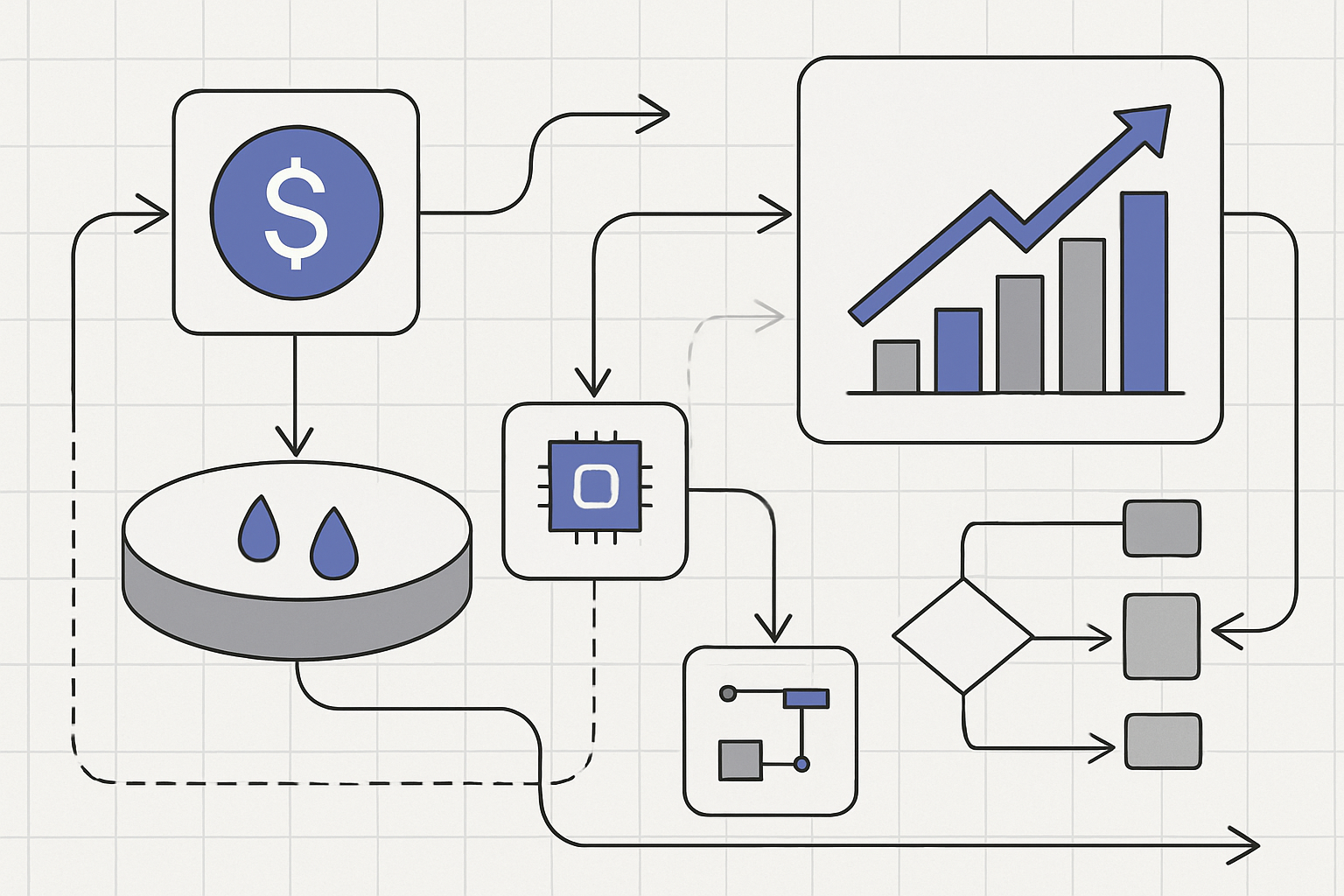

How to Securely Buy Bitcoin on the Dip Below $80K After 2026 ETF Outflows and Binance $1B SAFU Shift

How to Securely Buy Bitcoin on the Dip Below $80K After 2026 ETF Outflows and Binance $1B SAFU Shift

Bitcoin’s price has dipped to $77,693.00, a level that triggers opportunistic buying among seasoned investors. This decline...