Japan’s crypto landscape is on fire in 2025, with two seismic shifts converging to shake up how millions buy and use digital assets. The election of Sanae Takaichi as Japan’s first female prime minister signals bold new leadership, while the Binance-PayPay alliance is set to unlock crypto’s mainstream moment. For anyone looking to buy cryptocurrency in Japan or across Asia, these changes could mean faster, safer, and more accessible trading than ever before.

Japan’s Iron Lady: Sanae Takaichi and the Crypto Boom

Sanae Takaichi’s rise to power isn’t just historic – it’s a game-changer for Japan’s financial markets. Known as the “Iron Lady, ” Takaichi is pushing for expansionary fiscal policies, but her real ace up the sleeve is crypto regulation. She’s championing reforms that could align crypto gains with equities at approximately 20% tax, compared to the punishing rates up to 55% that traders currently face. That means more profits stay in your pocket, fueling a wave of risk-taking and innovation.

Takaichi’s government is also committed to refining blockchain regulations, making it easier for startups and established players alike to experiment with new technology while still maintaining Japan’s gold-standard regulatory framework. The result? A surge of confidence among investors and a clear signal that Japan wants to be Asia’s crypto leader.

The Binance-PayPay Alliance: Crypto Meets Everyday Money

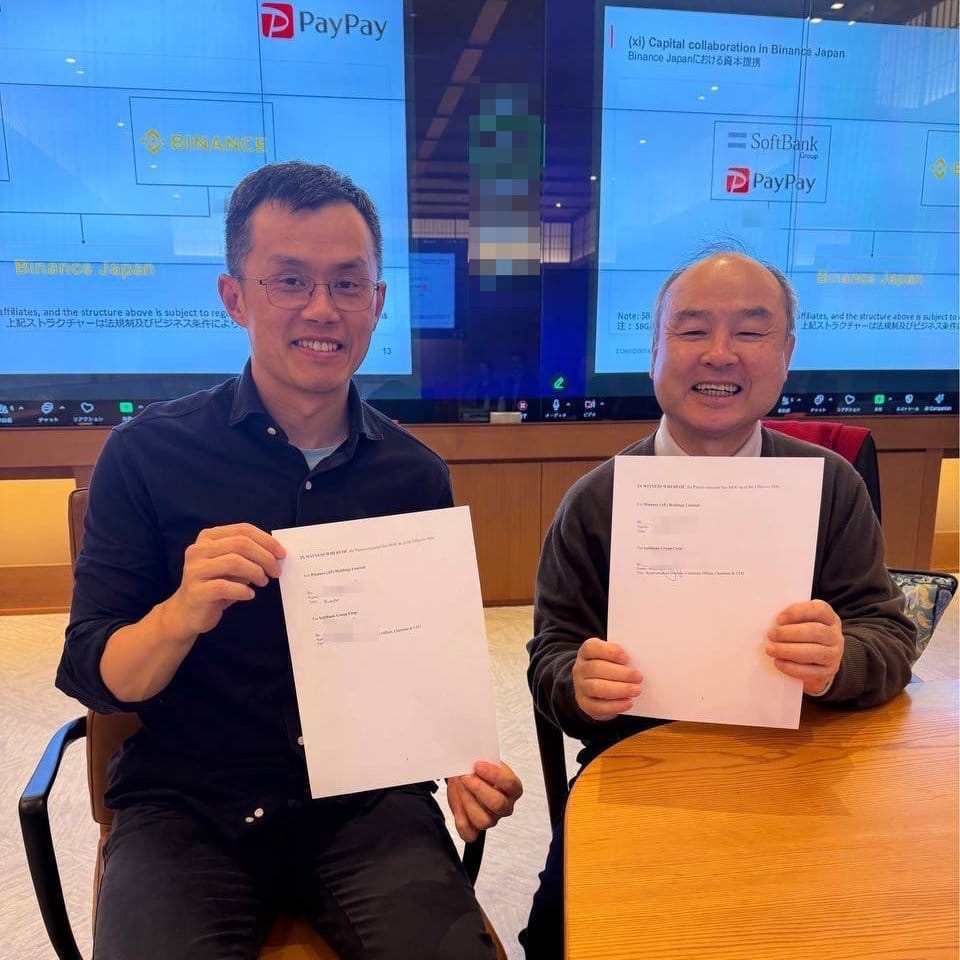

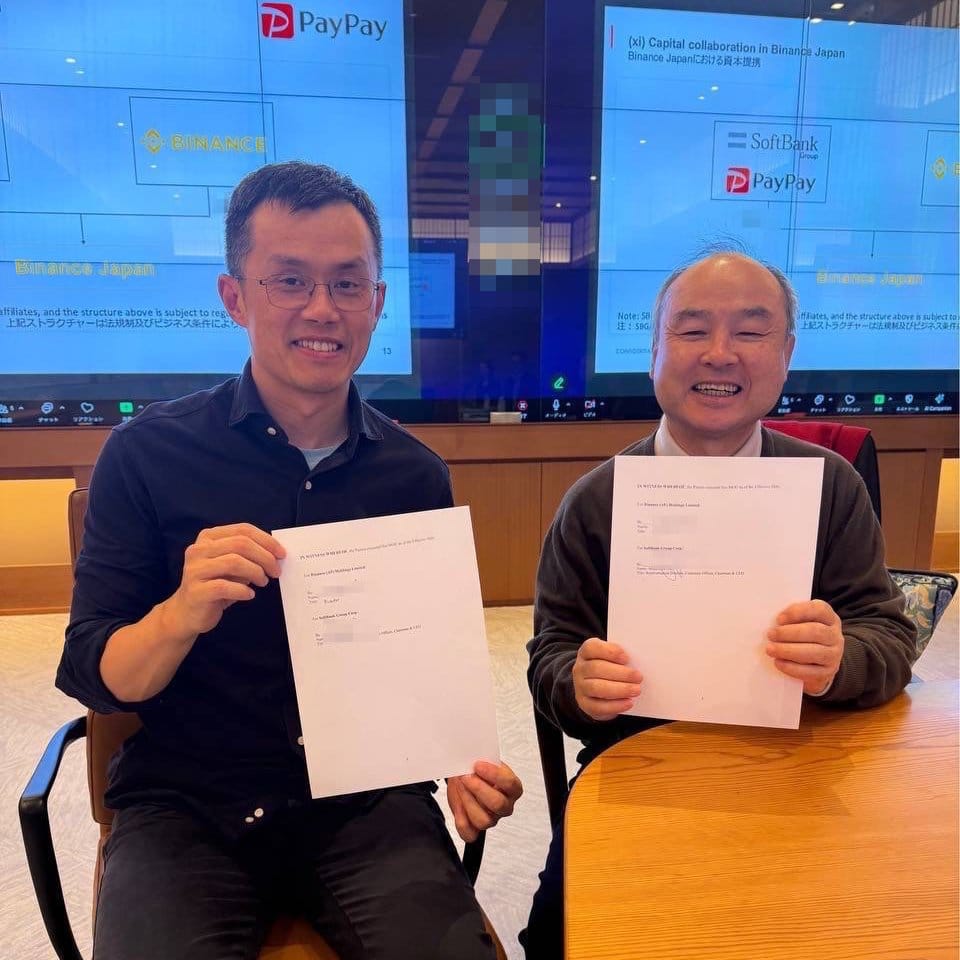

While policy sets the stage, it’s the Binance-PayPay alliance that brings crypto buying directly into people’s daily lives. PayPay Corporation, backed by SoftBank, has snapped up a 40% stake in Binance Japan. This isn’t just a headline – it means over 60 million PayPay users can now access Binance’s world-class blockchain platform inside their favorite payments app.

The partnership enables seamless crypto purchases using PayPay Money, and lets users cash out their crypto instantly back into yen. With Japan forecasted to hit ¥33.7 trillion ($230B) in crypto transactions in 2025, this integration could supercharge adoption not just in Japan but across Asia.

Top 5 Benefits of the Binance-PayPay Partnership

-

1. Seamless Crypto Purchases via PayPay MoneyJapanese users can now buy cryptocurrencies directly through PayPay Money in the Binance Japan app, streamlining the buying process and making digital assets more accessible than ever.

-

2. Instant Withdrawals to PayPay WalletsCrypto sellers can withdraw proceeds directly to their PayPay wallets, enabling fast, convenient access to funds and eliminating the need for complex bank transfers.

-

3. Enhanced Security and Regulatory ComplianceThe partnership leverages Japan’s robust regulatory framework and Binance’s global compliance standards, offering users a safer, more transparent trading environment.

-

4. Access to PayPay’s Massive User BaseWith over 60 million registered PayPay users, Binance gains immediate access to one of Japan’s largest digital payment communities, accelerating mainstream crypto adoption.

-

5. Lower Barriers for New Crypto InvestorsBy integrating familiar payment tools, the alliance reduces complexity for beginners, encouraging more Japanese residents to explore and invest in cryptocurrencies confidently.

Setting the Stage for Secure Crypto Buying in Asia

Why does this alliance matter so much? Because it finally bridges the gap between traditional finance and Web3 in a way that feels safe, simple, and familiar. Users can buy Bitcoin, Ethereum, or other assets right from their PayPay wallet – no more jumping through hoops or worrying about shady exchanges.

This move aligns perfectly with Takaichi’s push for regulatory clarity and consumer protection. By embedding digital assets within mainstream financial apps and tightening oversight, Japan is signaling that secure crypto buying in Asia is not just possible – it’s here.

Asian Crypto Adoption: Why This Matters Now

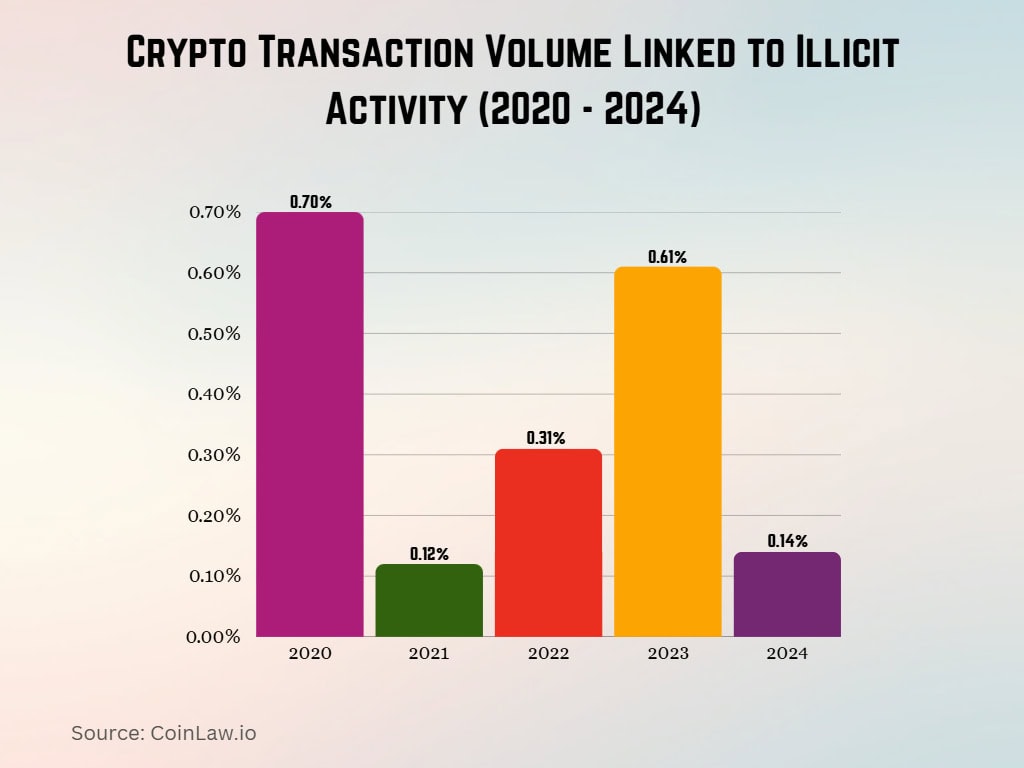

If you’re trading or investing in digital assets, these changes are more than headlines – they’re a blueprint for where Asian markets are headed next. The combination of forward-thinking regulation and real-world integration could set off a domino effect across Asia, driving adoption in South Korea, Taiwan, and beyond. And with Bitcoin recently reaching new all-time highs in both U. S. dollar and yen terms, there’s never been more momentum for risk assets in Japan.

Everyday investors and seasoned traders alike are watching Japan’s new crypto playbook closely. With easier access, lower taxes, and user-friendly apps, the barriers to entry are melting away. The days of navigating complex onboarding or worrying about regulatory whiplash could soon be over for Japanese buyers. Instead, expect a market where speed, security, and simplicity rule.

Let’s not overlook the ripple effect on fintech innovation. As Japan’s fintech giants embrace blockchain, expect a wave of new features: instant settlements, cross-border payments, and creative DeFi integrations. This isn’t just about buying Bitcoin, it’s about unlocking an entire digital finance ecosystem that puts users in the driver’s seat.

What’s Next? Eyes on Regulation and Regional Expansion

Regulatory clarity is set to be the real game-changer. Takaichi’s administration is already working to align tax policy with global standards and encourage responsible innovation. If her government delivers on its promises, we could see even more institutional investors pouring into Japan’s crypto sector, and potentially a model for other Asian economies to follow.

Meanwhile, the Binance-PayPay partnership is poised for rapid scaling. As user feedback rolls in and crypto buying becomes as routine as ordering lunch on your phone, competitors across Asia will scramble to catch up. For now, Japan is setting the pace, and anyone serious about buying cryptocurrency in Asia should be paying attention.

5 Ways Japan’s Crypto Reforms Could Impact Asia-Pacific

-

Streamlined Crypto Taxation Could Set a Regional Precedent: Japan’s proposed shift to a flat ~20% tax rate on crypto gains—matching equities—may inspire similar reforms in neighboring countries, making crypto investing more attractive across Asia.

-

Binance-PayPay Integration May Accelerate Mainstream Adoption: By enabling millions of PayPay users to buy and sell crypto directly through Binance Japan, this alliance could become a blueprint for fintech-crypto partnerships throughout Asia-Pacific.

-

Regulatory Clarity Expected to Attract Institutional Investment: Prime Minister Sanae Takaichi’s commitment to refining blockchain regulations could provide the legal certainty needed for Asian institutional investors to enter the crypto space with confidence.

-

Cross-Border Payment Innovations Could Expand: Seamless crypto purchases and withdrawals via PayPay Money may inspire regional payment platforms—like Korea’s KakaoPay or Singapore’s GrabPay—to explore similar blockchain integrations.

-

Japan’s Market Momentum Could Influence Crypto Prices: With Japan’s crypto transaction volume projected to reach ¥33.7 trillion ($230B) in 2025, increased activity may drive liquidity and set trends that ripple across Asia-Pacific markets.

The Bottom Line: Adapt Fast or Get Left Behind

The message from Tokyo is crystal clear: adapt fast or risk missing out. Whether you’re an investor chasing alpha or a builder launching new products, Japan’s blend of regulatory vision and fintech muscle is rewriting the rules for secure crypto buying in Asia. Eyes will be glued to BTC/JPY and ETH/JPY price action as this story unfolds.

If you want to ride this wave, stay nimble, the next big opportunity may drop at any moment. Speed, discipline, adaptability: that’s how you win in this new era of Japanese crypto dominance.