Bitcoin has once again rewritten the rules of digital finance, soaring to an all-time high of $126,157.00 before settling at $124,356.00 as of the latest market data. For first-time crypto buyers, this headline-grabbing milestone is both a powerful motivator and a source of anxiety. The question on everyone’s mind: does this historic surge signal a new era for Bitcoin or a moment of overheated speculation?

Bitcoin Surges Past $125,000: What’s Fueling the Rally?

The current rally is not happening in isolation. Several macroeconomic and regulatory factors have converged to push Bitcoin into uncharted territory:

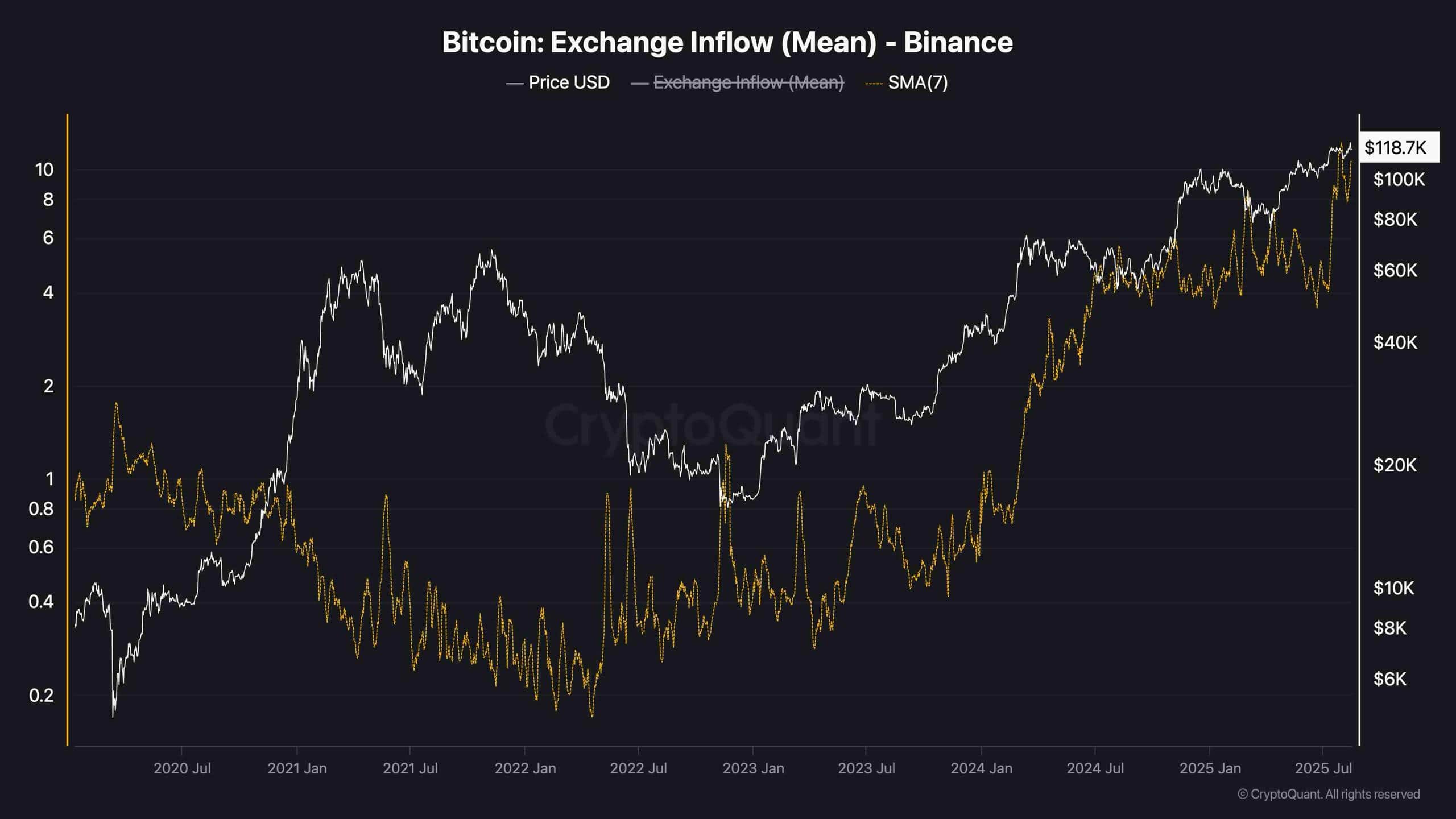

- Institutional Inflows: Spot Bitcoin ETFs have attracted $3.2 billion in inflows last week alone, their second-best week since launch. This wave of institutional capital is providing newfound stability and legitimacy for Bitcoin as an asset class.

- Regulatory Tailwinds: The U. S. government’s approval of updated stablecoin regulations and a more constructive SEC policy stance have created a supportive environment for crypto adoption.

- Macro Uncertainty: With expectations of Federal Reserve rate cuts and ongoing concerns about a prolonged U. S. government shutdown, investors are seeking refuge in alternative assets like Bitcoin.

This trifecta has emboldened both seasoned investors and newcomers alike, but it also raises the stakes for those considering their first purchase now.

Navigating FOMO: Should First-Time Buyers Jump In?

The fear of missing out (FOMO) is palpable when headlines trumpet new highs. Yet history teaches us that chasing parabolic moves can be risky business, especially in crypto markets known for their volatility. After its recent peak above $126,000, Bitcoin experienced an orderly pullback to around $124,356.00 within hours, a classic reminder that what goes up swiftly can also retrace just as quickly (source).

If you’re considering buying cryptocurrency in 2025 for the first time, it’s crucial to develop a strategy that goes beyond hype:

Essential Risk Management Tips for New Crypto Buyers

-

Start Small and Only Invest What You Can Afford to LoseGiven Bitcoin’s current price of $124,356.00 and its recent surge above $125,000, the market remains highly volatile. Begin with a modest investment to minimize potential losses and avoid financial strain.

-

Diversify Your Portfolio Across Established AssetsDon’t put all your funds into Bitcoin alone. Consider other leading cryptocurrencies such as Ethereum (ETH) and Solana (SOL), as well as traditional assets, to reduce risk and smooth out volatility.

-

Use Reputable Exchanges and Secure WalletsChoose well-established platforms like Coinbase, Kraken, or Gemini for buying and selling. Store your assets in secure wallets, such as Ledger or Trezor hardware wallets, to protect against hacks and theft.

-

Stay Informed About Regulatory ChangesRecent regulatory shifts, such as the approval of new stablecoin regulations and updated SEC policies, can impact the market. Regularly check trusted sources like CoinDesk and Reuters for updates.

-

Adopt a Long-Term Perspective and Avoid Emotional TradingBitcoin’s price recently dipped after hitting its all-time high. Resist the urge to chase short-term gains or panic during pullbacks. Consider dollar-cost averaging and focus on long-term growth.

-

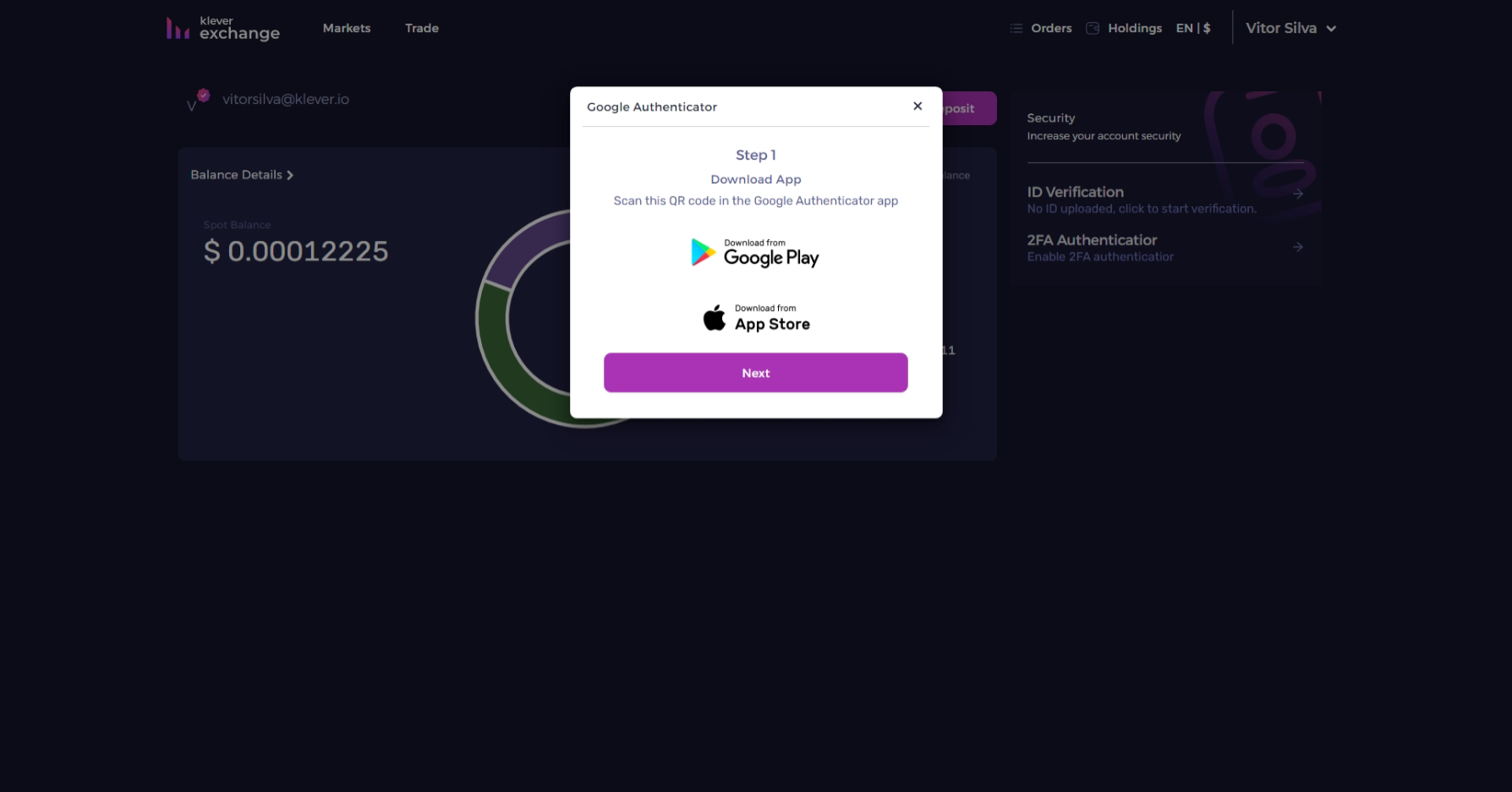

Enable Two-Factor Authentication and Practice Good Security HygieneProtect your accounts on exchanges and wallets by enabling 2FA and using strong, unique passwords. Be cautious of phishing attempts and never share your private keys.

The most successful investors view these moments through a long-term lens and resist emotional decision-making.

The Macro Picture: Why Institutions Are Betting on Bitcoin Now

This rally stands apart from previous cycles due to the scale and nature of institutional involvement. Pension funds, insurance companies, and endowments are now allocating capital to spot Bitcoin ETFs, a trend that reflects growing acceptance at the highest levels of finance (source). Their participation isn’t just about chasing returns; it’s also about hedging against macro risks like inflation, currency debasement, and fiscal instability.

For retail investors watching from the sidelines or contemplating their first move into crypto assets, this shift matters deeply. Institutional flows can cushion volatility, but they can also amplify both rallies and corrections as large players adjust positions dynamically.

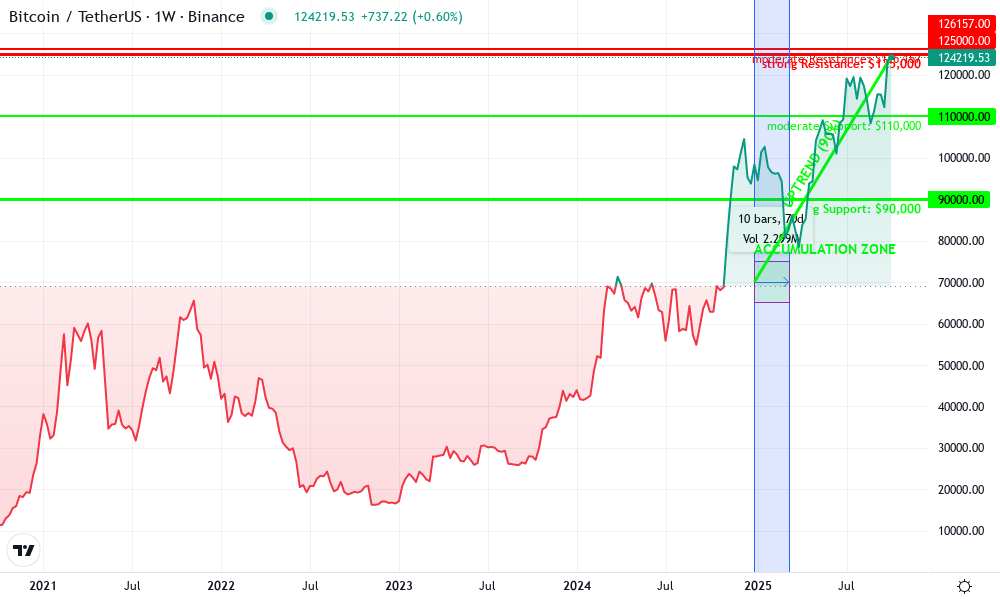

Bitcoin Technical Analysis Chart

Analysis by Jill Carmichael | Symbol: BINANCE:BTCUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

Draw a primary uptrend line from the breakout zone (~$70,000 in early 2025) to the current price at ~$124,223. Highlight horizontal resistance at $125,000 (recent ATH) and support at $110,000 and $90,000, marking these with horizontal lines. Use a rectangle to denote the strong accumulation zone between $65,000 and $75,000 from early 2025. Mark a potential consolidation zone between $120,000 and $126,000. Place a callout at the all-time high ($126,157) to highlight the breakout. Use a date range to emphasize the rapid advance from Q1 2025 to the present. Consider text annotations to note ETF inflows and regulatory tailwinds.

Risk Assessment:medium

Analysis: Bitcoin has entered uncharted territory after a powerful, institutionally driven rally.

While fundamentals support higher prices, the pace and magnitude of gains raise the risk of near-term corrections.

For conservative investors, patience and disciplined position sizing are essential.

Jill Carmichael’s Recommendation: Wait for a healthy pullback or consolidation before committing new capital.

Maintain long-term exposure but avoid chasing after parabolic moves.

Monitor volume and momentum for signs of exhaustion or further continuation.

Key Support & Resistance Levels

📈 Support Levels:

- $110,000-Recent swing low,moderate

- $90,000-Previous consolidation,strong

- $70,000-Breakout level,strong

📉 Resistance Levels:

- $125,000-Psychological round number,strong

- $126,157-Absolute peak,moderate

Trading Zones (low risk tolerance)

🎯 Entry Zones:

- $110,000-medium risk

- $90,000-low risk

🚪 Exit Zones:

- $126,157-profit target

- $105,000-stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern:

Volume spike likely around breakout,

High volume on breakout above $70k confirms institutional buying.

📈 MACD Analysis:

Signal:

Likely bullish,

Momentum positive but risk of overextension rising.

Applied TradingView Drawing Utilities

This chart analysis utilizes professional drawing tools:

Trend Line Horizontal Line Rectangle Callout Date Range Text

This technical analysis by Jill Carmichael is for educational purposes only and should not be considered as financial advice.

Trading involves risk.

Past performance does not guarantee future results.

The analysis reflects the author’s personal methodology and risk tolerance (low).

Bitcoin (BTC) Price Prediction 2026-2031

Analyst Forecasts Post-$125,000 All-Time High: Scenario Analysis and Yearly Outlook

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-on-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $88,000 | $132,000 | $168,000 | +6% | Post-ATH consolidation; possible correction before next cycle |

| 2027 | $110,000 | $146,000 | $190,000 | +11% | Renewed institutional inflows, regulatory clarity |

| 2028 | $125,000 | $162,000 | $220,000 | +11% | Halving year, increased scarcity, mainstream adoption |

| 2029 | $120,000 | $180,000 | $260,000 | +11% | Bull run continuation, global macro tailwinds |

| 2030 | $140,000 | $210,000 | $320,000 | +17% | Major tech upgrades, new ETF approvals, global adoption |

| 2031 | $170,000 | $245,000 | $390,000 | +17% | Potential for Bitcoin as digital gold, increased corporate treasury use |

Price Prediction Summary

Bitcoin’s historic surge above $125,000 in 2025 sets a strong foundation for the next market cycle. The coming years are expected to see periods of consolidation, new highs, and potential corrections as the market matures. Institutional participation, regulatory clarity, and technological improvements are likely to drive sustained growth. However, volatility remains, and both sharp pullbacks and significant rallies are possible. Average price projections suggest a steady upward trend, with the possibility of Bitcoin reaching $245,000 by 2031 under base-case scenarios.

Key Factors Affecting Bitcoin Price

- Institutional investment and ETF inflows

- Global regulatory developments and policy shifts

- Macroeconomic conditions (e.g., Fed rate decisions, inflation)

- Bitcoin halving cycles and supply dynamics

- Technological upgrades (e.g., scalability, security)

- Adoption trends among retail and corporate users

- Competition from other digital assets and stablecoins

- Geopolitical events impacting capital flows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A Quick Look at Volatility, and Opportunity

No discussion about buying cryptocurrency safely would be complete without acknowledging volatility. Even as institutions bring stability to some degree, sharp price swings remain part of Bitcoin’s DNA. The past week alone saw intraday lows near $123,373.00, reminding us that patience is essential when entering such dynamic markets (more here).

It’s easy to get swept up in the headlines, but first-time crypto buyers should remember that market cycles are a natural feature of any emerging asset class. While Bitcoin’s current price of $124,356.00 is a testament to its resilience and growing mainstream appeal, it also reflects the reality that corrections can follow even the most exuberant rallies. The key is not to time the market perfectly, but to approach your entry with discipline and clear expectations.

How to Buy Bitcoin Safely in 2025: A Pragmatic Approach

Security and due diligence are more important than ever as new investors flood into the crypto space. Scams, phishing attempts, and platform failures have not disappeared just because prices are rising. The fundamentals of a safe purchase remain unchanged:

If you’re new, consider using regulated exchanges that offer robust security features and transparent fee structures. Enable two-factor authentication, use strong passwords unique to each platform, and never share your private keys or seed phrases with anyone.

Avoiding Common Pitfalls: FOMO, Overexposure, and Short-Term Thinking

The psychological pressure of seeing Bitcoin at all-time highs can lead even seasoned investors astray. First-timers often make these mistakes:

Common Mistakes First-Time Crypto Buyers Make in Surging Markets

-

Chasing FOMO (Fear of Missing Out): Many new investors buy Bitcoin impulsively after seeing headlines about its all-time high above $125,000, without a clear strategy or understanding of the risks.

-

Ignoring Market Volatility: First-timers often underestimate how quickly Bitcoin can swing in price—after peaking at $126,157, it recently settled near $124,356. This volatility can lead to panic selling or buying at the worst moments.

-

Overlooking Regulatory Changes: New buyers may ignore the impact of evolving regulations. Recent supportive U.S. policies have boosted confidence, but rules can change quickly. Stay updated via trusted sources like CoinDesk or Reuters Crypto.

-

Short-Term Mindset: Many newcomers expect quick profits and are unprepared for downturns. Adopting a long-term perspective and using educational resources from platforms like Binance Academy can help build resilience.

Instead of going all-in at once, many experts recommend dollar-cost averaging, investing fixed amounts over time regardless of price, to smooth out volatility and avoid buying peaks unintentionally.

Looking Ahead: What This All-Time High Means for Crypto’s Future

Bitcoin’s break above $125,000, with a current price near $124,356.00, signals more than just speculative enthusiasm. It reflects an evolving macro environment where digital assets are increasingly seen as legitimate portfolio diversifiers by both individuals and institutions. Regulatory clarity is helping remove barriers for mainstream adoption; meanwhile, global economic uncertainty is driving demand for alternatives beyond traditional stocks and bonds.

Yet this moment also comes with heightened responsibility for new entrants. As the market matures, so do the risks, from sophisticated scams to sudden regulatory shifts or sharp corrections fueled by profit-taking whales. Staying informed is non-negotiable; following trusted news sources and engaging with reputable communities can help you stay ahead of fast-moving developments.

Takeaways for First-Time Crypto Buyers in 2025

- Start small: Only invest what you can afford to lose; treat your first purchase as an educational experience as much as an investment.

- Diversify: Don’t put all your capital into one asset, even if it’s Bitcoin at record highs.

- Stay patient: Volatility is inevitable; set realistic goals and timelines for your investment journey.

- Pursue knowledge: Take advantage of free resources before making decisions, understanding custody options, tax implications, and security best practices will serve you well long-term.

The crypto market will continue to evolve rapidly as institutional flows grow and regulations adapt. For those entering now, at a historic inflection point, success will be defined less by timing than by preparation and perspective. Invest thoughtfully, act with purpose, and let macro trends inform rather than dictate your approach.