Another wild week for crypto! With over $1.5 billion in leveraged positions liquidated and Bitcoin’s price dipping to $109,476, new buyers are staring down the barrel of volatility. If you’re thinking about buying cryptocurrency during a market crash, you’re not alone, and you’re not crazy. Volatility is part of the game, but entering smartly is what separates winners from bagholders.

Bitcoin Holds Above $109,000: What Does This Mean for New Buyers?

Let’s be real: The recent Bitcoin price dip below $112,000 has shaken both rookies and pros. But here’s the secret, these shakeouts are often when new fortunes are made if you play your cards right. The current market correction isn’t just a test of nerves; it’s a chance to enter with discipline and security top of mind.

The key? Don’t get caught up in the hype or panic. Instead, use proven strategies designed for volatile markets and high-stakes liquidations.

“Speed, discipline, and adaptability are your best friends in crypto, especially after a billion-dollar liquidation event. “

Strategy #1: Use Regulated Platforms with Robust Security

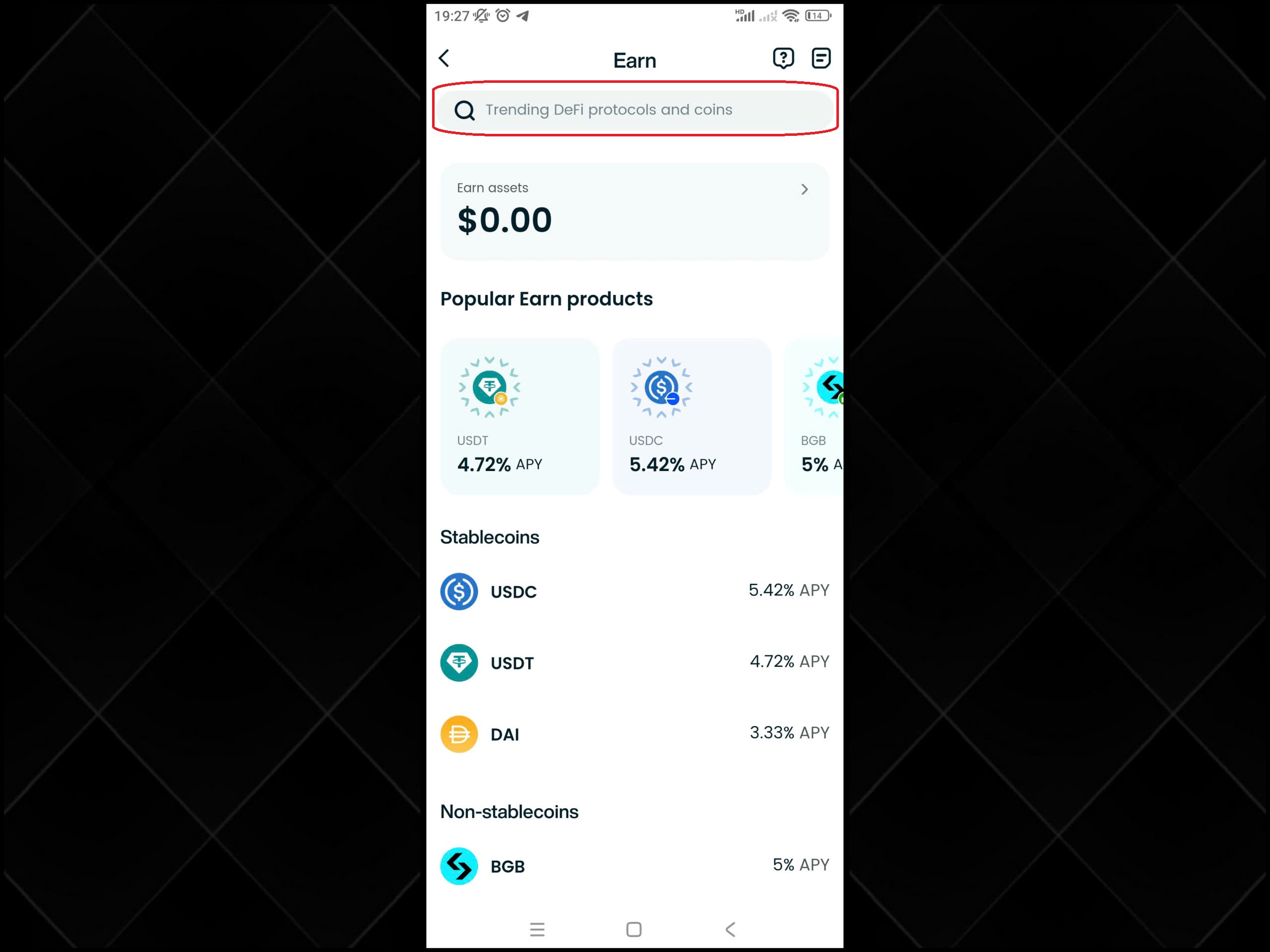

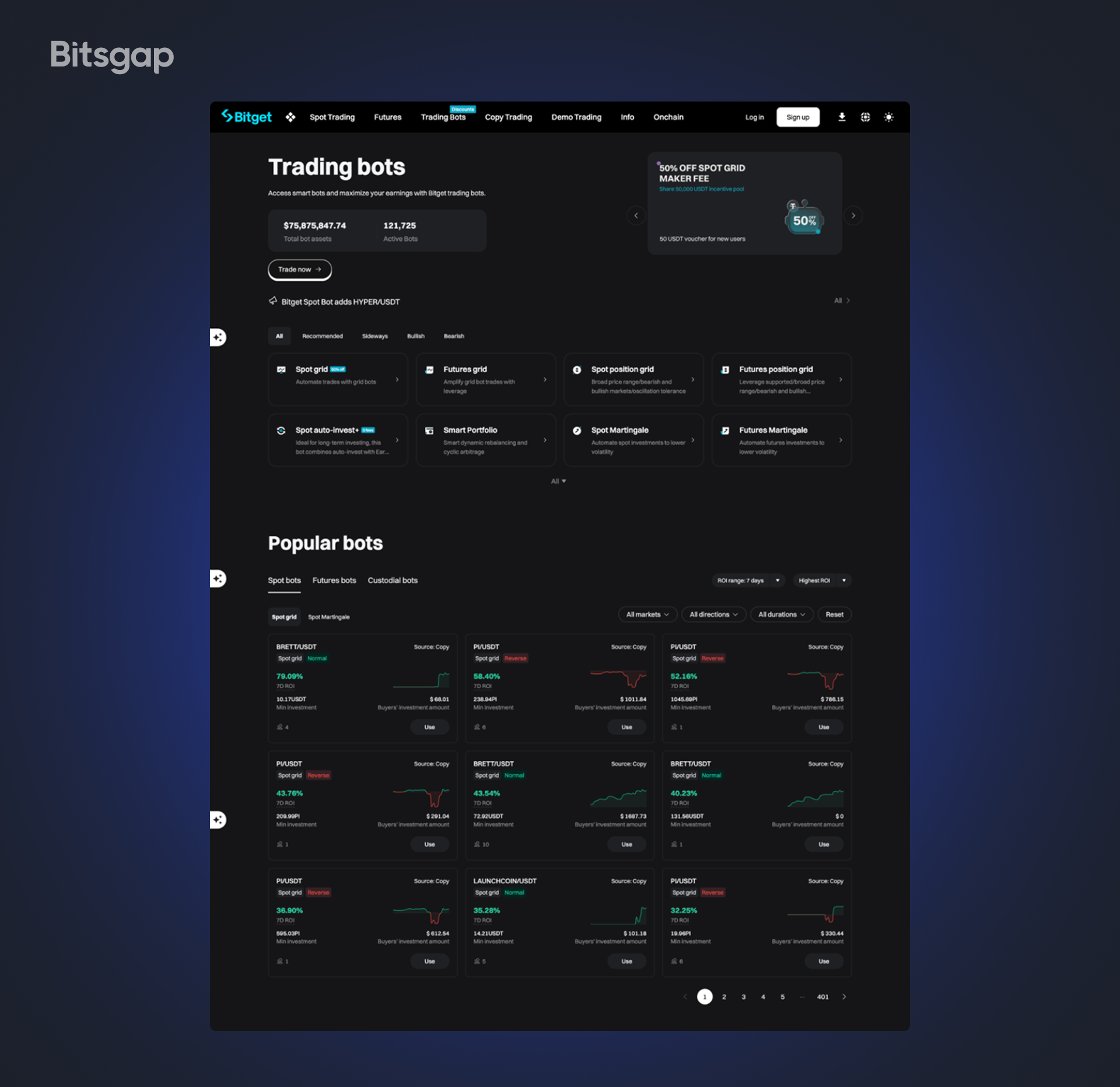

Your first line of defense is choosing where you buy and store your assets. In times like these, only platforms with ironclad regulation and security should make your list. Bitget, for example, offers not just regulated trading but also secure wallet options that help keep your digital assets safe from hacks or platform failures (Source: Bitget). Don’t risk your hard-earned cash on sketchy exchanges, security is non-negotiable when the market is in turmoil.

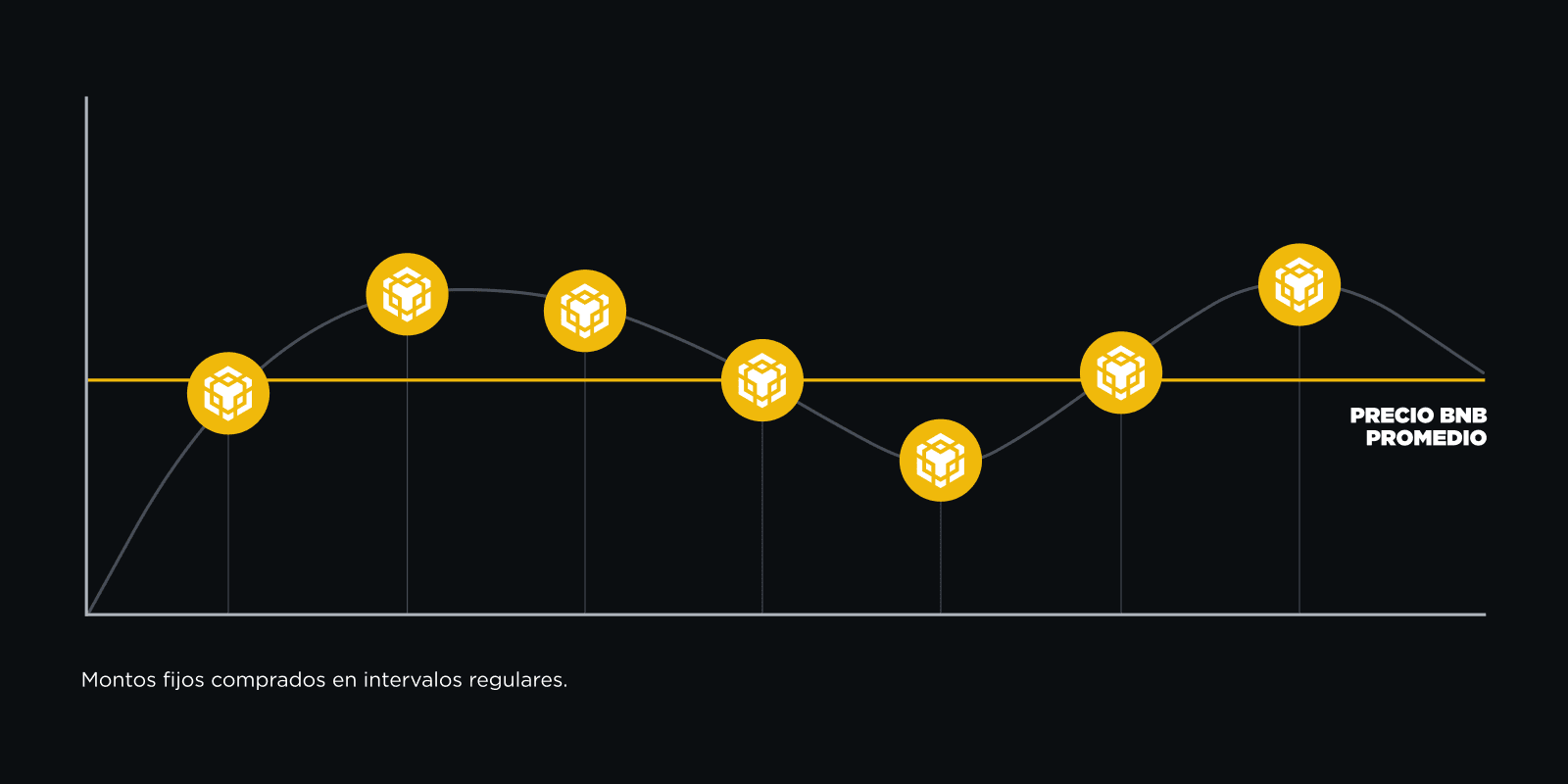

Strategy #2: Implement Dollar-Cost Averaging (DCA) to Reduce Entry Risk

If there’s one tactic that helps new investors sleep at night during wild swings, it’s dollar-cost averaging (DCA). Instead of going all-in at $109,476, or trying to time the bottom, DCA means investing a fixed amount on a set schedule (weekly or monthly). This spreads out your risk and averages your entry price over time. It takes emotion out of the equation and keeps you from panic-buying or selling on impulse (Source).

Strategy #3: Diversify Crypto Holdings Across Multiple Assets

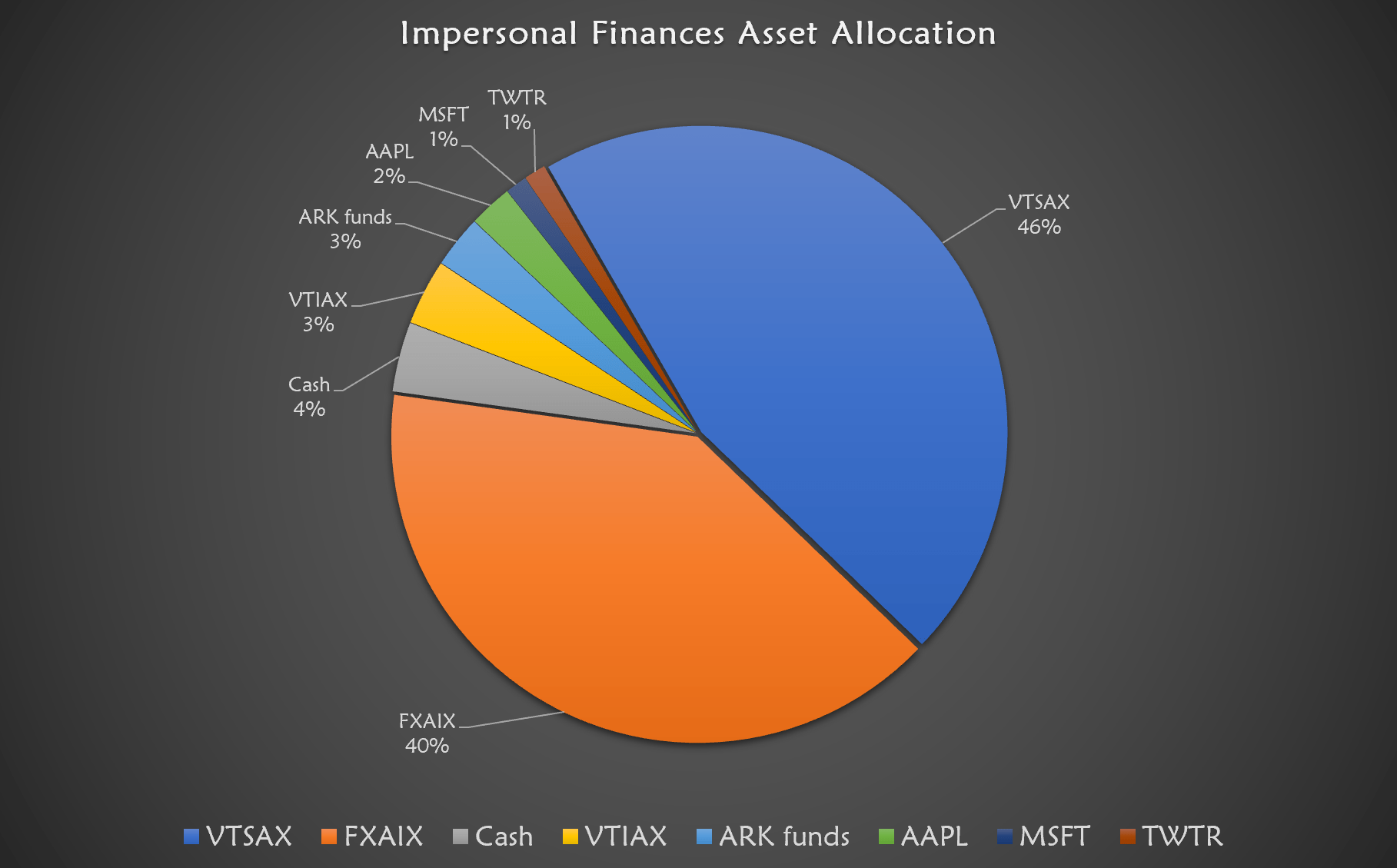

The recent liquidation wave proved how dangerous it is to put all your eggs in one basket. By diversifying across several cryptocurrencies, not just Bitcoin, you reduce the impact any single asset’s crash has on your portfolio (Source). Mix large caps like Ethereum with selected altcoins for better risk-adjusted returns.

5 Secure Strategies for Building a Resilient Crypto Portfolio

-

Use Regulated Platforms with Robust Security (e.g., Bitget) for All Transactions and Storage: Protect your assets by trading and storing crypto on regulated exchanges like Bitget, which offers advanced security features and insurance funds. Secure storage options such as Bitget Wallet further reduce risks from hacks or unauthorized access.

-

Implement Dollar-Cost Averaging (DCA) to Reduce Entry Risk During Volatile Price Swings: Invest a fixed amount at regular intervals, regardless of Bitcoin’s price (currently $109,476), to smooth out market volatility and avoid emotional buying or selling.

-

Diversify Crypto Holdings Across Multiple Assets to Mitigate Single-Asset Liquidation Impact: Build a balanced portfolio by allocating funds to major coins like Bitcoin, Ethereum, and select altcoins. Diversification helps cushion the blow from sudden liquidations or price drops in any single asset.

-

Set Stop-Loss Orders and Portfolio Alerts to Automate Risk Management: Protect your investments by using stop-loss orders and real-time alerts. These tools help you react instantly to sharp market moves, limiting losses and locking in gains automatically.

-

Stay Informed on Market News, Institutional Flows, and Regulatory Updates to Time Purchases Strategically: Follow reputable crypto news sources and monitor institutional activity. Being informed empowers you to make smarter, timely decisions—especially during volatile periods like the recent $1.5 billion liquidation event.

This isn’t about chasing every shiny coin, it’s about building resilience so one bad move doesn’t wipe out everything you’ve built.

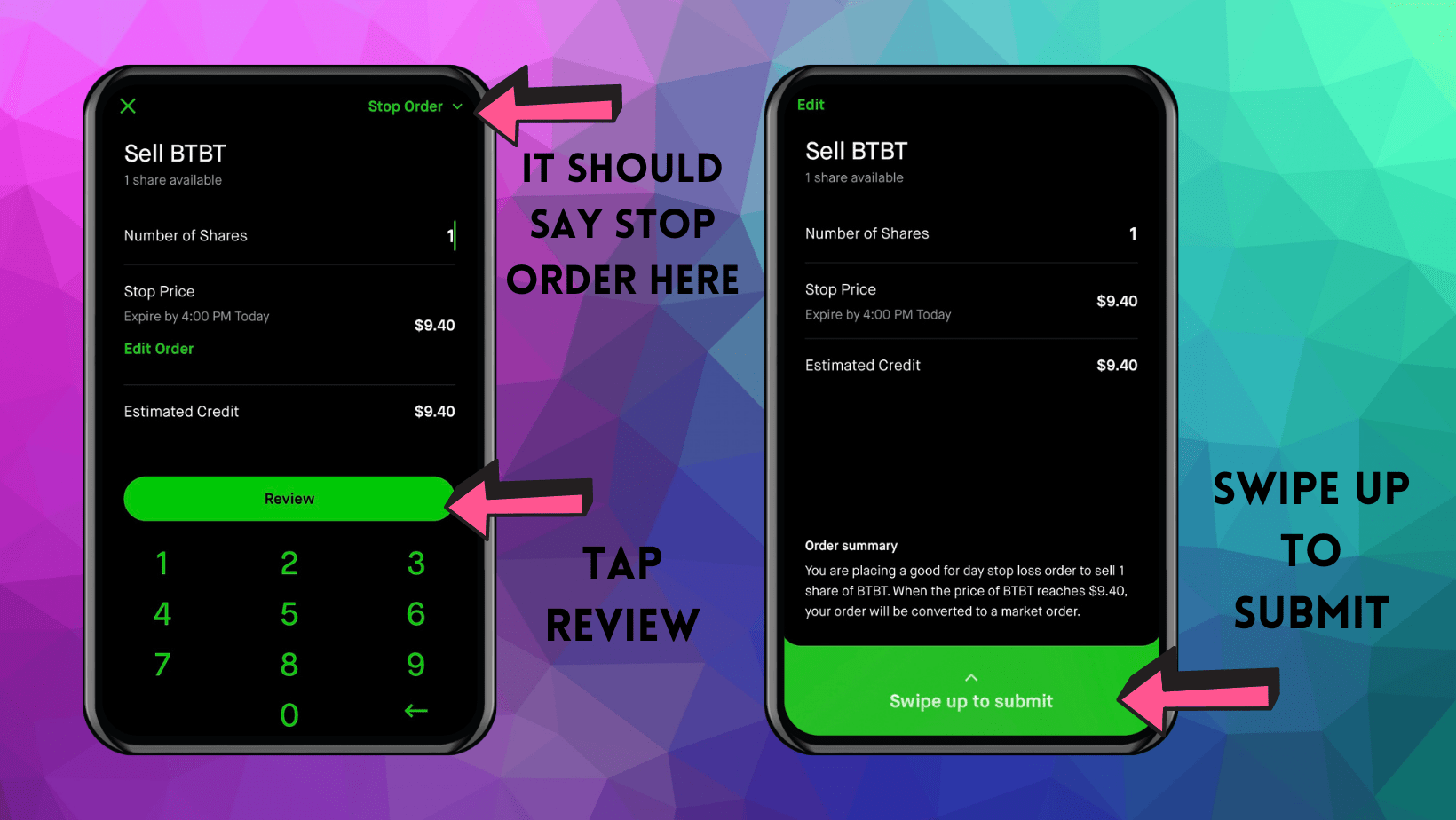

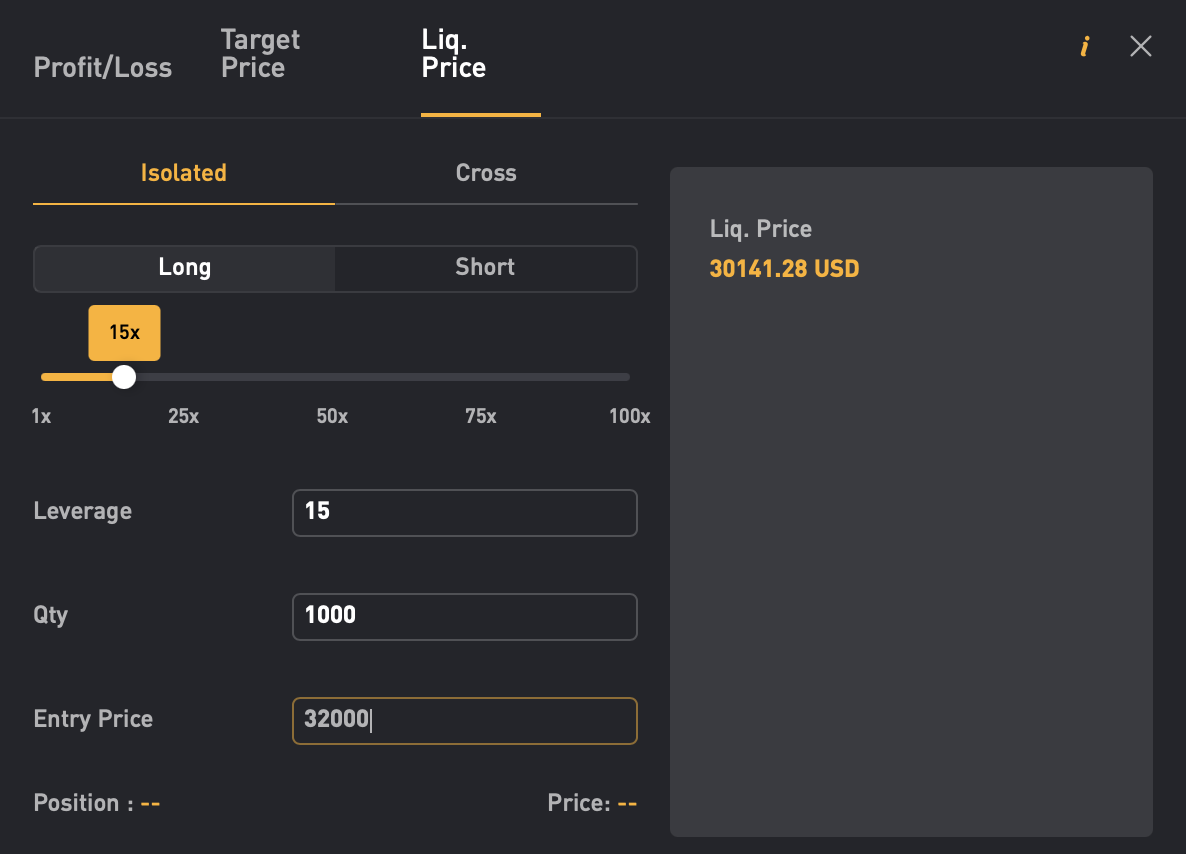

Strategy #4: Set Stop-Loss Orders and Portfolio Alerts to Automate Risk Management

Let’s face it, nobody can watch the charts 24/7, especially when Bitcoin is swinging around $109,476 after a billion-dollar liquidation. That’s why automated risk management is non-negotiable. Setting stop-loss orders ensures you never lose more than you’re comfortable with, your trades exit automatically if prices drop to your limit. Combine this with portfolio alerts so you get notified about big moves or when your favorite tokens hit buy zones. This discipline keeps your emotions in check and helps you stick to your plan during chaos.

Stop-losses aren’t just for pros. They’re a must-have shield for anyone serious about surviving volatile markets like we’re seeing now.

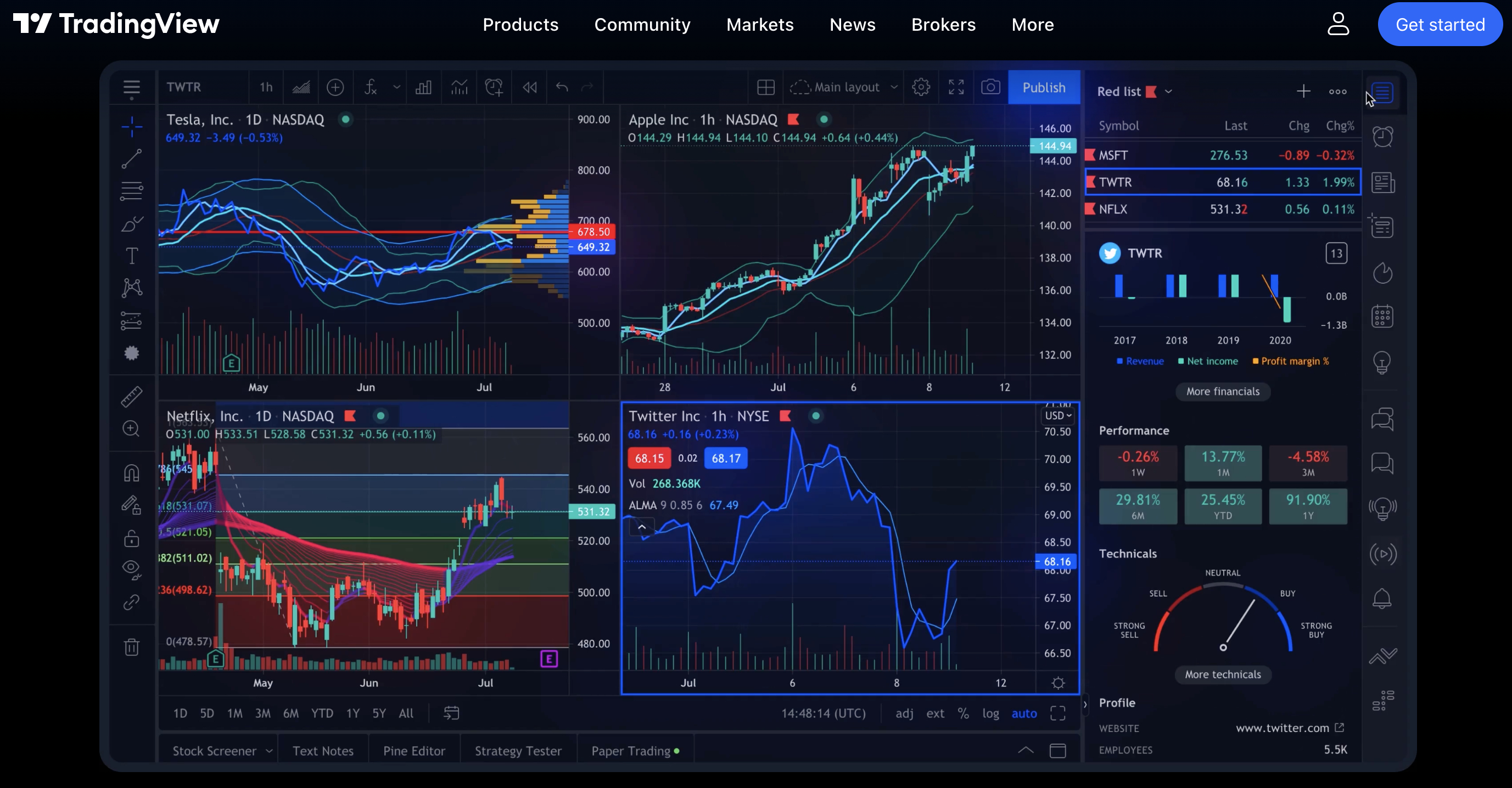

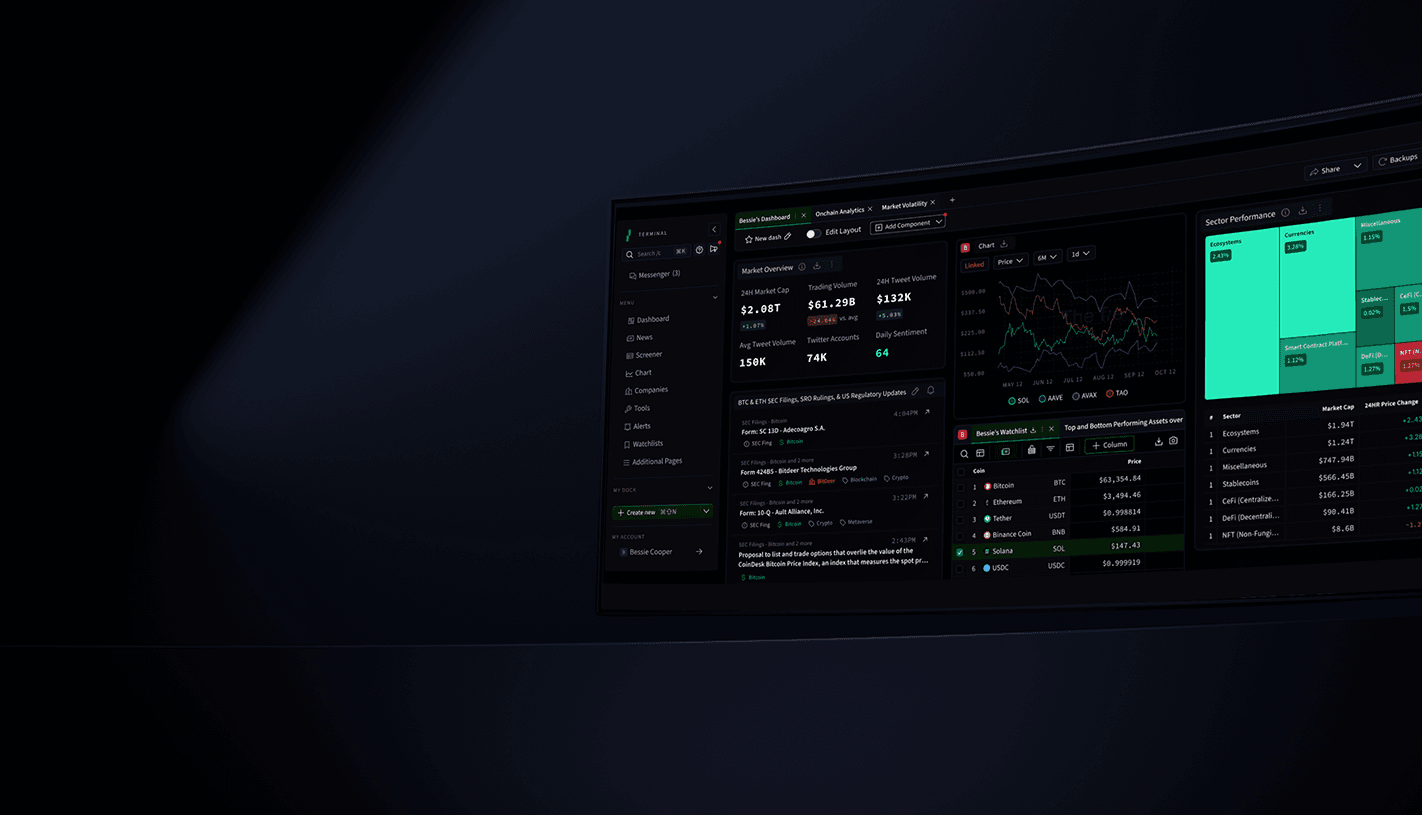

Strategy #5: Stay Informed on Market News, Institutional Flows and Regulatory Updates

The crypto landscape changes at lightning speed, especially after massive shakeouts like the recent $1.5 billion liquidation event. Staying plugged into real-time news, institutional flows, and regulatory updates gives you an edge that most new buyers overlook (Source). Knowing when big players are entering or exiting, or when regulations are shifting, can help you time your purchases strategically and avoid getting caught off guard by sudden moves.

Don’t rely on luck, rely on information. Set up alerts from trusted sources, follow top analysts on social media, and check platform updates regularly.

Your Secure Entry Playbook: Putting It All Together

If you’re looking to buy cryptocurrency during a market crash or after a major liquidation event like we just witnessed at $109,476 BTC, here’s your actionable checklist:

5 Secure Entry Strategies for New Crypto Buyers

-

Use Regulated Platforms with Robust Security (e.g., Bitget) for All Transactions and Storage: Choose reputable, regulated exchanges like Bitget to trade and store your crypto assets. Platforms with strong security protocols and insurance help protect your funds from hacks and unauthorized access.

-

Implement Dollar-Cost Averaging (DCA) to Reduce Entry Risk During Volatile Price Swings: Invest a fixed amount at regular intervals, regardless of Bitcoin’s price (currently $109,476). DCA helps smooth out purchase prices and minimizes the impact of sudden market dips.

-

Diversify Crypto Holdings Across Multiple Assets to Mitigate Single-Asset Liquidation Impact: Spread your investments across established cryptocurrencies like Bitcoin, Ethereum, and select altcoins. Diversification reduces the risk of heavy losses if one asset experiences a sharp decline.

-

Set Stop-Loss Orders and Portfolio Alerts to Automate Risk Management: Use stop-loss orders to automatically limit potential losses and set portfolio alerts to stay updated on price movements. This automation helps you react quickly to volatile swings without constant monitoring.

-

Stay Informed on Market News, Institutional Flows, and Regulatory Updates to Time Purchases Strategically: Follow trusted crypto news sources and monitor regulatory changes. Being informed allows you to make smarter, more timely investment decisions during rapid market changes.

The truth? Volatility isn’t going anywhere, but neither is opportunity. The difference between getting rekt and building wealth is all about preparation and mindset. Use regulated platforms like Bitget for every transaction; DCA into positions to avoid emotional mistakes; diversify so one coin won’t tank your stack; automate risk management with stop-losses and alerts; stay informed so you can react fast to market-moving news.

This approach won’t just help you survive wild markets, it’ll set you up to thrive in them. The next time headlines scream “liquidation wipeout, ” remember: discipline beats FOMO every single time.