Imagine finding a promising new token on Uniswap, only to hit a wall: no liquidity. This is a common scenario for crypto enthusiasts chasing early opportunities or obscure assets. Without liquidity, your order can’t be fulfilled—there’s simply no pool of tokens available to swap against. But does this mean you’re out of options? Not necessarily. There are several practical solutions and alternatives you can explore if you’re determined to buy crypto on Uniswap when there’s no liquidity.

Understanding the Liquidity Challenge on Uniswap

Uniswap relies on user-supplied liquidity pools for every trading pair. If no one has added both sides of a trade (e.g., ETH and your desired token), swaps are impossible. This situation is especially common with newly launched tokens or those not yet embraced by the broader community. It’s crucial to recognize that buying or selling a token with zero liquidity is fundamentally different from trading low-liquidity assets; in the former case, there’s literally nothing to buy or sell.

Have you ever been unable to buy a token on Uniswap due to zero liquidity?

Sometimes, tokens on Uniswap have no available liquidity, making them impossible to buy. We’re curious about your experience with this issue.

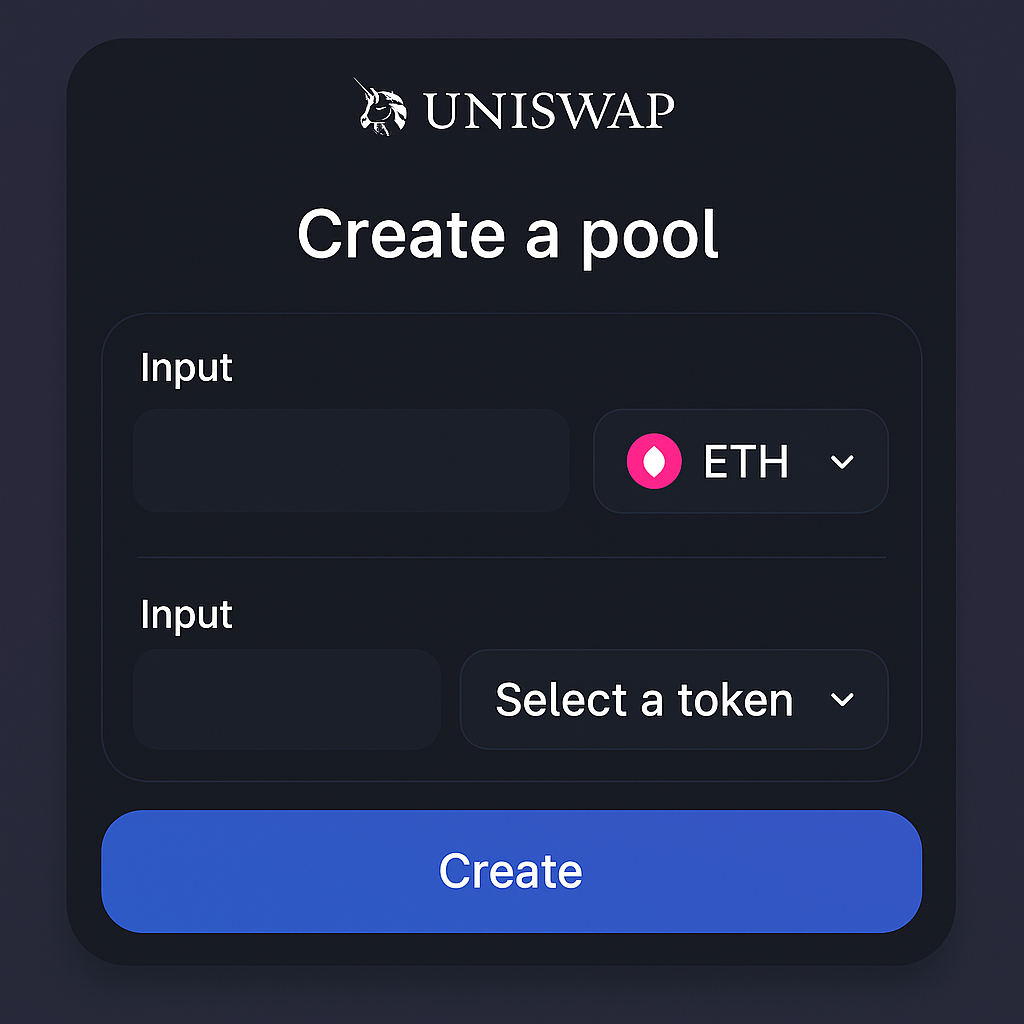

Solution #1: Provide Liquidity Yourself by Creating a Uniswap Pool

If you have conviction in the token’s legitimacy and future potential, you can take matters into your own hands by creating a new Uniswap pool. This involves pairing the token with ETH (or another ERC-20) and supplying both assets as initial liquidity.

Solutions When There’s No Liquidity on Uniswap

-

Provide Liquidity Yourself by Creating a Uniswap Pool: If you trust the token’s legitimacy and potential, you can create a new liquidity pool on Uniswap by pairing the token with ETH or another ERC-20 token. This process involves depositing equal values of both tokens, enabling trading for yourself and others. Be aware that this requires capital and exposes you to impermanent loss if prices fluctuate significantly.

-

Seek Out Centralized Exchanges or Peer-to-Peer Platforms: Some tokens lacking Uniswap liquidity may be listed on smaller centralized exchanges (CEXs) like KuCoin or Gate.io, or available through peer-to-peer (P2P) trading platforms such as PancakeSwap P2P (for BSC tokens) or LocalCryptos. Always verify the platform’s credibility and security before trading.

-

Monitor Community Channels for Upcoming Liquidity Events: Many projects announce planned liquidity additions or community-driven liquidity events in their official Telegram, Discord, or Twitter channels. Staying engaged with these communities can help you time your purchase when liquidity is added, minimizing risk and slippage.

This approach comes with trade-offs. You’ll need capital for both sides of the pair, and you’ll be exposed to impermanent loss if prices shift dramatically. However, it enables not only your own purchase but also creates an opportunity for others to trade the token—potentially attracting more liquidity over time.

Alternative #2: Seek Out Centralized Exchanges or Peer-to-Peer Platforms

If providing liquidity isn’t feasible (or desirable), look beyond Uniswap. Some tokens may be listed on smaller centralized exchanges (CEXs) or peer-to-peer (P2P) platforms even before they’re liquid on DEXs. These venues might offer limited trading options but can serve as early access points.

Caution: Always verify platform credibility—low-liquidity tokens attract scams and rug pulls, especially off major exchanges.

Strategy #3: Monitor Community Channels for Upcoming Liquidity Events

The crypto world moves fast, and communities often coordinate liquidity events. Projects may announce upcoming pool launches or incentivized campaigns in their official Telegram groups, Discord servers, or Twitter feeds. Staying engaged lets you time your entry when fresh liquidity arrives—often reducing slippage and risk.

If you’re serious about buying new tokens on Uniswap despite current illiquidity, these three strategies offer tangible paths forward. Let’s break them down further—and weigh their pros and cons—in detail below.