Bitcoin’s recent price action has left both seasoned investors and crypto newcomers watching ETF flows like hawks. As of September 30,2025, Bitcoin (BTC) is trading at $112,864, up 0.67% in the past 24 hours. But headlines have focused less on day-to-day moves and more on the massive outflows from U. S. -listed Bitcoin ETFs earlier this year. Over $5.5 billion exited these funds in just five weeks ending in March, raising tough questions: What do ETF outflows mean for Bitcoin’s future? And how should buyers position themselves as 2026 approaches?

ETF Outflows: Signal or Noise for Crypto Buyers?

To understand why bitcoin ETF outflows matter, it’s important to know what they represent. When investors pull money from Bitcoin ETFs, it doesn’t directly force the sale of underlying BTC – but it does reflect shifting sentiment and can trigger secondary selling by funds needing to rebalance. In early 2025, outflows were driven by a combination of rising interest rates, profit-taking after Bitcoin’s explosive 2024 rally, and ongoing regulatory uncertainty.

For those buying bitcoin securely during periods of ETF rebalancing, volatility is both a risk and an opportunity. Large-scale ETF withdrawals can provoke sharp price dips – but these moments may also offer disciplined buyers a chance to enter or add to positions at discounted levels.

Bitcoin Maintains Position Above $100,000: What Does It Mean for 2026?

Despite the turbulence caused by ETF flows, Bitcoin has held firmly above the psychologically significant $100,000 mark for much of 2025. The current price of $112,864 underscores resilience even as some traditional investors take profits off the table.

The big question now is where BTC heads next. Forecasts remain wide-ranging. Anthony Scaramucci’s bullish call that Bitcoin could triple by mid-2026 – reaching around $170,000 – stands in contrast to more conservative models projecting prices between $100,000 and $150,000 depending on future ETF inflows and regulatory clarity (source). Meanwhile, Changelly highlights that large-scale inflows or outflows in ETF holdings can still provoke sudden price swings as we approach the next halving cycle.

Bitcoin Price Prediction Table: 2026–2031 (Post-ETF Outflows Analysis)

Comparing Major Analyst Forecasts and Market Scenarios After 2025 ETF Outflows

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $85,000 | $135,000 | $170,000 | +20% | ETF inflows stabilize, regulatory clarity improves |

| 2027 | $95,000 | $150,000 | $200,000 | +11% | Adoption grows, halving effects linger |

| 2028 | $110,000 | $170,000 | $240,000 | +13% | Mainstream adoption, institutional entry increases |

| 2029 | $125,000 | $195,000 | $285,000 | +15% | Global payment use cases expand |

| 2030 | $140,000 | $220,000 | $330,000 | +13% | Regulatory harmonization, competition from CBDCs |

| 2031 | $155,000 | $245,000 | $370,000 | +11% | Mature market, Bitcoin as digital gold |

Price Prediction Summary

Bitcoin’s price outlook for 2026–2031 reflects both the potential for substantial growth and the risks of ongoing volatility. Despite recent ETF outflows and macro headwinds in 2025, most analysts anticipate a recovery and a renewed uptrend, driven by increasing institutional participation, supply constraints, and improving regulatory clarity. However, the wide min/max ranges highlight persistent uncertainty and the impact of global economic conditions.

Key Factors Affecting Bitcoin Price

- ETF inflows/outflows and institutional investor behavior

- Global regulatory developments and enforcement actions

- Macroeconomic trends (inflation, interest rates, risk appetite)

- Bitcoin’s halving cycles and supply dynamics

- Mainstream and enterprise adoption rates

- Competition from other cryptocurrencies and CBDCs

- Technological upgrades and network security improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Crypto Market Analysis in 2025

The interplay between ETF flows and spot prices is just one factor shaping crypto market analysis in 2025. Regulatory risks remain front-and-center; September saw another notable outflow event ($258 million), reflecting how quickly sentiment can shift with new policy headlines or enforcement actions.

For strategic buyers looking to build positions ahead of potential catalysts in 2026 – such as further regulatory clarity or increased institutional adoption – understanding these crosscurrents is essential. Rather than chasing short-term moves driven by ETF headlines alone, focus on robust research and secure buying practices.

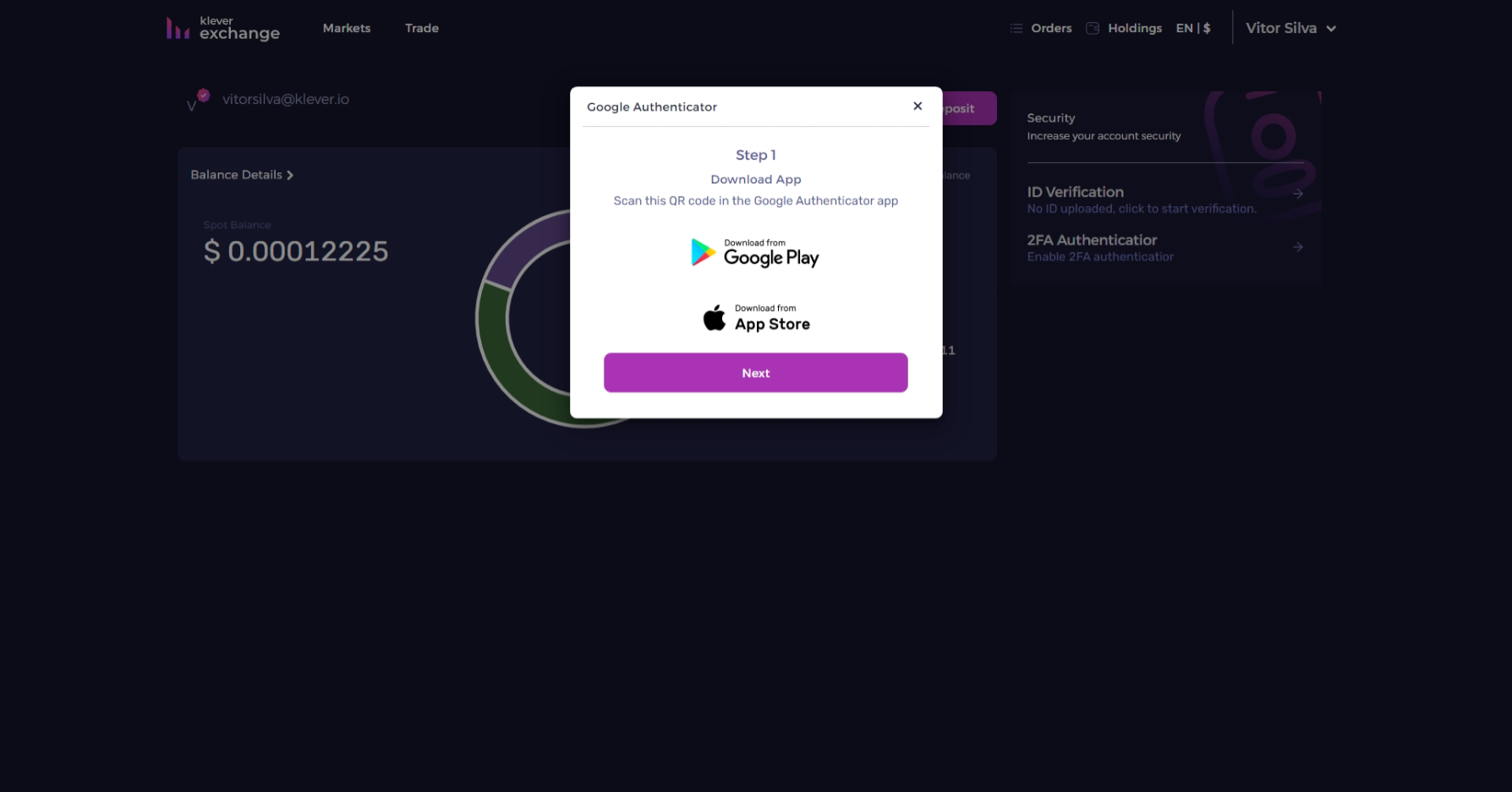

Assessing the current landscape, it’s clear that ETF-driven volatility is a double-edged sword. While outflows can rattle nerves, they also flush out speculative excess and reset the market for more sustainable growth. For those prioritizing buying bitcoin securely, this means using regulated platforms, enabling two-factor authentication, and considering staged entries to mitigate timing risk during periods of heightened ETF rebalancing.

How to Buy Bitcoin During ETF Rebalancing

If you’re looking to accumulate BTC while ETFs are seeing heavy flows, discipline is key. Don’t let headlines alone drive your decisions. Instead:

How to Buy Bitcoin Securely During ETF Volatility

-

Enable Two-Factor Authentication (2FA): Protect your account by activating 2FA through authenticator apps like Authy or Google Authenticator. This adds an extra layer of security against unauthorized access.

-

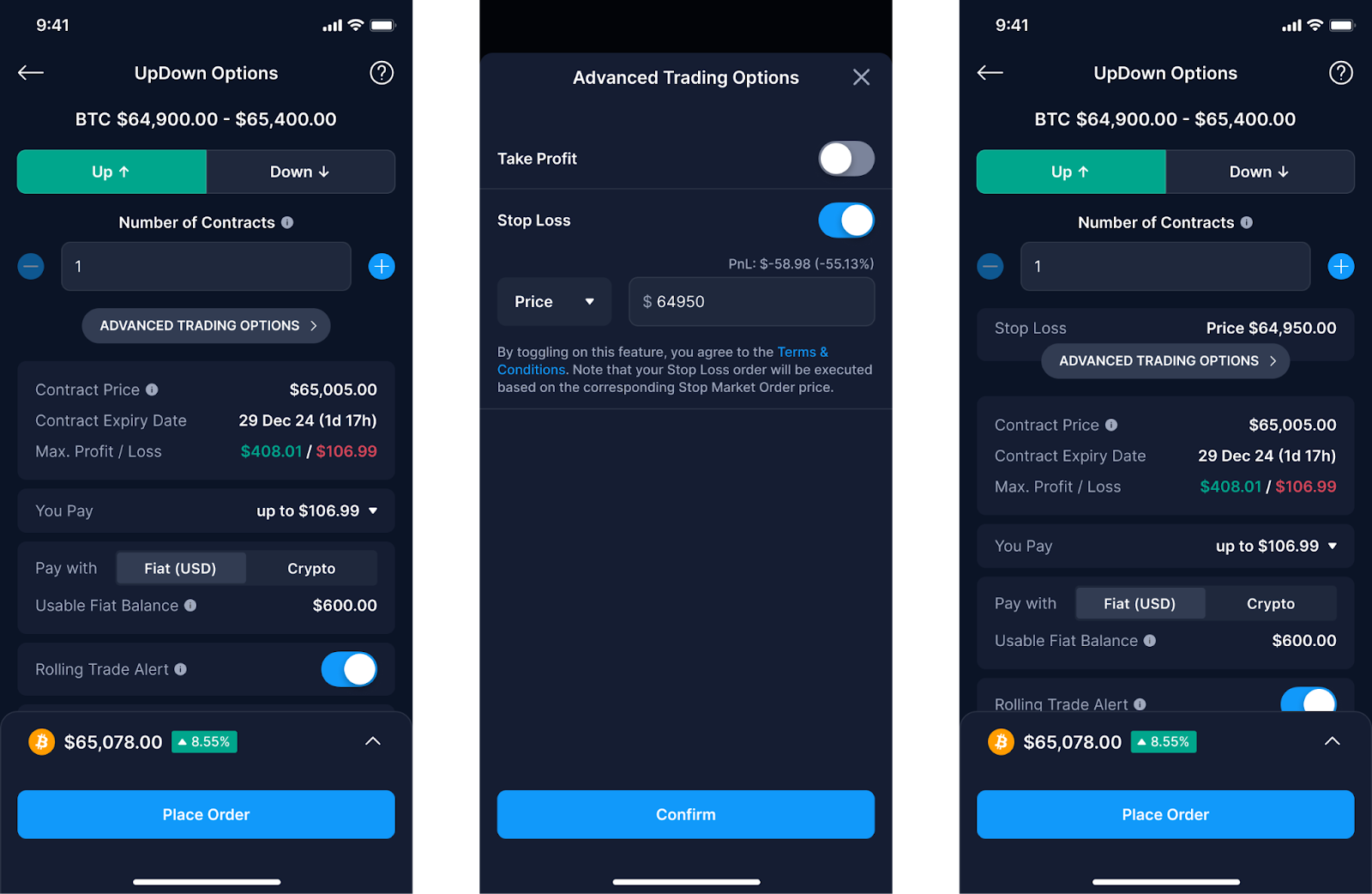

Set Limit Orders Instead of Market Orders: Use limit orders on your chosen exchange to control your entry price, especially when Bitcoin is volatile. This helps avoid unexpected slippage during rapid price movements.

-

Stay Updated on Regulatory Developments: Follow updates from trusted sources like U.S. Securities and Exchange Commission (SEC) and CoinDesk for news that could impact Bitcoin and ETF markets.

-

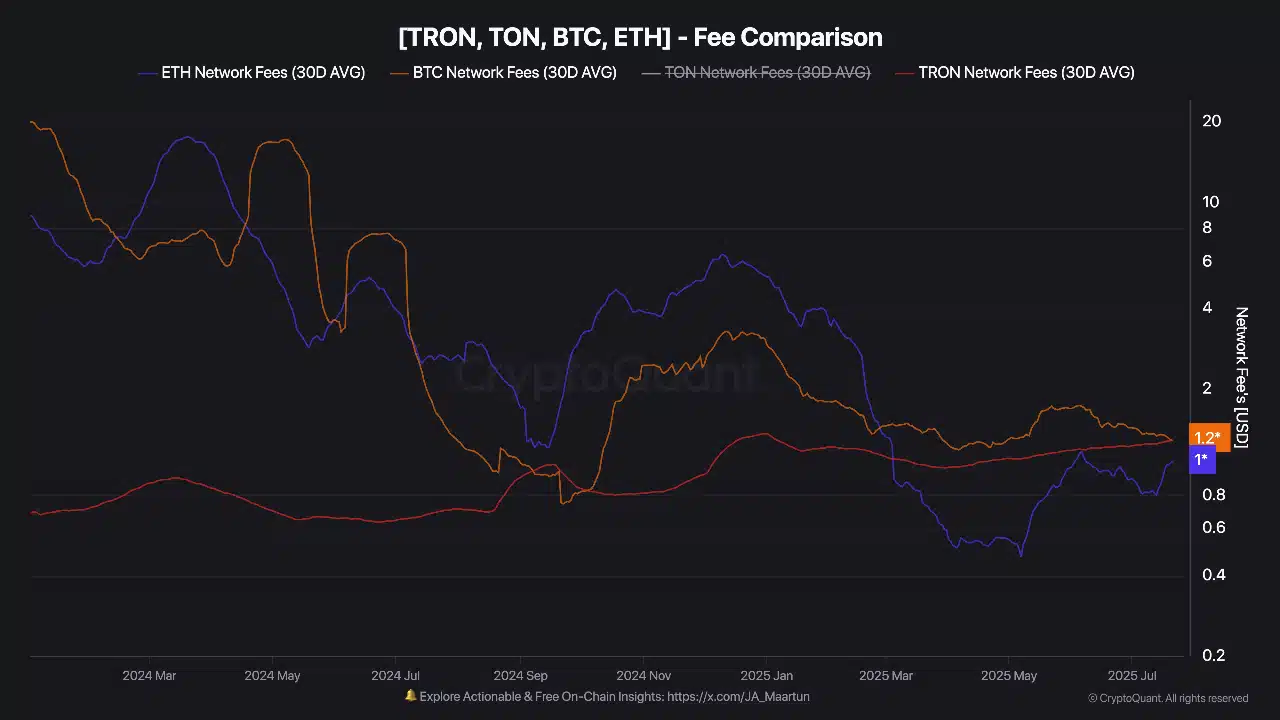

Review Transaction Fees and Withdrawal Limits: Compare the fee structures and withdrawal policies of major exchanges before buying. High fees or restrictive limits can impact your returns, especially during periods of heightened activity.

-

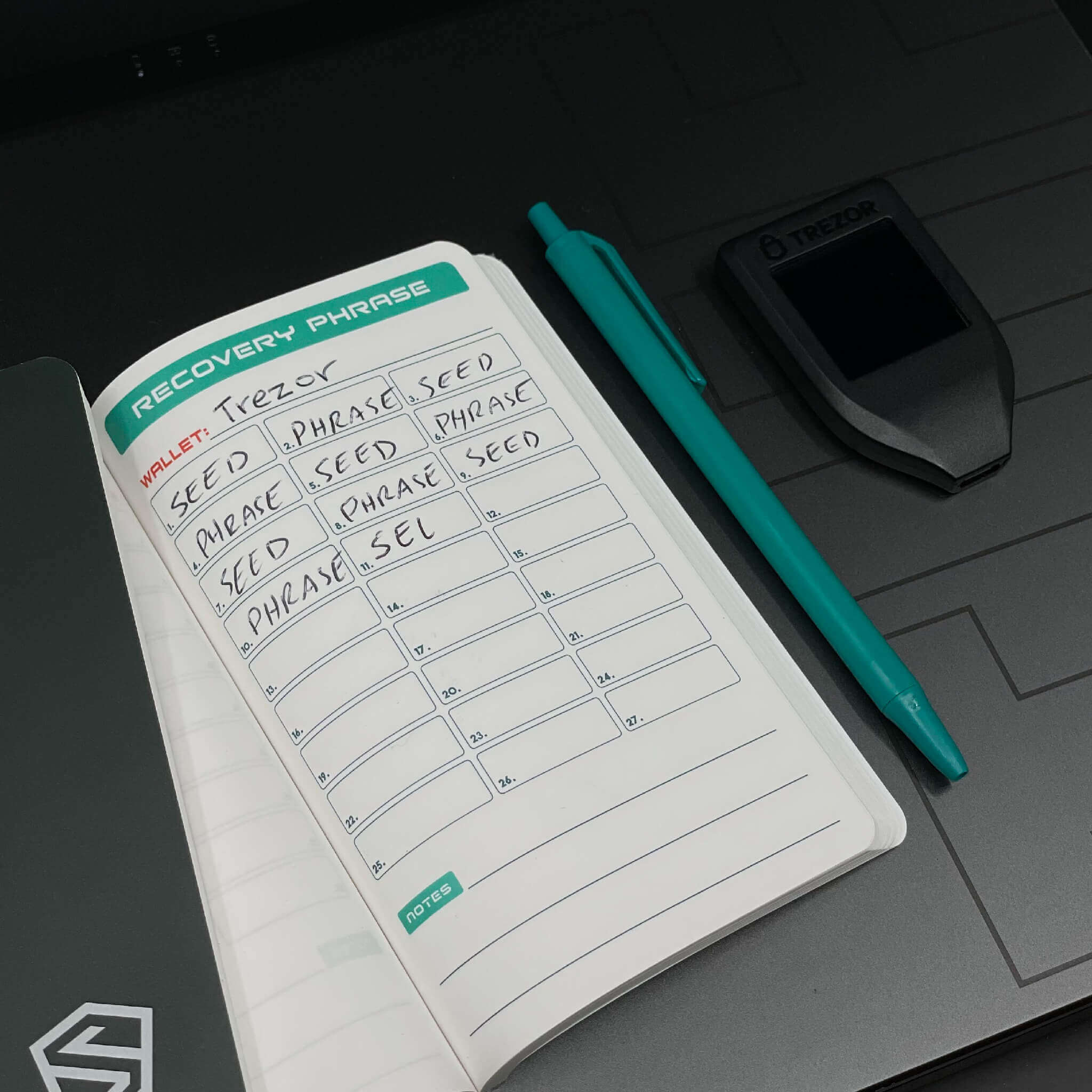

Document and Secure Your Recovery Phrases: When using hardware wallets, securely record your recovery phrase offline. Never share it online or store it digitally to prevent loss or theft of your Bitcoin.

By focusing on security and patience, you position yourself to benefit if the market rebounds after a bout of ETF-driven selling.

Beyond ETFs: Other Factors Shaping Bitcoin’s 2026 Trajectory

While ETF flows dominate short-term narratives, long-term price direction will hinge on broader factors. Regulatory clarity remains pivotal; favorable rulings could unlock new institutional demand, while restrictive measures may cap upside or trigger further outflows. Macroeconomic shifts, like changing interest rates or inflation surprises, also play a role in shaping demand for non-sovereign assets like BTC.

Meanwhile, network-level developments such as the next Bitcoin halving (expected in 2028) and ongoing upgrades to transaction efficiency will influence both supply dynamics and investor confidence as we move toward 2026.

The Strategic Playbook for Crypto Buyers Now

Navigating these crosscurrents calls for a pragmatic approach:

- Stay informed: Follow credible sources tracking both ETF flows and regulatory updates.

- Diversify entry points: Use dollar-cost averaging or limit orders rather than lump-sum buys during volatile periods.

- Prioritize security: Choose exchanges with robust compliance standards and self-custody options when possible.

- Avoid emotional trading: Reacting impulsively to headlines can erode long-term returns.

If Bitcoin maintains its position above $100,000 through continued ETF turbulence, it may signal deeper institutional conviction in the asset class, even if short-term sentiment remains fragile.

No one can predict with certainty whether Bitcoin will hit $170,000 by mid-2026 or retrace to lower levels. But by focusing on fundamentals, network growth, regulatory trends, secure buying practices, you set yourself up to weather storms and seize opportunities as they arise. As always in crypto: fortune favors the prepared mind.