South Korea’s Financial Services Commission (FSC) set the global crypto world abuzz in August 2025, imposing a hard stop on new crypto lending products across major domestic exchanges. This move was not just regulatory theater; it came after a wave of forced liquidations that affected around 13% of 27,000 local lending customers in a single month, exposing deep systemic risks in leveraged crypto products. For global crypto buyers and long-term investors, understanding the ripple effects of this crackdown is critical to navigating the rapidly evolving landscape of digital assets and buying cryptocurrency securely in 2025.

Why South Korea’s Crackdown Matters for Global Crypto Markets

South Korea is no fringe player in the digital asset ecosystem. The country consistently ranks among the world’s top five crypto markets by trading volume and retail participation. Its regulatory moves often foreshadow broader trends across Asia and set precedents for other jurisdictions grappling with how to balance innovation and investor protection.

The FSC’s new rules are sweeping. They cap crypto lending interest rates at 20%, ban all forms of leveraged loans, restrict lending to only the top 20 cryptocurrencies by market capitalization, and enforce strict collateral alignment. These measures are designed to curb reckless risk-taking after South Korean exchanges saw $1.1 billion borrowed by over 27,000 investors in just one month, a surge that led directly to cascading liquidations and market instability.

“South Korea’s regulatory stance signals a maturing phase for global digital assets, one where stability and transparency are prioritized over unchecked growth. ”

Key Features of South Korea’s Crypto Lending Regulation

Key Points of South Korea’s New Crypto Lending Rules

-

20% Interest Rate Cap: All crypto lending platforms in South Korea must cap annual interest rates at 20% to prevent predatory lending and protect retail investors.

-

Ban on Leveraged Loans: The new rules prohibit leveraged crypto loans, aiming to reduce systemic risk and prevent forced liquidations like those affecting 13% of recent borrowers.

-

Restriction to Top 20 Cryptocurrencies: Lending is now limited to the top 20 cryptocurrencies by market capitalization, minimizing exposure to highly volatile or illiquid assets.

-

Mandatory Collateral Alignment: Platforms must align collateral requirements with loan amounts, reducing the risk of cascading liquidations and enhancing market stability.

-

Suspension of New Lending Products: The Financial Services Commission (FSC) has suspended new crypto lending activities on major exchanges like Upbit and Bithumb until comprehensive guidelines are finalized in 2026.

-

Alignment with International Standards: South Korea’s regulations align with the OECD Crypto-Asset Reporting Framework (CARF), requiring exchanges to share transaction data with tax authorities from 2027.

The reforms introduced by South Korea are not isolated; they reflect a growing international consensus around tighter oversight for digital asset markets:

- Interest Rate Cap: No lender can offer more than 20% annualized interest on crypto loans, an aggressive move compared to previous double- or triple-digit rates seen on some platforms.

- Ban on Leveraged Loans: Platforms can no longer offer loans exceeding the value of posted collateral, eliminating margin trading through lending products.

- Lending Restrictions: Only top-20 cryptocurrencies (by market cap) are eligible as loan collateral or loaned assets, reducing exposure to illiquid or highly volatile coins.

- Collateral Alignment: Borrowers’ collateral must match loaned assets more closely, minimizing cross-asset risks during sharp market swings.

The Immediate Market Impact: Capital Flight and Volatility Reduction

The regulatory clampdown triggered an immediate reallocation of capital both within South Korea and globally. According to AInvest, retail investors moved $12 billion into U. S. -based crypto assets in 2025 alone as they sought more stable, and perceived safer, environments for their funds. This shift underscores how national policy changes can reshape global capital flows almost overnight.

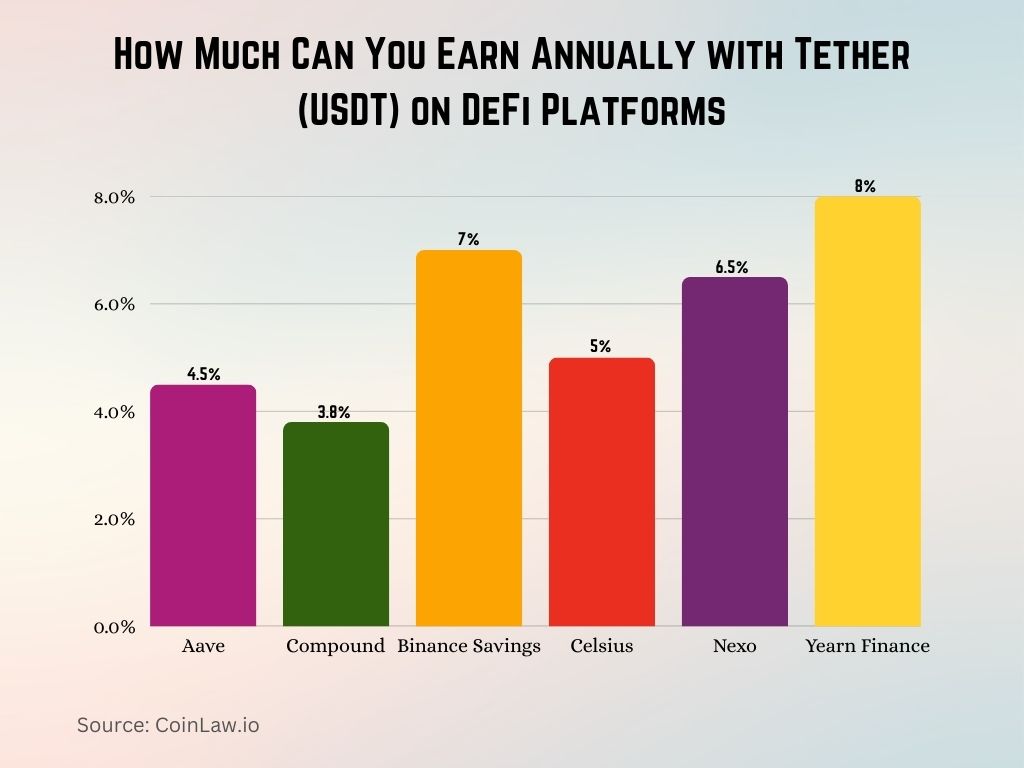

Interestingly, these reforms have already contributed to a remarkable 25% reduction in market volatility by October 2025. Stricter collateral requirements have limited forced liquidations, the domino effect that often exacerbates price drops during sell-offs, helping stabilize major stablecoins like Tether (USDT) across regional markets.

A Model for Global Crypto Regulation?

This is not just about one country tightening its belt; it’s part of a broader movement toward harmonized global standards. South Korea’s alignment with frameworks like the OECD’s Crypto-Asset Reporting Framework (CARF): which will require exchanges to share transaction data with tax authorities starting in 2027, positions it as a bellwether for responsible innovation. For buyers worldwide, these changes raise important questions about where digital assets can be acquired securely, what protections exist against systemic shocks, and how evolving regulations could impact portfolio strategies moving forward.

For global crypto buyers, South Korea’s new rules offer a preview of the next chapter in digital asset investing: one where transparency and risk management are not optional, but essential. The days of outsized returns from high-risk lending products may be fading, replaced by a regulatory environment that prizes investor protection and sustainable growth. As more jurisdictions look to South Korea’s example, expect similar interest rate caps and restrictions on leveraged lending to become the norm across major markets.

How This Affects Buying Cryptocurrency Securely in 2025

With these reforms, the landscape for buying cryptocurrency securely in 2025 is fundamentally shifting. Investors now face stricter due diligence requirements from exchanges and lenders, with enhanced collateral checks and eligibility screenings. While this may slow the onboarding process, it dramatically reduces the risk of sudden liquidations or platform failures, scenarios that have plagued less-regulated markets in recent years.

South Korea’s crackdown also means that global buyers must pay closer attention to where their platforms are domiciled and how they manage counterparty risk. Exchanges operating under robust frameworks like those now seen in Seoul are likely to attract more institutional capital and long-term investors seeking stability over speculation.

Lessons for Global Crypto Investors

- Regulatory arbitrage is narrowing: As more countries adopt South Korea-style rules, opportunities to exploit looser jurisdictions will shrink.

- Market volatility is likely to decrease: Tighter controls on lending reduce forced selling, which benefits all holders by dampening price swings.

- Portfolio diversification matters more than ever: With lending options restricted to top-20 coins, investors should reassess their exposure to smaller-cap assets and consider stablecoins as part of a defensive allocation.

Tips for Secure Crypto Buying Under New Global Rules

-

Verify Crypto Asset Eligibility: Under South Korea’s new rules, lending and trading are restricted to the top 20 cryptocurrencies by market cap. Stick to established coins like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) to ensure compliance and liquidity.

-

Monitor Interest Rate Caps: Be aware that South Korea and other jurisdictions now cap crypto lending interest rates at 20%. Avoid platforms offering unusually high returns, as these may be unregulated or non-compliant with new global standards.

-

Avoid Leveraged and Over-Collateralized Loans: New regulations ban leveraged crypto loans and restrict over-collateralization to reduce risk. Only use lending products that clearly state compliance with these rules, and avoid high-risk borrowing strategies.

-

Stay Informed on Tax Reporting: With the OECD’s CARF and South Korea’s new data-sharing rules taking effect in 2027, ensure you report all crypto transactions accurately and consult tax professionals familiar with global crypto regulations.

-

Watch for Market Stability Signals: Regulatory crackdowns, like South Korea’s, have reduced market volatility by 25% in 2025. Monitor stablecoins such as Tether (USDT) and major market indices to gauge overall market health before making purchases.

The regulatory tide also brings increased transparency. With the OECD’s Crypto-Asset Reporting Framework (CARF) coming into force in 2027, already embraced by South Korea, exchanges will soon be required to share transaction data with tax authorities. This move not only deters illicit activity but also rewards compliant buyers who prioritize secure platforms over yield-chasing at any cost. For further details on these international standards, see CoinLaw.

What Comes Next?

The South Korean model is already influencing regional policy discussions from Singapore to Europe. The resulting shift toward harmonized regulation will likely boost confidence among mainstream investors while putting pressure on exchanges operating outside these frameworks. For retail buyers, this means safer choices, but also fewer shortcuts and higher expectations around compliance.

If you’re navigating this new era of digital assets, remember: sustainable investing is about more than chasing returns; it’s about understanding risk, adapting to changing rules, and choosing partners who put safety first. As always, staying informed, and acting with purpose, will be your best defense against volatility as the crypto world matures.