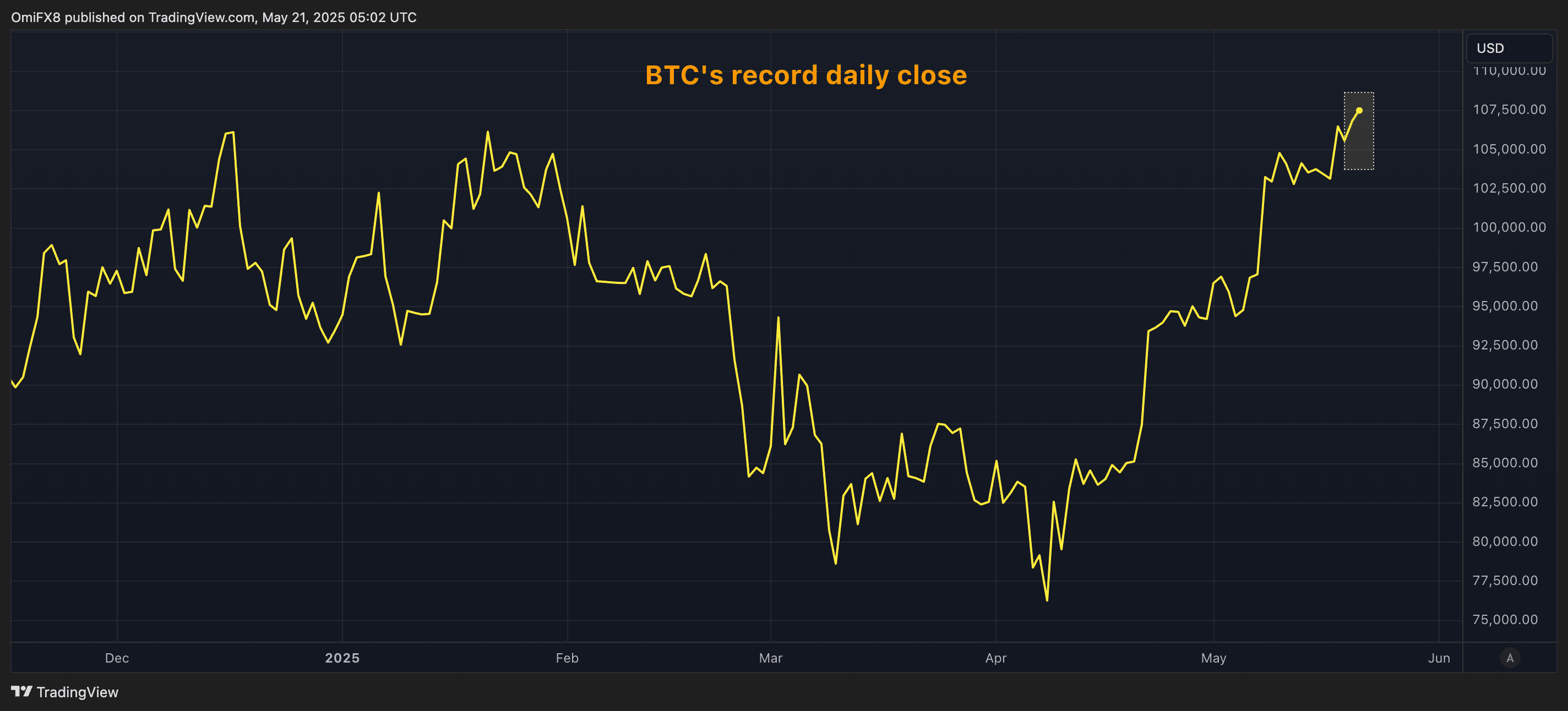

Singapore has long been recognized as a global crypto hub, but as of June 30, 2025, the landscape has shifted dramatically. The Monetary Authority of Singapore (MAS) now enforces some of the world’s toughest crypto exchange regulations, directly affecting how global crypto buyers access and use Singapore-based platforms. These changes are not just local news, they reverberate across the international digital asset market, impacting liquidity, compliance strategies, and the very nature of buying cryptocurrency securely.

What Are Singapore’s 2025 Crypto Regulations?

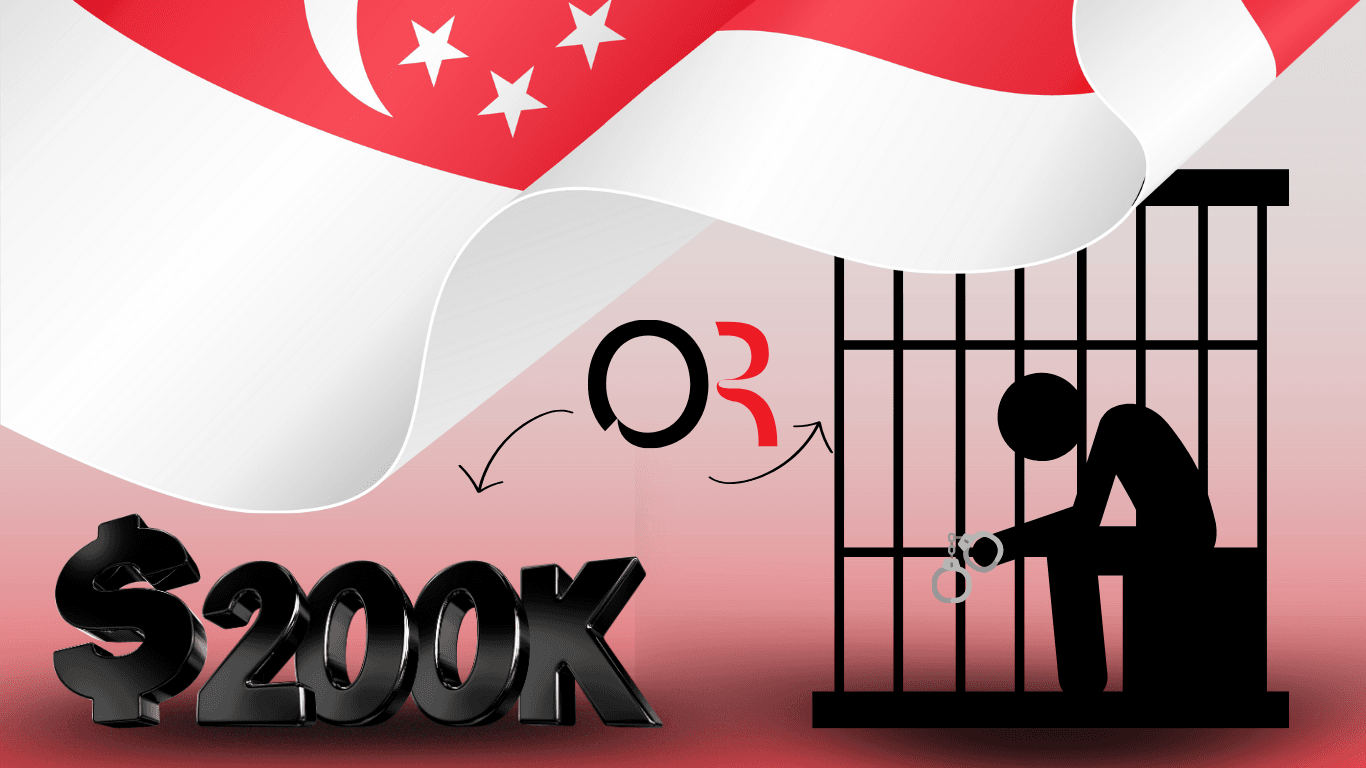

Under the new rules, all Singapore-based entities offering digital token services to overseas clients must obtain a Digital Token Service Provider (DTSP) license. Non-compliance is no small matter: penalties include fines up to SGD 250, 000 (approximately $200, 000) and imprisonment for up to three years (source). The licensing process is rigorous and highly selective, MAS has stated that approvals will be granted only in “extremely limited circumstances. ”

This regulatory clampdown is a direct response to mounting concerns over money laundering risks and aims to boost market confidence after several high-profile scandals rocked the region. For retail buyers and institutional investors alike, these changes mean that many familiar exchanges may soon become inaccessible or undergo significant restructuring.

Immediate Impacts for Global Crypto Buyers

The ripple effects are already visible. Leading exchanges such as Bitget and Bybit are considering relocating their operations to more crypto-friendly jurisdictions like Hong Kong or Dubai (source). For users outside Singapore who rely on these platforms for trading or investment, this shift could lead to:

- Reduced access to popular Singapore-based exchanges

- Potential delays or disruptions in transaction processing during transition periods

- Narrower token selections, as some platforms may limit offerings due to compliance costs

- Tighter KYC/AML requirements, impacting onboarding speed and privacy expectations

Additionally, with MAS signaling near-zero tolerance for unlicensed operations serving offshore clients, global buyers may see certain exchanges disappear from their options overnight. This could tighten liquidity in some markets but also push innovation toward alternative hubs.

How Global Crypto Buyers Are Adapting to Singapore’s 2025 Rules

-

Shifting to Alternative Crypto Hubs: With Singapore-based exchanges like Bitget and Bybit considering relocation, global buyers are increasingly turning to platforms in Hong Kong and Dubai, which offer more favorable regulatory environments.

-

Prioritizing Licensed Platforms: Buyers are focusing on using exchanges that have secured a Digital Token Service Provider (DTSP) license from Singapore’s MAS, ensuring compliance and reducing legal risk.

-

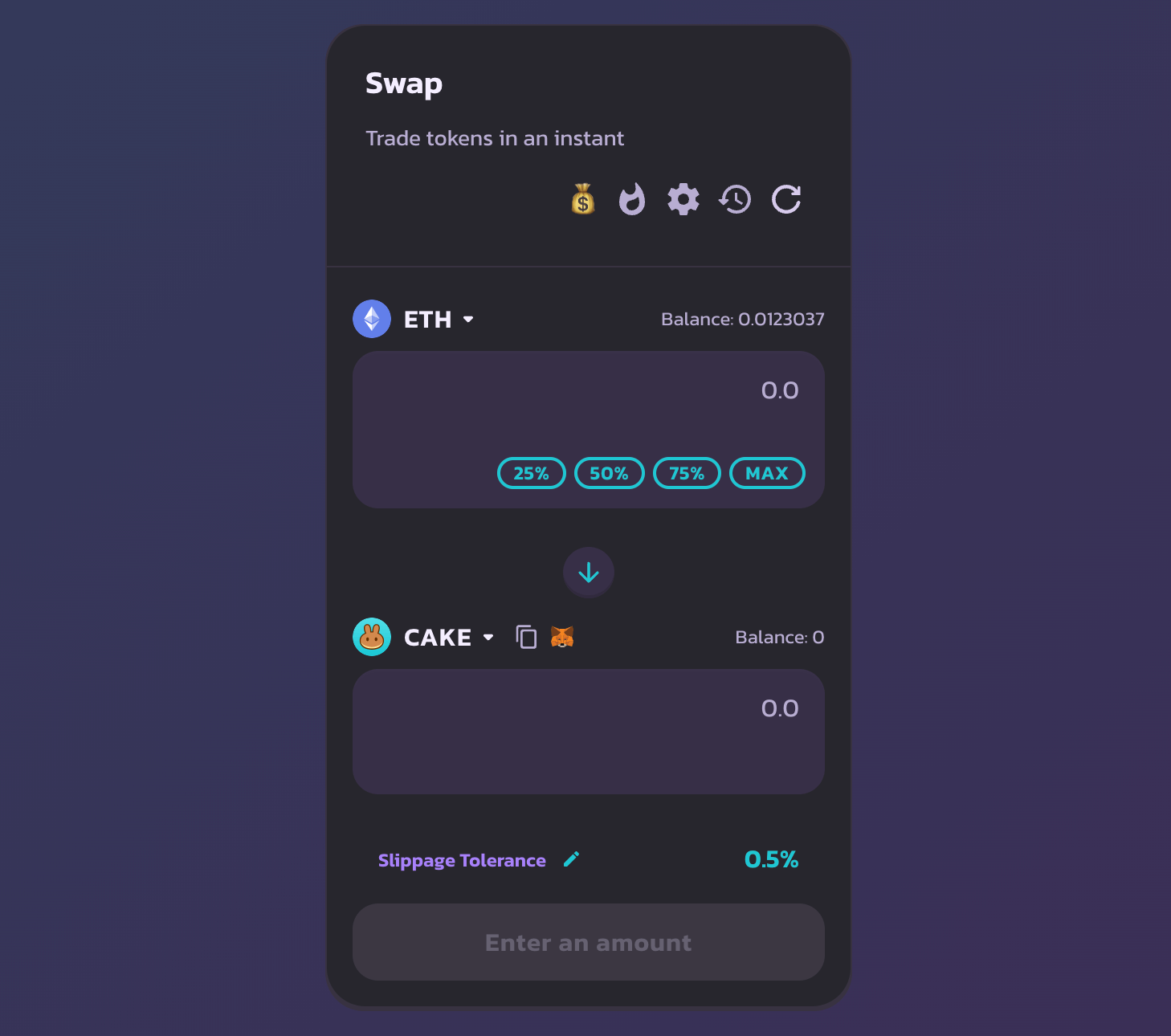

Exploring Decentralized Exchanges (DEXs): To avoid regulatory hurdles, many are shifting to established DEXs like Uniswap and PancakeSwap, which operate without centralized oversight and are not subject to Singapore’s licensing requirements.

-

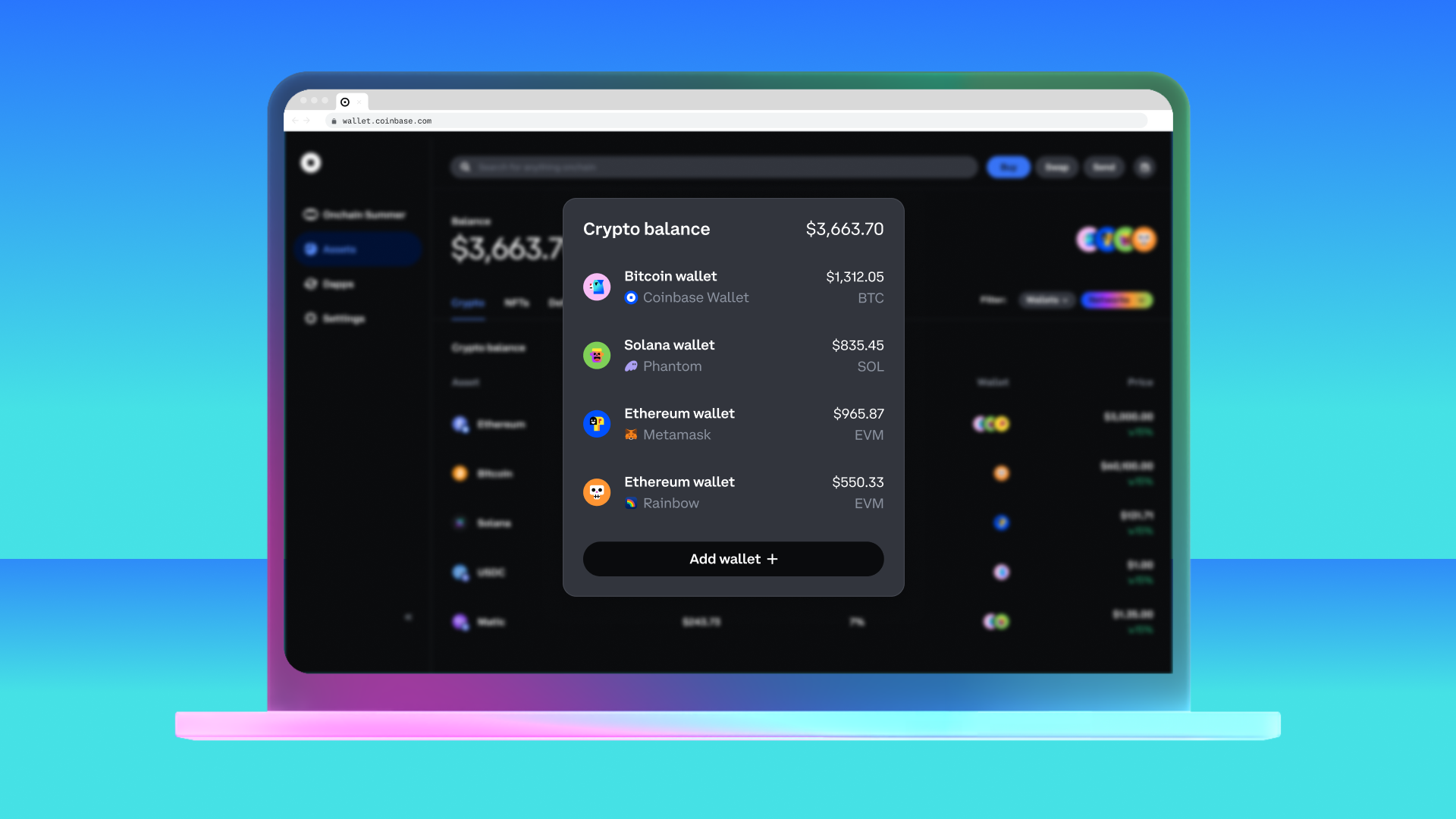

Utilizing Offshore Accounts and Custodians: Some buyers are opening accounts with international custodians or exchanges outside Singapore’s jurisdiction, such as Binance and Kraken, to maintain uninterrupted access to crypto markets.

-

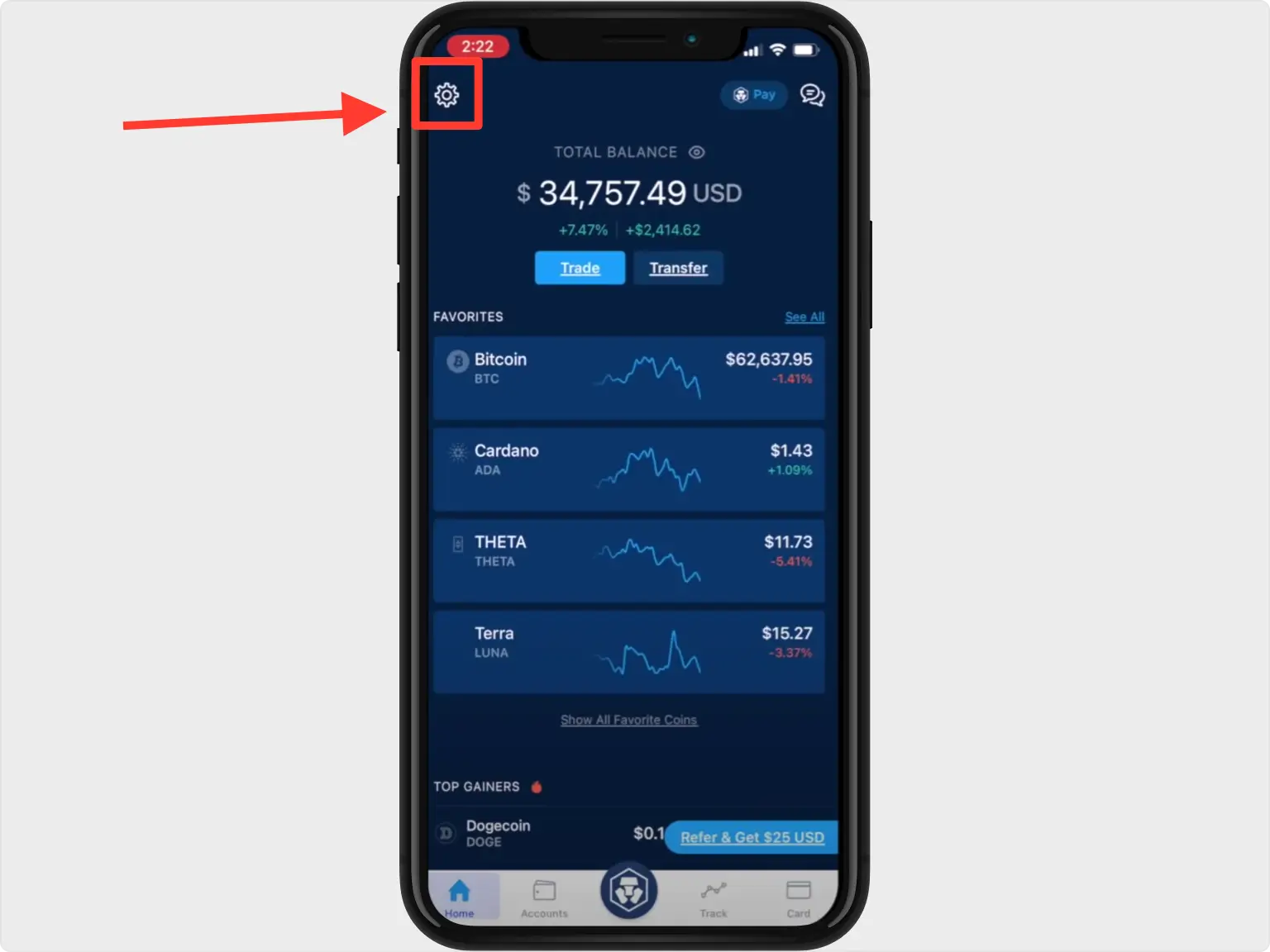

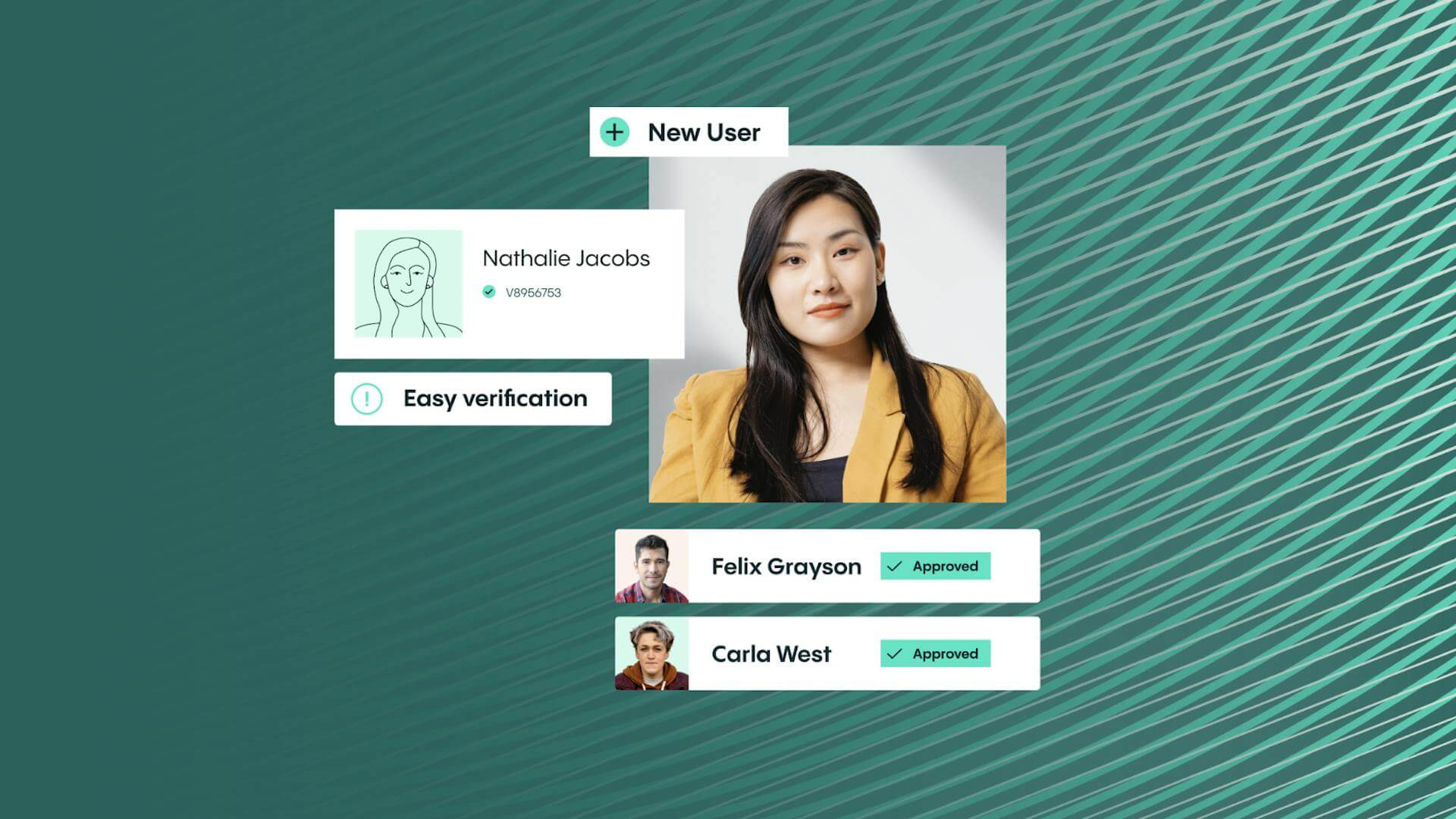

Increasing Due Diligence and KYC Compliance: In response to stricter anti-money laundering measures, buyers are more diligent about completing Know Your Customer (KYC) processes and verifying the regulatory status of their chosen platforms.

The New Compliance Landscape: Licensing and Enforcement Risks

The heart of these reforms is crypto exchange licensing. Any company providing digital token services from Singapore to foreign clients must clear MAS’s high bar for risk management, anti-money laundering controls, and operational transparency. Failure means not just hefty fines but also possible jail time for executives.

This high-stakes environment is forcing both established players and startups to reassess their business models. Some may opt for costly compliance upgrades; others will seek friendlier jurisdictions. For global users interested in buying cryptocurrency securely from reputable sources, due diligence around licensing status becomes more critical than ever.

The broader trend is clear: as regulators worldwide tighten oversight on offshore crypto clients and cross-border flows, global crypto compliance standards will rise across the board. But while some doors close in Singapore, new opportunities are opening elsewhere, especially in emerging hubs that welcome innovation while balancing robust oversight.

For buyers, the challenge is twofold: ensuring ongoing access to reliable platforms and navigating the evolving patchwork of international regulations. Many users are now diversifying their exchange accounts and exploring new markets to mitigate sudden service interruptions. The days of relying on a single, Singapore-based provider are over for most global crypto buyers.

Opportunities and Risks in Alternative Jurisdictions

With Singapore’s regulatory environment tightening, other financial centers such as Hong Kong and Dubai are positioning themselves as attractive alternatives. These jurisdictions offer more flexible frameworks for crypto exchange licensing and actively court both startups and established players looking to relocate.

However, moving operations is not without risk. Regulatory arbitrage, the practice of shifting businesses to less restrictive environments, can introduce new uncertainties. Buyers must carefully assess the credibility, security measures, and compliance standards of any new platform before transferring assets or initiating trades.

What Should Global Crypto Buyers Do Next?

For those seeking to buy cryptocurrency securely in 2025, vigilance is key. Here’s how savvy buyers can adapt:

Checklist: Choosing Compliant Crypto Exchanges Post-Singapore Regulation

-

Verify DTSP License Status: Ensure the exchange holds a valid Digital Token Service Provider (DTSP) license from the Monetary Authority of Singapore (MAS). Only licensed platforms can legally serve overseas clients after June 30, 2025.

-

Check for Global Regulatory Compliance: Prefer exchanges that are also regulated in major jurisdictions like Hong Kong (SFC license) or Dubai (VARA license), such as OKX or Crypto.com.

-

Review AML and KYC Procedures: Select platforms with robust Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, which are now mandatory under Singapore’s new rules.

-

Assess Platform Reputation & Security: Choose exchanges with a strong security record and positive user feedback, like Coinbase or Kraken.

-

Confirm Overseas Service Availability: After June 30, 2025, verify that the exchange is authorized to serve international users and has not ceased or relocated operations due to Singapore’s regulations.

-

Review Supported Payment Methods: Ensure the exchange supports compliant funding options, as credit card purchases are now banned for retail users under Singapore law.

-

Monitor Regulatory Updates: Stay informed via official sources like the MAS website and exchange announcements for ongoing compliance and service changes.

It’s also wise to monitor regulatory updates not just in Singapore but across all major jurisdictions you interact with. The trend toward stricter oversight is global, and what starts in one hub often spreads quickly elsewhere.

The Bigger Picture: Toward Global Crypto Compliance

The ripple effect of Singapore’s move extends beyond its borders. By raising the bar for digital token service providers, especially those serving offshore clients, the MAS has set a precedent other regulators may soon follow. This could accelerate the emergence of international standards around KYC/AML processes, custodial practices, and consumer protections.

While some see these developments as restrictive, others argue they are essential for maturing the industry and protecting retail investors from fraud or illicit activity. Ultimately, tighter rules can foster greater trust in digital assets, provided they do not stifle innovation or limit global access unduly.

As we move into the second half of 2025, one thing is clear: Singapore’s crypto regulations have redrawn the map for global buyers. Whether this shift leads to a safer market or simply pushes activity elsewhere will depend on how exchanges adapt, and how quickly users educate themselves about compliance in this fast-changing landscape.