Imagine waking up to the news that 61,000 Bitcoin, worth a jaw-dropping $6.75 billion, have been seized by UK authorities in the world’s largest cryptoasset bust. That’s not just a headline, it’s a seismic event for everyone buying cryptocurrency today. With Bitcoin currently trading at $119,960.00, this seizure isn’t just about one criminal case, it’s about how the landscape of crypto security and regulation is shifting beneath our feet.

Bitcoin at $119,960.00: Why This Seizure Matters for Every Crypto Buyer

The conviction of Zhimin Qian, who defrauded over 128,000 victims in China before laundering her crypto in London, is making waves across the globe (BBC, The Guardian). This isn’t just another crypto scam story, it’s a wake-up call that law enforcement is leveling up its game. The Metropolitan Police’s recovery of these funds sets new precedents for digital asset crimes and signals that no wallet is invisible anymore.

If you’re buying cryptocurrency safely or thinking about your next move in this market, here’s what you need to know:

- Law enforcement is watching: Massive seizures like this prove that global authorities are tracking illicit flows and have the tools to act.

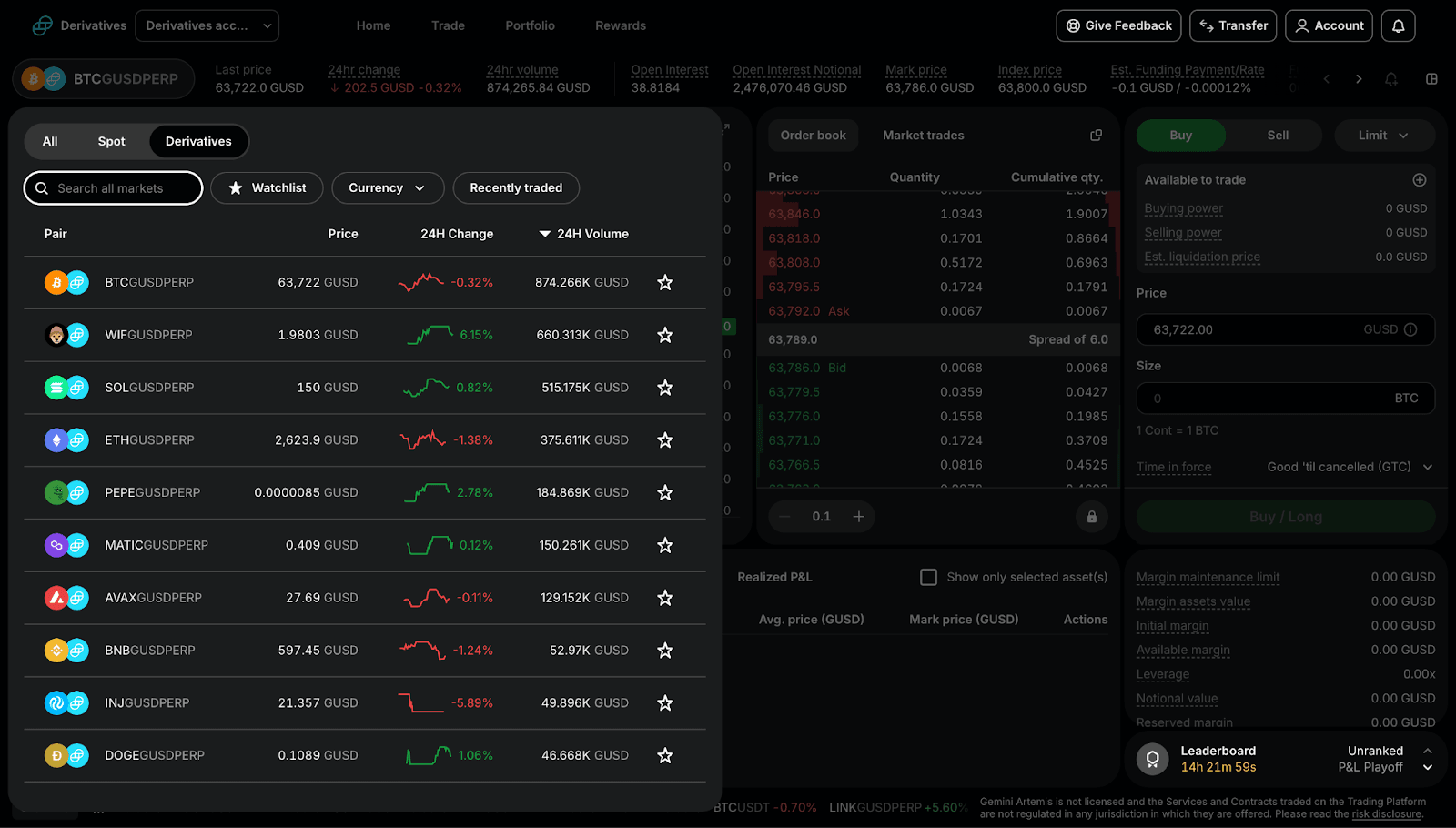

- Market volatility can follow: When billions in Bitcoin are suddenly frozen or moved by authorities, expect some wild short-term price swings.

- Your security practices matter more than ever: As criminals get creative, so must your approach to protecting your assets.

Crypto Security Gets Real: Protecting Your Coins After Major Seizures

The scale of this Bitcoin seizure has turbocharged conversations around crypto security. If you’re holding BTC or any digital asset right now, ask yourself: Are my coins safe from both hackers and regulators? The reality is that as enforcement ramps up against fraudsters and scammers, buyers need to double down on best practices.

Top 5 Secure Ways to Buy Crypto After Major Seizures

-

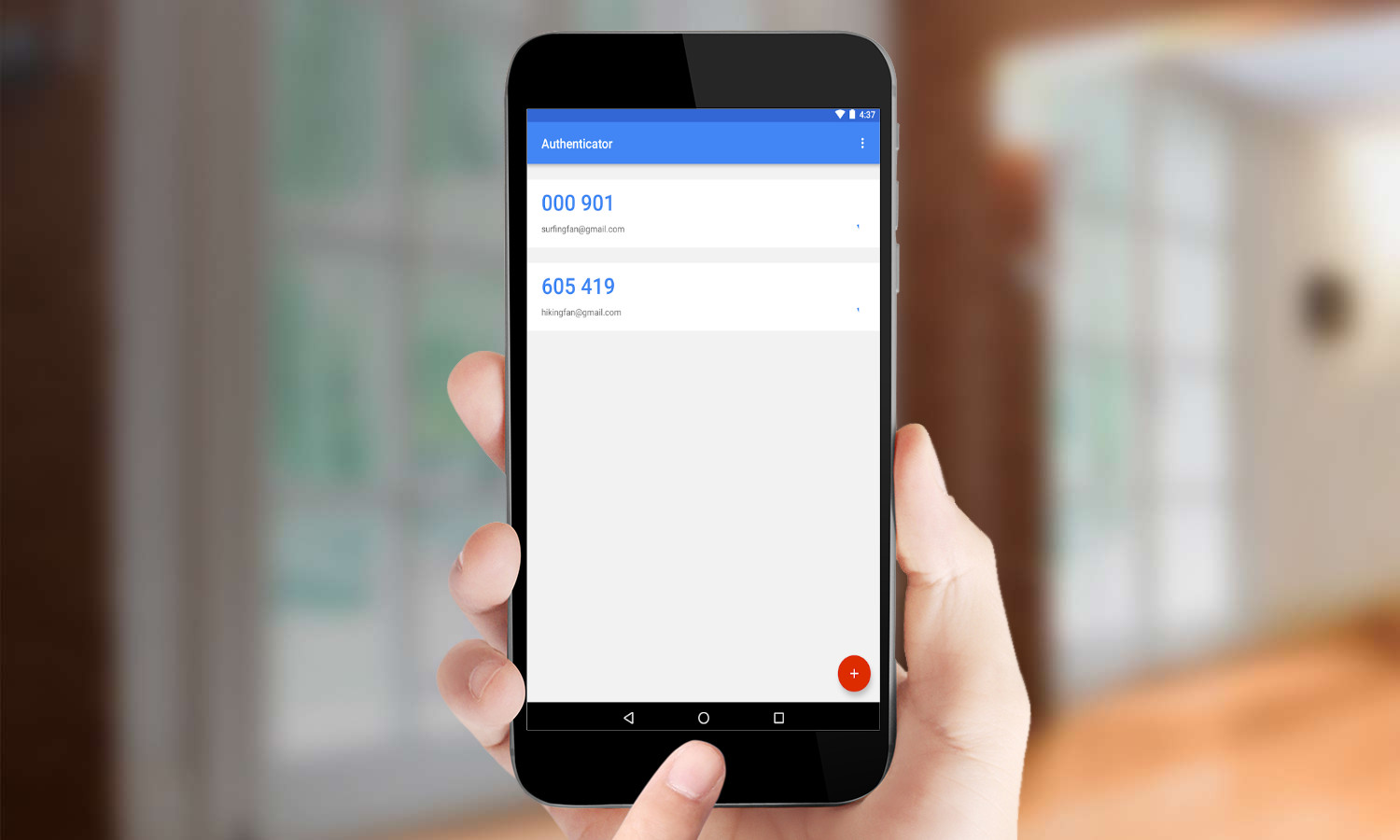

Enable Two-Factor Authentication (2FA): Always activate 2FA on your accounts using trusted apps like Google Authenticator or Authy. This adds an extra layer of protection beyond just a password.

-

Monitor Official Regulatory Updates: Regularly check updates from authorities like the U.S. Department of Justice and U.S. Securities and Exchange Commission to stay informed about new rules, enforcement actions, and security alerts.

The Department of Justice (DOJ) also recently seized over $225 million from crypto confidence scams (justice.gov). These high-profile actions are building trust among legitimate investors but also pushing exchanges and wallets to tighten their own compliance checks.

Tighter Regulation Ahead? What Buyers Should Watch For

If you think regulation was already tough, buckle up, because events like this set the stage for even stricter rules. Expect more rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks when opening accounts or moving large sums. Governments want transparency and accountability as crypto becomes mainstream.

This means every buyer should stay sharp by monitoring updates from agencies like the DOJ and UK police. Don’t get caught off guard by new compliance hoops, adapt fast so your trading doesn’t miss a beat!

Bitcoin Price Prediction 2026-2031

Forecasts based on current post-seizure market environment, regulatory trends, and adoption cycles. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $93,000 | $128,000 | $160,000 | +7% | Possible correction after recent highs; regulatory clarity may drive recovery |

| 2027 | $105,000 | $140,000 | $185,000 | +9% | Renewed institutional interest; potential for ETF-driven inflows |

| 2028 | $120,000 | $162,000 | $215,000 | +16% | Halving event year; supply shock could trigger bullish momentum |

| 2029 | $140,000 | $185,000 | $250,000 | +14% | Wider adoption, especially in emerging markets; technological upgrades |

| 2030 | $160,000 | $210,000 | $285,000 | +13% | Matured regulatory frameworks, increased integration with TradFi |

| 2031 | $175,000 | $235,000 | $320,000 | +12% | Potential new all-time highs; Bitcoin as a global digital asset class |

Price Prediction Summary

Bitcoin is expected to experience moderate but steady growth over the next six years, with price action influenced by major regulatory developments, adoption cycles, and technological improvements. While short-term volatility is likely following large-scale seizures and enforcement actions, the long-term trend remains upward, supported by increasing institutional participation and maturing market infrastructure. Minimum prices reflect potential bearish scenarios including regulatory crackdowns or macroeconomic downturns, while maximum prices represent bullish outcomes from adoption surges or technological breakthroughs.

Key Factors Affecting Bitcoin Price

- Regulatory clarity and enforcement actions (e.g., large-scale seizures) affecting market trust and compliance costs.

- Institutional adoption and integration with traditional finance systems (ETFs, custody solutions).

- Bitcoin halving events reducing new supply and historically triggering bullish cycles.

- Technological improvements (scalability, security, Layer-2 solutions).

- Macro-economic conditions including inflation, monetary policy, and global capital flows.

- Potential competition from other digital assets and evolving blockchain ecosystems.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the dust settles from the $6.75 billion Bitcoin seizure, the ripple effects are just beginning to hit the market. With Bitcoin holding strong at $119,960.00, crypto buyers are facing a new era of scrutiny and opportunity. The question isn’t just whether you can buy crypto securely, but how quickly you can adapt to these shifting tides.

One thing’s for sure: the days of flying under the radar are over. Exchanges are tightening onboarding procedures, demanding more documentation, and using advanced analytics to spot suspicious activity. This is great news for those who value transparency and want to keep crypto scams at bay, but it also means every buyer needs to step up their game.

How to Stay Ahead: Action Steps for Smart Crypto Buyers

If you want to thrive in this new landscape, here’s how you stay one step ahead:

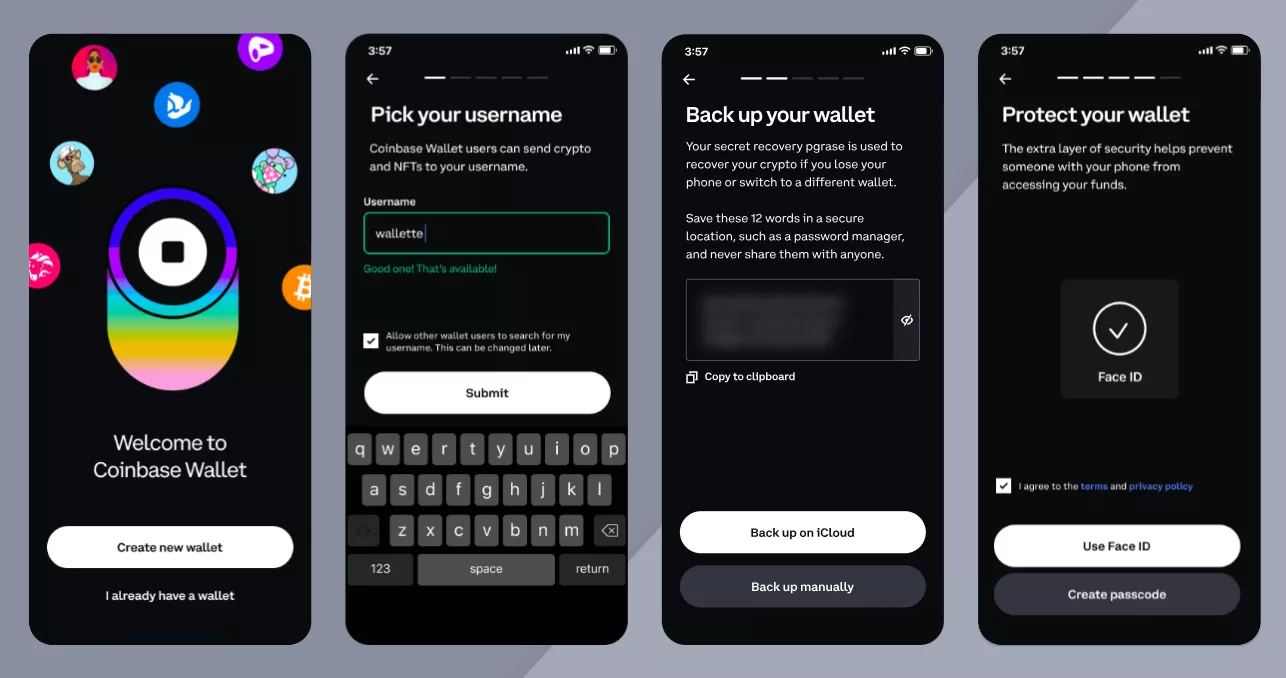

1. Prioritize Security: Use hardware wallets, enable two-factor authentication, and never share your private keys. Treat your assets like gold, because at these prices, they practically are.

2. Embrace Compliance: Don’t fear KYC or AML checks, see them as a badge of legitimacy. Platforms that play by the rules will stick around longer and keep your funds safer.

3. Stay Agile: Markets react fast when billions in Bitcoin move or freeze. Set alerts for major news events and price swings so you’re ready to act, not react.

4. Keep Learning: Follow updates from regulators and industry leaders so you’re always up-to-date on what’s expected from buyers like you.

The Big Picture: What This Means for Crypto’s Future

The world’s biggest Bitcoin fraud case is a turning point, not just for law enforcement but for everyone who believes in the future of digital assets. As governments crack down on illicit activity, legitimate investors stand to gain from cleaner markets and stronger protections. But only if they’re ready to adapt with speed and discipline.

This is a moment where risk meets reward head-on, where those who take security seriously will come out on top as crypto hits new milestones.

The bottom line? If you want to buy cryptocurrency safely today, and tomorrow, you need to be proactive. The market is moving fast, regulations are evolving, but so are the tools available for smart investors willing to play by the rules.