Bitcoin trades at $83,931 today, a modest pullback that savvy investors view as a prime entry point amid steady Federal Reserve policy and surging whale activity. Large players like MicroStrategy, under Michael Saylor’s guidance, just snapped up 2,932 BTC for $264.1 million during this dip, pushing their holdings past 712,000 BTC. This isn’t panic selling; it’s calculated accumulation signaling deep conviction in Bitcoin’s trajectory through 2026.

Such moves underscore a broader trend: whales positioning aggressively as the Fed holds rates steady, creating a favorable macro backdrop. With Bitcoin’s 24-hour low hitting $81,169 and rebounding, the question for everyday investors becomes clear. How do you securely join this dip-buying without falling into common traps like unsecured exchanges or emotional timing?

Decoding Whale Signals: MicroStrategy’s Blueprint for Dip Mastery

MicroStrategy’s relentless buying spree offers a masterclass in bitcoin whale accumulation strategy. Their latest haul at an average cost near $75,000 per BTC brings total acquisitions to over $58 billion worth. Saylor’s philosophy? Treat dips as discounts in an inexorable bull market. Recent filings show they added 22,305 BTC in a single week earlier this month, undeterred by short-term volatility.

This isn’t blind faith. Their average purchase price of $75,353 positions them handsomely as Bitcoin hovers at $83,931. For retail investors eyeing a secure bitcoin purchase $84k, emulate this by focusing on verified on-chain data and avoiding FOMO-fueled spikes. Whales thrive on patience; they’ve boosted holdings to 687,410 BTC in one stretch alone, turning market fear into portfolio strength.

Saylor predicts nations will spark a Bitcoin shopping spree in 2026, amplifying corporate buys like MicroStrategy’s.

Current metrics reinforce this: 24-hour high at $84,398 shows resilience, with whales bracing for policy stability. Your edge lies in mirroring their discipline, not their scale.

Fed’s Steady Hand Creates Ideal Conditions for Safe BTC Entry

The Federal Reserve’s decision to hold its stance eliminates rate-hike overhangs, pairing perfectly with whale momentum for a bullish 2026 setup. Bitcoin’s off to a strong start this year, buoyed by DeFi trends and macro shifts toward digital assets. MicroStrategy kickstarted 2026 with a $116 million buy, adding 1,283 BTC and lifting reserves to 673,783 valued at $62.6 billion.

In this environment, safe crypto buying Fed rate hold means prioritizing liquidity and security over yield-chasing. Volatility persists, but dips to $83,931 offer lower risk entries compared to peaks. Historical patterns show post-dip rallies reward accumulators; MicroStrategy’s $1.25 billion purchase marked their largest ever, averaging gains from volatility.

Opinion: While skeptics fixate on government shutdown whispers, real alpha comes from ignoring noise. Whales like MicroStrategy buy the fear, HODL through cycles, and emerge dominant. Retail can too, with the right platforms and tactics.

Top Platforms for Buying the BTC Dip at $83,931 Securely

When targeting the best platforms buy BTC dip, stick to battle-tested names with robust compliance and insurance. Coinbase leads for U. S. users: intuitive interface, FDIC-insured USD balances up to $250,000, and seamless fiat on-ramps. Fees hover at 0.5-1.49% for market buys, but their security track record shines with no major hacks since inception.

Binance suits global traders seeking depth, offering spot trading at 0.1% fees and advanced tools like limit orders to snag $83,931 precisely. Enable 2FA, withdrawal whitelists, and consider their SAFU fund covering user losses. Kraken rounds the trio: strong on privacy, with Gemini-level reserves audits and staking options post-purchase.

Across all, activate two-factor authentication, use hardware wallets like Ledger or Trezor for storage, and verify KYC upfront. Avoid unproven DEXs during dips; centralized liquidity ensures execution at current prices without slippage.

Bitcoin (BTC) Price Prediction 2027-2032

Forecast from post-2026 dip recovery ($84K baseline, year-end $120K), factoring whale accumulation, Fed policy hold, halving cycles, and institutional adoption

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $120,000 | $180,000 | $250,000 |

| 2028 | $200,000 | $350,000 | $500,000 |

| 2029 | $280,000 | $450,000 | $650,000 |

| 2030 | $400,000 | $600,000 | $900,000 |

| 2031 | $550,000 | $800,000 | $1,200,000 |

| 2032 | $750,000 | $1,100,000 | $1,600,000 |

Price Prediction Summary

Bitcoin is forecasted to surge from its 2026 year-end $120K level, driven by whale accumulation (e.g., MicroStrategy’s $264M+ buys), steady Fed policy, and the 2028 halving. Average prices could reach $1.1M by 2032, with min/max reflecting bearish corrections (20-30% dips) and bullish peaks (50-100% rallies) amid adoption growth. Potential 10x+ ROI from current $84K dip.

Key Factors Affecting Bitcoin Price

- Whale and corporate accumulation (MicroStrategy holding 700K+ BTC)

- Federal Reserve policy hold supporting liquidity

- 2028 Bitcoin halving increasing scarcity

- Rising institutional adoption via ETFs and treasuries

- Regulatory clarity and global nation-state buying

- DeFi expansion, Lightning Network improvements

- Macro trends: lower rates, inflation hedge demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Prediction models incorporating MicroStrategy’s accumulation and Fed stability project Bitcoin climbing to $90,000 short-term before pushing toward $120,000 by year-end. This aligns with whale patterns, where dips like today’s at $83,931 become launchpads for gains.

Proven Strategies: Dollar-Cost Averaging Meets Whale Discipline

To master buy bitcoin dip 2026, blend MicroStrategy’s conviction with retail-friendly tactics. Dollar-cost averaging (DCA) stands out: invest fixed amounts weekly, smoothing volatility. At $83,931, a $500 weekly buy captures averages below peaks, mirroring Saylor’s dip hunts without timing perfection.

Limit orders add precision; set buys at $83,000 support levels observed in recent 24-hour lows of $81,169. Pair with HODLing: commit to 4 and year horizons, as MicroStrategy’s $75,353 average proves long-term edges. Avoid leverage; spot buys on secure platforms minimize liquidation risks amid Fed-induced swings.

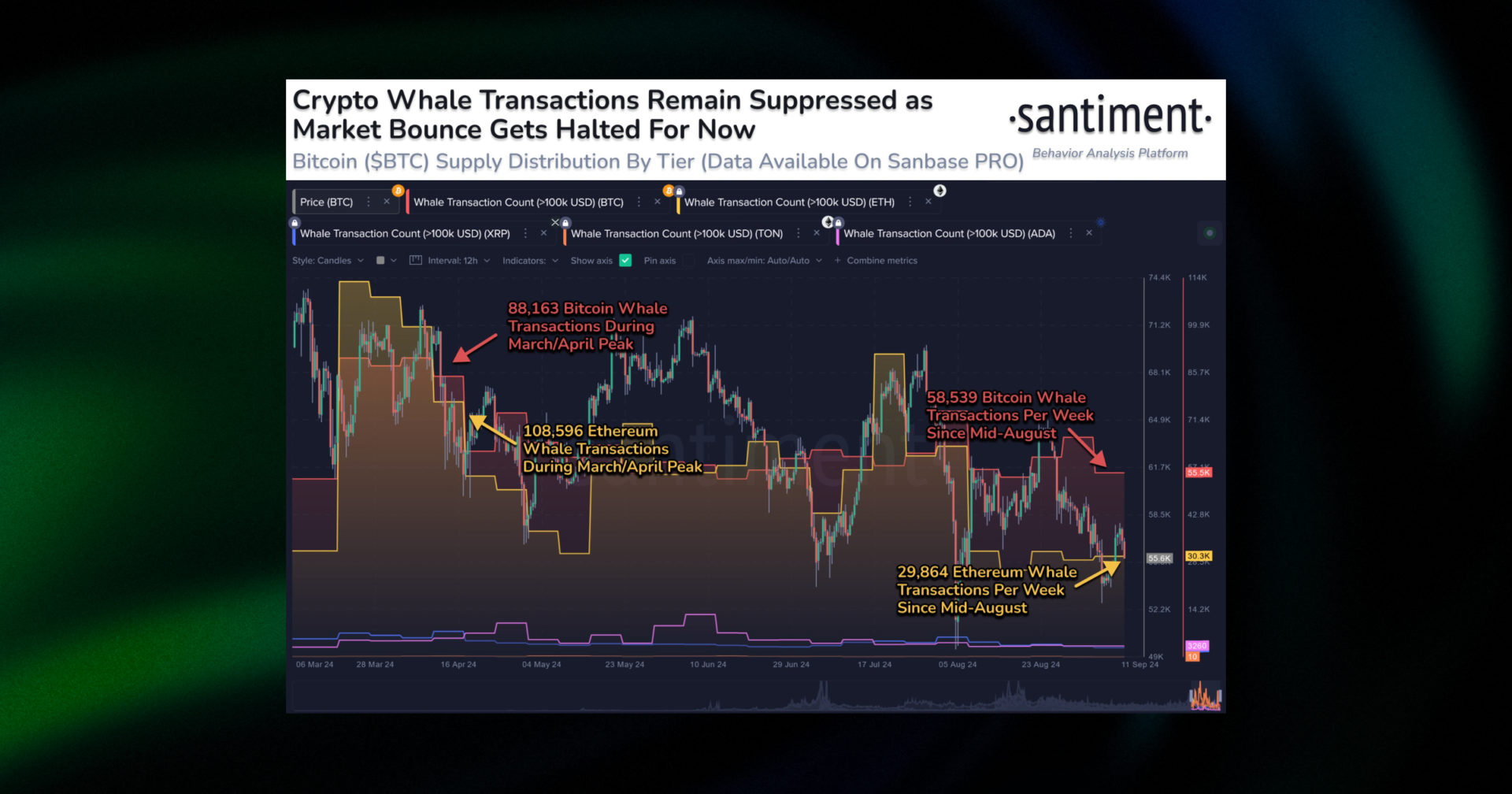

Advanced play: track whale wallets via on-chain tools like Glassnode. When accumulations spike, as with MicroStrategy’s 712,647 BTC total, scale in gradually. This bitcoin whale accumulation strategy turns data into dollars, far from guesswork.

Security anchors every move. Post-purchase, sweep to cold storage; Ledger Nano X or Trezor Model T shield against exchange hacks. Multisig setups for larger sums add layers, echoing institutional prudence.

Risks to Sidestep in This $83,931 Opportunity

Dips tempt, but pitfalls lurk. Phishing scams surge during volatility; verify URLs and never share seeds. Regulatory whiplash, like shutdown odds, fades against Fed holds, yet diversify beyond BTC at 5-10% portfolio allocation max.

Tax traps: track cost basis meticulously, as U. S. IRS eyes crypto. Tools like Koinly automate reporting. Emotional sells erode gains; MicroStrategy’s $2.13 billion January spree ignored noise, holding through cycles.

Safe BTC Dip Buy Checklist

-

1. Enable 2FA Everywhere: Activate two-factor authentication with apps like Google Authenticator on platforms such as Coinbase, Binance, and Kraken to secure accounts against hacks.

-

2. Transfer to Hardware Wallet: After purchase, withdraw BTC to a Ledger Nano X or Trezor Model T for offline cold storage, minimizing exchange risks.

-

3. Complete KYC Verification: Use regulated exchanges requiring full KYC to ensure compliance and reduce fraud risks during buys at $83,931.

-

4. Schedule DCA Purchases: Set up dollar-cost averaging on Coinbase or Kraken to automatically buy BTC dips like today’s $83,931 price, averaging costs over time.

-

5. Monitor Whale Alerts: Follow Whale Alert on X (Twitter) to track accumulations by whales like MicroStrategy amid Fed holds.

Whale signals amplify conviction. Altcoin Buzz notes 2026 DeFi momentum fueling BTC strength, with nations eyeing reserves per Saylor. At $83,931, this dip rewards the prepared.

Your Action Plan: From Dip to Portfolio Powerhouse

Start small: $100 test buys build confidence on best platforms buy BTC dip. Scale as conviction grows, always prioritizing secure bitcoin purchase $84k protocols. MicroStrategy’s playbook scales down perfectly; their $264 million grab at similar levels netted instant paper profits as price rebounded to $84,398 highs.

Fed’s steady policy cements stability, letting whales like MicroStrategy stack without macro fears. Retail mirrors this via disciplined execution, turning $83,931 into foundational wealth.

Discipline trumps speculation. MicroStrategy’s evolution from 673,783 to over 712,000 BTC showcases relentless execution. As whales accumulate and policy supports, your secure entry at $83,931 positions for 2026 upside. Research deeply, act deliberately, and let compounding work.