Grayscale Investments has once again taken center stage in the crypto market, this time with its ambitious push for spot exchange-traded funds (ETFs) tied to Cardano (ADA) and Polkadot (DOT). With S-1 registration statements submitted to the U. S. Securities and Exchange Commission (SEC) in August 2025, Grayscale is betting that the next wave of institutional and retail crypto adoption will be driven by regulated ETF products. The implications for how investors buy Cardano and Polkadot in 2025 could be profound.

Grayscale’s Strategic Move: Expanding Beyond Bitcoin and Ethereum

While Bitcoin and Ethereum ETFs have dominated headlines, Grayscale’s focus on Cardano and Polkadot signals a shift toward broader altcoin exposure. The Grayscale Cardano ETF, set to trade on NYSE Arca under the ticker GADA, and the Grayscale Polkadot ETF, slated for Nasdaq with ticker DOT, are designed to give investors direct access to ADA and DOT prices without the complexities of self-custody or navigating crypto exchanges.

This is not just about convenience. By leveraging Coinbase Custody Trust Company as their custodian, these ETFs promise institutional-grade security for underlying assets. That means both retail traders looking to buy Cardano ETF 2025 or buy Polkadot ETF 2025, as well as family offices and hedge funds, can gain exposure in a secure, regulated wrapper.

The Regulatory Backdrop: SEC Deadlines and Soaring Approval Odds

The regulatory landscape for crypto ETFs remains dynamic but increasingly optimistic. According to recent filings, the SEC has set October 26,2025 as its final decision deadline for the Cardano ETF application (source). Notably, approval odds have surged to an impressive 87%, up 11% in just one week after Grayscale’s amended S-1 filing (source). This surge reflects growing confidence that regulators are warming up to altcoin-based ETFs beyond Bitcoin.

The significance here cannot be overstated: if approved, these would be among the first spot ETFs for major altcoins in U. S. markets. This would not only validate ADA and DOT as investable assets but could also open doors for other cryptocurrencies like Solana or XRP currently awaiting SEC review.

Market Impact: How ADA at $0.814081 and DOT at $3.75 Set the Stage

As of September 1,2025, Cardano (ADA) trades at $0.814081, with a daily range between $0.795446 and $0.84281; Polkadot (DOT) sits at $3.75, fluctuating from $3.66 to $3.88 over the last 24 hours. These price levels reflect a period of consolidation amid anticipation of regulatory decisions.

The prospect of spot ETFs is already having an effect on sentiment and trading volumes for both coins:

- Liquidity boost: A regulated ETF structure will likely attract new capital from institutions previously hesitant due to custody or compliance concerns.

- Volatility dampening: Increased participation from long-term investors could reduce sharp price swings often seen in pure crypto markets.

- Easier access: For those asking “how to buy ADA ETF” or “how to buy DOT ETF”, traditional brokerage accounts may soon provide seamless entry points, no wallets or private keys needed.

Cardano (ADA) Price Prediction Post-ETF Approval (2026-2031)

Forecasting ADA price evolution amid Grayscale’s ETF push, regulatory shifts, and crypto market maturation.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.78 | $1.05 | $1.40 | +29% | ETF approval likely boosts institutional inflows; volatility persists as market adjusts. |

| 2027 | $0.95 | $1.40 | $1.95 | +33% | Growing adoption and new DeFi/NFT use cases drive demand; risk of profit-taking corrections. |

| 2028 | $1.10 | $1.80 | $2.60 | +29% | Maturing regulatory clarity attracts more funds; Cardano ecosystem expansion accelerates. |

| 2029 | $1.25 | $2.25 | $3.20 | +25% | Continued ETF inflows and broader crypto acceptance; possible tech upgrades increase utility. |

| 2030 | $1.45 | $2.75 | $4.10 | +22% | Mainstream integration and potential bullish cycle; competition from other L1s intensifies. |

| 2031 | $1.60 | $3.30 | $5.00 | +20% | Wider institutional usage and global partnerships; macro risks may limit extreme upside. |

Price Prediction Summary

Cardano (ADA) is poised for significant growth following Grayscale’s ETF efforts, with the potential for steady price appreciation as regulated investment vehicles unlock new demand. While volatility and corrections are likely, especially in the early years post-ETF launch, long-term prospects remain strong if adoption and technological development continue. Prices could surpass $3.00 by 2031 in average scenarios, with bullish cycles pushing higher, though downside risk remains if regulatory or tech challenges emerge.

Key Factors Affecting Cardano Price

- ETF approval and timeline: Institutional access via ETFs can dramatically increase liquidity and demand.

- Regulatory environment: Favorable SEC decisions and broader regulatory clarity are crucial for investor confidence.

- Technology upgrades: Cardano’s roadmap (e.g., scalability, interoperability) affects long-term utility and value.

- Market adoption: Growth in DeFi, NFTs, and real-world use cases on Cardano’s platform.

- Competition: Rival L1 blockchains (Ethereum, Solana, Polkadot) may capture market share if Cardano lags in innovation.

- Macro crypto cycles: Broader market trends, Bitcoin halving cycles, and global economic conditions will influence price trajectories.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A Catalyst for Crypto Maturity: What Sets These Filings Apart?

This wave of applications is more than just another regulatory milestone, it’s a testament to how far crypto markets have evolved since their early days of decentralized experimentation. Grayscale’s filings address stringent SEC requirements around custody, transparency, anti-money laundering practices, and investor protection (source). This level of compliance was unthinkable only a few years ago.

The success of these ETFs could serve as a blueprint for future listings, potentially accelerating mainstream adoption while reinforcing secure crypto buying practices across the industry.

For investors, the introduction of Grayscale Cardano ETF and Grayscale Polkadot ETF products could fundamentally reshape portfolio construction strategies. By allowing ADA and DOT exposure within tax-advantaged accounts or through regulated brokers, these ETFs break down longstanding barriers to entry. The result is a more level playing field between digital assets and traditional securities.

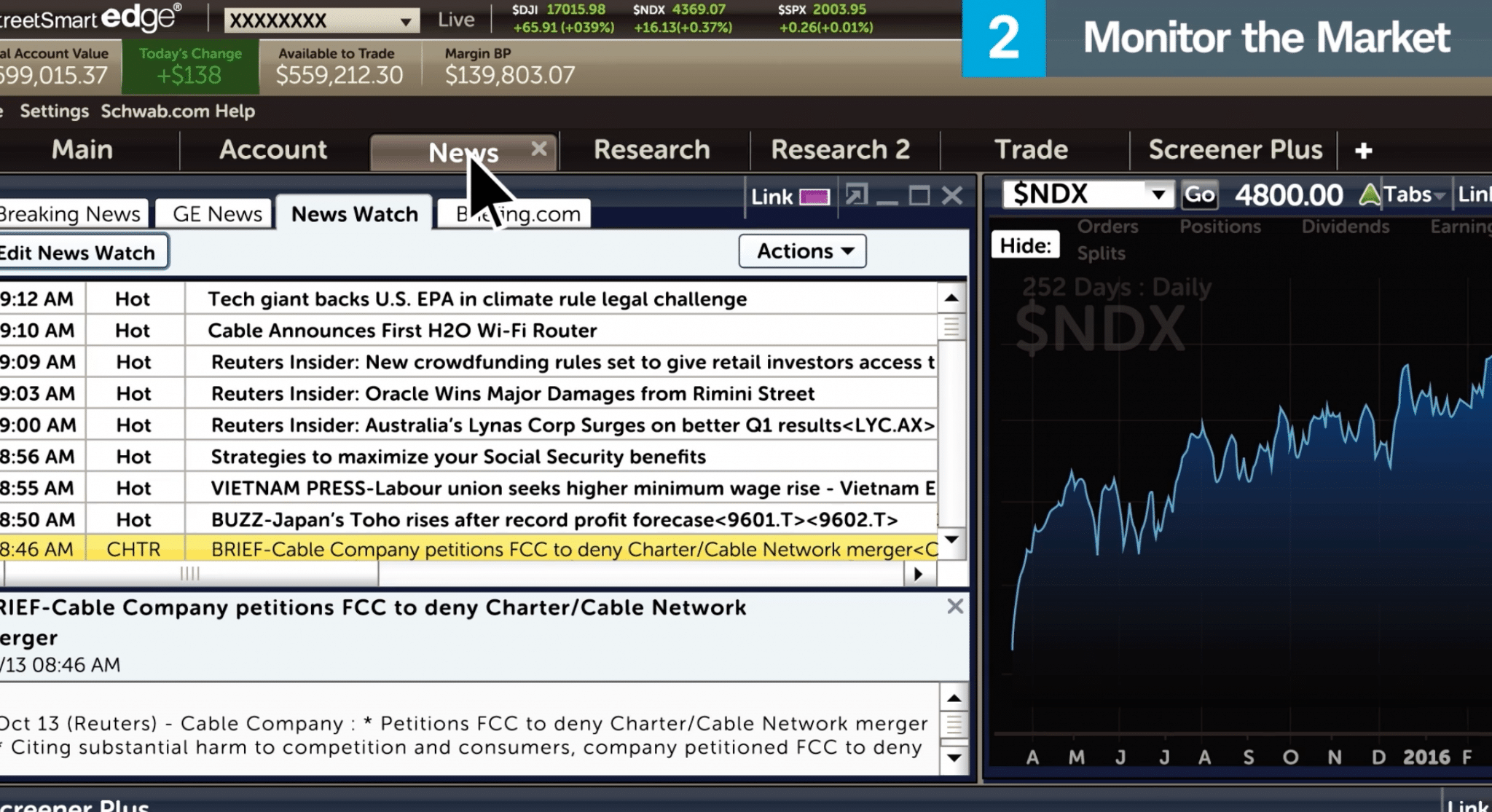

Investor Takeaways: How to Buy ADA and DOT ETFs in 2025

Those looking to buy Cardano ETF 2025 or buy Polkadot ETF 2025 should prepare for the following steps if SEC approval comes through:

How to Securely Buy ADA and DOT ETFs via Major Brokerages

-

Open an Account with a Major BrokerageStart by registering with a reputable, SEC-regulated brokerage platform that offers access to NYSE Arca and Nasdaq, such as Charles Schwab, Fidelity, or TD Ameritrade. Ensure your account is fully verified and eligible for ETF trading.

-

Fund Your Brokerage AccountDeposit funds using secure methods like bank transfers or ACH. Confirm that your account balance covers your intended investment in Cardano (GADA) or Polkadot (DOT) ETFs, plus any associated fees.

-

Research the ETF Tickers and ProspectusLocate the official ETF tickers: GADA (Cardano ETF on NYSE Arca) and DOT (Polkadot ETF on Nasdaq). Review the latest prospectus and disclosures provided by Grayscale Investments for details on custody, fees, and risk factors.

-

Place a Secure Buy OrderUse your brokerage’s trading platform to search for the ETF by ticker symbol (e.g., GADA or DOT). Place a buy order, selecting your preferred order type (market or limit) for added control and security.

-

Enable Two-Factor Authentication (2FA)Activate 2FA on your brokerage account to enhance security. This extra layer of protection helps safeguard your assets and personal information from unauthorized access.

-

Monitor ETF Performance and Market DataRegularly track the performance of your holdings. As of September 1, 2025, Cardano (ADA) is priced at $0.8141 and Polkadot (DOT) at $3.75. Use your brokerage’s dashboard or trusted financial news sources for ongoing updates.

Upon approval, expect these funds to become available on mainstream trading platforms, think Fidelity, Charles Schwab, or Robinhood, eliminating the need for specialized crypto accounts. Investors will be able to purchase shares using standard brokerage tools, track performance alongside stocks and bonds, and benefit from robust regulatory protection.

This is a significant departure from the current landscape, where buying ADA or DOT typically requires navigating exchanges, managing wallets, and understanding complex security protocols. The ETF wrapper simplifies this process without sacrificing exposure to underlying price movements.

Broader Implications: What Approval Could Mean for Crypto Markets

The impact of SEC approval would extend far beyond Cardano and Polkadot themselves. With approximately 92 crypto ETF applications under review, including those for Solana and XRP, the regulatory green light could trigger a domino effect across the industry. As more altcoin ETFs hit public markets, expect:

- Diversification: Investors can build multi-asset crypto portfolios without direct custody risks.

- Institutional inflows: Pension funds and asset managers may allocate capital to altcoins for the first time via regulated vehicles.

- Maturing market structure: Transparent pricing and daily NAV calculations will help anchor valuations and reduce manipulation risk.

The ripple effects are already visible in sentiment metrics. As noted earlier, Polymarket data shows an 87% probability of Cardano ETF approval, a remarkable shift that underscores investor optimism around secure crypto buying via ETFs (source). Should these odds materialize into reality by October 26,2025, we could see both ADA (currently at $0.814081) and DOT ($3.75) experience significant liquidity-driven price action.

Looking Ahead: Navigating Risks in a New Era of Crypto Access

No investment is without risk, even with regulatory approval in place. While ETFs will simplify access to Cardano and Polkadot exposure, they also introduce new dynamics such as tracking error (the difference between fund price and underlying asset value), management fees, and potential limits on after-hours liquidity compared to spot markets.

It’s essential for investors to understand these nuances before diving in. Due diligence remains paramount: review each fund’s prospectus carefully; consider how an ADA or DOT allocation fits your broader risk profile; stay informed about ongoing regulatory developments that could impact fund operations.

If successful, Grayscale’s push may mark a turning point, not just for their own product lineup but for the entire ecosystem of regulated digital asset investing. For those seeking secure crypto buying options with institutional safeguards, the coming months could offer unprecedented opportunities as new doors open on Wall Street’s trading floors.