The dawn of 2025 marks a turning point for cryptocurrency investors. Grayscale’s launch of the XRP Trust...

Bitcoin’s current price of $91,331.00 sits amid a volatile landscape where the Crypto Fear and amp; Greed...

The Upbit hack on November 27,2025, exposed vulnerabilities that no trader can ignore. South Korea’s largest exchange...

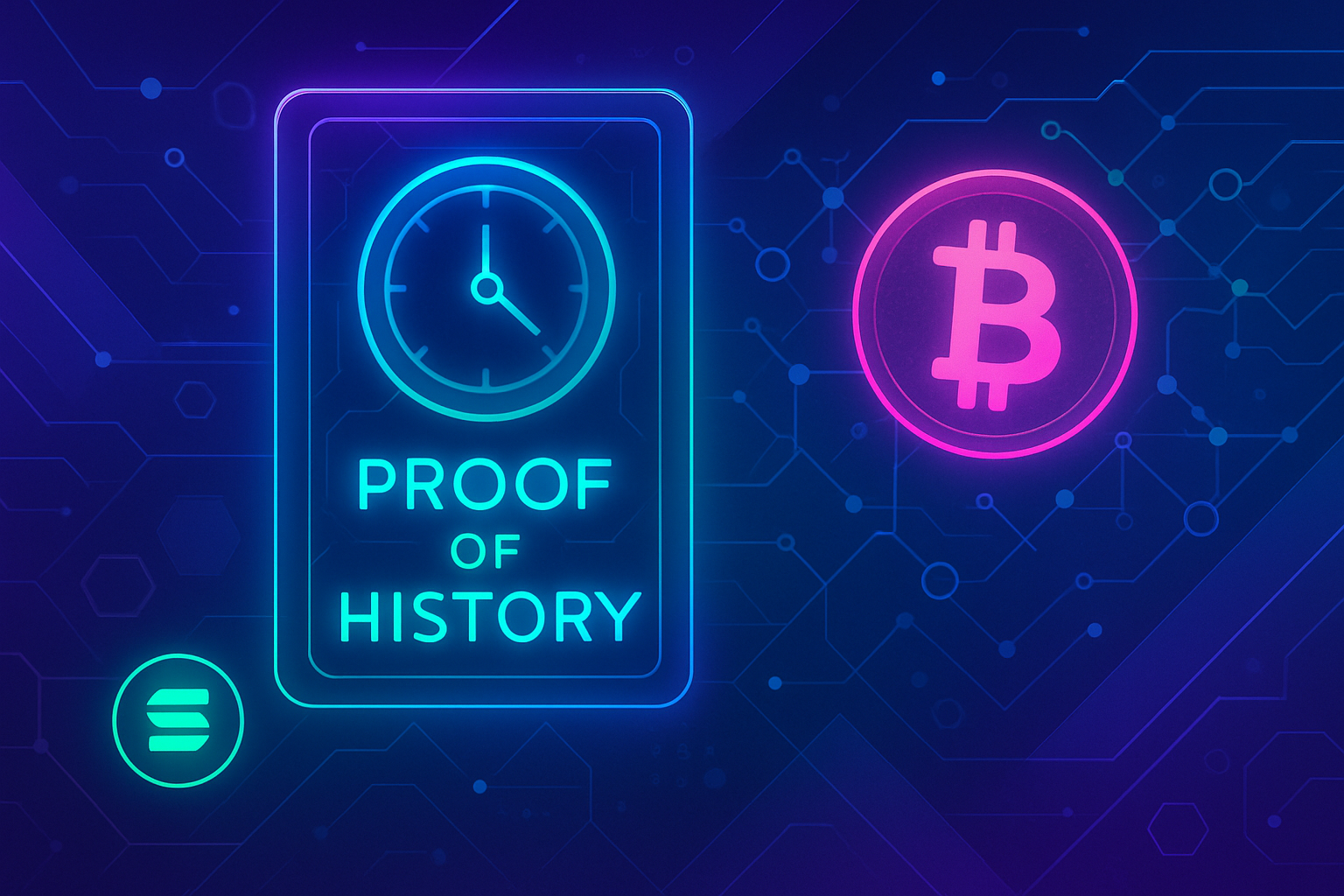

In the wake of South Korea’s Upbit exchange suffering a $30 million hot wallet breach involving Solana...

Texas just dropped $5 million on BlackRock’s iShares Bitcoin Trust (IBIT), igniting a fire under Bitcoin at...

Crush 2025 crypto gains with Webull’s killer rewards! Picture this: drop $100 and on Bitcoin or Ethereum,...

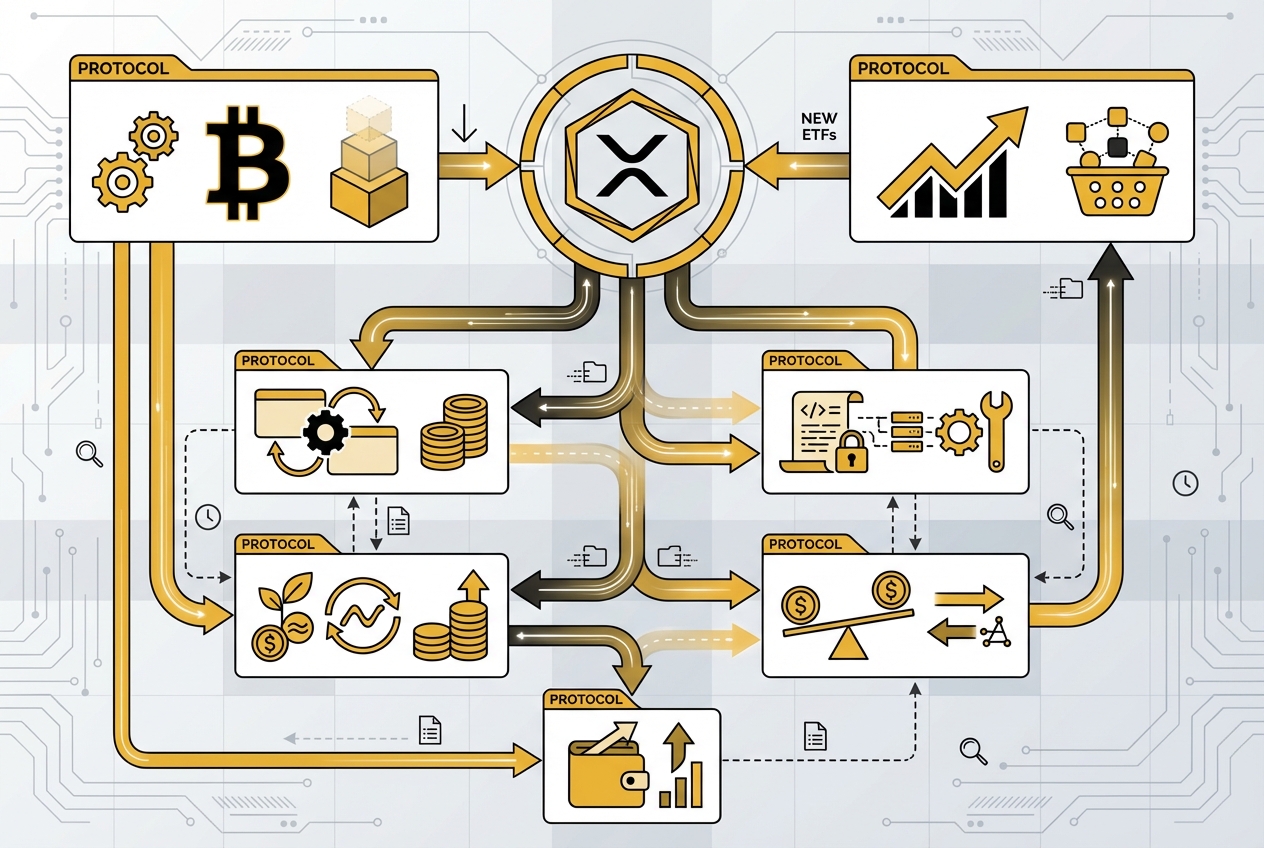

Something big is brewing in the XRP market, and savvy buyers are starting to take notice. As...

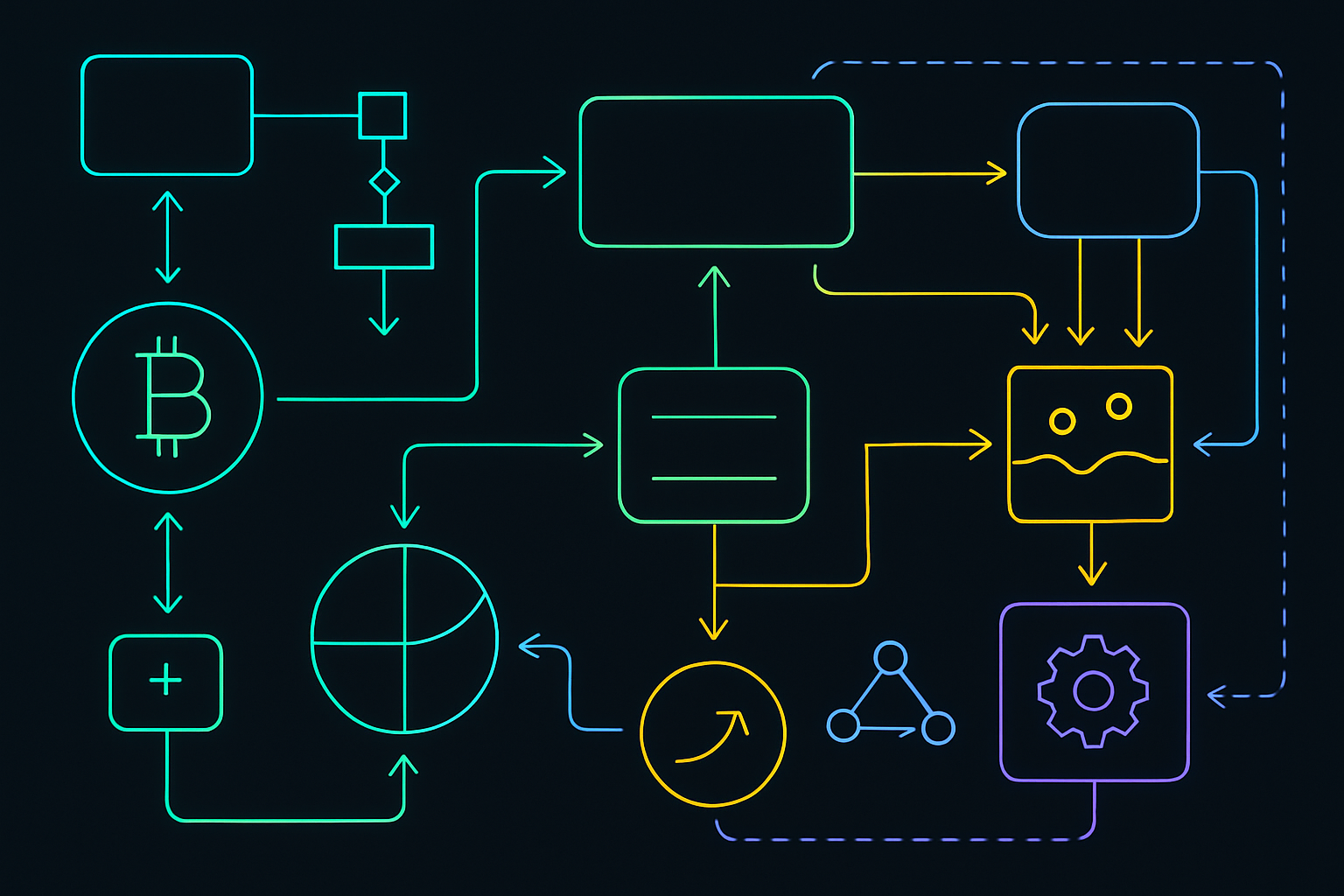

The IRS’s new cryptocurrency reporting rules for 2025 represent one of the most significant regulatory shifts in...

Bitcoin’s wild ride in 2025 has taken a sharp turn, leaving retail crypto buyers anxious and searching...

Bitcoin’s price has always been a lightning rod for speculation, but even seasoned crypto veterans are feeling...

Bitcoin’s rollercoaster ride is back in full swing, and crypto buyers everywhere are feeling the heat. As...

Bitcoin’s recent slide below the $90,000 threshold has sent shockwaves through the crypto community and reignited the...

Japan is on the cusp of a transformative shift in its approach to cryptocurrency regulation and taxation....

Bitcoin ETF Adoption Surges: What Harvard’s $BTC Investment Means for Everyday Crypto Buyers in 2025

Bitcoin ETF Adoption Surges: What Harvard’s $BTC Investment Means for Everyday Crypto Buyers in 2025

As of November 17,2025, Bitcoin (BTC) is trading at $95,438.00, reflecting a modest 0.36% dip over the...

BitMart’s official US launch in 2025 is a pivotal moment for American crypto buyers. With licenses secured...

On November 13,2025, the crypto market witnessed a pivotal moment: Canary Capital’s spot XRP ETF (ticker: XRPC)...

Institutional inflows have become the dominant force behind the price action of Bitcoin and Solana in 2025....

Brazil’s crypto landscape is undergoing a seismic shift as the Central Bank of Brazil unveils its 2025...

The regulatory landscape for cryptocurrency in 2025 is shifting rapidly, with the European Union’s AMLR 2027 and...

Ripple’s latest moves are sending shockwaves through the crypto sector. As of November 10,2025, XRP is trading...

The landscape for crypto investing in the United States is rapidly evolving, and the imminent launch of...

Stablecoins are no longer just a footnote in the crypto market – in 2025, they’re the driving...

Bitcoin’s recent decline below the $100,000 mark has reignited a classic debate among long-term investors: is this...

Bitcoin’s price volatility is once again in the spotlight. On November 5,2025, Bitcoin (BTC) slipped below the...