On July 17,2025, New Zealand made headlines by issuing a sweeping ban on all cryptocurrency ATMs, marking a significant escalation in the global regulatory response to digital assets. The move is part of a comprehensive overhaul of the country’s Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework. According to Associate Justice Minister Nicole McKee, crypto ATMs had become “tools for organized criminal activities, ” enabling rapid, anonymous conversion of cash into digital currencies with minimal oversight. This decisive action has left both local and global crypto buyers questioning: What does this mean for secure cryptocurrency buying and the future of compliant on-ramps?

Why Did New Zealand Ban Crypto ATMs?

The core motivation behind the crypto ATM ban in New Zealand is to disrupt illicit financial flows and reinforce compliance standards. Authorities argue that these machines, by allowing quick and relatively anonymous cash-to-crypto transactions, present an attractive vector for money launderers and organized crime syndicates. In tandem with the ban, New Zealand also imposed a NZ$5,000 cap on international cash transfers and empowered its Financial Intelligence Unit (FIU) to demand real-time data from financial institutions when investigating suspicious activity.

This approach mirrors moves by other jurisdictions such as the United Kingdom and Singapore, which have also tightened regulations or outright banned crypto ATMs in recent years. The message from regulators is clear: unregulated crypto services are under intense scrutiny, and compliance with global AML/CFT standards is non-negotiable.

Impact on Crypto Buyers: Local Shockwaves, Global Ripples

The immediate effect for Kiwis is obvious – anyone accustomed to using crypto ATMs for fast Bitcoin or Ethereum purchases no longer has that option. But this crackdown resonates far beyond New Zealand’s borders. For global investors watching regulatory trends in 2025, it signals a broader shift toward stricter oversight and heightened expectations for transparency in every step of the crypto buying journey.

CoinFlip, New Zealand’s largest crypto ATM provider, voiced concern that the blanket ban may stifle innovation rather than encourage responsible growth. They argue that targeted regulation – such as enhanced KYC checks at machines – could have balanced risk reduction with user access. For users seeking secure cryptocurrency buying methods post-ban, understanding compliant alternatives becomes critical.

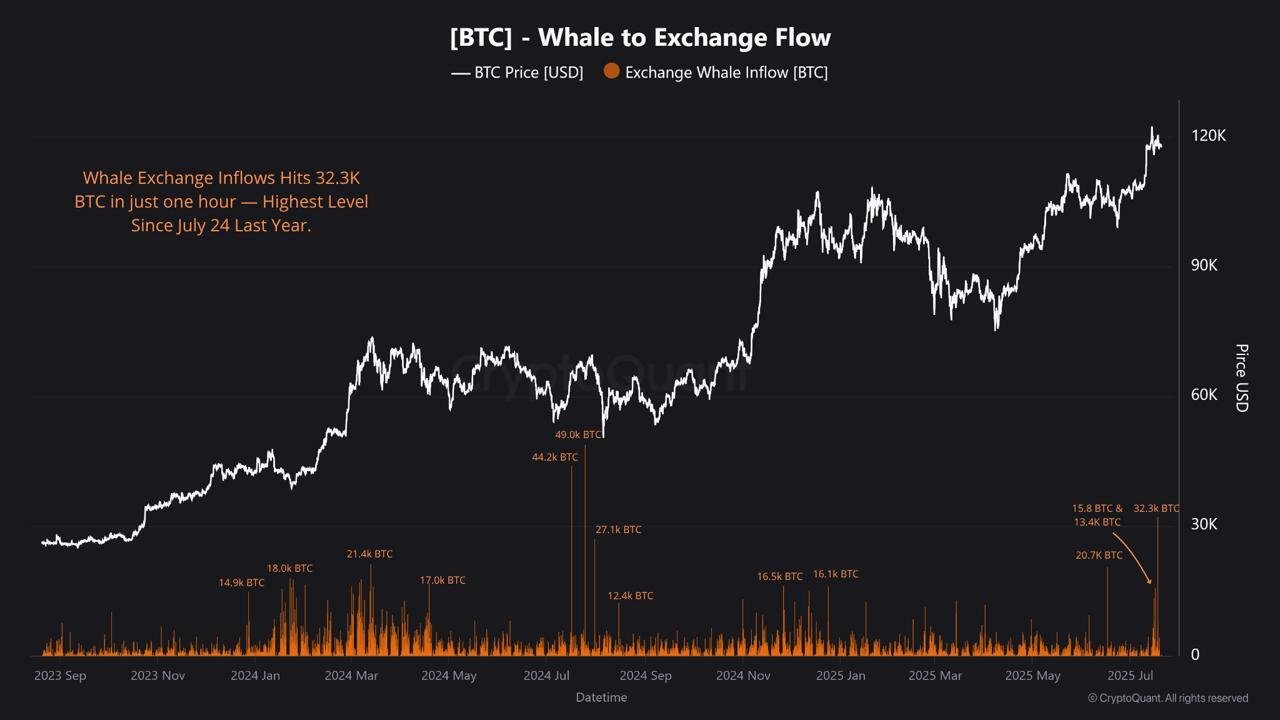

Current Market Landscape: Bitcoin Holds Above $118K Amid Regulatory Shifts

The regulatory landscape may be shifting rapidly, but market fundamentals remain robust. As of July 24,2025:

- Bitcoin (BTC): $118,371, down just 0.185% over 24 hours

- Ethereum (ETH): $3,729.17, up 3.201%

This price stability suggests that while regulatory news can spark short-term volatility, institutional interest and adoption continue to underpin major cryptocurrencies’ value propositions.

Bitcoin (BTC) Price Prediction 2026-2031: Post-NZ Crypto ATM Ban

Forecasts reflect latest regulatory environment, adoption trends, and current BTC price as of July 2025 ($118,371)

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $102,000 | $128,000 | $145,000 | +8.2% | Mild regulatory headwinds, but global adoption continues; temporary volatility after NZ ban |

| 2027 | $110,000 | $142,000 | $162,000 | +10.9% | Institutional inflows resume, CEX and regulated onramps gain traction |

| 2028 | $125,000 | $165,000 | $190,000 | +16.2% | Next Bitcoin halving drives renewed interest; regulatory clarity improves |

| 2029 | $140,000 | $185,000 | $215,000 | +12.1% | Wider mainstream adoption, integration with global payment systems |

| 2030 | $155,000 | $202,000 | $235,000 | +9.2% | Mature market, increased use as digital gold, but growth moderates |

| 2031 | $170,000 | $217,000 | $255,000 | +7.4% | Global regulatory harmonization, BTC seen as established store of value |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 remains broadly bullish despite regulatory crackdowns such as New Zealand’s crypto ATM ban. While short-term volatility is expected due to shifting on-ramp methods and compliance costs, BTC’s long-term trajectory is supported by increasing institutional adoption, technology improvements, and growing mainstream acceptance. Minimum prices reflect occasional bearish market cycles or regulatory shocks, but the average and maximum projections anticipate continued network growth, next halving effects, and a maturing asset class.

Key Factors Affecting Bitcoin Price

- Impact of global regulatory trends (including further bans or tighter compliance)

- Adoption of secure, compliant on-ramp alternatives (CEXs, P2P with KYC/AML)

- Institutional investment and ETF approvals

- Next Bitcoin halving (2028) and supply dynamics

- Macro-economic factors (inflation, fiat currency weakness)

- Competition from other digital assets and blockchain innovations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What Are Secure On-Ramp Alternatives After the Crypto ATM Ban?

If you’re in New Zealand – or any jurisdiction tightening its grip on unregulated exchanges – it’s essential to pivot toward more compliant ways to onboard into digital assets:

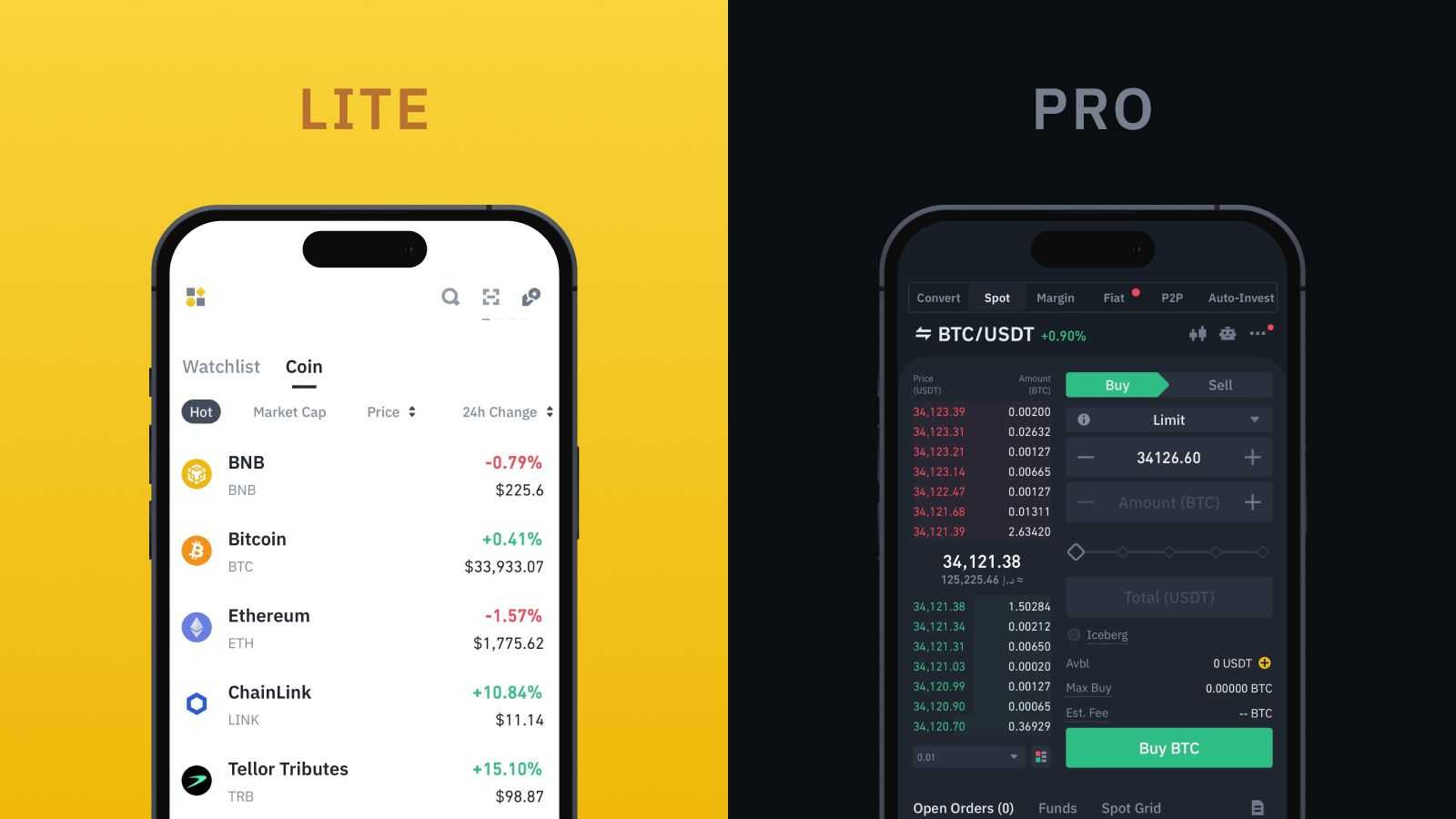

- Centralized Exchanges (CEXs): Platforms like Coinbase or Binance require robust KYC/AML processes but provide security features such as insurance coverage and transaction monitoring.

- P2P Platforms: Peer-to-peer marketplaces can be viable but should only be used if they offer strong escrow protections and identity verification tools.

- Bank-integrated On-Ramps: Many fintech apps now enable direct fiat-to-crypto purchases with bank-grade security measures built in.

The key takeaway? As regulators clamp down on anonymity-driven services like crypto ATMs, buyers must prioritize platforms that meet evolving compliance standards without sacrificing ease of use or security.

For many retail investors, the disappearance of crypto ATMs is more than a mere inconvenience. It represents a pivotal moment in the evolution of secure cryptocurrency buying. The regulatory focus is now squarely on traceability and user protection, meaning that every fiat-to-crypto on-ramp must withstand heightened scrutiny. While some users may lament the loss of convenience, others see this as an overdue push toward greater market maturity and institutional trust.

Navigating Compliance: How to Buy Crypto Securely After the ATM Ban

With crypto ATMs off the table, buyers must adapt to new best practices for entering the market. Here are strategic steps to ensure your transactions remain compliant and secure:

Top 5 Secure Ways to Buy Crypto After NZ’s ATM Ban

-

Leverage Trusted Peer-to-Peer (P2P) Platforms like Paxful or LocalBitcoins: When using P2P services, always transact with highly rated users and use escrow features to minimize fraud risk. Never share personal details outside the platform.

-

Utilize Bank Transfers with Major Exchanges: Many leading exchanges, including Binance and Coinbase, support secure bank transfers for crypto purchases. Ensure your bank supports such transactions and monitor for any new restrictions following the ATM ban.

-

Monitor Real-Time Crypto Prices and Transaction Limits: Stay updated on Bitcoin’s current price—$118,371 as of July 24, 2025—and be aware of the new NZ$5,000 cap on international cash transfers. This helps you plan purchases and remain compliant with local laws.

Centralized exchanges (CEXs) remain the gold standard for most users. They offer multi-layered security, insurance against hacks, and full transparency around transaction histories. However, always use unique passwords and enable two-factor authentication to safeguard your account.

If you prefer decentralized or peer-to-peer (P2P) methods, research platforms with robust escrow services and third-party dispute resolution. Never bypass KYC checks in favor of speed; doing so not only increases your risk but may also violate local laws.

Global Regulatory Trends: What’s Next for Crypto On-Ramps?

The crypto ATM ban in New Zealand aligns with a broader international trend toward tighter controls on how individuals access digital assets. With countries like the UK and Singapore imposing similar restrictions, it’s clear that regulators are prioritizing anti-money laundering above frictionless onboarding.

This doesn’t mean innovation is dead. In fact, forward-thinking fintech firms are racing to develop compliant solutions that balance safety with accessibility. Expect growth in bank-integrated crypto buying options and partnerships between exchanges and legacy financial institutions, allowing users to move seamlessly between fiat and digital assets without compromising compliance.

Staying Ahead: Strategies for Safer Onboarding

The lesson from New Zealand’s crackdown is clear: adaptability is essential. Here’s how savvy investors can stay ahead:

- Stay informed: Monitor local regulations closely; sudden changes can impact your ability to buy or sell crypto overnight.

- Choose regulated platforms: Prioritize services that are transparent about their licensing and compliance measures.

- Document your transactions: Keep records of every purchase for tax reporting or future audits.

- Avoid cash-based workarounds: If it sounds too good to be true, or circumvents official processes, it likely carries hidden risks.

The Bottom Line for Crypto Buyers Worldwide

The end of crypto ATMs in New Zealand marks a new chapter in global crypto regulation, a chapter defined by higher standards for transparency, security, and user protection. As Bitcoin holds steady at $118,371 and Ethereum at $3,729.17, confidence remains high among informed buyers who prioritize compliant on-ramps over risky shortcuts.

If you’re navigating these changes or considering your next move as regulations evolve, explore our detailed guides on what New Zealand’s ATM ban means for global onboarding and safer alternatives post-ban.