Buying cryptocurrency with a credit card is one of the fastest ways to get started in the world of digital assets. It’s convenient, accessible, and often feels as simple as making any other online purchase. But before you reach for your Visa or Mastercard, it’s crucial to understand the limits, fees, and security measures that come with crypto credit card purchases. Let’s break down what you need to know so you can make your first purchase with confidence.

How Does Buying Crypto with a Credit Card Work?

The process of buying crypto with a credit card usually involves these steps: signing up on a reputable exchange or app, verifying your identity, linking your credit card, and selecting which cryptocurrency you want to buy. Major platforms like MoonPay and BitPay streamline this process for beginners and experienced users alike.

Key Steps to Buy Crypto with a Credit Card

-

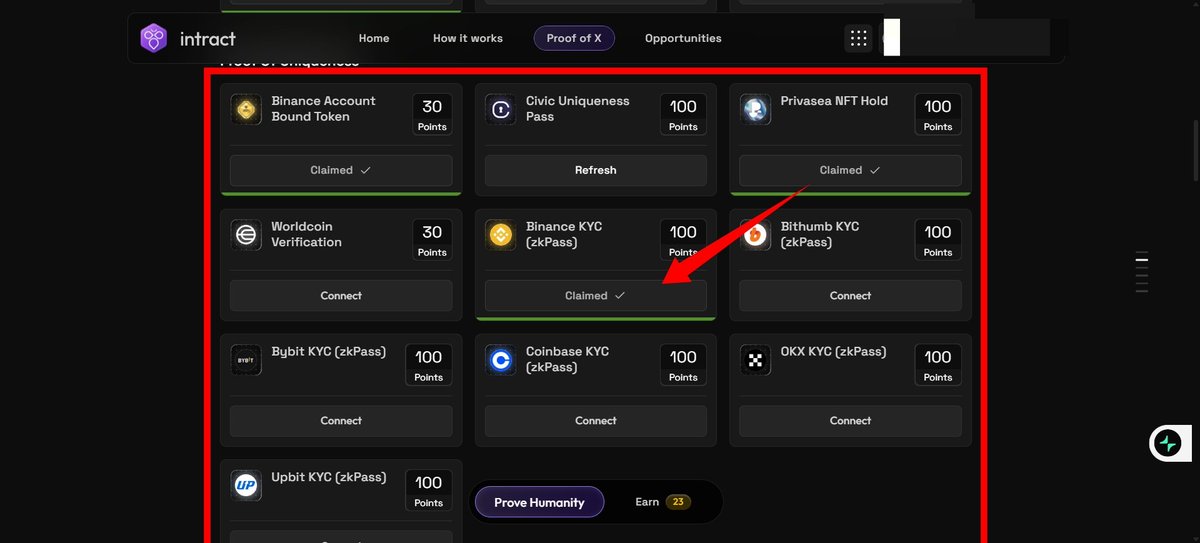

Create and verify your account by providing identification documents and completing any required KYC (Know Your Customer) steps on the platform.

-

Add your credit card as a payment method by securely entering your card details in the exchange’s payment section.

-

Select the cryptocurrency you wish to buy (for example, Bitcoin or Ethereum) and enter the purchase amount.

-

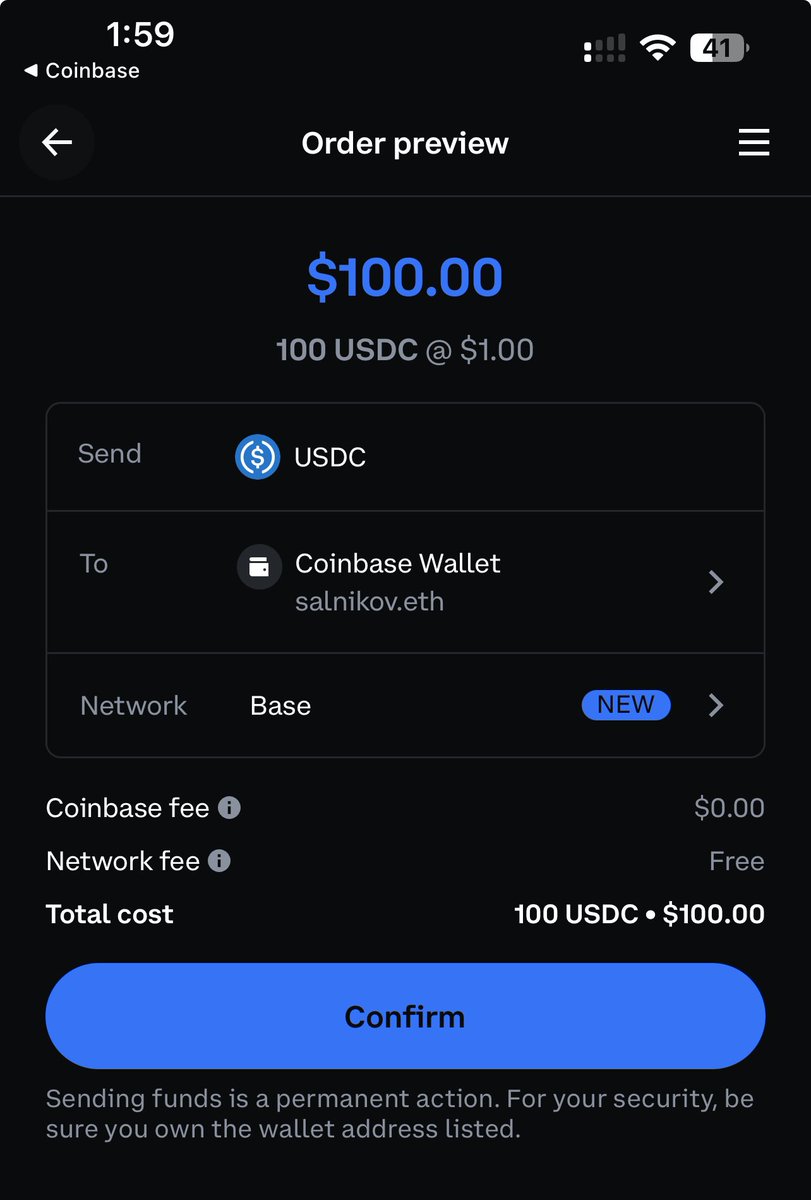

Review transaction fees and limits displayed by the platform before confirming your purchase. Major exchanges clearly show these details at checkout.

-

Complete your purchase and ensure your crypto is stored safely, either in the exchange wallet or by transferring to your personal wallet for added security.

However, not all banks support crypto transactions. For example, major U.S. banks such as Wells Fargo and Bank of America typically block credit card crypto purchases. Always check if your bank allows these transactions before getting started.

Understanding Crypto Credit Card Limits

Crypto credit card limits can vary dramatically depending on the exchange, your location, and your verification status. Most platforms set daily, weekly, or monthly caps on how much you can buy using a credit card—often ranging from $500 up to $10,000 per month for fully verified accounts. These limits exist for both regulatory compliance and fraud prevention.

If you’re just starting out or haven’t completed full identity verification (also known as KYC), expect much lower limits. Some platforms even restrict first-time buyers to small amounts until they build up transaction history.

Have you ever hit a purchase limit when buying crypto with a credit card?

Some exchanges set limits on how much crypto you can buy with your credit card. Have you ever reached one, and how did it make you feel?

The Real Cost: Fees When You Buy Crypto with Credit Card

Credit cards offer speed but rarely come cheap when it comes to buying Bitcoin or Ethereum. Crypto purchase fees typically include:

- Exchange fees: Usually 3-5% of the transaction amount

- Credit card processing fees: Sometimes bundled into the exchange fee or added separately

- Cash advance fees: Many banks treat crypto purchases as cash advances—triggering additional fees (often 3-5%) and higher interest rates

This means that if you spend $1,000 on Bitcoin using your credit card, you might pay $30-$100 in fees before even considering market fluctuations!

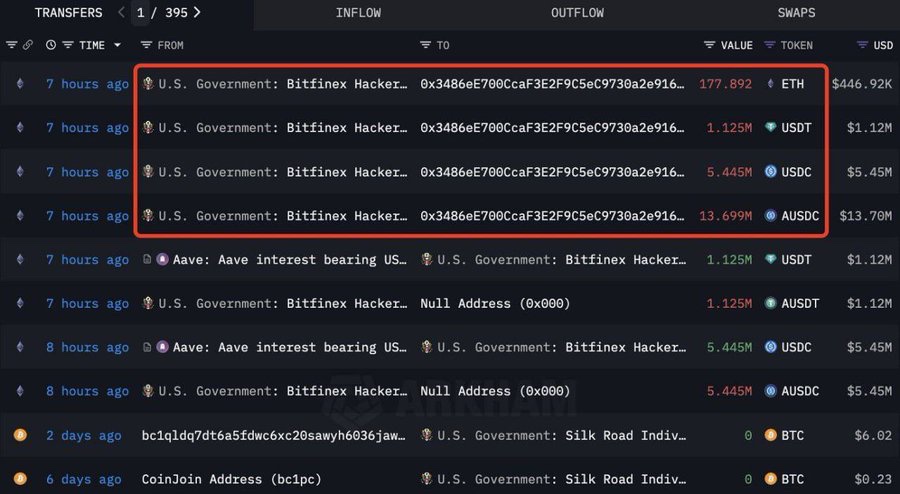

Your Security Checklist: Staying Safe When Using Credit Cards for Crypto

The convenience of buying crypto instantly comes with added risks—credit cards are attractive targets for fraudsters and phishing scams in the digital asset space. Always use secure exchanges that offer two-factor authentication (2FA), encrypted connections (look for HTTPS), and robust user protections.