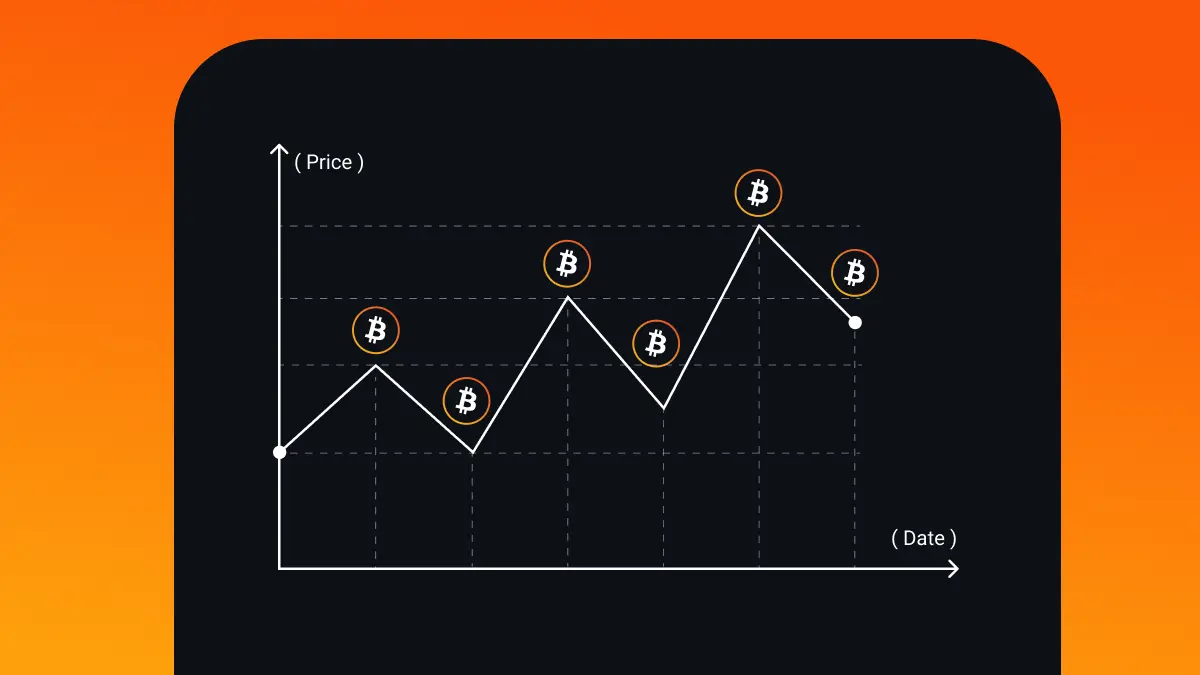

When President Donald Trump dropped the bombshell of a 100% tariff on all Chinese imports, the shockwaves didn’t just rattle Wall Street. They detonated a historic cascade in the crypto market, triggering a record $19 billion in liquidations within 24 hours. If you were watching your portfolio on October 10-11,2025, you probably felt that gut punch as Bitcoin (BTC) nosedived to $104,783 before clawing its way back to $115,053. Ethereum (ETH) tumbled over 12%, and altcoins like DOGE and AVAX saw jaw-dropping plunges of more than 60%. For anyone buying cryptocurrency during volatility, this was both a cautionary tale and an opportunity.

How Trump’s China Tariffs Set Off a Crypto Avalanche

The chain reaction started with Trump’s surprise announcement, which sent global markets into full risk-off mode. Investors scrambled to unwind leveraged bets across stocks and digital assets alike. The result? Over 1.6 million traders were caught in the crossfire as margin calls and forced liquidations wiped out positions at breakneck speed (source).

Bitcoin plunged more than 14% to its lowest level in months before rebounding to its current price of $115,053. Ethereum felt the pain too, dropping from above $4,200 to a low of $3,436 before partially recovering. Altcoins got absolutely hammered: HYPE fell 54%, DOGE cratered by 62%, and AVAX collapsed by 70%. If you blinked, you might’ve missed some of these wild swings.

The Anatomy of a $19 Billion Crypto Liquidation

This wasn’t your average dip-buying opportunity or “buy the rumor” scenario – it was a full-blown leverage purge. As traders scrambled for the exits, exchanges auto-liquidated over-leveraged positions en masse. The magnitude was unprecedented: $19 billion in crypto wiped out in one day (source). That’s not just numbers on a screen; it’s millions of real traders feeling the sting.

Why did things unravel so quickly? When markets are flush with leverage – think margin trading at 10x or even 50x – even small price moves can trigger cascading sell-offs as stop-losses are hit and positions get force-sold by exchanges. Add a geopolitical bombshell like Trump’s tariffs into the mix and you have all the ingredients for what analysts are now calling crypto’s “black swan event” of 2025.

What This Means for Buyers Right Now

If you’re looking to enter or add to your crypto holdings after this chaos, here’s what matters: volatility is both risk and opportunity. The liquidation event has purged much of the excess leverage from the system – meaning there could be fewer forced sellers next time volatility strikes (source). But don’t mistake this for smooth sailing ahead.

The current price action shows Bitcoin hovering at $115,053, while Ethereum sits at $4,243.30. Sentiment is cautious; buyers are wary but also aware that major shakeouts often lay the groundwork for new trends once dust settles.

Bitcoin (BTC) Price Prediction 2026-2031

Post-2025 Black Swan Event Outlook — Incorporating Tariff-Driven Volatility and Market Recovery Scenarios

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $96,000 | $124,000 | $165,000 | +7.8% | Recovery year after historic liquidation; volatility remains elevated with potential for regulatory pivots. |

| 2027 | $110,000 | $138,000 | $190,000 | +11.3% | Institutional re-entry and stabilization; gradual adoption of improved risk management tools. |

| 2028 | $125,000 | $156,000 | $225,000 | +13.0% | Macro tailwinds from global digital asset adoption; potential ETF/sovereign fund inflows. |

| 2029 | $140,000 | $172,000 | $260,000 | +10.3% | Bitcoin halving effects amplify scarcity narrative; increased adoption in emerging markets. |

| 2030 | $135,000 | $181,000 | $290,000 | +5.2% | Potential regulatory headwinds in US/EU; tech upgrades (e.g., Lightning Network) drive utility. |

| 2031 | $120,000 | $194,000 | $330,000 | +7.2% | Market matures, volatility tapers; Bitcoin seen as digital reserve asset, but faces competition from CBDCs and next-gen blockchains. |

Price Prediction Summary

Following the 2025 black swan liquidation event, Bitcoin is projected to enter a period of heightened but gradually stabilizing volatility. While minimum price scenarios reflect potential for renewed shocks (regulatory, macro), the average and maximum forecasts indicate a resumption of long-term growth, driven by technological adoption, institutional participation, and Bitcoin’s strengthening narrative as a digital reserve. By 2031, Bitcoin’s average price could approach $200,000, with upside potential if adoption accelerates or macro conditions favor digital assets.

Key Factors Affecting Bitcoin Price

- Geopolitical tensions and global macroeconomic policy (e.g., tariffs, trade wars)

- Regulatory frameworks in major economies (US, EU, China)

- Institutional and sovereign adoption rates

- Technological advancements (scalability, privacy, interoperability)

- Market liquidity and derivatives structure post-2025 liquidation

- Competition from altcoins, CBDCs, and new blockchain innovations

- Global risk appetite and investor sentiment after major market shocks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

So, what should smart buyers actually do in a market that just survived its biggest-ever leverage wipeout? First, recognize that the recent carnage has reset risk appetites. While some traders are licking their wounds, others see a rare window, prices are off their highs, leverage is lower, and the market’s emotional temperature has cooled from panic to cautious curiosity. This is prime territory for disciplined accumulation, but only if you’re prepared for more volatility ahead.

How to Buy Crypto Securely After a Historic Liquidation

Buying cryptocurrency during volatility is not for the faint of heart, but it isn’t rocket science either. Here’s how to approach the market with your head (and wallet) intact:

Secure Crypto Buying Strategies After Major Liquidations

-

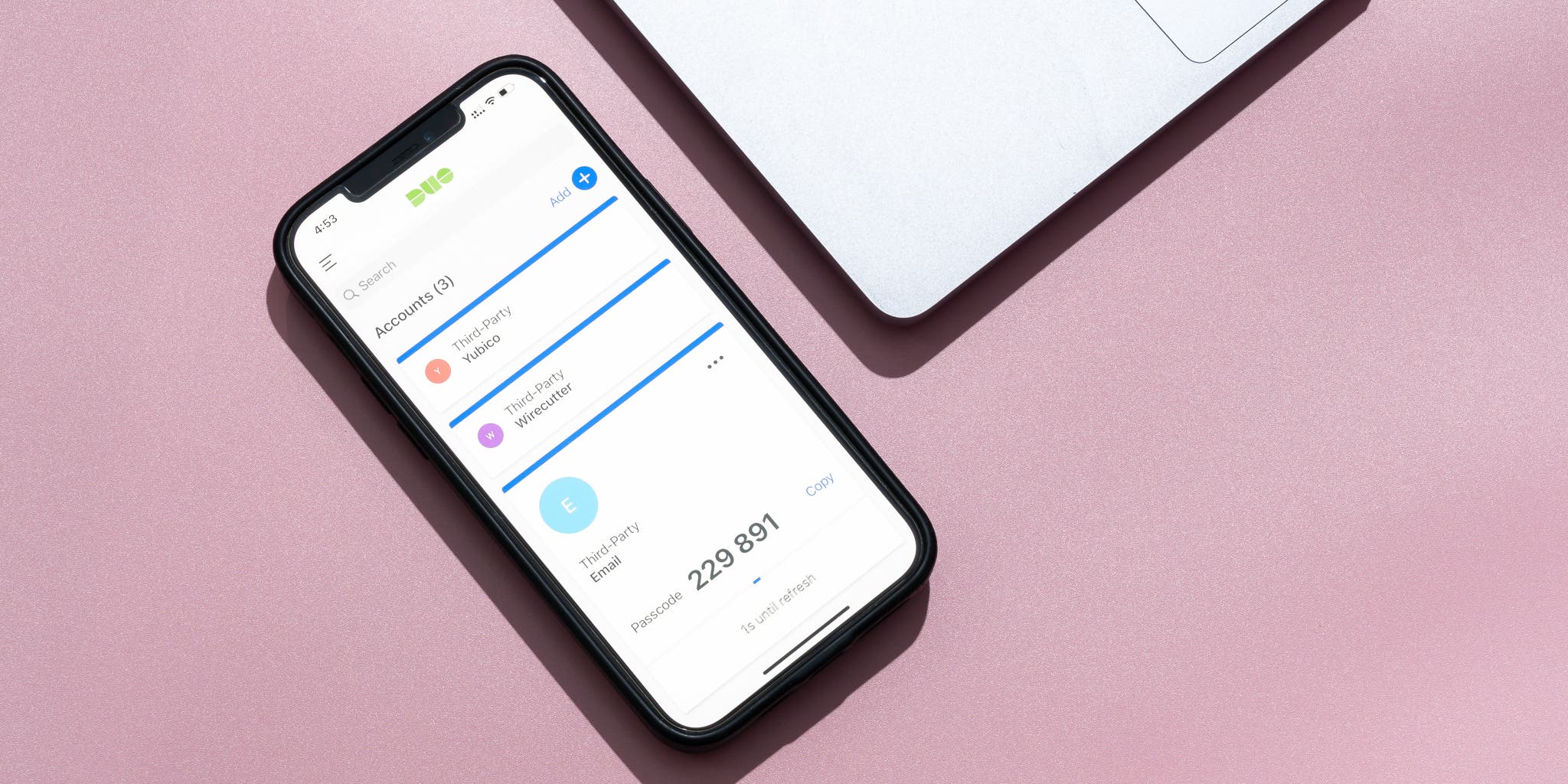

Enable Two-Factor Authentication (2FA) EverywhereAlways activate 2FA on your exchange and wallet accounts. Use trusted apps like Authy or Google Authenticator for an extra layer of protection, especially during volatile times.

-

Store Assets in Hardware WalletsAfter buying, move your crypto off exchanges and into cold storage devices like the Ledger Nano X or Trezor Model T. Hardware wallets keep your assets safe from online threats and exchange failures.

-

Use Dollar-Cost Averaging (DCA) to Reduce RiskSpread your purchases over time instead of buying all at once. Platforms like Swan Bitcoin and Coinbase Recurring Buys let you automate DCA, smoothing out volatility after big market swings.

-

Stay Informed With Real-Time AlertsSign up for price and news alerts on platforms like CoinGecko and Blockfolio. Quick updates help you react fast to market-changing events, such as tariff announcements or sudden liquidations.

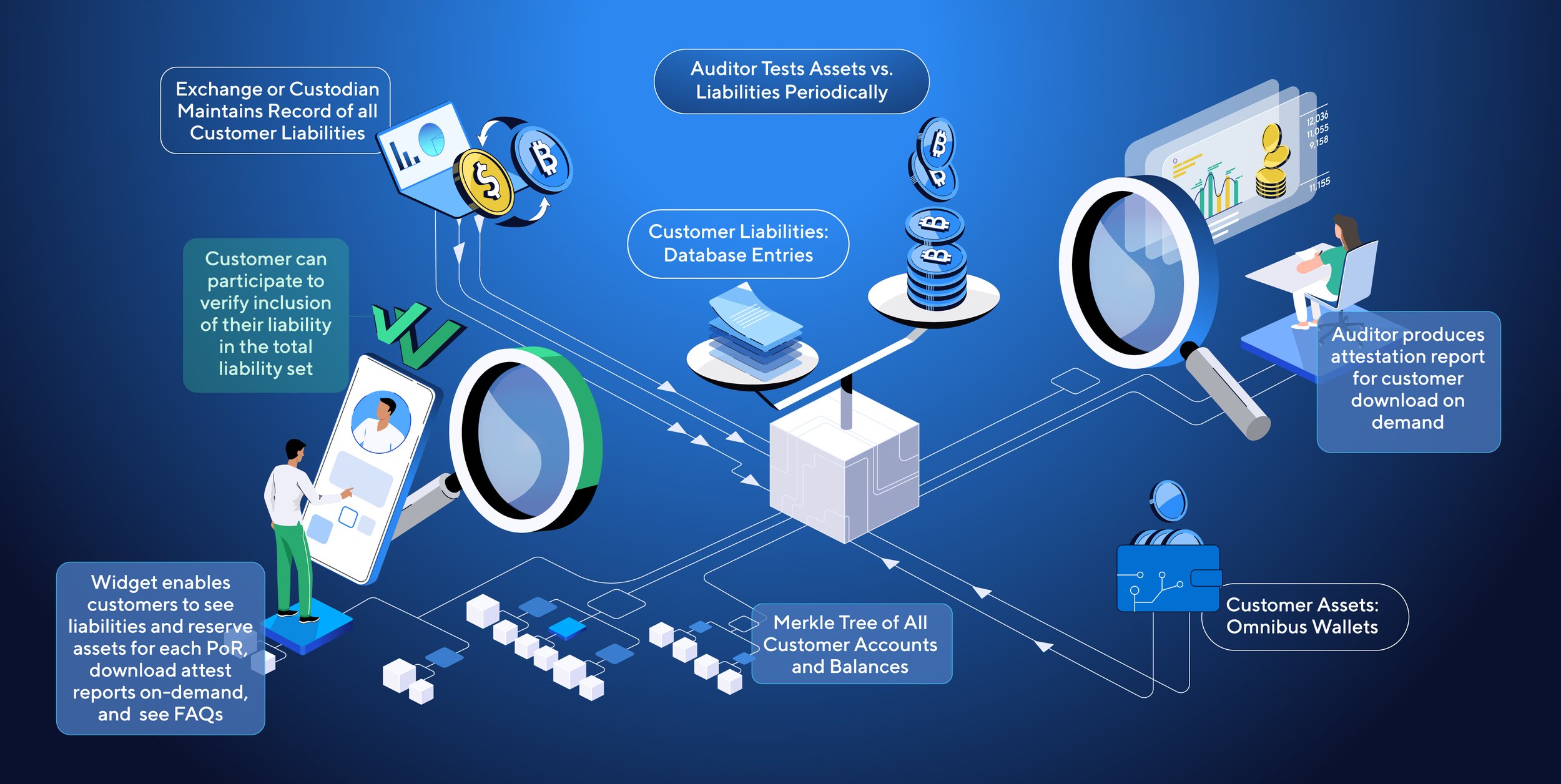

1. Prioritize Security and Simplicity: Stick to reputable exchanges with strong track records and transparent reserve audits. Don’t get lured by obscure platforms promising outsized returns or “zero fees”: these are often riskier during turbulent times.

2. Use Dollar-Cost Averaging (DCA): Instead of trying to time the absolute bottom, spread your buys out over days or weeks. This reduces the impact of short-term swings and helps you avoid emotional decision-making.

3. Consider Stablecoins for Staging: If you’re not ready to deploy all your capital at once, park funds in stablecoins like USDT or USDC while waiting for clearer signals. Just remember: even stablecoin minting can surge after big crashes as traders seek shelter from the storm.

4. Avoid Excessive Leverage: The $19 billion liquidation was a brutal lesson in why high leverage can be catastrophic during black swan events. If you use margin at all, keep it conservative and always set stop-losses.

What’s Next? Watching Resistance Levels and Macro Headlines

The path forward hinges on two things: how quickly crypto can rebuild confidence above current support levels (Bitcoin at $115,053, Ethereum at $4,243.30) and whether further geopolitical shocks emerge from Washington or Beijing. Analysts warn that resistance near recent highs could cap rallies unless fresh bullish catalysts appear, so keep an eye on both price charts and political headlines.

Bitcoin Technical Analysis Chart

Analysis by Maya Donovan | Symbol: BINANCE:BTCUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Aggressive post-crash trading is my game, and this BTCUSDT 4H chart just handed us a textbook volatility play. After Trump’s tariff shock, we saw a violent $19B liquidation wick down to about $104,800, followed by a sharp V-shaped bounce. The current action is a classic dead cat bounce, but given the market’s resilience and my appetite for risk, I’m eyeing momentum continuation. Draw a strong horizontal support line at the crash low ($104,800), a resistance at the recent swing high ($116,000), and another at $120,000 (prior breakdown zone). Use a fib retracement from the $104,800 low to the $126,000 pre-crash high to identify key retracement levels. Plot an aggressive uptrend line from the $104,800 low to the current price ($114,852). Watch for a breakout above $116,000 for momentum longs, with stops just below $112,000 support. If we drop back below $112,000, watch for another flush toward the $108,000 region. Draw rectangles to highlight accumulation between $110,000-$115,000 and distribution above $120,000. Mark the crash event with a vertical line and callout. Volume spike and MACD cross would confirm momentum, so annotate those as well.

Risk Assessment: high

Analysis: Volatility is still elevated post-black swan event; market could swing violently in either direction. Liquidity is thinner and emotions are running high, offering both outsized opportunity and risk.

Maya Donovan’s Recommendation: Play the momentum aggressively, but keep stops tight. Only risk what you can afford to lose. Watch for confirmation on volume and MACD before going heavy. I’m looking for rapid entries and exits, not diamond hands here.

Key Support & Resistance Levels

📈 Support Levels:

-

$104,800 – Crash wick low, major structural support after $19B liquidation event

strong -

$112,000 – Recent recovery consolidation support; potential bounce zone if retested

moderate

📉 Resistance Levels:

-

$116,000 – Immediate local resistance, capping current bounce

moderate -

$120,000 – Breakdown zone from pre-crash support, now strong resistance

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$116,000 – Potential breakout above resistance with momentum confirmation

high risk -

$112,000 – Aggressive dip buy if support holds post-retest

high risk

🚪 Exit Zones:

-

$120,000 – First profit target on breakout trade

💰 profit target -

$112,000 – Stop loss for breakout entry if move fails

🛡️ stop loss -

$108,000 – Secondary stop loss if market flushes lower

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Expecting a surge in volume on breakout above $116,000; volume spike confirmed on crash wick.

Draw a callout or arrow marker at the volume spike on the crash wick and monitor for new surges.

📈 MACD Analysis:

Signal: Look for MACD bullish cross to confirm momentum continuation if price breaks $116,000.

Annotate the MACD cross point with an arrow mark up for confirmation.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Maya Donovan is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

The good news? With so much leverage flushed out, there’s less fuel for another immediate meltdown, and more room for organic price discovery as new buyers step in.

Key Takeaways For Buyers After The Trump Tariff Crash

This weekend’s $19 billion crypto liquidation will be studied by traders for years as a case study in illusory liquidity and systemic risk. But if you’re thinking about entering the market now, remember:

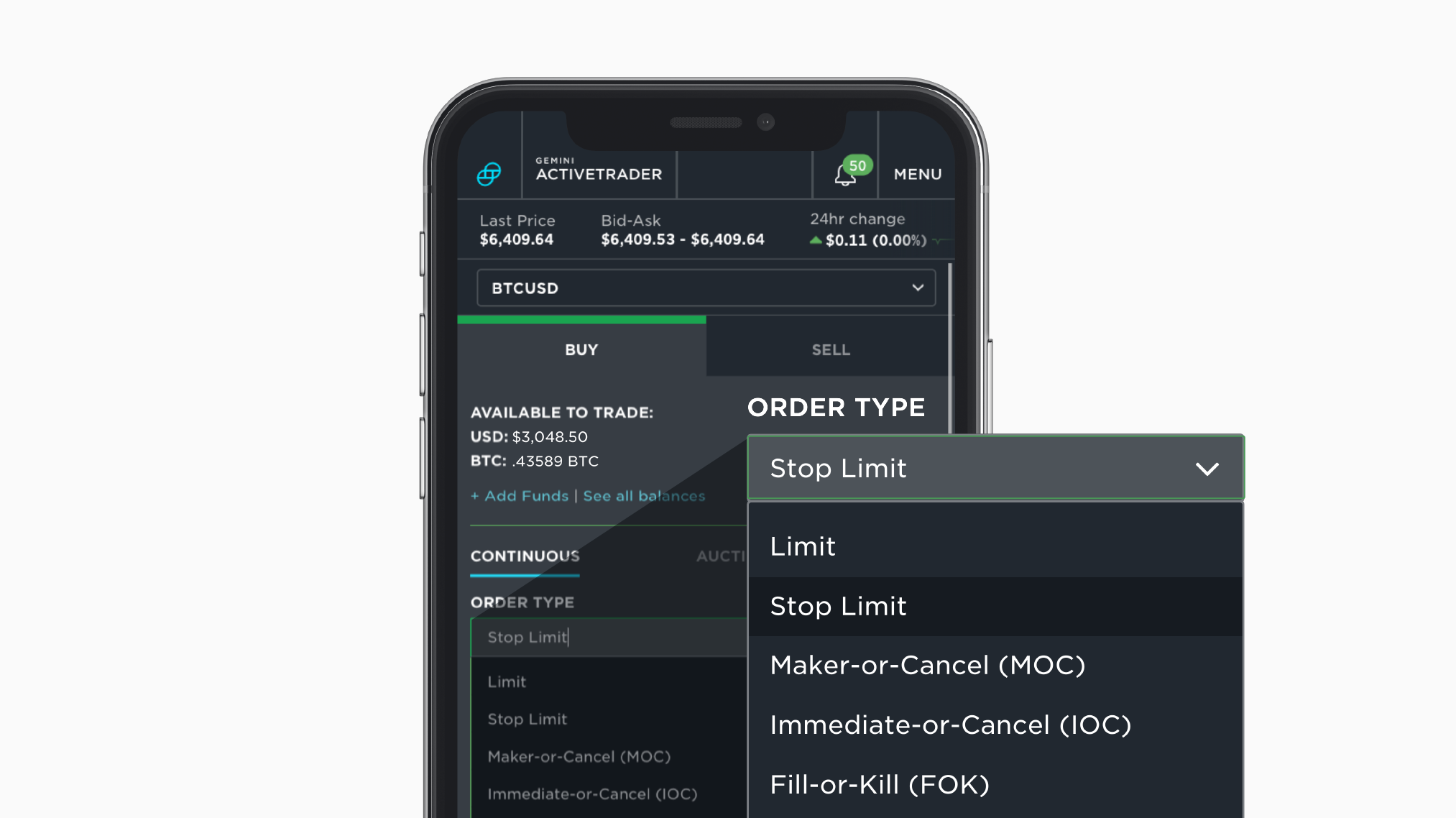

- Stay nimble: Use limit orders instead of market buys to avoid slippage during sharp moves.

- Diversify smartly: Don’t go all-in on one coin, spread exposure across majors like BTC, ETH, XRP ($2.61), LTC ($100.21) and BCH ($545.57) if you want broader coverage.

- Monitor sentiment: Social media and on-chain data often signal when fear or greed is peaking, use these cues alongside technical analysis.

- Tune out noise: Geopolitical headlines matter but don’t let them dictate every move; stick to your strategy and risk limits.

The dust may be settling after Trump’s China tariffs sparked this historic sell-off, but opportunity never sleeps in crypto land. Whether you’re a seasoned trader or a cautious newcomer, staying informed and disciplined is your best edge against whatever comes next.