When it comes to making substantial moves in the crypto market, many sophisticated investors and institutions turn to OTC (Over-the-Counter) crypto buying. Unlike trading on public exchanges, OTC channels offer a tailored experience for those looking to execute large transactions without sending ripples through the market. But with this privilege comes a unique set of advantages, risks, and crucial safety protocols that every participant must understand.

The Power of Large Trades Without Market Disturbance

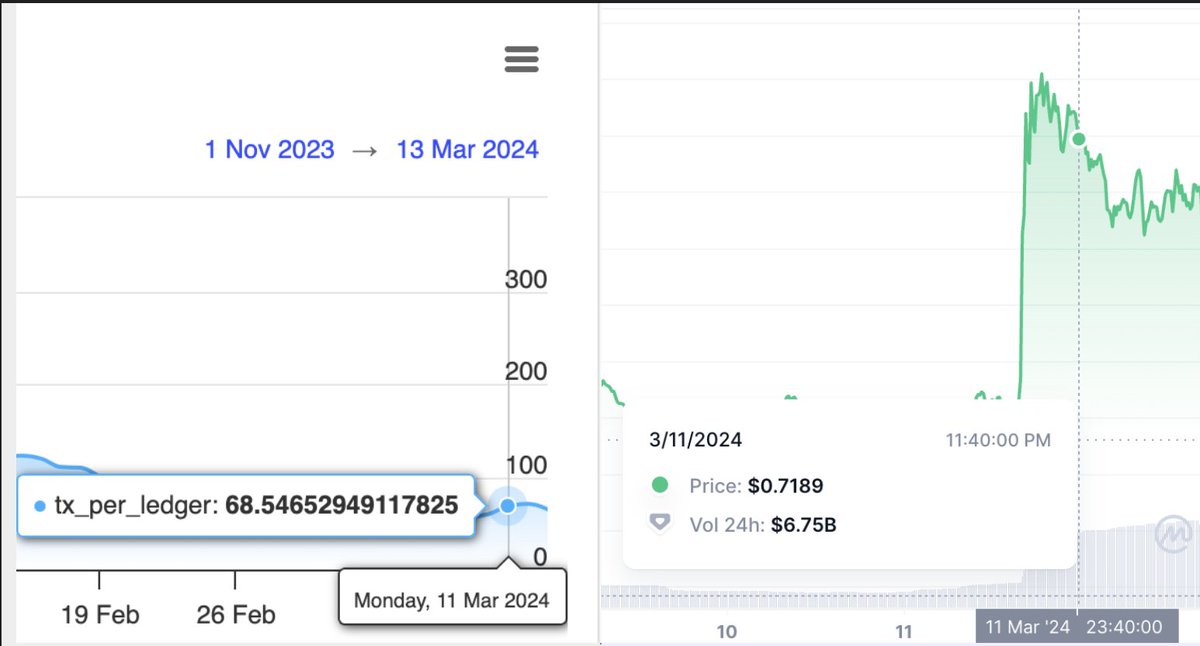

The most compelling advantage of OTC crypto trading is the ability to execute large trades with minimal market impact. On public exchanges, even moderately sized buy or sell orders can trigger significant price slippage, as order books are often thin and visible to everyone. OTC desks solve this by matching buyers and sellers privately, allowing massive sums—sometimes millions of dollars’ worth of Bitcoin or Ethereum—to change hands without alerting the broader market or causing sudden price swings.

Key Aspects of Buying Crypto OTC: Pro, Con, and Safe Practice

-

Pro: Ability to execute large trades with minimal market impact—OTC crypto trading allows buyers and sellers to transact significant amounts without causing price slippage, which is common on public exchanges. This is especially valuable for institutional investors or high-net-worth individuals seeking discreet, efficient execution. Major OTC desks like Cumberland, Kraken OTC, and Coinbase Institutional OTC specialize in facilitating such trades.

-

Con: Counterparty risk and reduced transparency—Unlike regulated exchanges, OTC trades rely on trust between parties or intermediaries, increasing the risk of fraud, default, or unfavorable pricing due to lack of order book visibility. Without transparent price discovery, participants may be exposed to hidden costs or malicious actors. Notable cases have highlighted the importance of due diligence when engaging in OTC trades.

-

Safe Practice: Use reputable OTC desks with strong compliance and escrow services—To mitigate risks, always verify the credentials of the OTC provider, ensure robust KYC/AML procedures are in place, and use escrow or third-party settlement solutions for added security. Established providers such as Genesis Trading, Binance OTC, and itBit OTC offer industry-standard compliance and secure settlement options.

This capability is why high-net-worth individuals and institutional players often prefer OTC for large crypto purchase tips. They can negotiate bespoke terms and settle trades efficiently while maintaining discretion. As noted in industry guides like Kraken’s Kraken OTC platform, the value lies in personalized service and privacy.

Counterparty Risk & Transparency Challenges

However, this privacy comes at a cost. The biggest risk in OTC transactions is counterparty risk and reduced transparency. Unlike regulated exchanges where trades are matched by algorithms and order books are open for all to see, OTC trades hinge on trust between parties or intermediaries. This introduces several hazards:

- Fraud: Without public records or exchange guarantees, there’s a risk that one party defaults after receiving funds.

- Unfavorable Pricing: Lack of order book visibility means you might not get the best available price.

- Regulatory Gaps: Some OTC desks operate in gray areas without robust compliance frameworks.

The headlines occasionally feature stories of traders burned by unscrupulous brokers—highlighting the importance of due diligence in this space. Real-world discussions on social media echo these concerns:

Your Essential Safety Net: Choosing Reputable Desks & Escrow Services

If you’re considering buying crypto via OTC channels today, your number one priority should be security. The most effective way to mitigate risk is to use reputable OTC desks with strong compliance and escrow services. Here’s what that means in practice:

- KYC/AML Procedures: Only work with providers that enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

- Escrow Solutions: Employ third-party escrow services or settlement layers so neither party can run off with funds before both sides fulfill their obligations.

- Reputation & Reviews: Research your desk—look for testimonials from institutional clients or coverage on trusted platforms like CoinDesk’s guide on crypto OTC desks.

Navigating the world of OTC crypto buying requires both technical savvy and street smarts. In the next section, we’ll break down step-by-step how an actual OTC trade works—and what you should watch out for at every stage.