Buying cryptocurrency at night or during low-volume periods can feel like stepping into a quiet, moonlit marketplace—serene, but full of hidden twists. While late-night trading offers unique opportunities, it also comes with its own set of risks and quirks. Whether you’re a night owl seeking the best time to buy Bitcoin or simply looking to optimize your crypto timing, understanding how to navigate these quieter hours is essential for both newcomers and seasoned traders.

Why Nighttime and Low Volume Trading Matters

Crypto markets never sleep, but the tempo changes dramatically after dark. During nighttime hours—especially when global trading volume dips—the market can behave unpredictably. Price swings become more pronounced due to thinner order books, and security risks may increase as scammers know fewer eyes are watching. Still, with the right strategies, you can minimize risk while optimizing your trades.

Top Five Strategies for Buying Crypto at Night and During Low Volume

Top 5 Best Practices for Buying Crypto at Night

-

Use Limit Orders to Avoid Price Slippage: During low-volume night hours, market orders may cause significant price slippage. Always set limit orders on reputable exchanges like Binance or Coinbase Pro to control your entry price and prevent unexpected costs.

-

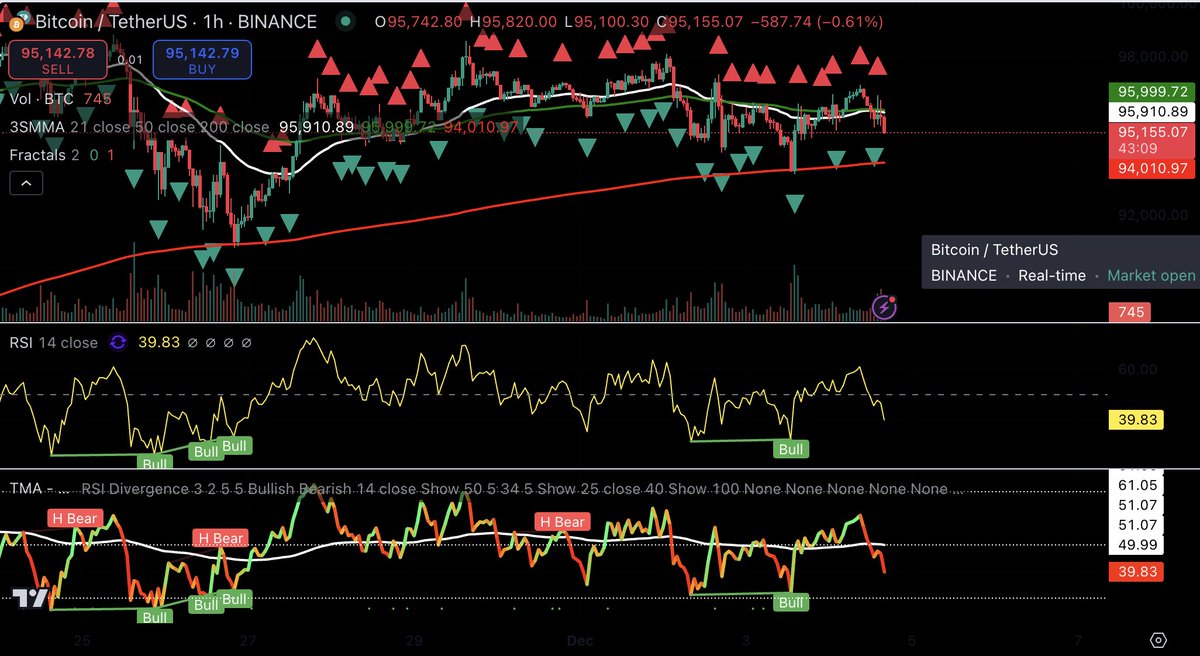

Leverage Price Tracking Tools and Alerts: Utilize real-time tracking tools like TradingView or CoinMarketCap and set alerts for your target prices. Nighttime volatility can create sudden opportunities or risks, so staying informed is crucial.

-

Prioritize Security with Two-Factor Authentication (2FA): Nighttime trading can attract scammers and phishing attempts. Ensure your exchange accounts are secured with strong 2FA (such as Authy or Google Authenticator) and avoid using public Wi-Fi when transacting.

-

Time Purchases Around Global Market Activity: Crypto markets are busiest during overlap of US and Asian trading hours. For calmer conditions, aim to buy late at night (11 pm–midnight local time), but always check recent volume trends on platforms like Binance Markets before executing trades.

1. Use Limit Orders to Avoid Price Slippage

One of the most important rules for nighttime crypto purchase is never rely on market orders. When trading volume is low, even a modest market order can trigger significant price slippage—meaning you pay far more (or less) than expected. By setting limit orders, you define your exact entry price and avoid unpleasant surprises. This approach lets you stay in control, especially when liquidity is thin.

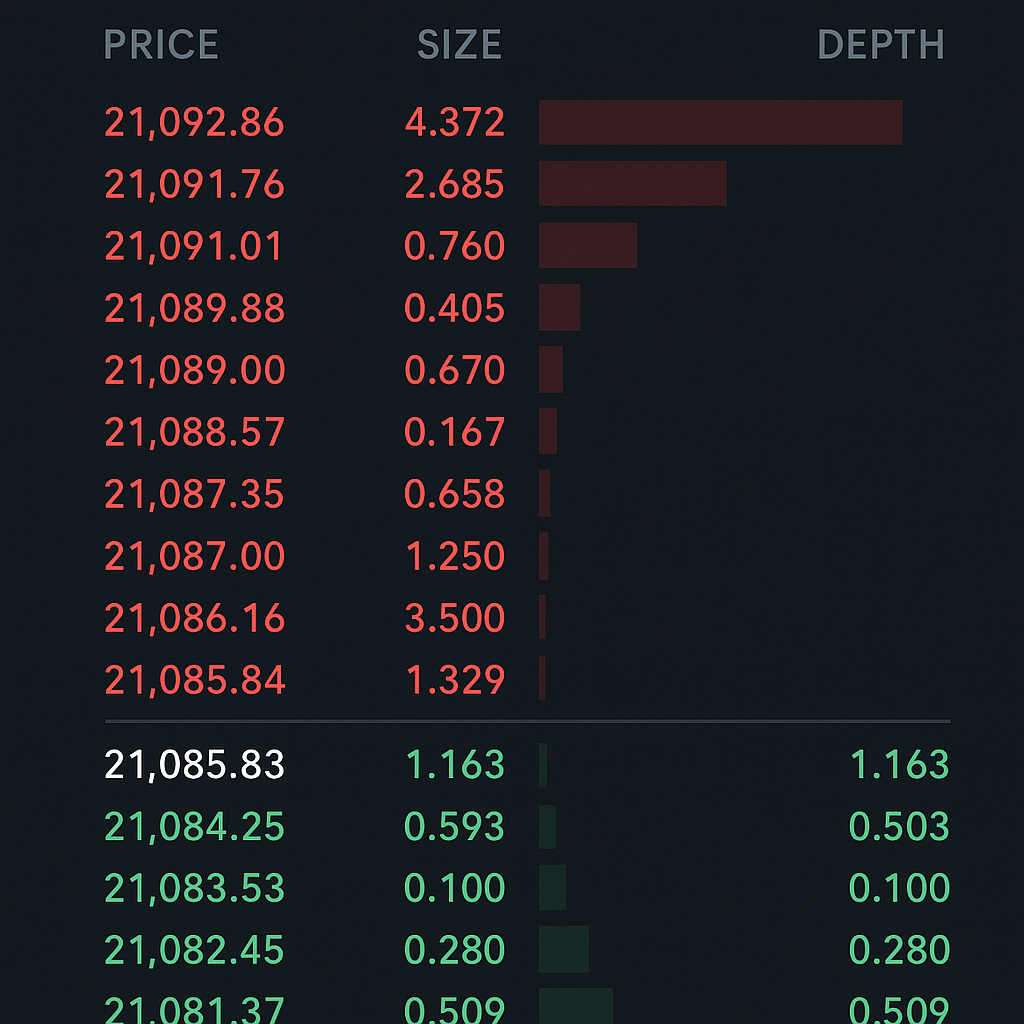

2. Monitor Liquidity and Order Book Depth

Before hitting that buy button late at night, always check the exchange’s order book for sufficient liquidity. Thin order books mean fewer buyers and sellers are present, so large trades can move prices sharply against you. If you’re planning a sizable purchase, consider splitting it into smaller increments to reduce impact—and always keep an eye on how deep (or shallow) the book really is.

Stay Ahead With Real-Time Tools & Security Measures

Navigating nighttime volatility isn’t just about timing—it’s about staying informed and protected:

- Leverage Price Tracking Tools and Alerts: Set up real-time tracking apps or browser extensions that alert you when your desired price hits. Nighttime volatility means sudden moves—don’t let opportunity (or risk) catch you off guard.

- Prioritize Security with Two-Factor Authentication (2FA): Scammers often target users during off-peak hours when support teams are slower to respond. Always enable strong 2FA on your exchange accounts, use unique passwords, and steer clear of public Wi-Fi when transacting after dark.