Asia’s relationship with cash isn’t just a cultural quirk – it’s a defining feature of daily life. From bustling Bangkok street markets to the neon-lit corners of Seoul, millions rely on physical bills for everything from snacks to smartphones. But what happens when you fuse this cash-first reality with the red-hot world of digital assets? Enter Moon Inc. ’s Bitcoin prepaid card rollout, a move that could reshape how people buy crypto across the continent.

Moon Inc. Bets Big on Bitcoin Prepaid Cards

Hot off a HK$65.5 million (about $8.8 million) funding round, Moon Inc. is making waves by launching Bitcoin prepaid cards in Thailand and South Korea, with plans to expand into Taiwan, Japan, and Vietnam. The company isn’t new to the prepaid game – they’ve built a business selling SIM cards and mobile top-ups all over Asia. Now they’re plugging Bitcoin directly into these familiar retail channels, letting everyday users buy bitcoin with cash as easily as reloading their phones.

This is no small experiment. According to their FY2025 report, Moon Inc. pulled in revenue of HK$189.6 million and is actively leveraging its distribution muscle for this crypto push (source). The company’s ambition? To make secure crypto buying as accessible as grabbing a coffee at 7-Eleven.

Why Cash-First Markets Matter for Crypto Adoption

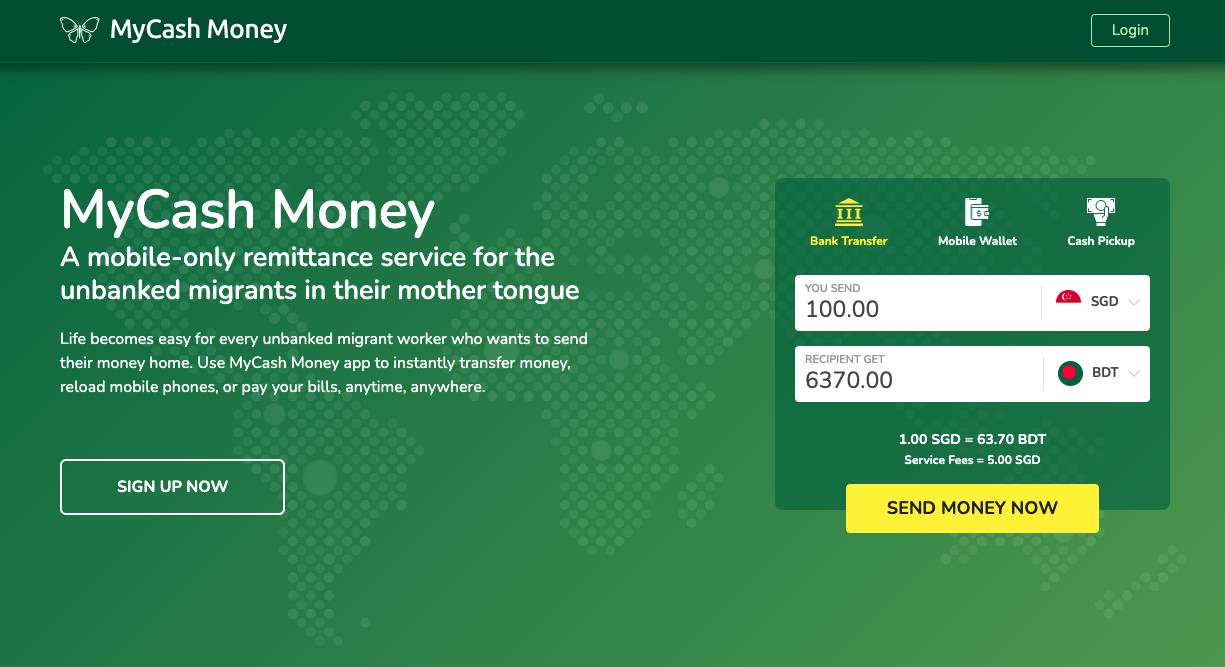

If you’re reading this from Singapore or Hong Kong, digital payments might seem like second nature. But step into rural Thailand or Vietnam and it’s clear: banking infrastructure hasn’t reached everyone. In fact, hundreds of millions across Asia remain unbanked or underbanked – yet almost all own a mobile phone and use prepaid top-ups daily.

This is where bitcoin prepaid cards become more than just another fintech gadget. By letting users buy bitcoin with cash at existing retail locations, Moon Inc. ’s solution bypasses the need for bank accounts or complicated wallet setups. It’s a game-changer for inclusion and could be the missing link that brings the next wave of users into crypto.

The Mechanics: How Do Bitcoin Prepaid Cards Actually Work?

The magic is all about simplicity: walk into your local shop, hand over cash, get a physical card (or code) loaded with bitcoin at today’s price – currently sitting at $111,305. No need to fumble through KYC forms or wait days for wire transfers to clear.

You can then store your BTC on the card itself or transfer it out to another wallet whenever you want more control over your assets. This hybrid model bridges old-school convenience with new-school tech – perfect for Asia’s unique financial landscape.

Bitcoin Price Prediction 2026-2031 After Moon Inc.’s Prepaid Card Rollout in Asia

Forecasts reflect potential impacts from Moon Inc.’s expansion, Asian cash-first market adoption, and broader crypto trends. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $90,000 | $125,000 | $170,000 | +12% | Adoption in Thailand & South Korea boosts demand; regional volatility and early regulatory uncertainties keep price swings high. |

| 2027 | $105,000 | $142,000 | $195,000 | +13.6% | Broader Asian expansion (Taiwan, Japan, Vietnam) and improved regulatory clarity drive sustained growth; potential for short-term corrections. |

| 2028 | $120,000 | $160,000 | $220,000 | +12.7% | Mainstream integration in retail and remittance sectors; increased competition from stablecoins and CBDCs tempers bullishness. |

| 2029 | $110,000 | $180,000 | $250,000 | +12.5% | Global macro tailwinds, rising institutional adoption, and better on-ramps (like Moon Inc.) support upside, but cycle corrections possible. |

| 2030 | $125,000 | $205,000 | $290,000 | +13.9% | Next halving and maturing Asian markets drive renewed interest; Bitcoin as a store-of-value narrative strengthens. |

| 2031 | $140,000 | $230,000 | $330,000 | +12.2% | Continued adoption in cash-first economies, integration with traditional finance, and increased scarcity underpin long-term growth. |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is bullish, supported by Moon Inc.’s prepaid card expansion in Asia and growing adoption in cash-first markets. While volatility and corrections are expected, the integration of Bitcoin into familiar retail channels and evolving regulatory landscapes provide strong catalysts for long-term appreciation. Both minimum and maximum price predictions reflect possible bearish and bullish scenarios, respectively, given the evolving market dynamics.

Key Factors Affecting Bitcoin Price

- Moon Inc.’s expansion success and adoption rates in Asia

- Regulatory developments in Asian markets and globally

- Integration of Bitcoin prepaid cards with retail and remittance sectors

- Potential competition from stablecoins and central bank digital currencies (CBDCs)

- Impact of Bitcoin halvings and macroeconomic cycles

- Institutional adoption and technological improvements in crypto infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Could This Spark an On-Ramp Revolution?

The timing couldn’t be better: with Bitcoin trading at $111,305, interest in secure crypto buying options is peaking across Asia (source). If Moon Inc. ’s approach takes off in Thailand and South Korea, expect copycats – and maybe even regulators – to take notice fast.

Moon Inc. isn’t just betting on technology. They’re leveraging deep retail relationships and a nuanced understanding of Asian consumer habits. By embedding Bitcoin onramps into the everyday cash economy, they’re making digital assets tangible for millions who have never set foot in a bank branch, let alone a crypto exchange.

What Sets Moon Inc. ’s Rollout Apart?

Unlike most competitors, Moon Inc. is tapping into existing prepaid infrastructure, think corner stores, mobile stalls, and even mom-and-pop kiosks. This means Bitcoin prepaid cards could soon be as common as phone top-ups in the region’s busiest neighborhoods. It’s not just about access; it’s about trust. People already rely on these points of sale for vital services, so adding Bitcoin to the mix feels like a natural evolution rather than a leap of faith.

Another key differentiator? Flexibility. Moon cards can reportedly be purchased with not just cash but also a variety of cryptocurrencies, including Lightning, USDC, USDT, Ether, Bitcoin Cash, and Litecoin (source). This multi-currency support could make them an appealing bridge for both new adopters and seasoned crypto users looking for an easy way to move between assets.

Risks and Rewards: What Could Go Wrong (or Right)?

No innovation comes without its hurdles. Security remains top-of-mind, both at the card level and across the supply chain. Moon Inc. ’s track record in the prepaid market suggests robust compliance processes are already in place, but scaling up with crypto introduces new regulatory questions across borders. There’s also the challenge of educating first-time buyers about digital asset risks and safe storage practices.

But if Moon Inc. nails execution? The upside is enormous. With Bitcoin holding steady at $111,305, more people than ever are searching for safe ways to get exposure without jumping through hoops or risking hacks on online exchanges.

Top Benefits of Bitcoin Prepaid Cards in Asia

-

Easy Access for Cash-First Users: Moon Inc.’s Bitcoin prepaid cards let users buy and top up Bitcoin with cash at local retailers, bypassing the need for a bank account or complex crypto wallet setup.

-

Financial Inclusion for the Unbanked: With millions across Asia lacking access to traditional banking, prepaid cards offer a gateway to digital finance and Bitcoin ownership for unbanked and underbanked populations.

-

Familiar Retail Experience: By leveraging existing telecom prepaid card distribution channels, Moon Inc. integrates Bitcoin buying into familiar retail top-up processes, making crypto adoption less intimidating for new users.

-

Instant Bitcoin Transactions: Users can purchase, store, and transfer Bitcoin instantly at the current market price—$111,305.00—without waiting for lengthy bank transfers or exchange approvals.

-

Enhanced Privacy and Security: Prepaid cards require minimal personal information compared to traditional exchanges, offering users greater privacy and reducing the risk of identity theft.

-

Low Barrier to Entry: No need for complicated KYC or technical know-how—just purchase a card, top it up, and start using Bitcoin, making it ideal for newcomers to crypto.

-

Potential for Regional Expansion: Moon Inc. plans to expand to Taiwan, Japan, and Vietnam, paving the way for broader crypto adoption in Asia’s cash-driven economies.

Looking Ahead: Will Other Markets Follow?

The real test will be how quickly Moon Inc. ’s model can scale beyond Thailand and South Korea into other cash-centric economies like Vietnam or Indonesia, where banking deserts are common but mobile penetration is sky-high. If successful, this could become the playbook for crypto adoption Asia-wide.

This rollout is more than just another fintech product launch, it’s a bold experiment in financial inclusion at a time when digital money is rewriting global rules. Whether you’re an unbanked worker in rural Thailand or a crypto enthusiast hunting for new onramps, keep your eyes on this space: Bitcoin prepaid cards might just be Asia’s next big thing.