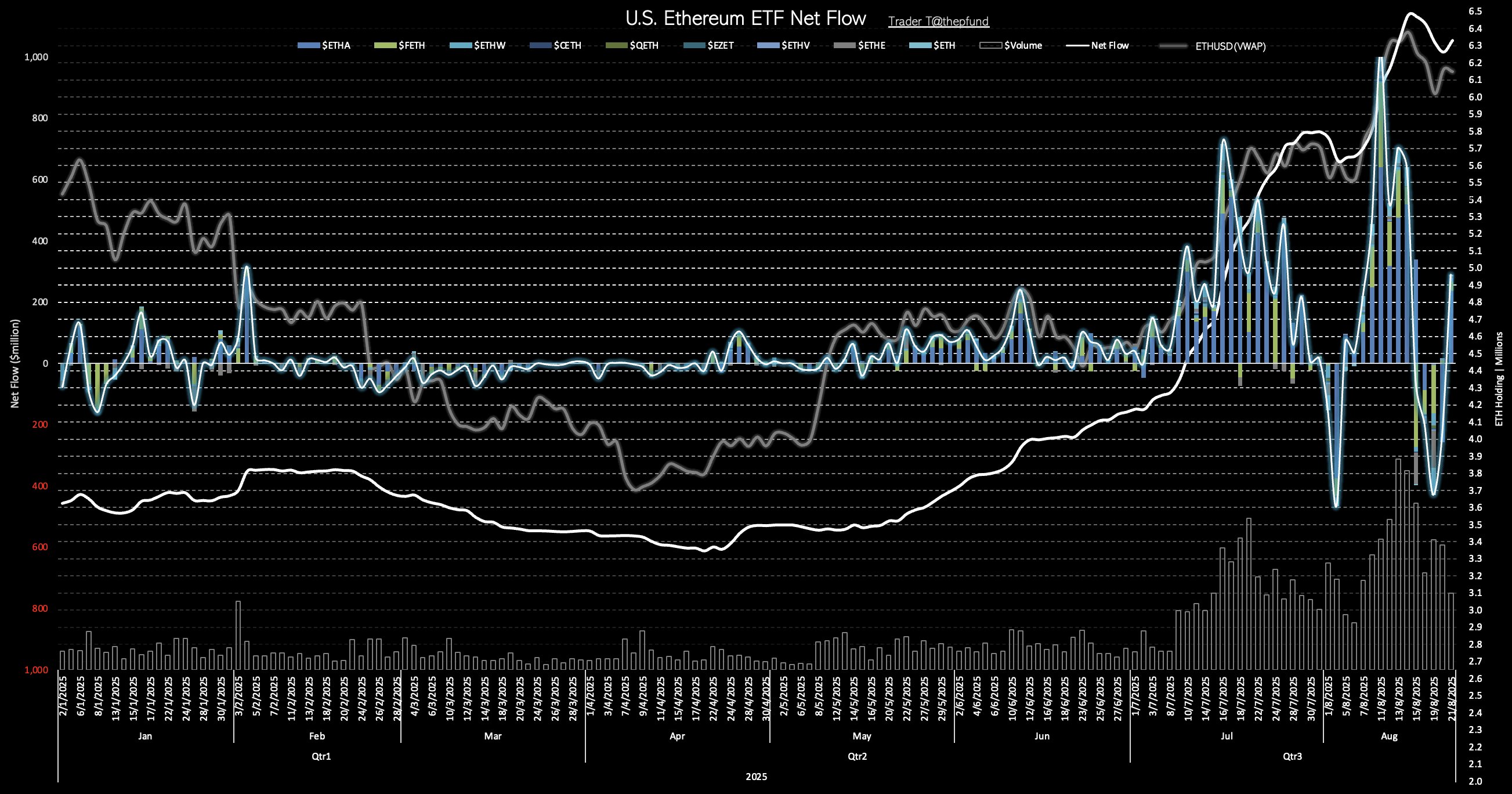

The numbers are stark: Ethereum ETFs attracted $3.87 billion in net inflows during August 2025, dwarfing Bitcoin’s $171 million over the same period (source). Year-to-date, Ethereum ETF inflows have hit $11 billion, surpassing Bitcoin’s ETF-linked totals in several key months. This divergence is more than just a headline; it reflects a significant capital rotation from Bitcoin to Ethereum by both institutions and whales.

Ethereum (ETH) Price Prediction 2026-2031

Professional price forecast based on 2025’s whale accumulation, ETF inflows, and evolving crypto market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Y/Y % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $7,000 | +16.5% | Sustained ETF inflows, but possible post-ETF hype correction. Regulatory clarity supports price floor. |

| 2027 | $4,600 | $6,200 | $8,500 | +19.2% | DeFi and Layer 2 adoption rise; ETH becomes institutional favorite. Competition from L1s limits upside. |

| 2028 | $5,200 | $7,400 | $10,000 | +19.4% | Smart contract and staking upgrades boost demand. Macro headwinds (rate hikes, global slowdown) cap max. |

| 2029 | $6,100 | $8,800 | $12,000 | +18.9% | Mainstream integration (tokenization, CBDCs) increases usage. Bearish scenario: tech disruption or regulatory clampdown. |

| 2030 | $7,000 | $10,200 | $14,500 | +15.9% | ETH 3.0 launch, robust DeFi/AI integration. Potential for new all-time highs if crypto adoption accelerates. |

| 2031 | $7,900 | $11,500 | $16,800 | +12.7% | Matured Layer 2 ecosystem, ETH as settlement layer. Bearish: Global regulation, competition from new platforms. |

Price Prediction Summary

Ethereum is forecasted to maintain its upward momentum through 2031, driven by continued institutional adoption, ETF inflows, and its expanding role in DeFi and Layer 2 applications. While price growth is expected to be robust, periodic corrections and competition from other smart contract platforms may introduce volatility. Bullish scenarios see ETH reaching above $16,000 by 2031, while bearish cases maintain a strong floor above $7,000 due to persistent institutional demand.

Key Factors Affecting Ethereum Price

- Sustained ETF inflows and institutional accumulation

- Regulatory clarity and SEC support for ETH

- Growth and adoption of DeFi and Layer 2 solutions

- Ethereum’s network upgrades and scalability improvements

- Potential for new competitors or disruptive technologies

- Global macroeconomic factors and crypto market cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This trend isn’t happening in isolation. The U. S. Securities and Exchange Commission’s more favorable stance on Ethereum ETFs has added fuel to the fire, making ETH increasingly attractive for large-scale buyers seeking exposure through regulated vehicles.

Why Are Whales Rotating from Bitcoin to Ethereum?

Several factors are driving this rotation:

- Staking Yields: Ethereum offers native staking rewards, an income stream not available with Bitcoin.

- Deflationary Mechanics: Since EIP-1559, ETH supply growth has slowed dramatically, creating scarcity during periods of high network activity.

- Diversification: Institutional investors are seeking exposure beyond Bitcoin as Ethereum’s ecosystem matures with DeFi and Layer 2 innovations.

The combination of rising staking yields and deflationary pressure is making ETH highly attractive for long-term holders looking for yield and upside potential.

This movement isn’t just theoretical. In August alone, one whale reportedly sold $1.1 billion of Bitcoin to rotate into Ethereum (source). Whale wallet accumulation reached approximately $882 million worth of ETH during the month, a clear signal that confidence is shifting toward Ethereum as a store of value and growth asset.

Current Price Action: Ethereum Holds Firm Above $4,400

Cryptocurrency 6-Month Price Comparison: Ethereum vs. Bitcoin and Major Altcoins

Real-time price performance of leading cryptocurrencies as of August 31, 2025. Data highlights the 6-month change, reflecting recent whale activity and institutional trends.

Asset

Current Price

6 Months Ago

Price Change

Ethereum

$4,464.26

$3,188.43

+40.2%

Bitcoin

$108,470.00

$105,219.96

+3.1%

Binance Coin

$859.56

$699.71

+22.8%

Solana

$204.10

$239.57

-14.8%

Cardano

$0.8251

$0.9000

-8.3%

XRP

$2.83

$3.11

-9.0%

Avalanche

$24.03

$22.50

+6.8%

Dogecoin

$0.2177

$0.2500

-12.9%

Analysis Summary

Ethereum has significantly outperformed Bitcoin and most major altcoins over the past six months, with a 40.2% price increase driven by strong whale accumulation and institutional inflows. Bitcoin posted a modest 3.1% gain, while several other large-cap cryptocurrencies experienced declines.

Key Insights

- Ethereum leads the market with a 40.2% gain, reflecting increased whale and institutional activity.

- Bitcoin’s price growth (+3.1%) has lagged behind Ethereum, coinciding with notable capital rotation into ETH.

- Binance Coin (BNB) also showed strong performance, up 22.8% over six months.

- Solana, Cardano, XRP, and Dogecoin all posted negative 6-month returns, highlighting divergent trends among major altcoins.

- Avalanche (AVAX) saw a modest gain of 6.8%, outperforming several peers but trailing ETH and BNB.

This comparison uses real-time price data as of August 31, 2025, and historical prices from exactly six months prior. All figures are sourced directly from the provided real-time market data, ensuring accuracy and relevance to current market conditions.

Data Sources:

- Main Asset: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Bitcoin: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Binance Coin: https://www.coingecko.com/en/coins/4096

- Solana: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Cardano: https://www.coingecko.com/en/coins/4096

- XRP: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Avalanche: https://www.coingecko.com/en/coins/4096

- Dogecoin: https://www.coingecko.com/en/coins/4096

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Cryptocurrency 6-Month Price Comparison: Ethereum vs. Bitcoin and Major Altcoins

Real-time price performance of leading cryptocurrencies as of August 31, 2025. Data highlights the 6-month change, reflecting recent whale activity and institutional trends.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $4,464.26 | $3,188.43 | +40.2% |

| Bitcoin | $108,470.00 | $105,219.96 | +3.1% |

| Binance Coin | $859.56 | $699.71 | +22.8% |

| Solana | $204.10 | $239.57 | -14.8% |

| Cardano | $0.8251 | $0.9000 | -8.3% |

| XRP | $2.83 | $3.11 | -9.0% |

| Avalanche | $24.03 | $22.50 | +6.8% |

| Dogecoin | $0.2177 | $0.2500 | -12.9% |

Analysis Summary

Ethereum has significantly outperformed Bitcoin and most major altcoins over the past six months, with a 40.2% price increase driven by strong whale accumulation and institutional inflows. Bitcoin posted a modest 3.1% gain, while several other large-cap cryptocurrencies experienced declines.

Key Insights

- Ethereum leads the market with a 40.2% gain, reflecting increased whale and institutional activity.

- Bitcoin’s price growth (+3.1%) has lagged behind Ethereum, coinciding with notable capital rotation into ETH.

- Binance Coin (BNB) also showed strong performance, up 22.8% over six months.

- Solana, Cardano, XRP, and Dogecoin all posted negative 6-month returns, highlighting divergent trends among major altcoins.

- Avalanche (AVAX) saw a modest gain of 6.8%, outperforming several peers but trailing ETH and BNB.

This comparison uses real-time price data as of August 31, 2025, and historical prices from exactly six months prior. All figures are sourced directly from the provided real-time market data, ensuring accuracy and relevance to current market conditions.

Data Sources:

- Main Asset: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Bitcoin: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Binance Coin: https://www.coingecko.com/en/coins/4096

- Solana: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Cardano: https://www.coingecko.com/en/coins/4096

- XRP: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Avalanche: https://www.coingecko.com/en/coins/4096

- Dogecoin: https://www.coingecko.com/en/coins/4096

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

As of August 31,2025, Ethereum trades at $4,464.26, up over $72 in the last 24 hours. This performance stands out amid broader market volatility and underlines how capital rotation is impacting price discovery across major cryptocurrencies. Meanwhile, Bitcoin continues to see profit-taking as whales move funds into Ether, a dynamic that could persist if ETF inflows remain strong.

Cryptocurrency 6-Month Price Performance Comparison (ETH vs. BTC and Majors)

Tracking price changes and whale accumulation trends among top cryptocurrencies as of August 31, 2025.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum (ETH) | $4,462.28 | $3,188.43 | +40.0% |

| Bitcoin (BTC) | $108,470.00 | $105,219.96 | +3.1% |

| BNB (Binance Coin) | $859.56 | $566.21 | +51.8% |

| Solana (SOL) | $204.38 | $239.57 | -14.7% |

| Cardano (ADA) | $0.8251 | $0.8142 | +1.3% |

| XRP (XRP) | $2.83 | $2.94 | -3.7% |

| Avalanche (AVAX) | $24.02 | $23.42 | +2.6% |

| Dogecoin (DOGE) | $0.2177 | $0.2364 | -7.9% |

Analysis Summary

Ethereum (ETH) outperformed most major cryptocurrencies over the past six months, gaining 40.0% and surpassing Bitcoin (BTC), which saw only a 3.1% increase. BNB (Binance Coin) led the market with a 51.8% surge, while Solana (SOL), XRP, and Dogecoin (DOGE) experienced notable declines. This period also saw a marked increase in Ethereum whale accumulation and institutional inflows, highlighting a shift in market sentiment toward ETH.

Key Insights

- Ethereum’s 40.0% price increase outpaces Bitcoin’s 3.1% gain, reflecting heightened whale and institutional accumulation in ETH.

- BNB (Binance Coin) was the top performer among majors, rising 51.8% over six months.

- Solana (SOL), XRP, and Dogecoin (DOGE) all posted negative returns, indicating divergent trends within the crypto market.

- Cardano (ADA) and Avalanche (AVAX) saw modest positive changes, while Bitcoin’s growth lagged behind Ethereum and BNB.

- The surge in Ethereum’s price coincides with record ETF inflows and increased whale wallet activity, suggesting growing investor confidence in ETH.

This comparison uses real-time price data as of August 31, 2025, with 6-month historical prices sourced directly from CoinMarketCap and CoinGecko. All figures are reported exactly as provided, ensuring accuracy and transparency in the analysis.

Data Sources:

- Main Asset: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Bitcoin: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- Solana: https://coinmarketcap.com/academy/article/2e66b1a4-05f7-47fc-804f-237ed57b5061

- BNB (Binance Coin): https://www.coingecko.com/en/coins/4096

- Cardano: https://www.coingecko.com/en/coins/4096

- XRP: https://www.coingecko.com/en/coins/4096

- Avalanche: https://www.coingecko.com/en/coins/4096

- Dogecoin: https://www.coingecko.com/en/coins/4096

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The technical picture supports this narrative: ETH has broken key resistance levels while whale wallet counts climb steadily upward. For crypto buyers strategizing for 2025, these trends suggest that understanding capital flows, and not just headline prices, will be critical for successful portfolio positioning.

How Crypto Buyers Can Respond: Strategies for 2025

The surge in Ethereum whale activity and ETF inflows is reshaping the landscape for both new and seasoned crypto investors. With ETH trading at $4,464.26, buyers are asking: How should I adjust my approach? The answer lies in adapting to a market where capital rotation, regulatory clarity, and on-chain metrics matter as much as headline prices.

Secure Crypto Buying & Allocation Strategies for 2025

-

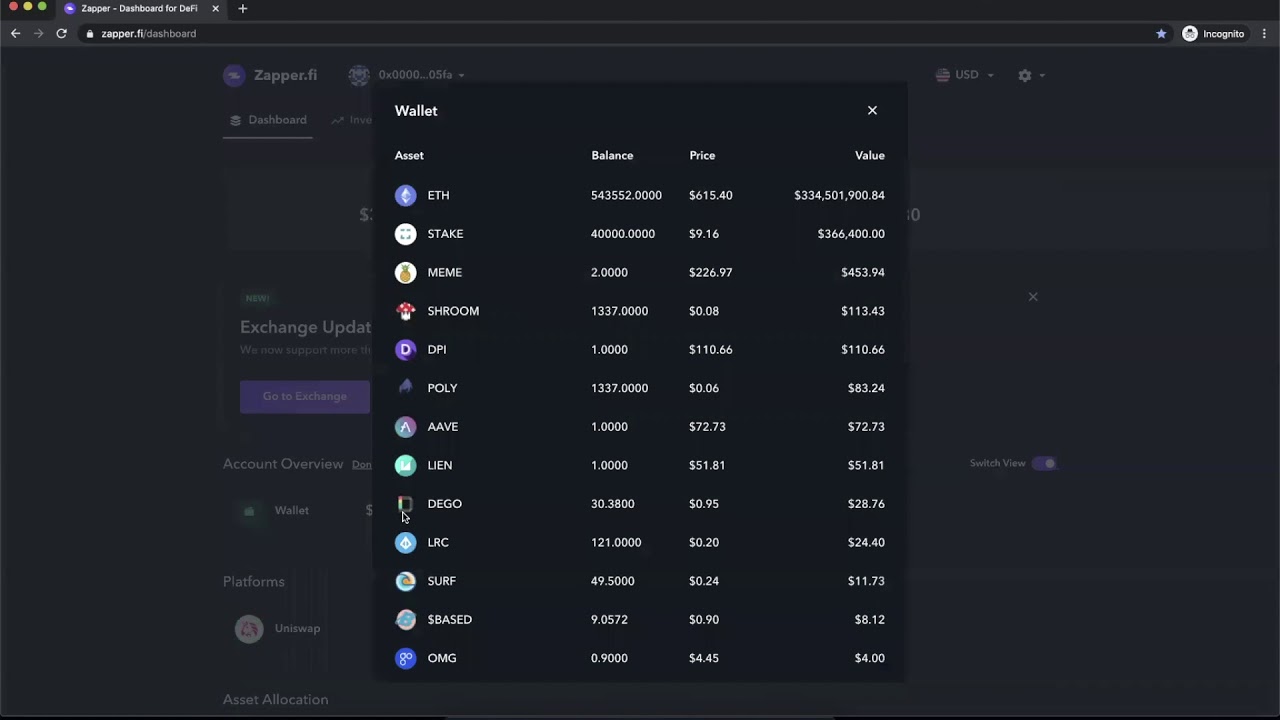

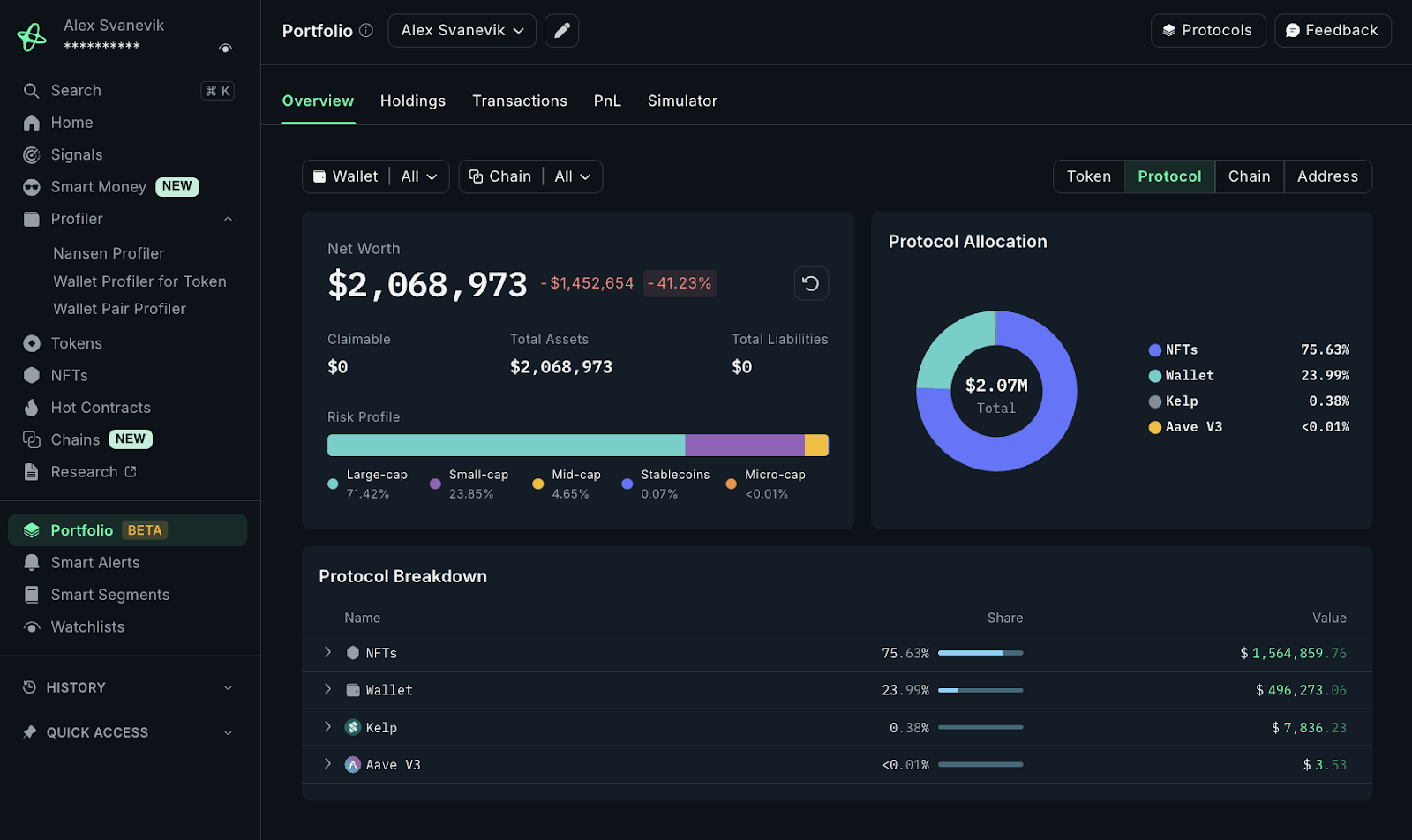

Diversify Across Major Assets and SectorsAllocate your portfolio among leading cryptocurrencies like Ethereum (currently $4,464.26), Bitcoin, and top DeFi tokens (e.g., Lido (LDO), Aave (AAVE)). This helps mitigate risk as market dynamics shift due to whale activity.

-

Monitor ETF Inflows and Institutional TrendsTrack real-time ETF data using resources like Bloomberg Crypto and Coinglass. In August 2025, Ethereum ETFs saw $3.87 billion in net inflows, outpacing Bitcoin’s $171 million—highlighting the importance of following institutional sentiment.

Diversification remains essential. While Ethereum’s fundamentals look robust, Bitcoin’s role as a macro hedge and digital gold is far from obsolete. Instead, consider a balanced allocation that reflects your risk tolerance, allocating more to ETH if you seek yield and ecosystem growth, while maintaining BTC exposure for stability.

Monitor ETF flows and on-chain data. In 2025, ETF inflows have become a leading indicator of institutional sentiment. Tracking these alongside whale wallet counts can provide early signals of trend reversals or momentum shifts. Resources like Bitget’s news feed (source) offer timely insights on these metrics.

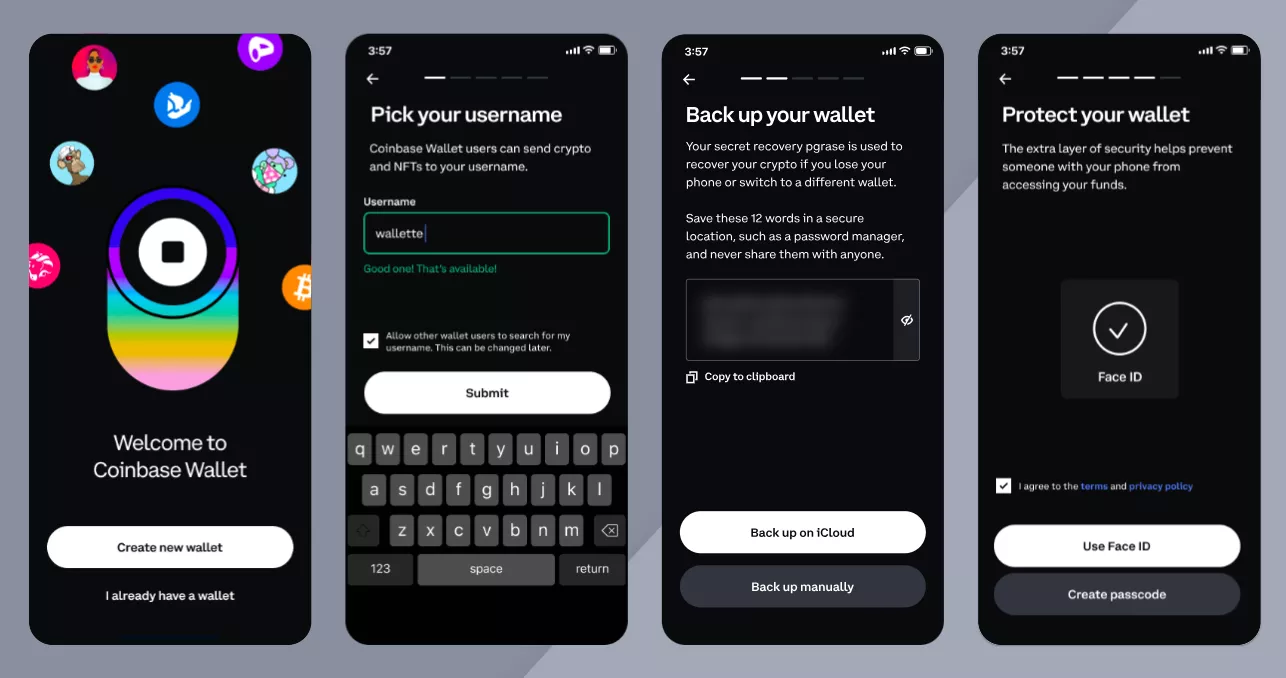

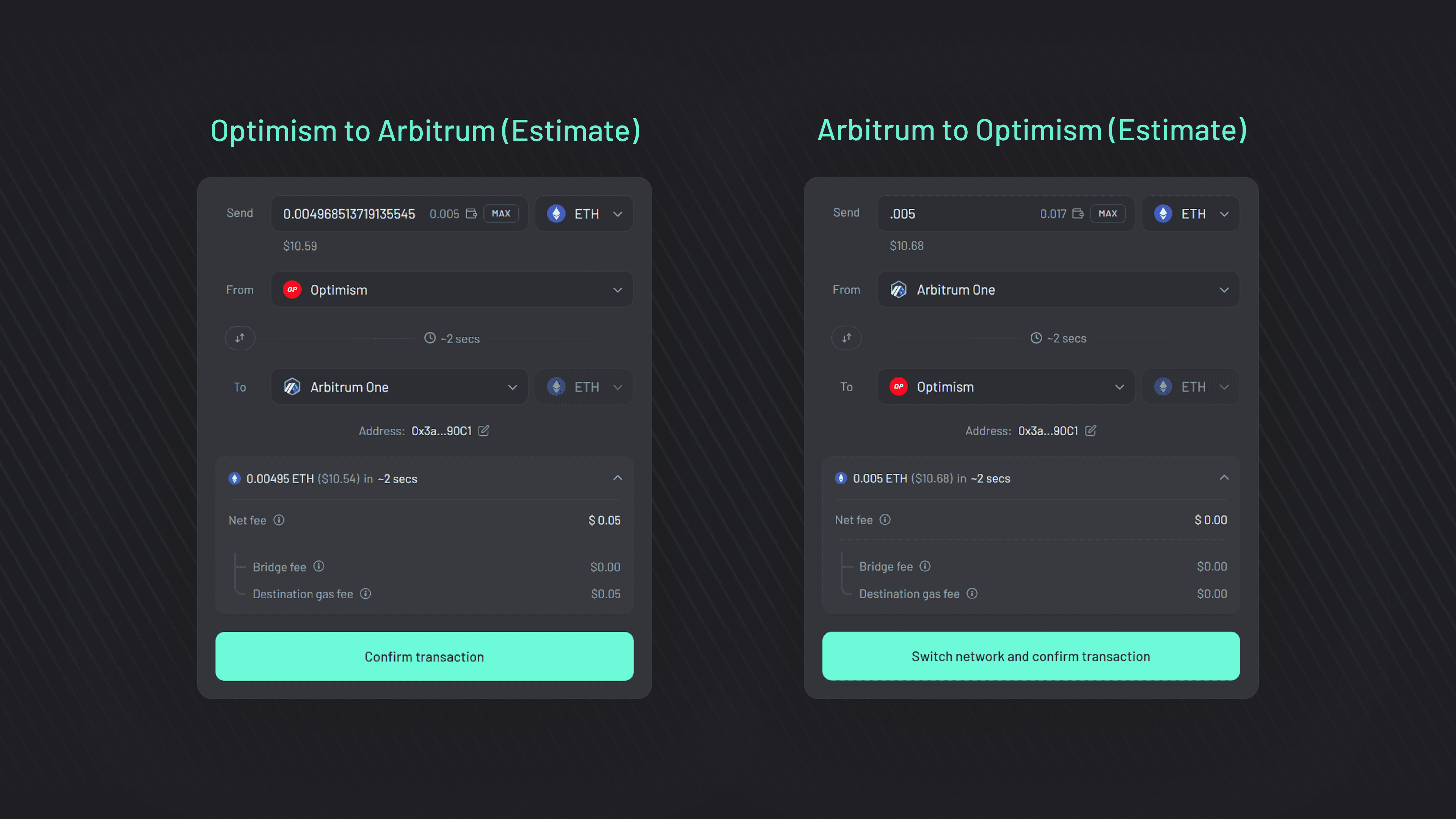

Prioritize secure purchase methods. As institutional interest rises, so does the sophistication of cyber threats. Stick to regulated exchanges with robust security protocols when buying either Ethereum or Bitcoin. Use hardware wallets for storage and enable multi-factor authentication on all accounts.

The Bigger Picture: What Capital Rotation Means for Crypto Markets

This rotation isn’t just about chasing the latest rally; it reflects a broader evolution in how capital allocates within crypto markets. The rise in Ethereum whale activity signals growing confidence in smart contract platforms, DeFi protocols, and Layer 2 scaling solutions, all key narratives heading into 2026.

For buyers, this means opportunity but also new risks. Market leadership can shift quickly if macro conditions change or if regulatory winds reverse course. Staying agile, rebalancing portfolios when warranted and keeping an eye on institutional flows, will be crucial to navigating this dynamic environment.

Community Pulse: Where Do You See Crypto Dominance Shifting?

Will Ethereum maintain its dominance over Bitcoin through 2025, or will BTC reclaim the top spot?

With Ethereum (ETH) trading above $4,400 and surpassing Bitcoin in whale activity and ETF inflows, many believe a shift in crypto market leadership is underway. Do you think Ethereum will keep its edge, or will Bitcoin bounce back as the dominant force by the end of 2025?

Navigating Volatility: Practical Tips for Secure Crypto Buying

The influx of institutional money often brings volatility as whales adjust positions rapidly. To avoid getting caught off guard:

- Avoid FOMO-driven buys: Wait for pullbacks rather than chasing parabolic moves.

- Dollar-cost averaging: Spread purchases over time to reduce timing risk during volatile periods.

- Stay informed: Follow credible sources tracking whale activity and regulatory updates impacting ETFs.

- Review your security setup regularly: As larger sums move into crypto markets, personal security is more important than ever.

The Road Ahead: Will Ethereum Sustain Its Lead?

If current trends continue, whale accumulation rising, ETF inflows outpacing Bitcoin, and price holding above $4,400: Ethereum could solidify its position as the institutional favorite heading into 2026. However, crypto markets are notoriously cyclical. Investors should stay nimble and prepared for rapid shifts as new narratives emerge.

The message for crypto buyers is clear: This is not the time to be passive. By tracking capital rotation trends, using secure buying strategies, and staying flexible in portfolio construction, you can position yourself to benefit from this historic shift in market dynamics, whatever shape it takes next.