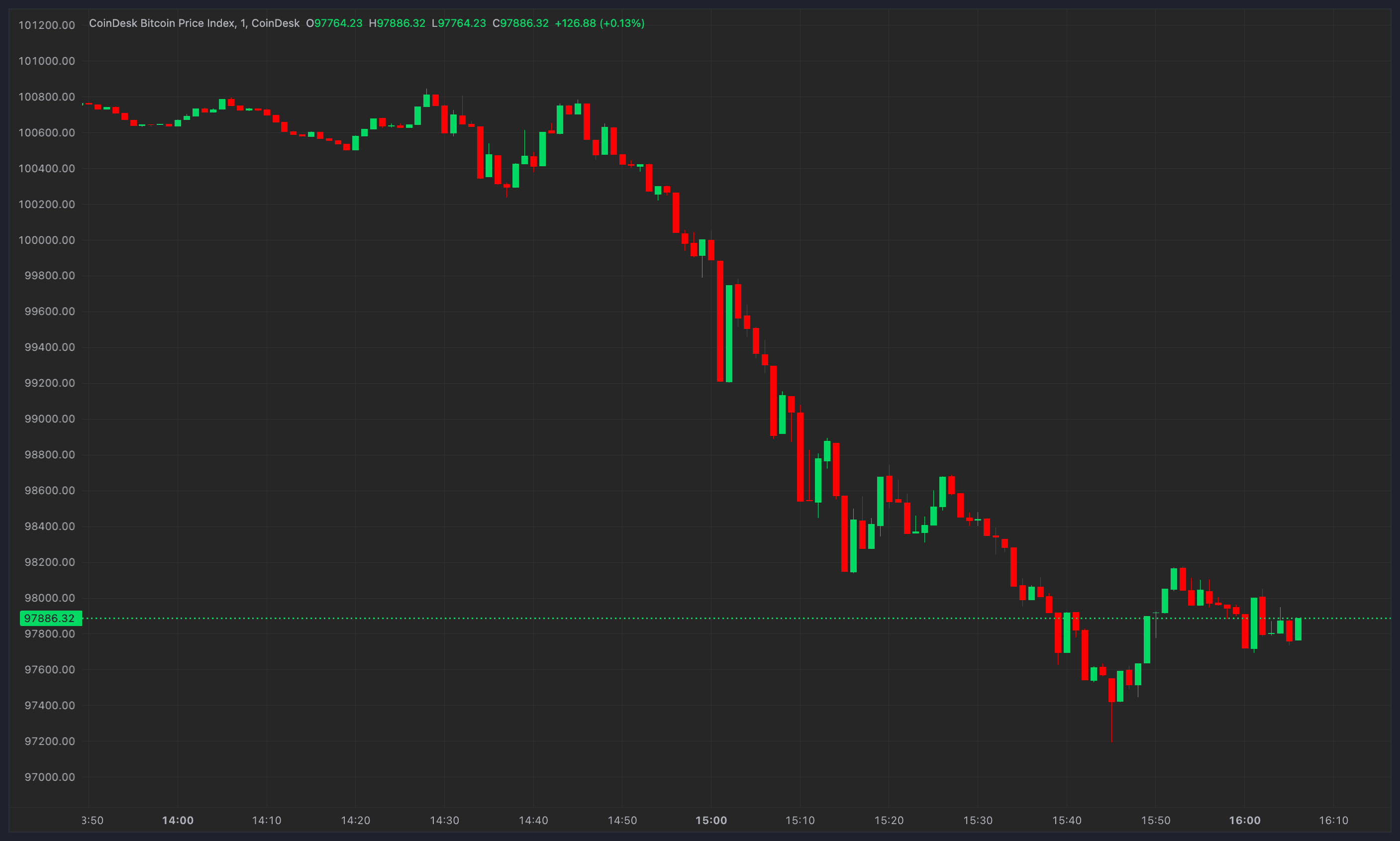

Japan is moving to crack open the gates for banks to participate directly in crypto trading and investment, and the global impact could be seismic. With Bitcoin currently priced at $109,509.00 and Japanese regulators contemplating a dramatic policy shift, this isn’t just another regulatory headline – it’s a potential turning point for how everyday people around the world buy cryptocurrency securely.

Japan’s Regulatory Pivot: Why It Matters Now

For years, Japan’s Financial Services Agency (FSA) kept banks at arm’s length from digital assets. Traditional institutions were blocked from buying, holding, or trading cryptocurrencies due to concerns over volatility and security. But as crypto adoption accelerates globally and Bitcoin sits above $100,000 for the first time in history, Japan’s stance is softening.

The FSA is considering letting banking group subsidiaries offer crypto trading services – a move that would allow securities arms of banks to compete with established players like SBI Holdings and Rakuten Wallet. Even more significant: a proposal to lift the outright ban on banks directly buying and holding digital currencies such as Bitcoin for investment purposes.

This is not just regulatory tinkering. If enacted, these changes would let some of Japan’s largest and most trusted financial brands enter the crypto market with full legitimacy. That’s a massive trust signal for hesitant retail investors both in Japan and worldwide.

What This Means for Crypto Buying Security

The biggest hurdle to mainstream crypto adoption has always been security – not just technical hacks but also fears of shady exchanges or unclear regulations. If Japanese megabanks start offering crypto services under strict FSA oversight, retail buyers gain access to familiar platforms backed by robust compliance frameworks.

Imagine being able to log into your bank app and buy Bitcoin at $109,509.00 as easily as you transfer funds or buy stocks – all while knowing your assets are protected by bank-grade custody solutions. This is about making buying cryptocurrency safer for everyone, not just tech-savvy early adopters.

The Ripple Effect: Global Crypto Market Access

Japan isn’t acting in isolation. Its regulators have long been among the most proactive in shaping digital asset frameworks that balance innovation with consumer protection. By opening up bank-backed crypto trading, Japan could set a template that other G7 nations follow.

Already we’re seeing strategic moves from major players anticipating this shift. SoftBank’s PayPay Corp recently acquired a 40% stake in Binance Japan, signaling a deepening alliance between fintech giants and global exchanges as regulatory barriers fall away. Soon Binance Japan users will be able to use PayPay Money directly for buying cryptocurrencies – an integration that would have seemed unthinkable just two years ago.

Bitcoin Price Prediction 2026-2031 After Japan’s Regulatory Shift

Professional forecasts based on Japan’s evolving crypto regulations, adoption trends, and global market context.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $90,000 | $120,000 | $155,000 | +9.6% | Initial adoption by Japanese banks, positive sentiment, but global macro uncertainty causes volatility |

| 2027 | $102,000 | $133,000 | $175,000 | +10.8% | Major Japanese banks roll out crypto services; increased institutional adoption globally |

| 2028 | $115,000 | $148,000 | $205,000 | +11.3% | Regulatory clarity in more G7 nations, new all-time highs, and mainstream payment integration |

| 2029 | $130,000 | $164,000 | $235,000 | +10.8% | Bitcoin ETF adoption in Asia, increased use cases, but cyclical market correction risk |

| 2030 | $145,000 | $182,000 | $270,000 | +11.0% | Widespread institutional integration, scaling upgrades, and global digital asset competition |

| 2031 | $160,000 | $200,000 | $310,000 | +9.9% | Mature market phase, Bitcoin as a strategic reserve asset, but competition from CBDCs and other assets |

Price Prediction Summary

Bitcoin is poised for strong growth following Japan’s regulatory reforms, which are likely to drive increased institutional adoption and mainstream integration. While price volatility and cyclical corrections are expected, the overall trajectory remains upward, with the potential for new all-time highs as global regulatory clarity improves and technological upgrades are adopted.

Key Factors Affecting Bitcoin Price

- Japan’s regulatory changes enabling banks to trade and hold Bitcoin, setting a global precedent

- Institutional adoption by traditional banks and financial institutions

- Integration of crypto with mainstream payment systems (e.g., PayPay x Binance Japan)

- Continued innovation in scaling and security solutions for Bitcoin

- Potential for global regulatory harmonization, especially in other G7 economies

- Market cycles, including periods of correction and consolidation

- Competition from central bank digital currencies (CBDCs) and other crypto assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you want more details on how these rule changes could reshape onboarding and global adoption, check out our deep dive here: Japan’s Potential Crypto Banking Revolution.

Why This Could Be a Global Blueprint

The bottom line: Japan’s willingness to let trusted banks handle cryptocurrencies could become a global case study in responsible integration of traditional finance with digital assets. For anyone watching the evolution of Japan crypto regulation, banks crypto trading, or simply looking for ways to buy cryptocurrency safely, these developments are impossible to ignore.

As the world’s third-largest economy, Japan’s embrace of crypto through its banking sector will force other regulators to take a hard look at their own policies. Expect a domino effect: if Japanese banks prove that secure, regulated crypto trading is possible at scale, European and North American institutions will face mounting pressure to follow suit or risk losing relevance in the next wave of financial innovation.

But it isn’t just about regulatory competition. The influx of institutional-grade capital and compliance standards could transform how global investors perceive digital assets. With Bitcoin holding steady at $109,509.00, institutional credibility is no longer just a wish list item, it’s becoming reality.

What Retail Investors Should Watch For

There are three key signals retail buyers should keep an eye on as Japan’s reforms play out:

Checklist for Tracking Japan’s Crypto Regulation Changes

-

Monitor FSA Announcements: Stay updated on official statements from Japan’s Financial Services Agency (FSA) regarding regulatory reforms for banks and crypto trading.

-

Track Major Bank Moves: Watch for updates from leading Japanese banking groups (e.g., MUFG, SMBC, Mizuho) as they may announce crypto trading or investment services if regulations change.

-

Compare Crypto Platforms: Evaluate how new bank-affiliated crypto services might compete with established platforms like Rakuten Wallet and SBI VC Trade.

-

Assess Risk Disclosures: Review risk warnings and educational materials provided by banks and securities subsidiaries, as required by the FSA for retail crypto investors.

-

Follow PayPay and Binance Japan Partnership: Track developments from PayPay Corp and Binance Japan as their partnership could influence payment and crypto integration.

-

Check Bitcoin Price Movements: Monitor Bitcoin’s current price in Japan, which is $109,509.00, and note any significant changes as regulatory news emerges.

-

Watch for International Reactions: Look for responses from global crypto exchanges and financial institutions as Japan’s regulatory stance could set precedents worldwide.

1. Clarity on Custody: Will Japanese banks use in-house solutions or partner with established crypto custodians? This will set the bar for global best practices in asset security.

2. Risk Disclosure Standards: The FSA is likely to mandate clear communication about volatility and risks. This could become the new gold standard for investor protection worldwide.

3. Product Integration: Watch how quickly banks integrate crypto into existing mobile apps and online banking platforms, ease of access will drive mainstream adoption.

How This Impacts Global Crypto Adoption

If you’re outside Japan, don’t underestimate the ripple effect. As Japanese banks launch crypto trading desks and offer direct Bitcoin purchasing at $109,509.00, cross-border partnerships and payment integrations will accelerate. Already, Binance Japan and PayPay are building bridges that make buying cryptocurrency as easy as sending a message on your phone.

If Japan’s megabanks move fast, expect a new era where buying cryptocurrency safely is not just possible, it’s effortless, familiar, and fully regulated.

For more insight into the Binance-PayPay alliance and what it means for Asia’s evolving market, read our analysis here: How Japan’s New Prime Minister and Binance-PayPay Alliance Could Transform Crypto Buying in Asia.

This isn’t just an incremental step for one country, it’s a potential paradigm shift for global crypto market access. If you’re looking to buy cryptocurrency safely or position yourself ahead of the next regulatory wave, keep your eyes locked on Tokyo.