It’s easy to feel overwhelmed by the wild price swings in the crypto market. One day, Bitcoin is soaring; the next, it’s plunging. How can everyday investors participate without getting caught up in the emotional rollercoaster? Enter dollar-cost averaging (DCA)—a time-tested approach that helps you build a solid average buy price in crypto while minimizing stress.

What is Dollar-Cost Averaging and Why Use It in Crypto?

Dollar-cost averaging is a simple idea: invest a fixed amount of money into an asset (like Bitcoin or Ethereum) at regular intervals, regardless of its price. This strategy smooths out your purchase price over time—sometimes you’ll buy when prices are high, sometimes when they’re low, but you avoid the risk of making one big purchase at the wrong moment. In a notoriously volatile market like crypto, this steady approach can be a real game-changer.

The beauty of DCA is that it takes emotion out of investing. You don’t have to guess when the “perfect time” to buy is—you simply stick to your schedule and let the averages work for you. Over months or years, this can lead to a more favorable average cost per coin and help reduce regret from market timing mistakes.

How Does Crypto DCA Strategy Work?

The core principle behind a crypto DCA strategy is consistency. Here’s how it typically works:

Steps to Start Dollar-Cost Averaging in Crypto

-

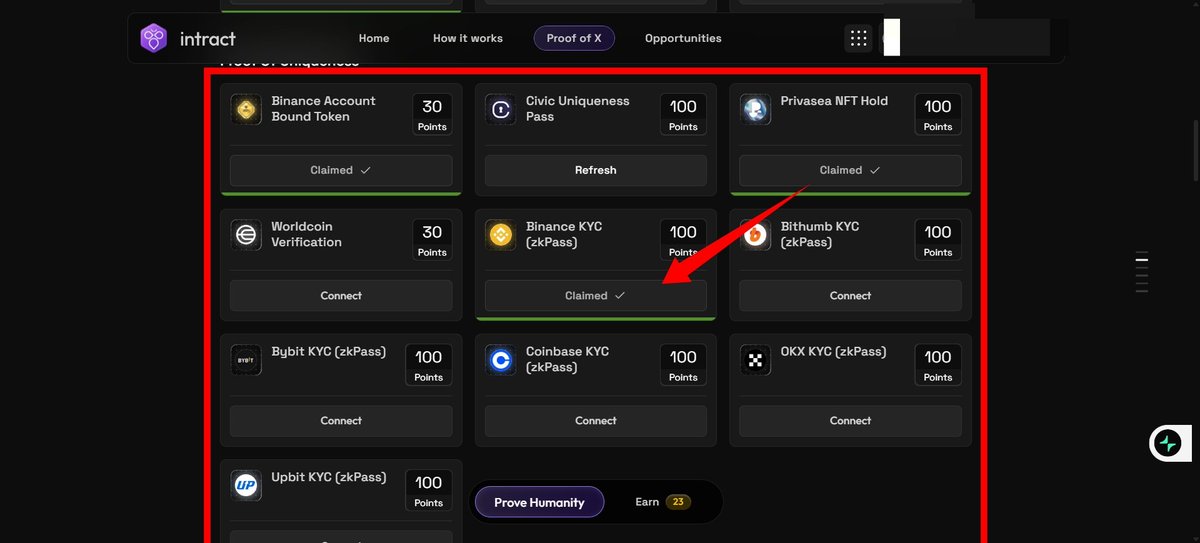

Create and Verify Your Account: Sign up and complete the required identity verification process to ensure secure and compliant trading.

-

Select Your Cryptocurrency: Decide which established crypto asset to invest in, such as Bitcoin (BTC) or Ethereum (ETH).

-

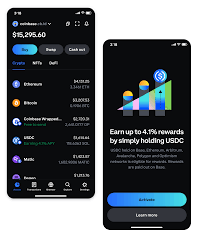

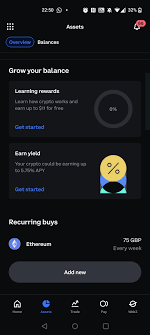

Set Up a Recurring Buy: Use the exchange’s automated purchase feature to schedule regular buys (e.g., weekly or monthly) for your chosen crypto. Most major platforms like Coinbase and Binance offer this option.

-

Choose Your Investment Amount: Decide on a fixed amount to invest each interval—start with what you’re comfortable with, even if it’s a small sum.

-

Secure Your Crypto: After purchase, consider transferring your assets to a reputable hardware wallet like the Ledger Nano S Plus or Trezor Model T for enhanced security.

-

Monitor and Adjust: Periodically review your DCA strategy and make adjustments as your goals or market conditions change. Most exchanges provide portfolio tracking tools.

Let’s say you decide to invest $50 into Bitcoin every week. Sometimes you’ll get more BTC for your money (when prices dip), sometimes less (when prices spike). Over time, these purchases add up and your average buy price reflects the real journey of the market—not just one lucky or unlucky entry point.

This method also makes use of automated crypto buying, which many exchanges now offer as a feature. Set up recurring buys and let technology remove the temptation to second-guess yourself.

The Benefits: Why Beginners Love DCA

If you’re new to digital assets, DCA offers several advantages:

- Simplicity: No need for technical analysis or predicting market tops and bottoms.

- Reduced Emotional Bias: You won’t panic-buy or panic-sell based on headlines.

- Easier Budgeting: By investing small amounts regularly, you avoid overcommitting your finances.

- Painless Entry Point: Even if prices are high today, DCA ensures you’ll catch future dips too.

DCA in Action: Real-World Examples

You might be surprised how effective this approach can be over time. Imagine starting small—$25 each week into Ethereum over two years. Even if ETH was wildly volatile during that period, your disciplined investing would have captured both highs and lows, leading to a reasonable average buy price compared to trying to “time” each purchase perfectly.

This isn’t just theory—many seasoned investors swear by DCA as their go-to beginner crypto investing tip because it builds habits and wealth steadily. Plus, seeing your portfolio grow bit by bit is incredibly motivating!

Common Pitfalls to Avoid with Dollar-Cost Averaging

While dollar cost averaging crypto is straightforward, there are a few traps that can trip up even the most enthusiastic beginners. First, avoid switching your schedule in reaction to market news—consistency is key. Pausing or doubling your buys based on headlines can undermine the whole point of DCA. Second, don’t forget about fees: frequent small purchases can add up if your exchange charges high transaction costs, so choose platforms with reasonable rates or fee-free recurring buy options.

Another pitfall? Overextending yourself financially. Stick to an amount you can comfortably commit to for months or years—this isn’t a get-rich-quick scheme but a disciplined path toward building crypto exposure.

Tips for Maximizing Your Crypto DCA Strategy

Smart Tips to Maximize DCA in Crypto

-

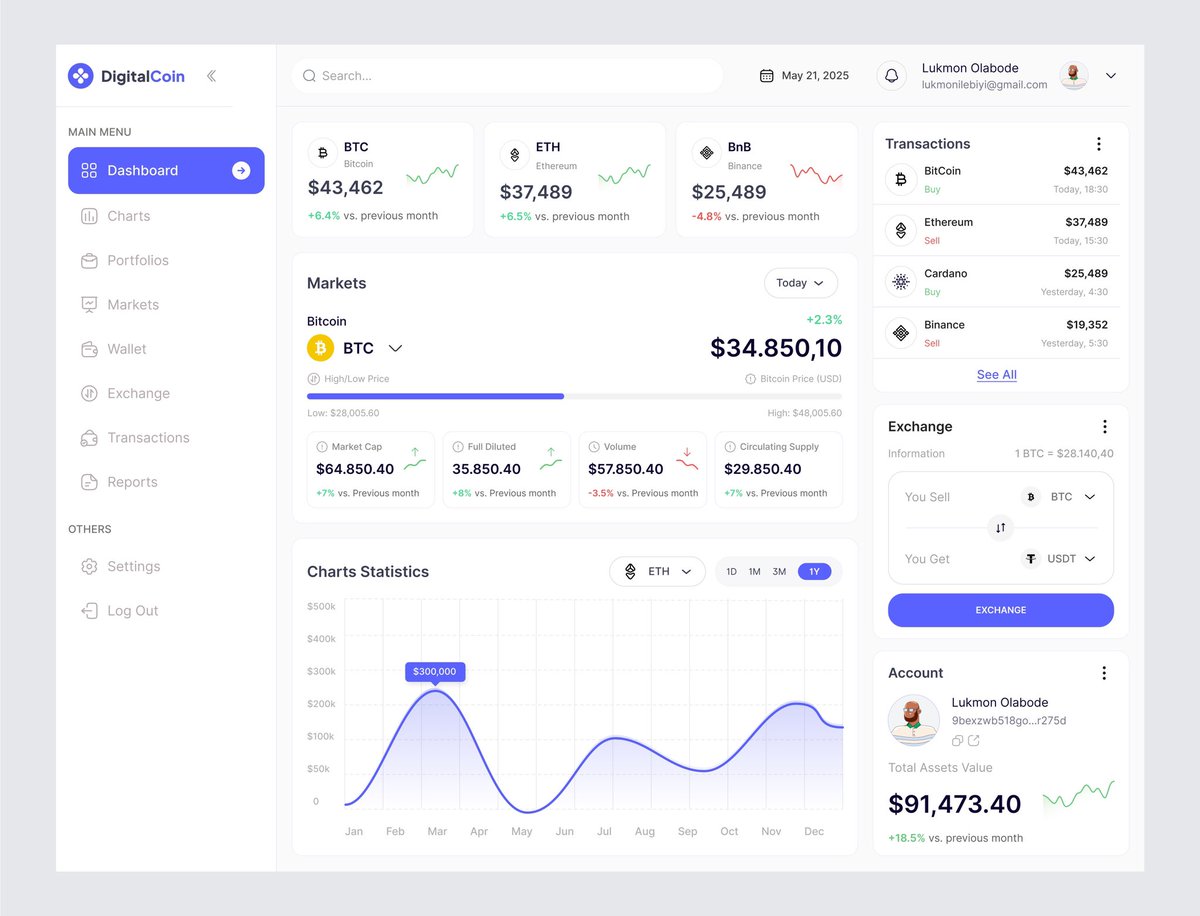

Track your average buy price using portfolio apps like CoinMarketCap Portfolio or Blockfolio (now FTX). Monitoring your progress helps you make informed adjustments.

-

Start with established cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These assets have a proven track record and high liquidity, making them safer choices for DCA beginners.

-

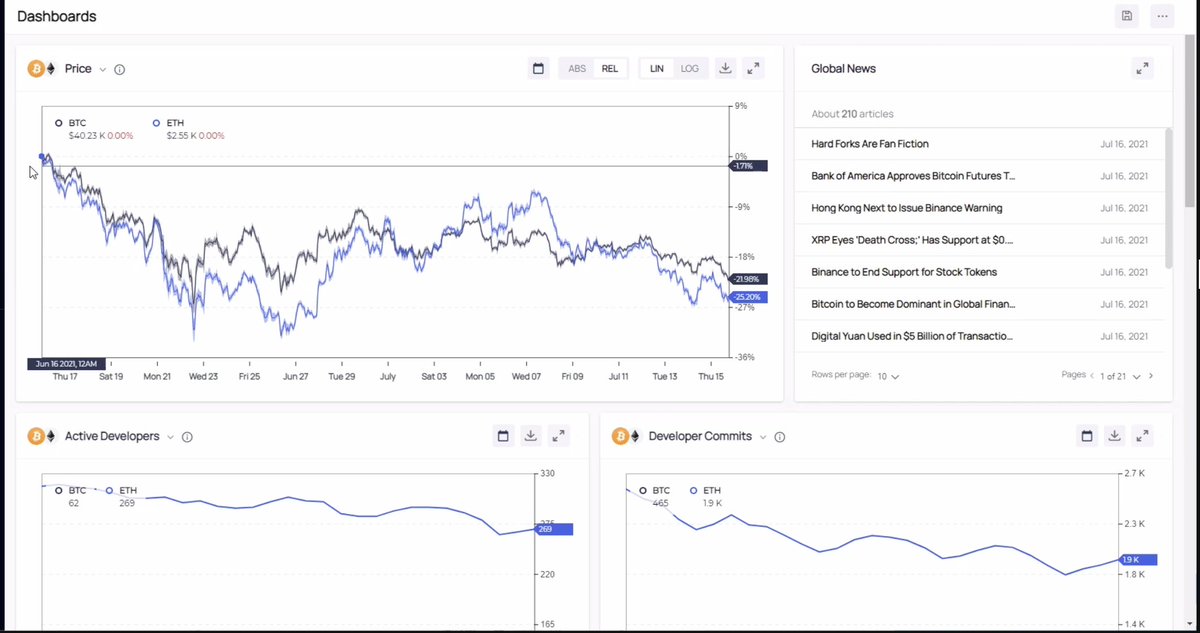

Review and adjust your DCA plan periodically using analytics from Glassnode or IntoTheBlock. These tools provide insights into market trends and your portfolio’s performance.

Automated crypto buying tools make it easy to set and forget your investments. Still, it pays to review your plan periodically: are you still comfortable with the amount and frequency? Are you investing in assets you truly believe in? Adjusting your approach as your financial situation evolves is wise—but always avoid knee-jerk changes based on price swings alone.

If you’re feeling ambitious, some investors diversify by running DCA strategies across multiple coins (like both BTC and ETH). This can help spread risk even further—but remember, more assets mean more research and tracking.

The Power of Patience: Letting Averages Work For You

Perhaps the greatest gift of DCA is peace of mind. By focusing on the long-term average buy price in crypto rather than short-term wins or losses, you gain confidence during dips—and resist FOMO during rallies. Over time, this patient approach often outperforms frantic trading attempts.

Still curious about how your investments might stack up? Try using a simple calculator to estimate potential outcomes:

Is Dollar-Cost Averaging Right For You?

No single strategy fits everyone, but if you value simplicity, discipline, and reduced stress in your investing journey, DCA deserves serious consideration. It’s especially powerful for those just starting out—removing guesswork and making it easier to stick with your plan through thick and thin.

The beauty of dollar cost averaging is that it’s accessible at any budget level. Whether you’re putting aside $10 or $1000 per month, consistency matters far more than size. As always with crypto: start small, learn as you go, and let the averages do their quiet work behind the scenes.