On July 18,2025, the United States vaulted into a new era of crypto oversight with President Donald Trump’s signature on the Guiding and Establishing National Innovation for U. S. Stablecoins (GENIUS) Act. This landmark law is more than political theater; it’s a direct response to years of uncertainty and patchwork rules that left stablecoin buyers exposed. With the stablecoin market now topping $238 billion, the stakes for secure crypto buying have never been higher.

GENIUS Act: The End of the Wild West for Stablecoins

The GENIUS Act is not just another regulatory footnote. It closes a longstanding gap by making it unlawful for anyone except permitted issuers to create payment stablecoins in the U. S. market. Only subsidiaries of insured depository institutions and federally qualified nonbank issuers (with explicit OCC approval) can mint these tokens now, a move designed to weed out fly-by-night operators and bring institutional-grade standards to digital dollars.

This means if you’re buying cryptocurrency securely in 2025, you’re likely using a stablecoin backed by an entity that faces real scrutiny from federal regulators. The old days of shadowy issuers are over: every dollar-backed token must be matched by reserves held in U. S. currency, demand deposits at insured banks, short-term Treasury bills, or certain repurchase agreements, no more mystery collateral or algorithmic sleight-of-hand.

Transparency and Trust: What Buyers Can Expect

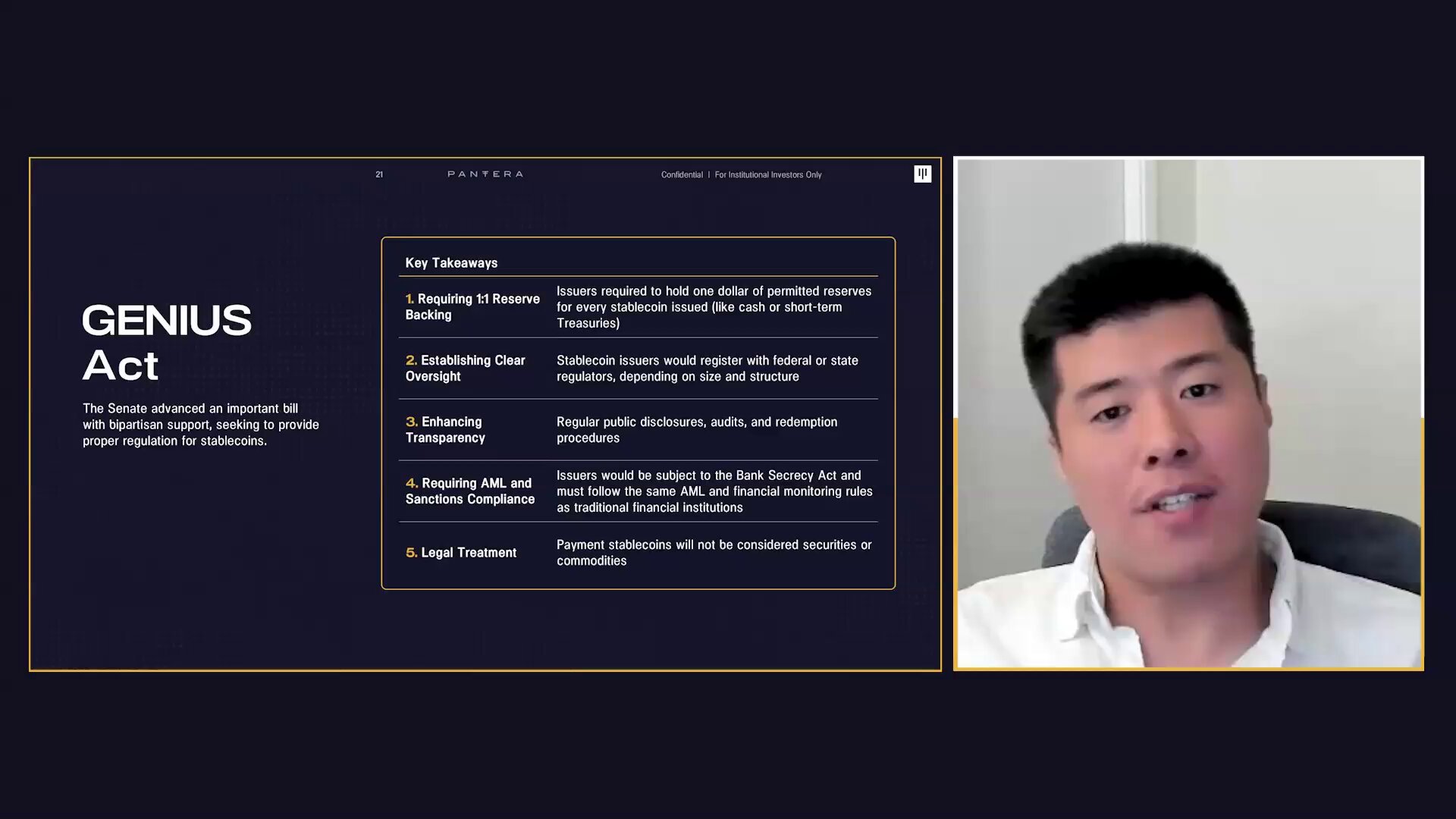

The heart of the GENIUS Act is transparency. Issuers are now required to publish monthly reserve reports and submit to independent audits, giving buyers clear visibility into what actually backs their digital dollars. For anyone who remembers past scandals where reserves turned out to be smoke and mirrors, this is a seismic shift.

But it doesn’t stop there. The law mandates customer asset segregation: if an issuer goes under, stablecoin holders get priority claims on those reserves, not just an IOU in bankruptcy court. This is a direct answer to long-standing concerns about whether users’ funds would evaporate during insolvency events.

Key Protections for Crypto Buyers Under the GENIUS Act

-

Strict Issuer Requirements: Only subsidiaries of insured depository institutions and federally qualified nonbank payment stablecoin issuers approved by the OCC can issue payment stablecoins, reducing the risk of unregulated or fraudulent issuers.

-

1:1 Reserve Backing: All stablecoins must be fully backed by reserves such as U.S. currency, insured demand deposits, short-term Treasury bills, and qualified repurchase agreements, ensuring holders can redeem their stablecoins for real dollars at any time.

-

Mandatory Transparency and Independent Audits: Issuers are required to publish monthly reports detailing their reserve holdings and undergo independent audits, providing buyers with clear, verifiable information about stablecoin backing.

-

Enhanced Consumer Protections: The Act mandates segregation of customer assets and prioritizes stablecoin holders’ claims in the event of issuer insolvency, safeguarding user funds from company liabilities.

-

Robust Anti-Money Laundering (AML) Compliance: Stablecoin issuers must comply with comprehensive AML and sanctions regulations, aligning with national security standards and reducing exposure to illicit activities.

With robust anti-money laundering (AML) rules also baked in, buyers can expect better screening against illicit transactions, and fewer surprises from sudden blacklists or frozen assets due to compliance failures.

Market Impact: From Regulatory Clarity to Institutional Confidence

The GENIUS Act’s comprehensive framework isn’t just about plugging holes; it’s about laying down a foundation that could finally pull traditional finance off the sidelines. As the Financial Times notes, regulatory clarity is expected to unlock broader adoption, with banks and major payment companies now able to participate without fear of regulatory whiplash.

This shift matters for everyday users as well as institutions. Buying cryptocurrency securely in 2025 means you’re dealing with products that meet federal standards for reserve management, transparency, and consumer protection, raising the bar across the board.

For crypto buyers, the GENIUS Act is a double-edged sword. On one hand, it puts an end to the “buyer beware” era of unvetted stablecoins. On the other, it sets a new baseline for what safe, compliant digital assets look like in the United States. The days of anonymous issuers and opaque collateral are gone; anyone buying stablecoins in 2025 can now demand proof, not promises.

One immediate effect: exchanges and wallet providers have already begun delisting non-compliant stablecoins and onboarding only those that meet the Act’s stringent requirements. This reduces fragmentation and risk for U. S. users but may limit some choices, especially for those accustomed to offshore or experimental tokens. However, most major platforms see this as a net positive, fewer rug pulls, more regulatory alignment, and a smoother path for institutional money to flow into crypto markets.

What Does This Mean for Secure Crypto Buying?

If you’re buying cryptocurrency securely in 2025, here’s what changes under the GENIUS Act:

Smart Steps for Choosing Regulated Stablecoins in 2025

-

Verify the Issuer’s Regulatory Status: Ensure the stablecoin is issued by a permitted entity—either a subsidiary of an insured depository institution or a federally qualified nonbank issuer approved by the OCC under the GENIUS Act.

-

Check for 1:1 Reserve Backing: Confirm that the stablecoin maintains fully-backed reserves—including U.S. currency, insured deposits, or short-term Treasuries—as required by law. Leading examples include USDC (by Circle) and Pax Dollar (USDP) (by Paxos).

-

Review Monthly Reserve Reports and Audit Results: Choose stablecoins whose issuers publish monthly reserve disclosures and undergo independent audits, as mandated by the GENIUS Act. Look for transparency reports on the issuer’s official website.

-

Assess Consumer Protection Measures: Select stablecoins with clear asset segregation and priority claim provisions, ensuring your funds are protected if the issuer becomes insolvent. Review the issuer’s customer protection policy.

-

Confirm AML and Compliance Standards: Make sure the issuer follows robust anti-money laundering (AML) and sanctions compliance protocols, aligning with GENIUS Act requirements. Major platforms like Coinbase and Gemini typically enforce these standards.

Transparency is no longer optional, monthly reserve disclosures and independent audits are now standard practice. Asset protection means your funds are legally segregated from issuer operations and bankruptcy risks. And with AML compliance front-and-center, you’re less likely to find your transactions caught up in legal gray areas or sudden regulatory crackdowns.

For many buyers, these reforms translate directly into peace of mind. You can verify reserves yourself before making large purchases or holding significant balances in stablecoins. If an issuer fails or faces legal trouble, you’re first in line for reimbursement, not just another unsecured creditor.

Looking Ahead: Safer On-Ramps and Bigger Players

The GENIUS Act doesn’t just protect retail investors, it’s also an invitation for bigger players to enter the space. With federal guardrails firmly in place, banks and traditional financial institutions are already exploring their own stablecoin products or partnerships with compliant issuers. This could mean more fiat on-ramps, better integration with existing payment systems, and ultimately faster mainstream adoption of digital assets.

The U. S. now sits at the forefront of global stablecoin regulation, a position that could shape international standards going forward. Other jurisdictions are watching closely; if this model proves effective at balancing innovation with safety, expect similar frameworks abroad.

The bottom line? Whether you’re a seasoned trader or just dipping your toes into crypto in 2025, the GENIUS Act delivers what users have long demanded: real accountability from issuers and a clear path to buying cryptocurrency securely, with confidence that your digital dollars are as safe as their name suggests.