Bitcoin’s current price of $89,945.00 draws fresh capital into the market, but so do scammers preying on excitement around secure bitcoin buying. In 2025 alone, global cryptocurrency scams drained $17 billion from victims, a 24% jump from prior years, per recent blockchain analysis. High-profile cases, like the U. S. government’s seizure of over $14 billion in bitcoin tied to a Cambodian executive, underscore the stakes. Add in $333 million lost to Bitcoin ATM fraud by Americans, and it’s clear: avoiding crypto theft demands vigilance, especially for safe ethereum purchases on reputable crypto exchanges 2026 style.

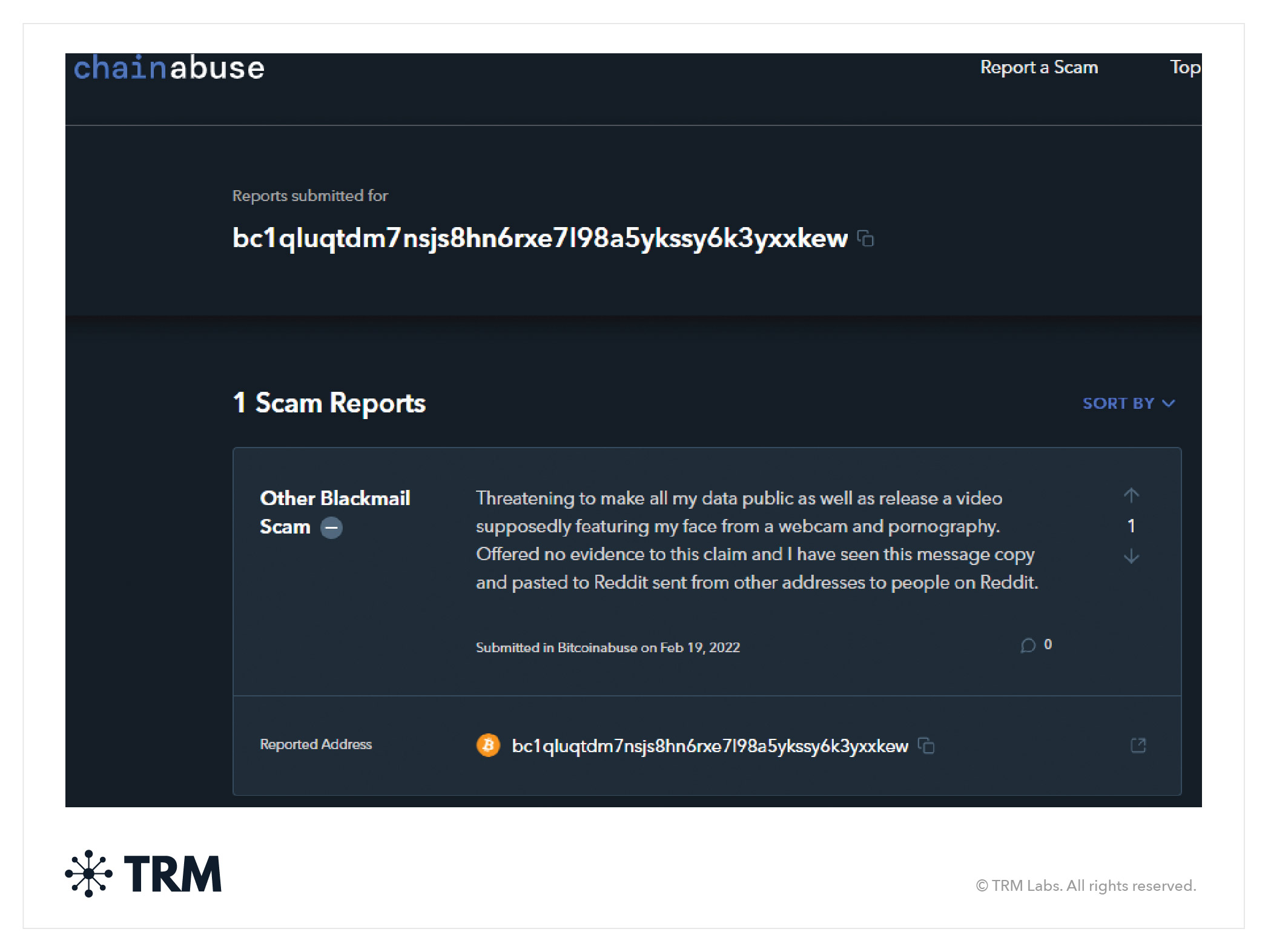

Criminals exploit age-old tricks on blockchain’s transparent ledger. BBC reports detail how thieves stole around $700 million, often through phishing or fake platforms. Victims like Helen and Richard, who lost $315,000 in Cardano, show even savvy investors falter. The pain hits harder because every transaction is forever etched on-chain, a public reminder of the breach. As markets mature, scams evolve with sophisticated innovations, targeting Bitcoin and Ethereum buyers via unsolicited offers or mimic sites.

Why Reputable Exchanges Are Your First Defense Against 2026 Scams

With Bitcoin near $90,000, the rush to buy invites pitfalls. Scammers thrive on FOMO, but strategic investors prioritize platforms with ironclad compliance. The explosion in thefts, from SIM swaps to wallet drains, traces back to weak entry points. Reputable crypto exchanges 2026 must offer more than low fees; they need regulatory armor. FBI warnings on rising ATM scams reinforce this: stick to audited venues where your funds aren’t a sitting duck.

Tip 1: Choose FIU-Registered Exchanges Like Coinbase, Kraken, and Gemini

Start here to sidestep most threats. FIU-registered exchanges like Coinbase, Kraken, and Gemini boast proven track records and full regulatory compliance, meaning they’ve weathered audits and hold user funds in segregated accounts. These platforms report suspicious activity and insure hot wallets, reducing hack risks. In contrast, unregulated offshore sites vanish overnight, as seen in countless rug pulls. For secure bitcoin buying or safe ethereum purchase, verify FIU status via official registries before depositing a dime. This single choice filters out 80% of scam vectors, aligning with my hybrid approach of fundamentals first.

Bitcoin (BTC) Price Prediction 2027-2032

Annual forecasts based on market cycles, regulatory clarity, adoption trends, and enhanced security measures amid rising scam awareness

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $105,000 | $140,000 | $200,000 |

| 2028 | $120,000 | $175,000 | $260,000 |

| 2029 | $155,000 | $230,000 | $350,000 |

| 2030 | $200,000 | $310,000 | $470,000 |

| 2031 | $260,000 | $400,000 | $600,000 |

| 2032 | $330,000 | $510,000 | $780,000 |

Price Prediction Summary

Starting from a 2026 baseline around $120,000 amid regulatory clarity and adoption, Bitcoin is forecasted to grow steadily through 2032. Average prices are expected to rise from $140,000 in 2027 to $510,000 in 2032, with bullish maxima reaching up to $780,000 driven by halvings, institutional inflows, and scam mitigation via reputable exchanges. Minimums reflect potential bearish corrections but remain progressively higher year-over-year.

Key Factors Affecting Bitcoin Price

- 2028 Bitcoin halving increasing scarcity and price pressure

- Regulatory clarity and anti-scam measures boosting investor confidence

- Institutional adoption via ETFs and corporate treasuries

- Technological upgrades like Lightning Network for scalability

- Macroeconomic shifts favoring BTC as inflation hedge

- Global adoption trends in payments and emerging markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tip 2: Always Verify Official URLs Via Bookmarks or App Stores

Phishing sites mimicking real platforms nabbed millions last year. Cybercriminals craft near-identical clones, tricking users into entering keys or credentials. Dodge this by bookmarking official URLs directly or downloading apps from verified stores like Google Play or Apple App Store. Never click email links or Google search results; type the domain manually. For instance, coinbase. com, not coinbace-support. com. This pragmatic habit, rooted in technical verification, blocks access before damage occurs. Combine it with browser extensions like uBlock Origin for extra layers, but bookmarks remain foolproof.

Tip 3: Enable 2FA with Hardware Keys Like YubiKey Over SMS

SIM-swap attacks surged in 2025, letting thieves hijack phone numbers to bypass SMS 2FA. Switch to hardware keys such as YubiKey; they generate codes offline, untouchable by remote hacks. Reputable exchanges support these via U2F or WebAuthn standards. Setup takes minutes: plug in, register, done. SMS feels convenient until it’s not; hardware enforces strategic security without compromising usability. In my portfolio management experience, this upgrade slashed unauthorized access risks across client accounts. Pair it with app-based backups like Authy for redundancy, but hardware leads.

Tip 4: Complete Mandatory KYC with Government ID on Verified Platforms

Skipping KYC might seem appealing for privacy hawks, but it’s a red flag on reputable crypto exchanges 2026. Platforms like Coinbase mandate it upfront, verifying your identity against government-issued IDs to block money launderers and fraudsters. This weeds out bad actors before they deposit, protecting the ecosystem. In 2025’s $17 billion scam wave, lax KYC venues crumbled first. Submit your passport or driver’s license early; delays only breed frustration. From a portfolio manager’s view, this compliance layer aligns with long-term holding strategies, ensuring your Bitcoin at $89,945.00 or Ethereum stays insulated from chain-level exploits.

Tip 5: Activate Withdrawal Whitelisting for Pre-Approved Addresses Only

Even if hackers snag your login, whitelisting locks withdrawals to your personal wallet addresses alone. Set this on Kraken or Gemini post-KYC; add your hardware wallet’s public key, approve via email or secondary device. Attempts to send elsewhere trigger instant alerts and blocks. This strategic control prevented millions in losses during last year’s exchange hacks. Scammers hate it because it neuters their endgame. Customize lists for BTC and ETH, reviewing quarterly as addresses evolve. Pragmatism dictates: treat exchanges as hot hotels, not vaults.

Tip 6: Buy Directly from the Exchange, Skip Intermediaries and P2P Offers

Unsolicited P2P deals or ‘exclusive’ intermediaries scream trap, especially amid Bitcoin’s climb past $89,000. Stick to exchange order books for secure bitcoin buying; market or limit orders execute transparently without third-party risks. Telegram groups hawking cheap ETH? Pure bait, often laced with malware or reversal scams. FBI data on $333 million ATM fraud echoes this: direct channels minimize human vectors. My decade in markets confirms volume on Coinbase dwarfs shady OTC, offering liquidity without the larceny.

Tip 7: Immediately Transfer BTC/ETH to Hardware Wallets Like Ledger or Trezor

Exchanges hold billions, prime hack targets. After buying, sweep assets to cold storage: Ledger Nano or Trezor shields keys offline, impervious to online breaches. Generate seed phrases on air-gapped devices, never screenshot them. With Ethereum’s smart contract vulnerabilities rising, this isolates your stack from DeFi rugs too. Time it right – post-confirmation, batch transfers to cut fees. In volatile swings like today’s 24-hour BTC range from $87,304 to $90,379, self-custody empowers strategic exits without platform downtime fears.

7 Tips to Avoid $700M Scams

-

Choose FIU-registered exchanges like Coinbase, Kraken, and Gemini with proven track records and full regulatory compliance.Pros: Coinbase (beginner-friendly, staking), Kraken (low fees, advanced trading), Gemini (institutional security).Fees: Coinbase 0-0.6%, Kraken 0-0.26%, Gemini 0-0.4% (maker-taker).Security: 95%+ cold storage, insurance, regular audits.

-

Always verify official URLs via bookmarks or app stores to dodge phishing sites mimicking real platforms. Check for HTTPS and exact spelling like coinbase.com.

-

Enable 2FA with hardware keys (e.g., YubiKey) instead of SMS to prevent SIM-swap attacks.

-

Complete mandatory KYC with government ID on verified platforms before any deposits for regulatory protection.

-

Activate withdrawal whitelisting to restrict transfers only to your pre-approved wallet addresses.

-

Buy directly from the exchange without intermediaries or unsolicited P2P offers to minimize risks.

-

Immediately move BTC/ETH to a hardware wallet like Ledger or Trezor for cold storage.

Layering these tips transforms avoid crypto theft from slogan to system. Bitcoin’s steady and 0.0078% 24-hour gain belies the undercurrent threats, yet disciplined execution unlocks upside. Victims in BBC’s $700 million saga often ignored one link: complacency. Hardware 2FA, whitelists, and cold storage form a pragmatic fortress, letting you capture Ethereum rallies safely.

Markets reward the prepared. As a CFA Level II candidate blending charts with fundamentals, I see 2026 favoring vigilant holders. FIU-compliant platforms plus personal vaults balance accessibility and armor, sidestepping the $17 billion pitfall. Your next trade at $89,945.00 could define portfolios; make it scam-proof.