The crypto landscape is buzzing with two major developments that could reshape your buying strategy: the passage of the GENIUS Act, a landmark U. S. law regulating stablecoins, and a jaw-dropping $9.6 billion Bitcoin whale transfer. Both events are sending ripples through the market, raising questions about stability, opportunity, and risk for everyday investors.

GENIUS Act Crypto Regulation: What Changed?

On July 18,2025, President Donald Trump signed the GENIUS Act into law. This sweeping legislation finally brings federal oversight to stablecoins, cryptocurrencies pegged to the U. S. dollar that are essential for trading and liquidity across exchanges. The new law requires stablecoin issuers to back their tokens with liquid assets like cash or short-term Treasury bills and publish monthly reserve audits. The goal? To boost trust and transparency in a sector long criticized for its opacity.

Proponents argue that these rules will make stablecoins safer for everyone, potentially attracting more institutional money and reinforcing the dollar’s dominance in digital finance (Reuters). However, critics warn that some loopholes still exist, especially around anti-money laundering safeguards, and worry that big tech firms or foreign players could consolidate too much power (FT).

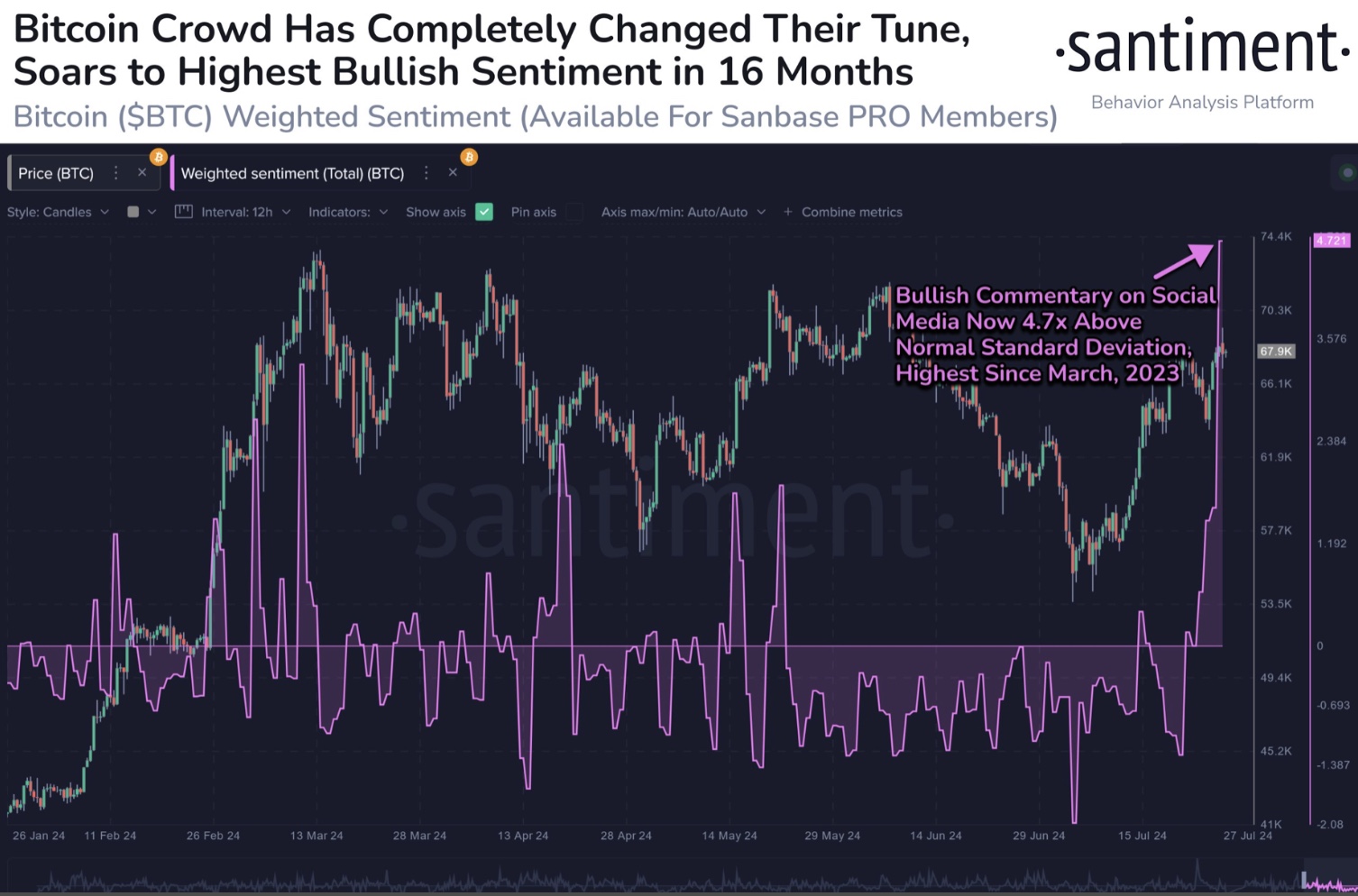

The immediate impact? Market optimism is high. The global crypto market cap has surged to $4 trillion as investors anticipate greater mainstream adoption.

Bitcoin Whale Transfer Impact: Security Move or Sell Signal?

Just weeks before this regulatory breakthrough, another headline-grabber hit the news: on July 4th, a long-dormant Bitcoin wallet moved 80,000 BTC, worth roughly $8.6 billion: to new addresses. This transfer came from an OG whale whose coins had been untouched since 2011.

Initially, some analysts sounded alarm bells about a possible sell-off sparking a market correction (Cointelegraph). However, blockchain intelligence firm Arkham quickly clarified that this was likely just a security upgrade: moving funds from old legacy addresses to more secure SegWit wallets. So far, there’s no evidence these coins have hit exchanges or been sold.

But even if it’s not an immediate dump on the market, such massive movements can spook traders and trigger short-term volatility. This is why savvy buyers should always keep an eye on whale activity, it can influence sentiment even when fundamentals remain strong.

Bitcoin (BTC) Price Prediction Table: 2026-2031 Post-GENIUS Act

Forecasts reflect the impact of the GENIUS Act, recent whale activity, and evolving crypto market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $97,000 | $128,000 | $155,000 | +8.3% | Post-GENIUS Act stability, moderate growth as institutions increase exposure |

| 2027 | $110,000 | $142,000 | $175,000 | +11.0% | Mainstream stablecoin adoption, increased regulatory clarity |

| 2028 | $120,000 | $160,000 | $200,000 | +12.7% | Potential Bitcoin halving cycle, continued institutional growth |

| 2029 | $140,000 | $182,000 | $230,000 | +13.8% | Global adoption accelerates, competition from CBDCs rises |

| 2030 | $160,000 | $205,000 | $265,000 | +12.6% | Bitcoin matures as a digital reserve asset, increased integration with financial systems |

| 2031 | $180,000 | $225,000 | $295,000 | +9.8% | Market matures, volatility decreases, technological improvements drive efficiency |

Price Prediction Summary

Bitcoin is projected to maintain a gradual upward trajectory from 2026 through 2031, buoyed by regulatory clarity from the GENIUS Act, increasing institutional participation, and further integration into global financial markets. While near-term volatility may persist due to macroeconomic shifts and large-scale transactions, the long-term outlook remains positive, with average prices anticipated to surpass $225,000 by 2031. Bullish scenarios could see Bitcoin testing the $295,000 level, while bearish conditions are likely to find strong support above $97,000.

Key Factors Affecting Bitcoin Price

- GENIUS Act implementation enhancing regulatory clarity and institutional confidence

- Increased transparency and legitimacy in stablecoin markets potentially boosting overall crypto liquidity

- Institutional adoption and integration of Bitcoin as a reserve asset

- Technological improvements (e.g., Layer 2 scaling, security enhancements)

- Potential impact of future Bitcoin halving cycles on supply and price

- Geopolitical and macroeconomic factors, including CBDC competition and global regulatory responses

- Market sentiment driven by large-scale whale transactions and on-chain metrics

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Crypto Buying Strategy 2025: Navigating New Rules and Big Moves

If you’re wondering how all this affects your own crypto buying strategy in 2025, you’re not alone! Here are some key considerations:

- Regulatory clarity: With stablecoins under federal oversight and monthly audits required by law, expect increased trust, and possibly less risk, when using US dollar-pegged tokens for trading or holding value.

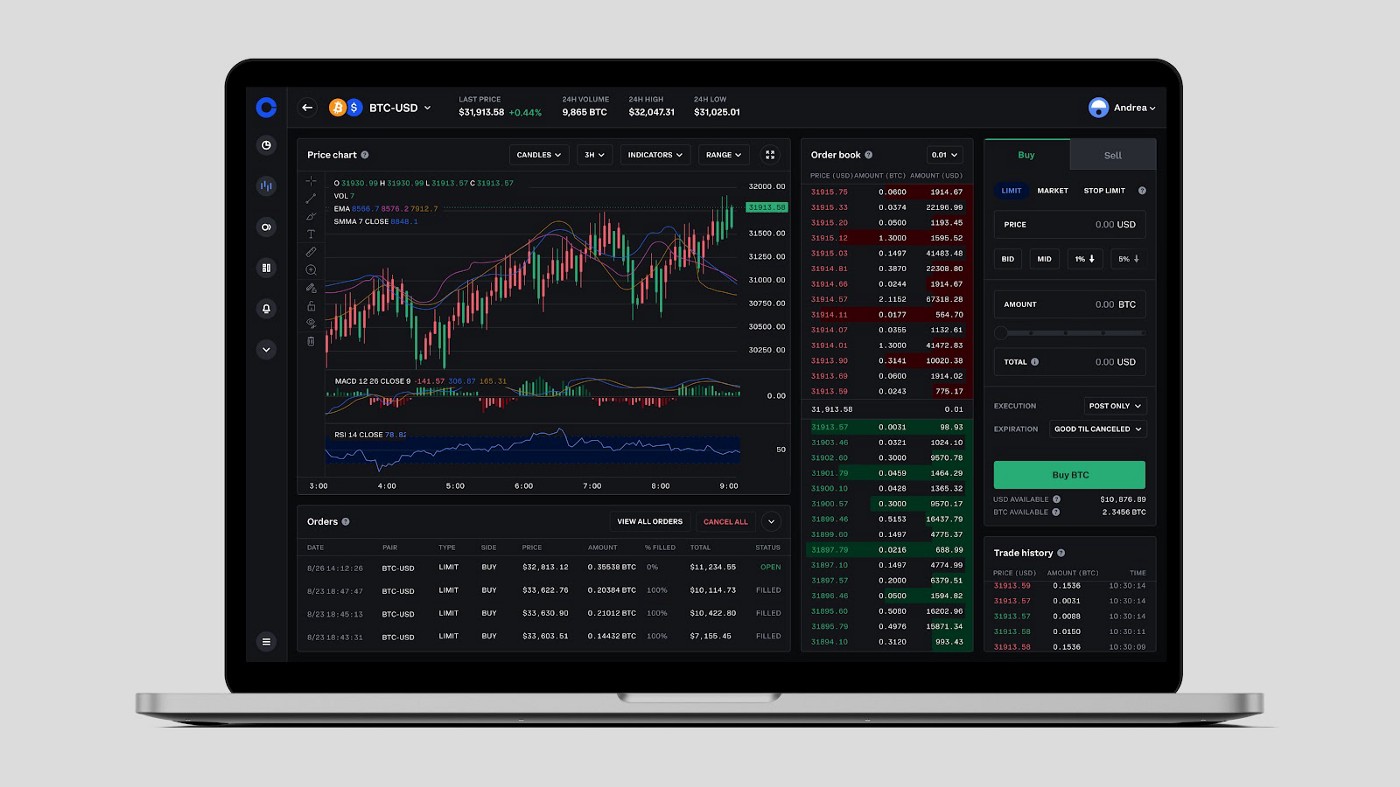

- Market liquidity: Institutional players may now feel more comfortable entering the space thanks to clearer rules around stablecoins. This could mean deeper order books and tighter spreads on major exchanges.

- Savvy monitoring: While the recent Bitcoin whale transfer appears benign so far, always watch for large wallet movements as they can shift short-term sentiment, even if fundamentals remain bullish.

As we move deeper into 2025, the interplay between regulatory shifts and whale activity is shaping a new era for crypto investors. With Bitcoin currently trading at $118,174, it’s clear that both institutional and retail buyers are recalibrating their strategies in response to these seismic changes.

Stablecoin Audit Requirements: A Double-Edged Sword?

The GENIUS Act’s mandate for monthly reserve disclosures by stablecoin issuers is a game-changer, but it comes with tradeoffs. On one hand, transparent audits should make it easier for buyers to trust digital dollars, no more guessing whether your USDC or USDT is truly backed by cash and Treasuries. On the other hand, some critics argue that self-policing mechanisms could open doors for creative accounting or regulatory arbitrage (FT). If you’re holding or trading stablecoins, consider diversifying across multiple issuers and keeping an eye on those monthly reports.

Smart Crypto Buying Tips After the GENIUS Act & Whale Move

-

Monitor Stablecoin Issuer Transparency: Choose stablecoins issued by platforms that meet the GENIUS Act’s new disclosure requirements, like Circle (USDC) and Paxos (USDP), which are known for regular, audited reserve reports.

-

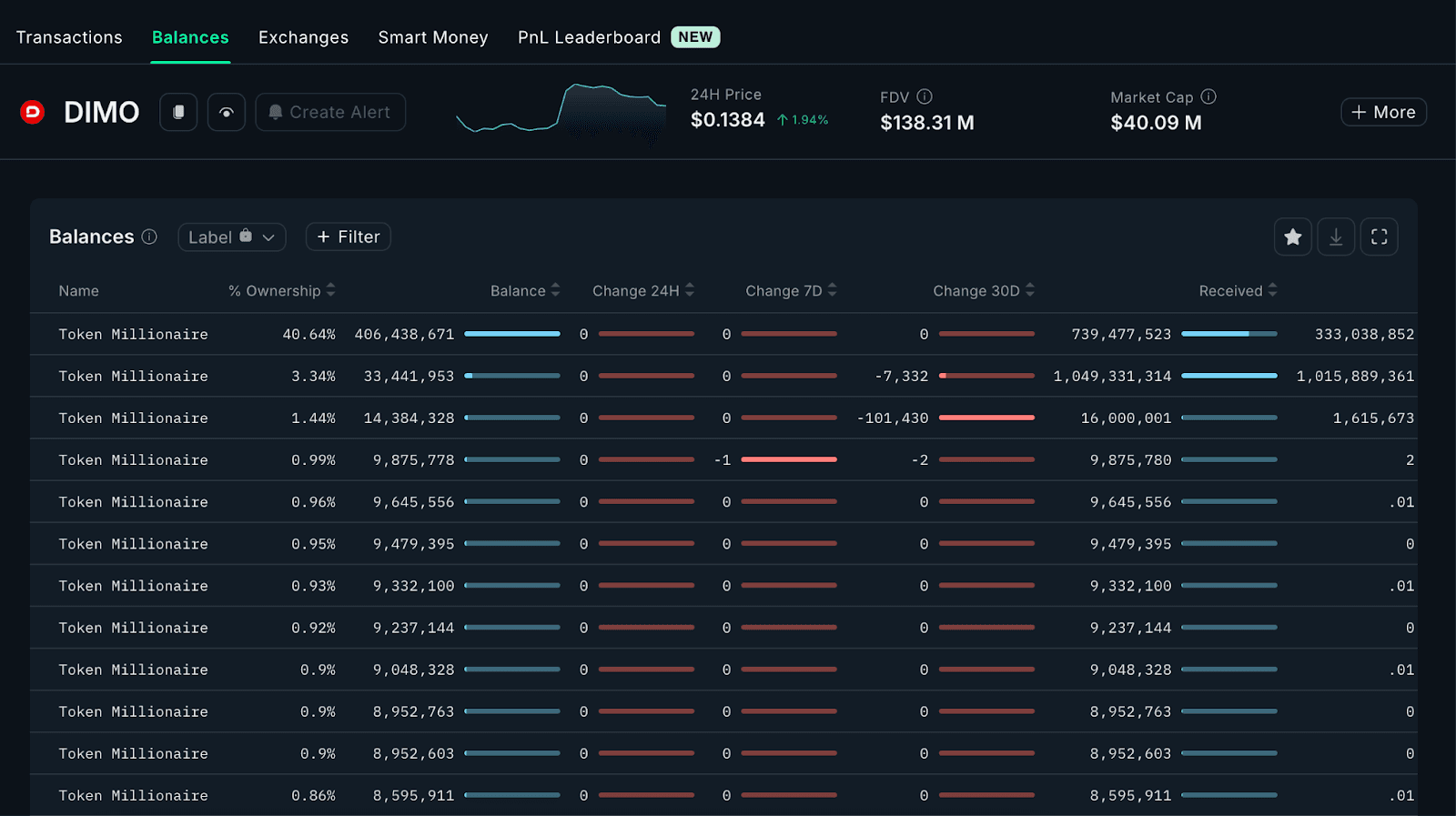

Stay Alert to Bitcoin Whale Activity: Use blockchain analytics on platforms like Glassnode or Chainalysis to track large Bitcoin transfers. While the recent $9.6B move was a security upgrade, such events can impact market sentiment.

-

Diversify with Stablecoins: Consider allocating part of your portfolio to regulated stablecoins like Tether (USDT) and USDC, which now offer greater regulatory clarity and may be less volatile during market corrections.

-

Review Market Sentiment Tools: Use real-time sentiment and analytics platforms such as Santiment or LunarCrush to gauge how events like the GENIUS Act and whale transfers are influencing trader psychology.

-

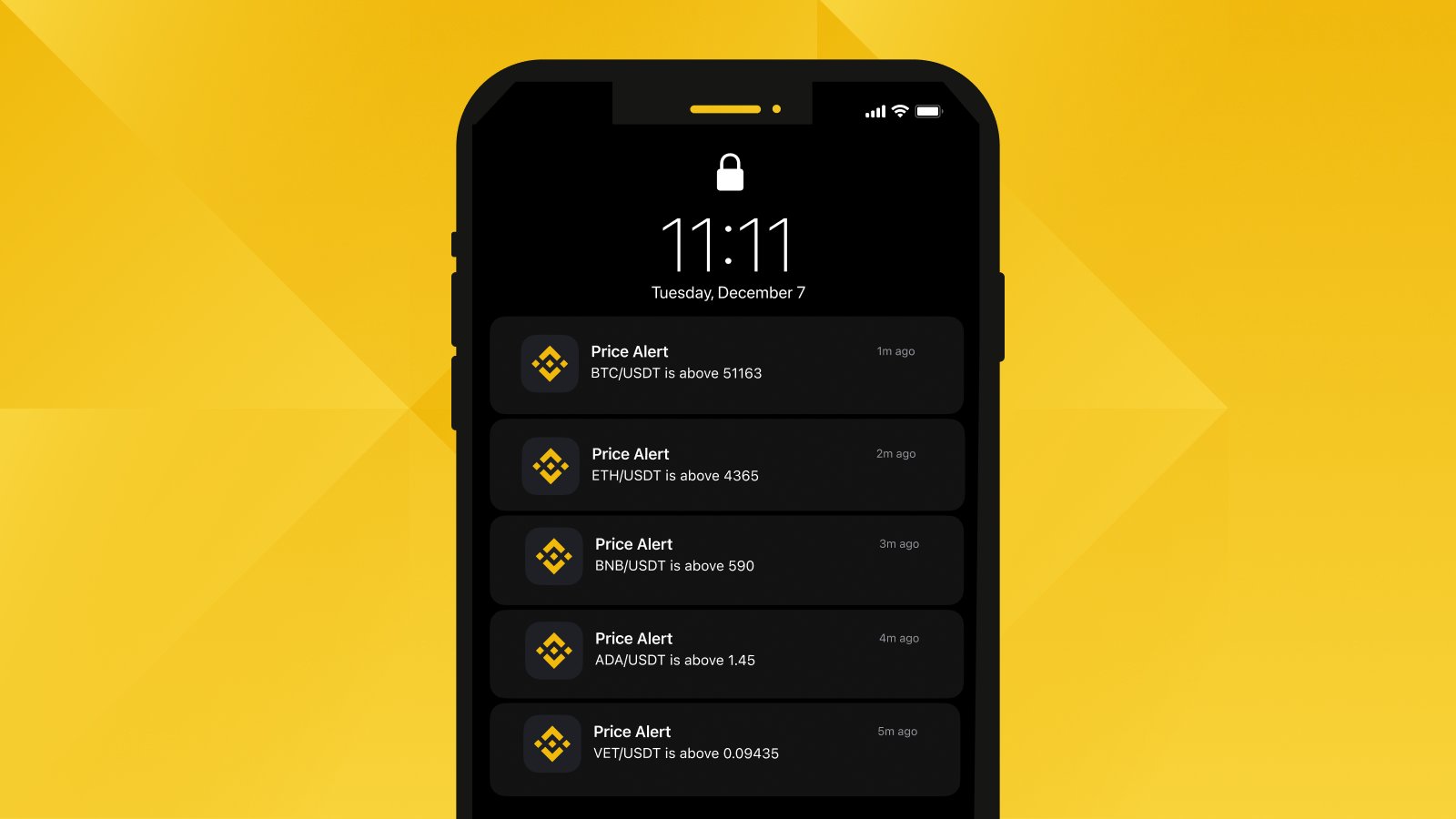

Set Price Alerts for Bitcoin: With Bitcoin trading at $118,174 (as of July 19, 2025), set price alerts on apps like Binance or CoinMarketCap to react quickly to sudden market moves.

It’s also worth noting that increased demand for U. S. Treasuries as stablecoin collateral could subtly impact yields and broader macro conditions, something sophisticated investors may want to monitor.

Crypto Market Correction Tips: Staying Resilient Amid Volatility

Whether or not the whale’s $8.6 billion Bitcoin transfer signals a coming correction, seasoned traders know market sentiment can shift fast when large wallets move. Here are some ways to keep your portfolio resilient:

- Set alerts for large on-chain movements using blockchain analytics tools.

- Use limit orders instead of market orders during periods of heightened volatility to avoid price slippage.

- Diversify beyond just Bitcoin and major stablecoins, consider exposure to regulated altcoins or DeFi assets with robust audit trails.

- Review your risk tolerance: Don’t overleverage or panic sell based on headlines alone.

The market’s resilience so far suggests that while corrections are always possible, the underlying fundamentals, clearer regulation and improved security practices, are stronger than ever. As always in crypto, staying informed is your best defense against sudden swings.

Looking Ahead: The Roadmap for Crypto Buyers

The passage of the GENIUS Act and high-profile Bitcoin whale moves underscore one thing: adaptability is key in this rapidly evolving landscape. Regulatory clarity around stablecoins could pave the way for more mainstream adoption, while heightened awareness of whale activity can help you anticipate market moves rather than react emotionally.

If you’re building a buying strategy today:

- Leverage new regulatory transparency by prioritizing audited stablecoins when moving funds between exchanges.

- Monitor large wallet transfers as part of your sentiment analysis toolkit, but don’t let fear override long-term conviction if the fundamentals remain strong.

- Stay nimble; adjust allocations as new data becomes available from both regulators and blockchain explorers.

The bottom line? Crypto markets in 2025 are more transparent, and potentially more volatile, than ever before. By understanding how laws like the GENIUS Act reshape risk profiles and by tracking on-chain movements from whales, you’ll be better equipped to make confident decisions in this next chapter of digital finance.