In the shadow of a sharp liquidity crunch that saw the top 12 stablecoins shed $2.24 billion...

Ecosystem News

Bitcoin’s recent dip to $78,866 – down 6.10% in the last 24 hours with a low of...

As Bitcoin trades at $84,425.00, down 5.41% over the past 24 hours with a low of $83,340.00...

Ledger’s rumored US IPO in 2026, targeting a valuation north of $4 billion, signals a maturing crypto...

Imagine having your UBS Private Bank relationship manager handle Bitcoin and Ether trades with the same precision...

Ethereum’s price has slid to $2,926.72, marking a 2.40% drop over the past 24 hours with a...

In an era where Bitcoin commands a price of $91,969, traditional finance institutions are redefining access to...

As Bitcoin hovers at $89,144 amid a post-peak correction from its October all-time high above $125,000, Wall...

Bitcoin’s price sits at $89,632.00 today, down 0.0284% over the past 24 hours with a high of...

Bitcoin’s holding strong at $92,020, even after dipping 1.42% in the last 24 hours with a high...

Vanguard’s monumental policy shift has just unlocked the simplest, most secure gateway for millions of investors to...

In a seismic shift for traditional finance, Vanguard, the $11 trillion asset management behemoth, has finally opened...

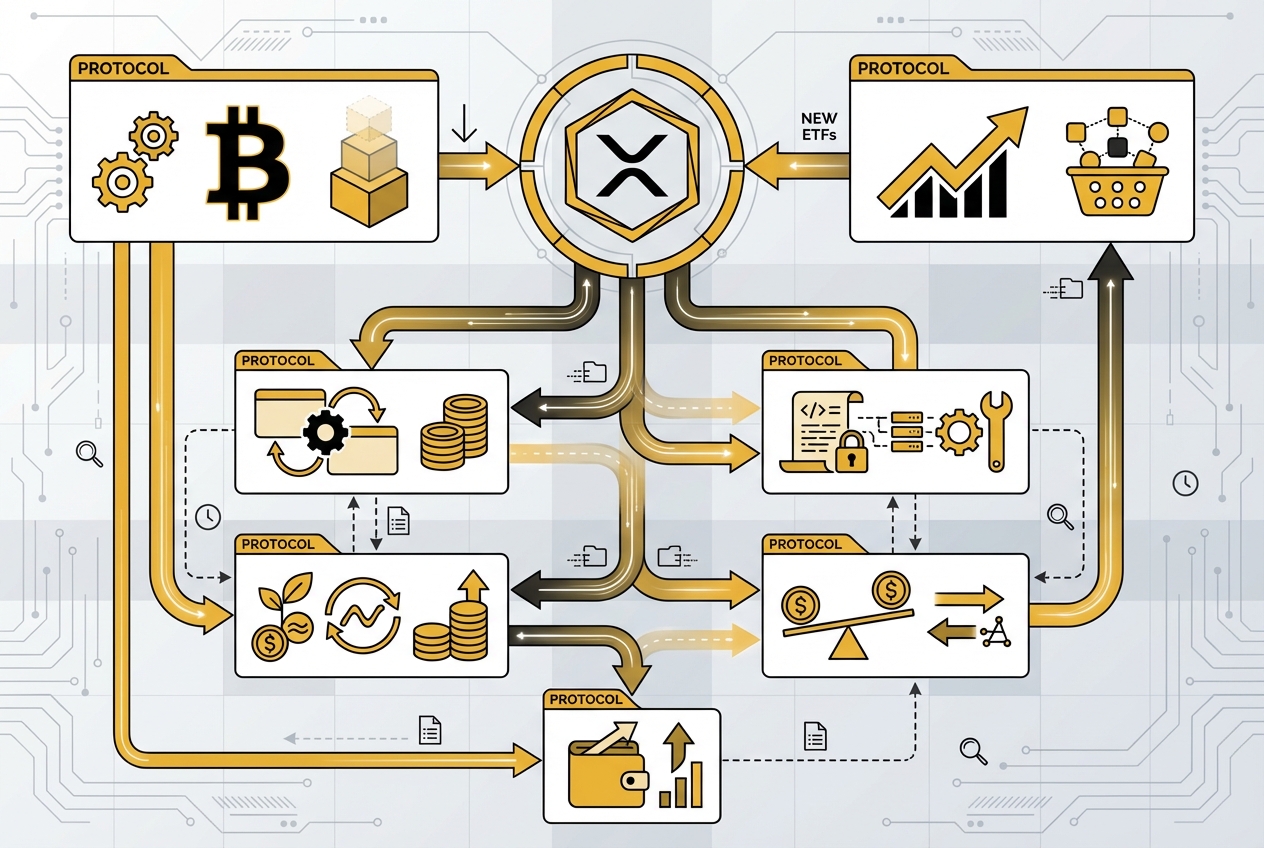

The dawn of 2025 marks a turning point for cryptocurrency investors. Grayscale’s launch of the XRP Trust...

In the wake of South Korea’s Upbit exchange suffering a $30 million hot wallet breach involving Solana...

Texas just dropped $5 million on BlackRock’s iShares Bitcoin Trust (IBIT), igniting a fire under Bitcoin at...

Something big is brewing in the XRP market, and savvy buyers are starting to take notice. As...

The IRS’s new cryptocurrency reporting rules for 2025 represent one of the most significant regulatory shifts in...

Bitcoin’s wild ride in 2025 has taken a sharp turn, leaving retail crypto buyers anxious and searching...

Bitcoin’s price has always been a lightning rod for speculation, but even seasoned crypto veterans are feeling...

Bitcoin’s rollercoaster ride is back in full swing, and crypto buyers everywhere are feeling the heat. As...

Japan is on the cusp of a transformative shift in its approach to cryptocurrency regulation and taxation....

Bitcoin ETF Adoption Surges: What Harvard’s $BTC Investment Means for Everyday Crypto Buyers in 2025

Bitcoin ETF Adoption Surges: What Harvard’s $BTC Investment Means for Everyday Crypto Buyers in 2025

As of November 17,2025, Bitcoin (BTC) is trading at $95,438.00, reflecting a modest 0.36% dip over the...

BitMart’s official US launch in 2025 is a pivotal moment for American crypto buyers. With licenses secured...

On November 13,2025, the crypto market witnessed a pivotal moment: Canary Capital’s spot XRP ETF (ticker: XRPC)...